Published as part of the ECB Economic Bulletin, Issue 1/2024.

This box summarises the findings of recent contacts between ECB staff and representatives of 70 leading non-financial companies operating in the euro area. The exchanges took place between 2 and 10 January 2024.[1]

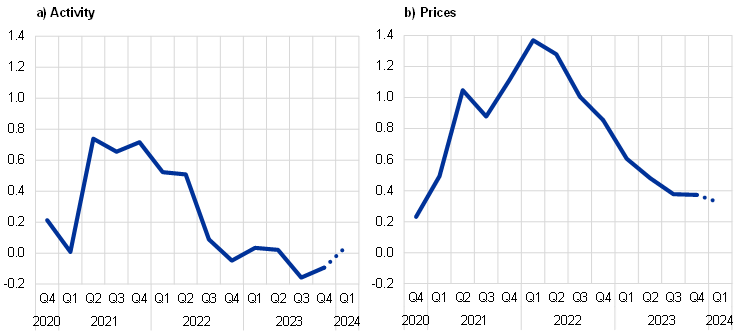

Contacts painted a largely unchanged picture of activity stagnating or contracting slightly in the fourth quarter of 2023, with little or no pick-up expected in the first quarter of 2024 (Chart A). There was still a lot of variation both within and across sectors in terms of reported dynamics. Manufacturing and construction activity were seen as remaining weak as were related transport and logistics services, while leisure-oriented consumer services and digital services were the main areas of growth. A year-long inventory correction has reportedly now largely come to an end, resulting in a bottoming out of demand for many intermediate goods. But long order backlogs caused by earlier supply disruption have dissipated, prompting a slowing of growth, or contraction, in capital goods production. Consequently, developments in manufacturing activity were now considered to better reflect the evolution of final consumption and investment demand.

Chart A

Summary of views on activity, employment, prices and costs

(averages of ECB staff scores)

Source: ECB.

Notes: The scores reflect the average of scores given by ECB staff in their assessment of contacts’ statements about quarter-on-quarter developments in activity (sales, production, orders), input costs (material, energy, transport, etc.) and selling prices, and about year-on-year wage developments. Scores range from -2 (significant decrease) to +2 (significant increase). A score of 0 would mean no change. For the current round, previous quarter and next quarter refer to the fourth quarter of 2023 and the first quarter of 2024 respectively, while for the previous round these refer to the third and the fourth quarter of 2023. Discussions with contacts in January and in March/April regarding wage developments normally focus on the outlook for the current year compared with the previous year, while discussions in June/July and September/October focus on the outlook for the next year compared with the current year. The historical average reflects an average of scores compiled using summaries of past contacts extending back to 2008.

Contacts indicated that consumers continued to favour leisure-related services rather than physical goods in general, and durable household items in particular. Demand for kitchen appliances, consumer electronics and furniture continued to fall, due to the reduction in households’ purchasing power coupled with declining activity in the housing market. Demand for passenger cars, which had generally been below production levels during 2023 as manufacturers worked through their long order backlogs, was said to be responding well to recent price incentives. Sales of most non-durable consumer goods (food, clothes, etc) were reportedly fairly stable, or growing slightly, albeit with continued downtrading as many consumers sought to make their money go further. By contrast, contacts noted that demand for leisure-related services, and in particular for tourism, continued to grow strongly, with 2023 proving to be a record year and current booking trends pointing to yet more growth in 2024.

Investment in housing and in machinery and equipment was contracting, according to contacts, but this was partly offset by growing investment related to the green transition and digitalisation. Investment in machinery and equipment and (even more so) in residential construction was dampened notably by the recent rises in interest rates, elevated uncertainty and low confidence. Residential construction and real estate activity were seen as falling sharply as existing projects were completed and demand for new projects was very limited. Contacts producing industrial machinery said that order intake was low and that production was being – or would be – cut as order backlogs could no longer sustain production as they had done in 2023. By contrast, civil engineering, renovation and projects related to the distribution and supply of renewable energy were continuing to benefit from growing demand. Moreover, contacts in – or supplying – the IT and digital services sector pointed to continued growth, implying a positive trend in intangible investment.

Chart B

Evolution of views on developments in and the outlook for activity and prices

(averages of ECB staff scores)

Source: ECB.

Notes: The scores reflect the average of scores given by ECB staff in their assessment of what contacts said about quarter-on-quarter developments in activity (sales, production and orders) and prices. Scores range from -2 (significant decrease) to +2 (significant increase). A score of 0 would mean no change. The dotted line refers to expectations for the next quarter.

The overall short-term outlook was still considered quite gloomy as interest rates and regulatory and geopolitical uncertainty hold back the recovery. Most contacts said that the business environment was “not getting worse, but not getting much better”, with a majority anticipating activity remaining stable or only growing very modestly in 2024. Even if domestic demand were to recover, European manufacturers would likely face increased competition from imports, given persistently high energy costs. A large number also cited the increasing burden of regulatory costs, especially related to sustainability reporting. Many contacts said that consumer and business confidence were unlikely to improve significantly until there was a clearer signal that inflation had been tamed and that interest rates would fall (or at least not rise further). Many also referred to the prevalence of bad news and heightened uncertainty amid increasing geopolitical tensions and armed conflict, including most recently the attacks on shipping in the Red Sea.

Contacts highlighted weakening employment amid prolonged uncertainty and an increasing need to contain costs. While most contacts said that employment in their company and/or sector was stable, an increasing number were either passively allowing headcount to decline via churn or actively shedding labour. The latter was particularly seen to be the case in the more energy-intensive parts of the intermediate goods sector, the durable consumer goods sector, construction and real estate, and road transport and logistics. In these sectors, the extent of the decline in activity, lower future anticipated activity and/or cost pressures and squeezed margins reportedly made reducing labour costs imperative. More generally across the economy, firms were increasingly cautious about hiring. Contacts in many sectors observed an increasing reluctance on the part of staff to change jobs. Employment agencies reported not only strong declines in temporary placements but also a slowdown in permanent placement activity. Many contacts still viewed the labour market as being “tight”, reflecting a structural shortage of supply in many professions and geographical areas, but others also said they were finding it easier to fill vacancies than a few quarters ago.

Contacts reported that growth in selling prices remained moderate in the fourth quarter of 2023, with some further easing expected in the short term (Chart B, panel b). The extent and rate of increases in selling prices still varied greatly. Selling prices were said to be generally stable on average in the industrial sectors. This reflects a continued easing of input costs in terms of materials, energy and transport, which most contacts described as stable or declining. With non-labour input cost pressures moderating and demand for many manufactured goods remaining weak or falling, many contacts in the industrial sectors expected prices to come under continued or increasing downward pressure or, at most, anticipated somewhat modest price increases going forward. Many contacts referred to the attacks on shipping in the Red Sea and, as a consequence of these attacks, they expected shipping costs to rise, albeit not on the scale experienced during the coronavirus (COVID-19) pandemic. Food retailers and their suppliers reported a fairly stable outlook for food prices, albeit at high levels. The cost of fresh produce had also been impacted by extreme weather, driven by climate change. Non-food retailers mostly reported stable or gently rising prices, but with somewhat stronger price growth in luxury segments. Elsewhere in the services sector, most contacts reported – and continued, on average, to expect – quite strong growth in selling prices. This was especially the case for tourism services (although air ticket prices were said to have peaked), digital services (that are in high demand) and services where prices are driven by indexation or rising labour costs.

Wage growth is expected to ease somewhat this year. Taking a simple average of the quantitative indications provided, contacts expected wage growth to decrease from around 5.3% in 2023 to 4.4% in 2024. This is slightly lower than the indications based on average expectations from the previous two survey rounds. The delayed effect of past (multiannual) negotiations meant that there was still an element of catch-up in actual or expected wage agreements for 2024 for some companies and sectors. However, most contacts now saw the easing of inflation and a subdued demand outlook as factors contributing to a moderation, or even normalisation, of wage growth.

For further information on the nature and purpose of these contacts, see the article entitled “The ECB’s dialogue with non-financial companies”, Economic Bulletin, Issue 1, ECB, 2021.