- THE ECB BLOG

How words guide markets: measuring monetary policy communication

9 August 2023

Words matter as much as actions for central banks. Because changes in tone can presage shifts in monetary policy. We have created an index to measure and compare the tone of policy communication by the ECB and the US Fed. This ECB Blog post talks you through the findings.

What central banks say can influence prices on financial markets and, ultimately, how the economy evolves. That makes communication an important tool of monetary policy as it helps clarify policymakers’ reaction function and steer expectations.[2] It is therefore useful to measure and quantify the sentiment or tone of what central banks communicate over time. We do this by analysing how “hawkish” or “dovish” their statements and press conferences are. These are the terms economists use to describe the extent to which communication indicates whether monetary policy is expected to tighten (hawkish) or loosen (dovish).

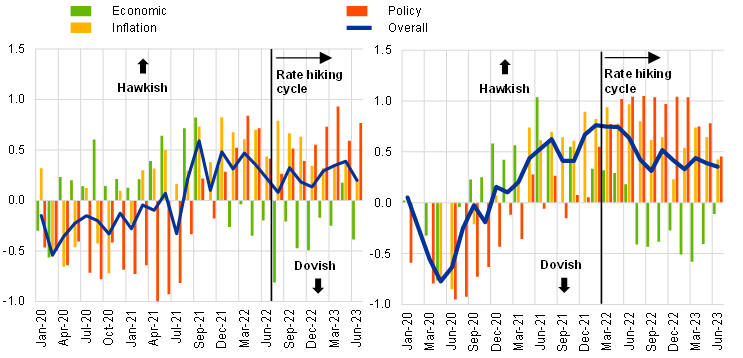

We found that the overall tone of the Federal Reserve’s (Fed) and the European Central Bank’s (ECB) meeting communication turned increasingly hawkish around early 2021 and mid-2021, respectively (Chart A – blue lines). This was about a year before the two central banks started to actually raise rates.

The hawkish shift in overall tone happened despite the economic outlooks being seen as relatively weak and the use of forward guidance on both sides of the Atlantic at that time (consistent with a muted contribution of the policy component). This finding is based on our topic-tone model – similar in spirit to that developed by Fed colleagues in Gardner et al. (2022). This model quantifies the directional tendency of official ECB and Fed communication of monetary policy decisions and press conference transcripts.[3]

Notably, the shift in the overall tone measured by our topic-tone model was predominantly driven by changes in the tone of communication on the inflation outlook and monetary policy in both the euro area and the United States (yellow and red bars). On the other hand, the assessment of the economic outlook turned increasingly dovish over the course of 2022 (green bars).

The ECB’s assessment of the economic outlook in 2023 has varied somewhat from meeting to meeting. This possibly reflects the information coming from the projections in March and June. At the same time the policy tone has stabilised in hawkish territory. Based on our indicator, the Fed has spoken less dovishly about the economic outlook since the start of 2023 and less hawkishly about inflation and policy.

Of course, central banks have different communication styles and institutional structures and are acting in different economic circumstances. It is nonetheless interesting that in 2021 and 2022 Fed communication was on average more hawkish than that of the ECB.[4] This difference in tone has, however, shrunk recently as the ECB has also become progressively more hawkish in tone.

Chart A

ECB (lhs) and Federal Reserve (rhs) topic-tone indicators

(index)

Sources: ECB Governing Council press conference transcripts, Federal Open Market Committee meeting statements and press conference transcripts, and ECB staff calculations.

Notes: The overall ECB tone reflects the average across the economic, inflation and policy tone for Governing Council communications during press conferences. The overall Federal Reserve tone reflects the average across the economic, inflation, labour market (not shown) and policy tone indicators for Federal Reserve communication.

Latest observations: June 2023 meetings.

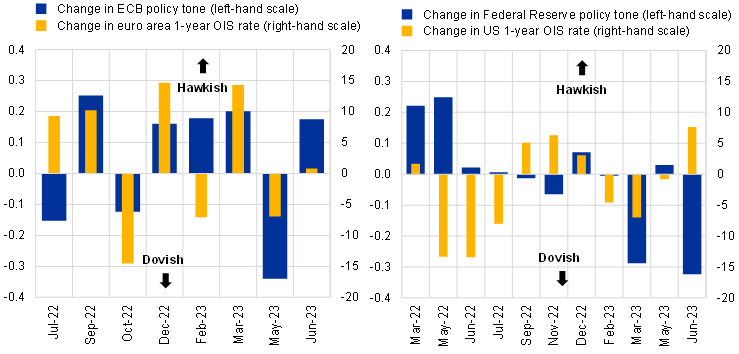

In the euro area, changes in policy communication have tended to affect a range of benchmark interest rates during the press conferences following the Governing Council’s monetary policy decisions. Changes in one-year overnight indexed swap (OIS) rates have tended to follow changes in the tone of the ECB Governing Council’s policy communication since the ECB began raising its interest rates in the summer of 2022 (Chart B – left-hand side). This shows that the ECB’s communication has affected markets beyond the immediate impact of policy decisions: more hawkish communication on policy generally resulted in a tightening market reaction.[5] A notable exception was the February 2023 Governing Council meeting: risk-free rates fell despite a somewhat more hawkish policy tone accompanying the 50-basis-point rate hike.[6] This dovish reading by markets may have been triggered by the Governing Council’s statements that “risks to the inflation outlook have also become more balanced” and that it would “evaluate the subsequent path of our monetary policy” at the March meeting. These statements may have led markets to expect that the pace of rate hikes would slow down after March. Overall, this evidence highlights the importance of central banks’ policy tone in communicating not only factual information, but also guiding the public’s assessment of the monetary policy reaction function.

In contrast, there has been no consistent co-movement between our measure of changes in the Fed’s policy tone and short-term rates during the Federal Reserve Chair’s post-meeting press conferences. This may suggest that other sources of information not directly captured by the press conference also play a key role in influencing how markets see the Fed’s reaction function. These other sources could, for example, include the Federal Open Market Committee’s own forecasts for the target federal funds rate (known as the “dot-plots”).

Chart B

One-year overnight indexed swap (OIS) rate reactions and change in policy tone around ECB (lhs) and Federal Reserve (rhs) meetings

(left-hand scale: index; right-hand scale: basis points)

Sources: Refinitiv Datastream, Bloomberg, ECB Governing Council press conference transcripts, Federal Open Market Committee meeting statements and press conference transcripts, and ECB staff calculations.

Notes: Changes in the one-year OIS rates are over the respective post-meeting press conferences of the ECB and Federal Reserve.

Latest observations: June 2023 meetings.

We also find evidence that the relative tone of central bank communication matters for asset prices. The uncovered interest party condition states that bilateral exchange rates will adjust to eliminate interest rate differentials between two jurisdictions. In line with this, we find that differences in policy tone between the ECB and Fed help to explain changes in the EUR/USD exchange rate. In addition to the communication following policy meetings, communications between such meetings, e.g. speeches by policymakers, can also affect financial markets.[7] Chart C plots the difference in policy tone between the ECB and Fed based on both meeting and inter-meeting communications.[8] Including a broader set of communication events allows for a more nuanced assessment of the relative dynamics between the two jurisdictions. In early 2021, the Fed started to communicate in more hawkish terms relative to the ECB, according to our tone indicators. At the same time the euro began to depreciate against the US dollar – to a greater extent than what would have been suggested by the widening in short-term interest rate differentials.[9] In contrast, this trend reversed to some extent as the policy tones of the two central banks grew closer again towards the end of 2022. Overall, this observation is consistent with central bank communication playing a significant role in guiding interest rate expectations and, by extension, exchange rate developments.

Chart C

Cumulative changes in monetary policy tone differential between the ECB and Federal Reserve, EUR/USD exchange rate and one-year interest rate differential

(left-hand scale: cumulative change in index; right-hand scale: cumulative percentage change for exchange rate, index for interest rate differential)

Sources: Refinitiv Datastream, Bloomberg, ECB Governing Council press conference transcripts, ECB Executive Board members’ speeches and interviews, Federal Open Market Committee meeting statements, press conference transcripts and minutes, Federal Reserve Board Governors’ speeches and congressional testimonies, and ECB staff calculations.

Notes: The policy tone differential reflects not only meeting communication but also inter-meeting speeches, interviews and testimonies before lawmakers. Due to the volatility of inter-meeting communication, the tone differential reflects a six-month moving average. The one-year interest rate differential is calculated as the difference between the one-year euro area and US OIS rates.

Latest observations: 17 June 2023.

The views expressed in each blog entry are those of the author(s) and do not necessarily represent the views of the European Central Bank and the Eurosystem.

Subscribe to the ECB blogDanielle Kedan is a Lead Economist in the ECB’s International Policy Analysis Division.

See, for example, Romer, C., and Romer, D. (2004), “A new measure of monetary shocks: Derivation and implications”, American Economic Review, 94(4), pp.1055-1084; Nakamura, E., and Steinsson, J. (2018), “High-frequency identification of monetary non-neutrality: the information effect”, The Quarterly Journal of Economics, 133(3), pp.1283-1330; Tobback, E., Nardelli, S., and Martens, D. (2017), “Between hawks and doves: Measuring central bank communication”, Working Paper Series, No 2085, ECB; Hansen, S., and McMahon, M. (2016), “Shocking language: Understanding the macroeconomic effects of central bank communication”, Journal of International Economics, 99, pp. S114-S133; Lucca, D., and Trebbi, F. (2009), “Measuring central bank communication: an automated approach with application to FOMC statements”, Working Paper, No 15367, National Bureau of Economic Research; Hansen, S., McMahon, M., and Tong, T. (2019), “The long-run information effect of central bank communication”, Journal of Monetary Economics, 108, pp.185-202 (also available as an ECB Working Paper); Jarocínski and Karadi (2020), “Deconstructing Monetary Policy Surprises – The Role of Information Shocks”, AEJ: Macroeconomics, 12(2) (also available as an ECB Working Paper); Gorodnichenko, Y., Pham, T., and Talavera, O. (2023), “The voice of monetary policy”, American Economic Review, 113(2), pp.548-584; Parle. C. (2022), “The financial market impact of ECB monetary policy press conferences – A text based approach”, European Journal of Political Economy, 74; and Husted, L., Rogers, J., and Sun, B. (2020), “Monetary policy uncertainty”, Journal of Monetary Economics, 115, pp. 20-36.

The topic-tone indicators are constructed by categorising short word sequences in ECB and Fed meeting-related communication as either hawkish (positive sign) or dovish (negative sign) based on user-defined dictionaries. The methodology is similar in spirit to Gardner, B., Scotti, C., and Vega, C. (2022), “Words speak as loudly as actions: Central bank communication and the response of equity prices to macroeconomic announcements”, Journal of Econometrics, 231(2), pp.387-409. Words denoting moderation and amplification are also taken into account in order to pick up nuances in communication over time. For example, the phrase “inflation increased very sharply” is classified as more hawkish than “inflation increased only slightly”. The resulting topic-tone indicators can theoretically go below -1 or above 1 due to the presence of amplifiers/modifiers. Our results for the Federal Reserve may differ from those of Gardner et al. (2022) due to differences in dictionaries and the analysed text corpus.

The use of dictionaries that are specific to the ECB and Fed, respectively, facilitates comparison of the indicators across central banks. However, it cannot be excluded that structural differences in communication styles between the central banks may affect the levels of the indicators.

The market reaction to central bank communication is affected by several factors, including, but not limited to, the tone of the central bank’s statements along different dimensions as markets try to disentangle “private” information that policymakers may have about the economic outlook from signals about the central bank’s monetary policy reaction (Jarocínski and Karadi, 2020, op. cit.). Moreover, financial market prices internalise investors’ expectations about both the economic outlook and monetary policy, such that market reactions to central bank communication capture the surprise element. As a proxy for the “news” component of central bank communication, Chart B plots the change in the tone of policy communications between meetings, as measured by our topic-tone model.

Another exception was in July 2022, when the ECB’s hiking cycle started. As the July hike had been largely priced in due to the pre-announcement in June 2022, the movement in risk-free interest rates on the day of the press conference may have reflected other signals.

The ECB and Fed each hold eight regularly-scheduled policy meetings per year. Including inter-meeting communication in the dataset allows for the construction of higher-frequency policy tone indicators, which is especially useful when analysing how policy tone affects high-frequency financial market variables over extended periods of time.

The dataset includes communications by ECB Executive Board Members and US Federal Reserve Board Governors that took place between the regular meetings. Their inclusion gives a richer, albeit more volatile, time series of individual policymakers’ views on the economy, inflation and monetary policy, at a higher frequency than the policy decision cycle, which may differ from the aggregate assessment conveyed by the tone of post-meeting communications.

Regressing the EUR/USD exchange rate on one-year risk-free interest rate differentials and the relative policy tone confirms that adding the relative policy tone difference significantly increases the explained variation in the exchange rate. The results also hold when looking at 2-year rate differentials. Short-term interest rate differentials were muted in 2021 on account of the forward guidance that was in place in both the euro area and US at that time.