Overview

Economic growth is projected to remain strong over the next three years despite some headwinds in the near term.[1] Sharply rising rates of coronavirus (COVID-19) infections in several euro area countries have led to a renewal of restrictions and heightened uncertainty about the duration of the pandemic. The emergence of the Omicron variant has added to this uncertainty.[2] In addition, supply bottlenecks have intensified and are now expected to last longer, only gradually dissipating from the second quarter of 2022 and fully unwinding by 2023. Real GDP is now expected to exceed its pre-crisis level in the first quarter of 2022, which is one quarter later than foreseen in the September 2021 projections. Nevertheless, as global supply constraints ease, the pandemic-related restrictions and associated uncertainty decrease and inflation abates from high levels, growth is expected to regain momentum from mid-2022, notwithstanding a less supportive fiscal stance and higher market interest rate expectations. Private consumption will remain the key driver of economic growth, benefiting from a rebound in real disposable income, some unwinding of the accumulated savings and a robust labour market, with the unemployment rate at the end of the projection horizon lower than observed at any time since the euro area was established in 1999. Compared with the September 2021 projections, the intensified global supply bottlenecks and tighter pandemic-related restrictions have led to a downward revision to growth in the short term. At the same time, the gradual dissipation of these headwinds should support a stronger bounce-back from the second quarter of 2022 leading to real GDP rising above the level foreseen in the September 2021 projections by the end of 2022, with carry-over effects resulting in a significant upward revision to annual growth in 2023.

Inflation is expected to be higher for longer but should fall slightly below 2% by the end of 2022 and stand at 1.8% in 2023 and 2024. Price pressures have increased significantly over recent months and inflation is expected to have peaked in the fourth quarter of 2021. Although considerably stronger than previously expected, these pressures are still assessed to be largely temporary, reflecting a surge in energy prices and international and domestic mismatches in demand and supply as economies reopen. Energy inflation is expected to remain elevated on average in 2022 but to moderate sharply during the course of the year as downward base effects are reinforced by an assumed decline in oil, gas and electricity prices. In 2023 and 2024 the contribution of the energy component to inflation is expected to be low. HICP inflation excluding energy and food is projected to decline in the course of 2022 as supply bottlenecks gradually ease. Thereafter, it is expected to increase gradually – while still remaining below 2% – as the economic recovery progresses, slack is absorbed and labour costs increase, supported in addition by higher inflation expectations. Compared with the September 2021 projections, headline inflation has been revised strongly upwards, especially in 2022. This reflects recent data surprises; greater upward direct and indirect effects from higher energy commodity prices; a depreciation of the euro exchange rate; more persistent upward pressures from supply disruptions; and robust wage growth.

Growth and inflation projections for the euro area

(annual percentage changes)

Notes: Real GDP figures refer to seasonally and working day-adjusted data. Historical data may differ from the latest Eurostat publications due to data releases after the cut-off date for the projections.

1 Real economy

Real GDP growth remained strong in the third quarter of 2021, close to the rate foreseen in the September 2021 projections. The ongoing rebound in growth has been driven primarily by domestic demand, notably for consumer services, as a result of high vaccination rates, the associated reduced fear of infection and the easing of pandemic-related restrictions. It has also been boosted by a pick-up in real disposable income and a substantial decline in the saving ratio. In the third quarter the services-led growth more than compensated for the increasing importance of supply bottlenecks as a factor constraining industrial activity.

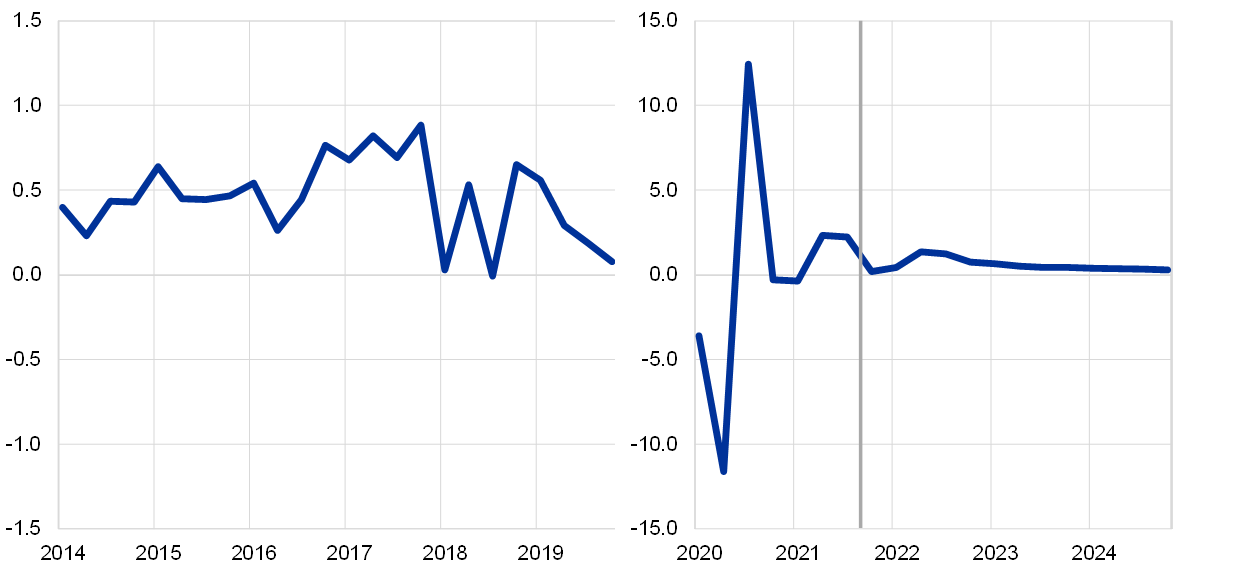

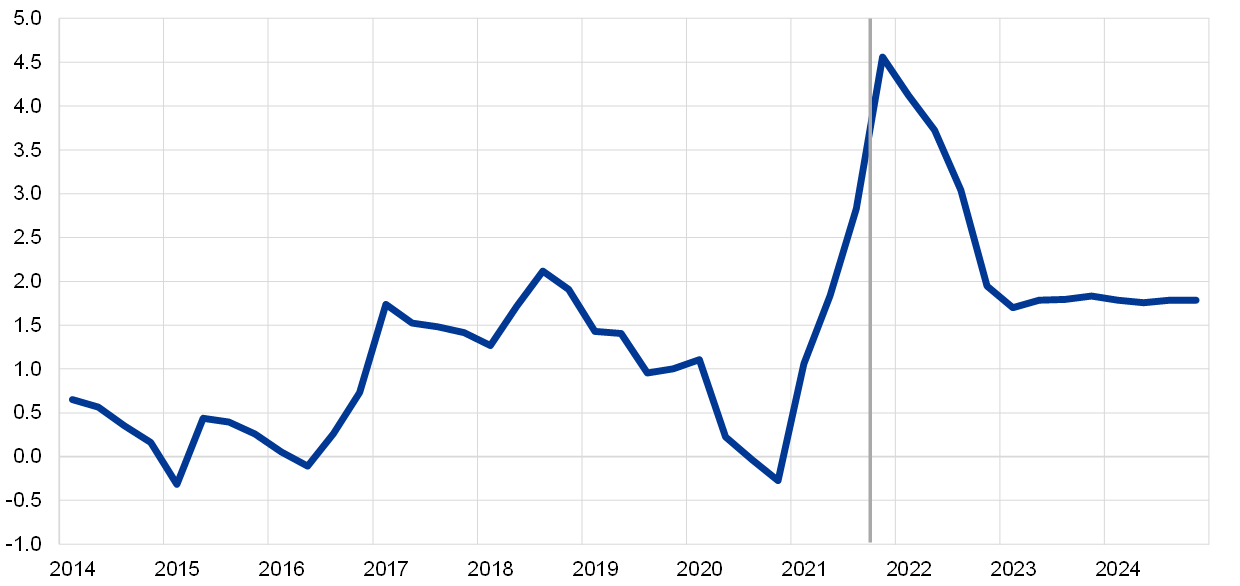

Chart 1

Euro area real GDP growth

(quarter-on-quarter percentage changes, seasonally and working day-adjusted quarterly data)

Notes: Data are seasonally and working day-adjusted. Historical data may differ from the latest Eurostat publications due to data releases after the cut-off date for the projections. The vertical line indicates the start of the projection horizon.

Real GDP growth is expected to be weak in the near term as pandemic-related restrictions tighten and supply bottlenecks intensify (Chart 1). The renewed intensification of the COVID-19 pandemic has led to a tightening of restrictions since the beginning of the fourth quarter of 2021 and a reduction in mobility in recent months. These tighter restrictions are expected to be maintained over the turn of the year. Mobility should gradually return to pre-pandemic levels from the second quarter of 2022 as the pandemic is expected to loosen its grip on the euro area. The significant moderation in economic growth at the turn of the year is confirmed by the available data releases and survey evidence. For example, retail sales in October stood just 0.2% above their level in the third quarter and the composite output Purchasing Managers’ Index (PMI) stood on average in October and November clearly below its average level in the third quarter. At the same time, manufacturing supply bottlenecks remained severe up to November, with an ongoing lengthening of suppliers’ delivery times as indicated by the respective PMI index. Real GDP growth has therefore been revised sharply down for the last quarter of 2021 and the first quarter of 2022. This reflects the stricter pandemic-related restrictions relative to the assumption in the September 2021 projections, on account of the spread of the Delta variant in many countries and, to a lesser extent, concerns about the Omicron variant, as well as the stronger headwinds from supply bottlenecks.

Global supply bottlenecks have been a significant constraint on euro area industrial production and goods trade in the course of 2021, and are expected to last longer.[3] As the economic recovery strengthened in the spring and summer of 2021, global shipping disruptions and input shortages prevented euro area firms from increasing their production in line with the rapid growth in demand for manufactured goods. The imbalance at the global level between strong demand and supply shortages has intensified more than previously assumed, affecting more countries and sectors (see also Box 2). Countries with larger shares of sectors that are more integrated into global value chains tend to be more affected by shortages of materials and equipment. The supply bottlenecks are now expected to last longer than assumed in the September projections, only gradually dissipating from the second quarter of 2022 and fully unwinding by 2023. This is in line with recent survey evidence suggesting that the impact of supply bottlenecks could last well into 2022.

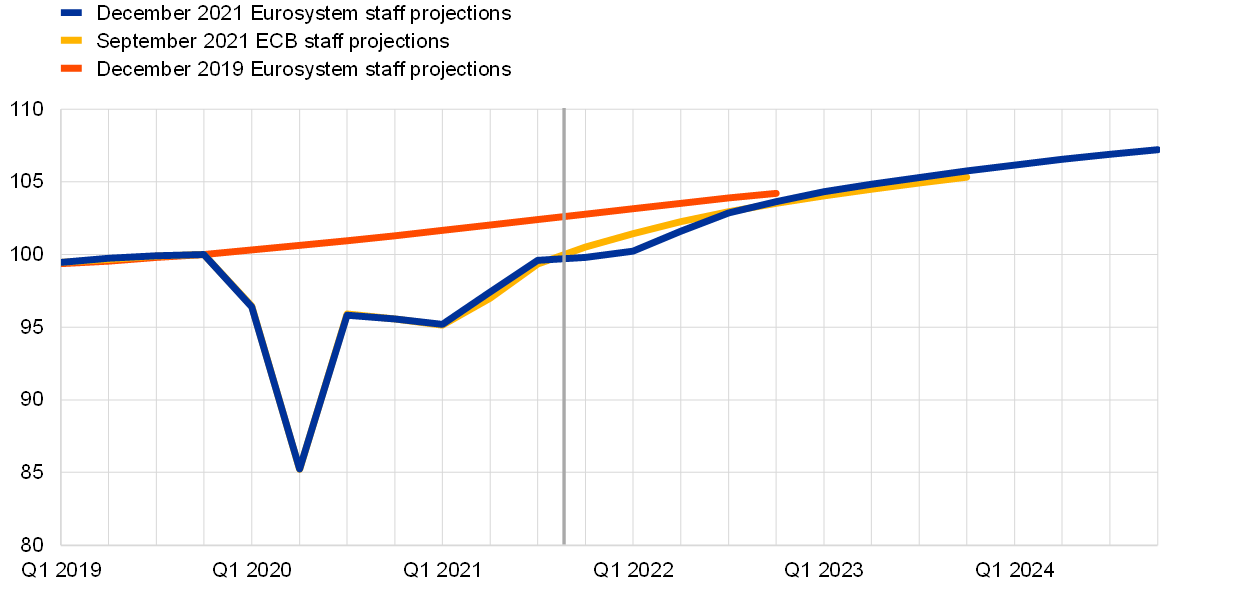

After the near-term weakness, growth is projected to pick up strongly from the second quarter of 2022 before slowing down in 2023-24 towards historical average rates. The expected rebound beyond the short term is based on the assumption of a gradual resolution of the COVID-19 pandemic and a decline in its economic impact which should reduce the related uncertainty and strengthen confidence. Moreover, it is based on a gradual unwinding of supply bottlenecks from the second quarter of 2022; continued favourable financing conditions; some unwinding of the high level of accumulated savings; and the ongoing global recovery. In 2023-24 real GDP growth is expected to return to more moderate rates. Although the Next Generation EU (NGEU) programme is expected to boost investment in some countries, the contribution of other fiscal policies is projected to decline compared with 2021, despite being somewhat stronger than that embedded in the September 2021 projections. Real GDP is projected to exceed its pre-crisis level in the first quarter of 2022 – one quarter later than foreseen in the September 2021 projections. However, the upward revision to growth from the second quarter of 2022 brings the level of GDP above that foreseen in the September exercise by the end of 2022 and just slightly below the level expected in the pre-crisis projections (Chart 2).

Chart 2

Euro area real GDP

(chain-linked volumes, Q4 2019 = 100)

Notes: Data are seasonally and working day-adjusted. Historical data may differ from the latest Eurostat publications due to data releases after the cut-off date for the projections. The vertical line indicates the start of the current projection horizon.

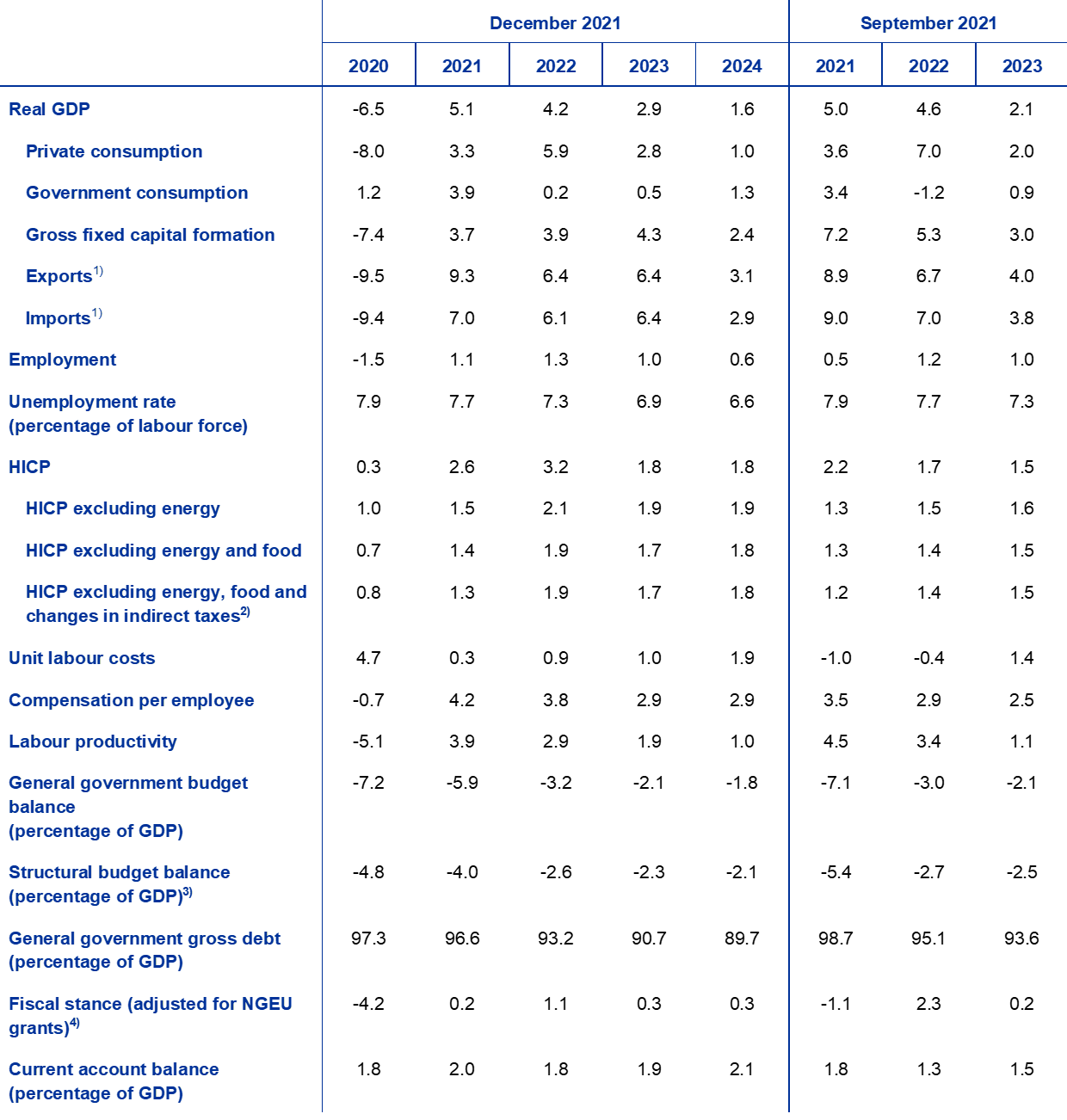

Table 1

Macroeconomic projections for the euro area

(annual percentage changes)

Notes: Real GDP and components, unit labour costs, compensation per employee and labour productivity refer to seasonally and working day-adjusted data. Historical data may differ from the latest Eurostat publications due to data releases after the cut-off date for the projections.

1) This includes intra-euro area trade.

2) The sub-index is based on estimates of actual impacts of indirect taxes. This may differ from Eurostat data, which assume a full and immediate pass-through of indirect tax impacts to the HICP.

3) Calculated as the government balance net of transitory effects of the economic cycle and measures classified under the European System of Central Banks definition as temporary.

4) The fiscal policy stance is measured as the change in the cyclically adjusted primary balance net of government support to the financial sector. The figures shown are also adjusted for expected NGEU grants on the revenue side. A negative figure implies a loosening of the fiscal stance.

Private consumption is expected to grow strongly over the projection horizon, notwithstanding a likely slowdown in the near term. Private consumption recovered more strongly than expected in the second and third quarters of 2021, but it still stood 2.4% below its pre-pandemic level in the third quarter. The upward surprise largely reflected a somewhat faster than expected decline in the household saving ratio. Household disposable income continued to be mostly driven by labour compensation, which typically entails a relatively high marginal propensity to consume. Private consumption growth is expected to decrease sharply in the near term as pandemic-related restrictions are tightened and high energy prices weigh on households’ purchasing power. Looking beyond the short term, given the assumed continued resolution of the health crisis in 2022, private consumption growth is projected to strengthen significantly in the second quarter of 2022 and to exceed its pre-crisis level in the third quarter. It should continue to outstrip the path of real income growth in 2023, as the expected dissipation of uncertainty will allow for some unwinding of accumulated excess savings. In 2024 both consumption dynamics and the saving ratio are projected to be close to their historical average levels.

Following a modest decline in the short term, real disposable income is expected to resume its upward path, supported by a rebound in labour income. Following positive growth rates in the second and third quarters of 2021, real disposable income will likely decline, albeit modestly, at the turn of the year, affected by the strong rise in inflation. It is expected to increase thereafter, reflecting the rebound in labour income as the economic recovery proceeds. In contrast, following a strong positive contribution in 2020, net fiscal transfers will weigh on income growth from 2021, as the number of people in job retention schemes decreases and other temporary pandemic-related fiscal measures expire, despite new measures to compensate for the impact of high energy prices.

The household saving ratio is expected to decline to below its pre-crisis level, before stabilising towards the end of the projection horizon. Following its recent steep drop, the saving ratio is expected to continue to fall throughout 2022. This fall is being driven by diminishing forced savings, amid high vaccination rates and an assumed relaxation of pandemic-related restrictions after the winter, as well as a reduction in precautionary savings on account of improving labour markets and fading uncertainty. After falling below its pre-crisis level in the course of 2022, the saving ratio is expected to continue to decline until mid-2023, and then to stabilise close to its historical average level in 2024. The temporary undershooting reflects some unwinding of the excess household savings which have accumulated since the start of the pandemic, supporting vigorous consumption growth. However, this effect is attenuated by the concentration of excess savings in wealthier and older households with a lower propensity to consume.[4]

Box 1

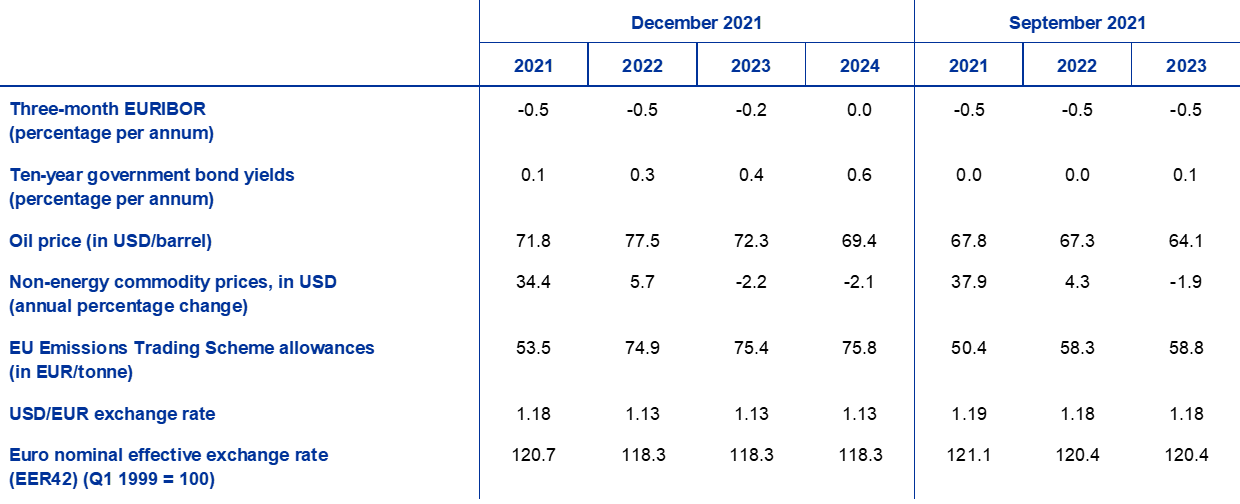

Technical assumptions about interest rates, commodity prices and exchange rates

Compared with the September 2021 projections, the technical assumptions include higher interest rates and oil prices, and a depreciation of the euro. The technical assumptions about interest rates and commodity prices are based on market expectations with a cut-off date of 25 November 2021. Short-term interest rates refer to the three-month EURIBOR, with market expectations derived from futures rates. The methodology gives an average level for these short-term interest rates of -0.5% in 2021-22, -0.2% in 2023 and 0% in 2024. Market expectations for euro area ten-year nominal government bond yields imply an average annual level of 0.1% for 2021, gradually increasing over the projection horizon to 0.6% for 2024.[5] Compared with the September 2021 projections, market expectations for short-term interest rates are 30 basis points higher for 2023, while market expectations for euro area ten-year nominal government bond yields are marginally higher for 2021 and have increased by around 30 basis points for 2022-23.

As regards commodity prices, the projections consider the path implied by futures markets by taking the average for the two-week period ending on the cut-off date of 25 November 2021. On this basis, the price of a barrel of Brent crude oil is assumed to rise from USD 71.8 in 2021 to USD 77.5 in 2022, before declining to USD 69.4 by 2024. This path implies that, in comparison with the September 2021 projections, oil prices in US dollars are 15% higher for 2022 and 13% higher for 2023. The prices of non-energy commodities in US dollars are expected to rise strongly in 2021 and more moderately in 2022, and to slightly decrease in 2023-24. EU Emissions Trading Scheme (ETS) allowances, are assumed, based on futures prices, to stand at around €75 per tonne over the projection horizon – an upward revision of almost 30% since the September 2021 projections (see Box 3).

Bilateral exchange rates are assumed to remain unchanged over the projection horizon at the average levels prevailing in the two-week period ending on the cut-off date of 25 November 2021. This implies an average exchange rate of USD 1.13 per euro over the period 2022-24, which is around 4% lower than in the September 2021 projections. The assumption for the effective exchange rate of the euro implies a depreciation of 1.7% since the September 2021 projections.

Technical assumptions

The momentum in housing investment is expected to moderate over the projection horizon. Housing investment declined somewhat in the third quarter of 2021 mainly owing to supply constraints. Despite ongoing supply bottlenecks and uncertainty related to the worsening pandemic situation, resilient demand, supported by favourable financing conditions, should contribute to a pick-up in housing investment in the fourth quarter of 2021. Thereafter, continued support should stem from positive Tobin’s Q effects, rising disposable income, improving consumer confidence and the large stock of accumulated savings. Housing investment is expected to catch up with its pre-crisis trajectory by the end of 2022, before its momentum normalises during the remainder of the projection horizon.

Business investment is expected to recover substantially over the projection horizon and to account for an increasing proportion of real GDP. The rebound in business investment seen in the first half of 2021 is expected to be temporarily slowed down by supply-side bottlenecks in the second half of 2021. It is projected to resume its recovery thereafter as supply constraints gradually diminish, global and domestic demand recover and profit growth improves, supported in addition by favourable financing conditions and the positive impact of the NGEU programme. Expenditures related to digitalisation as well as the low carbon transition (including in the car industry owing to environmental regulations and the transition to electric vehicle production) are expected to provide an additional boost to business investment in the medium term. As a result, business investment should account for an increasing share of real GDP over the projection horizon.

Box 2

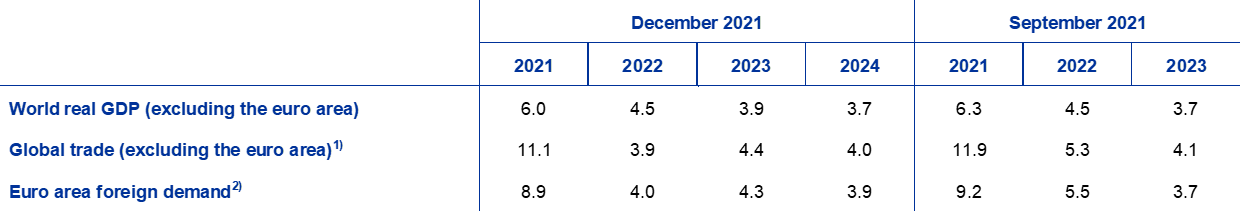

The international environment

Global economic activity and trade lost some momentum in the second half of 2021. The resurgence in COVID-19 cases, particularly in the United States and in parts of Asia, dented consumer sentiment even in the absence of strict containment measures. After a temporary respite at the end of the summer, COVID-19 cases started to rise again. The detection of the new Omicron variant was announced after the assumptions regarding the international environment were finalised and there are concerns about the potential economic fallout, although the implications remain highly uncertain. Global shortages of production inputs have also weighed on economic activity and trade and are expected to constitute further headwinds. High-frequency indicators available up to late November point to stalling growth in manufacturing activity, whereas the services sector is gradually recovering amid the progressive reopening of many economies.

Supply bottlenecks are assumed to weigh on trade and activity in the near term and to fully unwind by 2023. They reflect a combination of demand and supply imbalances, resulting in shortages of intermediate inputs which are particularly felt in large advanced economies and the manufacturing sector (especially the automotive industry). Compared with the September 2021 projections, supply bottlenecks are assumed to affect a larger number of countries and sectors. They have intensified further in the fourth quarter of 2021 and are now assumed to start easing only from the second quarter of 2022 and to fully unwind by 2023, as consumer demand rotates back from goods to services, and shipping capacity and the supply of semiconductors increase on the back of planned investment.

The global economy is projected to remain on a recovery path over the projection horizon, despite some near-term headwinds. Global real GDP (excluding the euro area) is estimated to expand by 6.0% in 2021 and to moderate to 4.5% in 2022, 3.9% in 2023 and 3.7% in 2024. Compared with the September 2021 projections, growth has been revised down for 2021. In addition to the above-mentioned resurgence in COVID-19 infections, country-specific factors have weighed on growth, such as a weaker profile than previously assumed for government spending in the United States, particularly in the third quarter, and a decline in growth in China amid the slowdown in the residential property sector and energy shortages. Growth for 2022 has been revised down for advanced economies, owing to more persistent supply bottlenecks, and for some emerging market economies (including China). However, upward revisions to growth for some other countries, mainly for India and, to a lesser extent, for Turkey, mean that the aggregate growth rate is unchanged. Growth for 2023 has been revised upwards, especially for advanced economies and particularly for the United States, reflecting the expected full unwinding of supply bottlenecks by then.

A weaker outlook for key trading partners, amid persistent supply bottlenecks, is weighing on euro area foreign demand. Supply bottlenecks are assumed to weigh more on trade compared with industrial production and GDP growth because the weakness in the logistics sector disproportionately affects trade. Moreover, the shift towards domestic suppliers and domestic goods might help to cushion the negative shock to industrial production. As a result, euro area foreign demand is projected to increase by 8.9% this year and by around 4% in 2022-24. This implies a downward revision to the 2021 and 2022 growth rates compared with the September 2021 projections, and an upward revision for 2023 as the unwinding of supply bottlenecks leads to a partial recovery of the ground lost in the previous two years.

The international environment

(annual percentage changes)

1) Calculated as a weighted average of imports.

2) Calculated as a weighted average of imports of euro area trading partners.

Supply bottlenecks are expected to weigh on euro area export market shares until mid-2022, after which these should unwind, resulting in strong gains. Export market shares in 2021 have been driven by two separate developments: first, the impact of supply bottlenecks starting at the beginning of the year and further intensifying in the third quarter, and, second, the recovery in services exports in the second and third quarters. While suppliers’ delivery times have remained elevated and shipping costs have flattened at record levels, the bottlenecks are assumed to persist until they gradually dissipate in the course of 2022. Services trade, and in particular tourism, recovered strongly during the summer owing to seasonality and progress in the vaccination campaigns. However, the resurgence in COVID-19 cases in several euro area countries in the fourth quarter has led to a dampening of confidence in the tourism sector, pointing to another bleak winter season for major travel destinations. With the dissipation of bottlenecks and an easing of travel restrictions by the middle of next year, the pace of the recovery in exports is expected to increase again. The unwinding of global supply bottlenecks is projected to have a positive impact on euro area foreign demand (Box 2) and the recent depreciation of the euro should improve export competitiveness. The pace of import growth should increase again in 2022 and 2023 as domestic demand recovers, but should normalise towards the end of the projection horizon owing to the fading-out of pent-up demand. All in all, net exports are expected to provide a strong positive contribution to real GDP growth in the second half of 2022 before gradually declining to a slightly positive contribution as the effects of the euro depreciation fade out.

The unemployment rate continued to decline in the third quarter of 2021 and is expected to decrease further as the recovery gains pace. A stronger than expected expansion in employment growth in the third quarter of 2021, accompanied by a sharp decline in the number of workers in job retention schemes, underlies the strength of the labour market and the decline in the unemployment rate. The recent increase in job vacancies, coupled with strong employment growth, signals that labour as a factor limiting production remains a sector-specific issue which is being driven by hiring backlogs in the sectors most affected by the pandemic. As the situation in the labour market is likely to improve further, the unemployment rate is projected to fall to its pre-pandemic level by the end of 2021 and to reach 6.6% in 2024, driven by the projected strong labour demand in line with the ongoing economic recovery, but also affected by demographic developments.[6] Such an unemployment rate would be lower than observed at any time since the euro area was established in 1999.

Labour productivity growth is expected to be temporarily affected by the short-term slowdown in economic growth before regaining momentum. Labour productivity growth increased by 1.2% in the third quarter of 2021, after 1.4% in the second quarter. The slowdown in economic growth related to supply bottlenecks and the renewed intensification of the pandemic implies a sharp decline in productivity at the turn of the year. From mid-2022 labour productivity is expected to regain momentum, following the strengthening of economic growth. By the end of the projection horizon, labour productivity (per person employed) is expected to be around 4½% above its pre-crisis level.

Compared with the September 2021 projections, real GDP growth has been revised down for 2022 and up for 2023. The downward revision to the short-term outlook, reflecting some further tightening of supply constraints, higher energy prices and stricter pandemic-related restrictions, has a negative carry-over effect on annual real GDP growth in 2022. On the back of the expected resolution of the pandemic and the gradual unwinding of supply bottlenecks, quarterly growth has been revised up from the second quarter of 2022, resulting in an upward revision to annual real GDP growth for 2023. A smaller fiscal tightening and an effective depreciation of the euro since the September 2021 projections contributed to the upward revisions, although these factors were partly offset by the negative impact of higher oil prices, weaker foreign demand and higher long-term interest rates.

2 Fiscal outlook

The withdrawal of fiscal support measures is expected to start in 2022 and to continue in 2023-24. After the strong expansion in 2020, the euro area fiscal stance adjusted for NGEU grants is projected to turn broadly neutral in 2021 and to tighten considerably in 2022 and to a lesser extent over the rest of the projection horizon. The tightening of the fiscal stance in 2022 is related to the reversal of a significant part of the pandemic emergency support. Compared with the September 2021 projections, the fiscal stance has tightened significantly for 2021, mostly on account of revenue windfalls and other factors, which often manifest during a recovery and a lower estimate (by about ½ percentage point of GDP) of the overall discretionary stimulus measures. For 2022, the fiscal stance is expected to be around 1 percentage point of GDP looser than expected in the September 2021 projections. This reflects mainly the adoption of new pandemic-related measures, or the extension and re-evaluation of existing measures, as well as new measures compensating for higher energy prices, further social transfers and reductions in direct taxes and social security contributions. Only slight revisions have been made to the fiscal stance for 2023.

The euro area budget balance is projected to improve steadily, particularly in 2022, while remaining below the pre-crisis level at the end of the projection horizon. The euro area budget deficit is estimated to have remained high in 2021, after having peaked in 2020. Over the projection horizon the substantial improvement in the budget balance is driven mainly by the cyclical component and the lower cyclically adjusted primary deficit. Interest payments also contribute to this trend and are projected to continue declining to 1.0% of GDP in 2024. At the end of the projection horizon the budget balance (at -1.8% of GDP) is foreseen to be still below the pre-crisis level. After the sharp increase in 2020, euro area aggregate government debt is expected to decline over the entire projection horizon, reaching about 90% of GDP in 2024, which is above its pre-pandemic level. The decline is mainly due to favourable interest rate-growth differentials, but also to deficit-debt adjustments, which together more than offset the persisting, albeit decreasing, primary deficits. Compared with the September 2021 projections, the fiscal outlook for 2021 has improved, mainly on account of the developments in the fiscal stance. The outlook for 2022-23 remains broadly unchanged, with a slight deterioration in 2022 which mainly reflects the additional stimulus measures added to the baseline in 2022 and other non-discretionary factors. The path of the euro area aggregate debt ratio has been revised downwards over the entire projection horizon on account of favourable revisions to the interest rate-growth differentials, stemming mainly from revisions to nominal growth, and base effects from 2020. Interest payments remain broadly unchanged compared with the September 2021 projections at the euro area aggregate level.

3 Prices and costs

Having reached 4.9% in November 2021, HICP inflation is projected to decrease sharply during the course of 2022 (Chart 3). High energy prices (for transport fuels, electricity and gas), stronger demand in the context of the reopening of the economy, and increasing producer prices as a result of global supply bottlenecks and higher transport costs have led to a strong surge in inflationary pressures, which are also expected to sustain inflation into 2022. However, HICP inflation is expected to decline in 2022 mainly owing to base effects in both the energy and non-energy components, partly related to the reversal of the temporary cut in the German VAT rate in January 2021.[7] HICP energy inflation is expected to have peaked at the end of 2021, driven by higher fuel prices and gas and electricity tariffs (see Box 3 for more details). These tariffs should continue to increase up to the beginning of 2022. Energy inflation will decrease in 2022 mainly owing to base effects combined with the impact of prices for oil and for wholesale gas and electricity, which are assumed to decline in line with futures prices. HICP inflation excluding energy and food is also likely to decline from its peak in late 2021, partly as a result of base effects, but also as price pressures ease on account of the assumed gradual resolution of supply bottlenecks starting in the second quarter of 2022, while indirect effects from surging energy prices could exert upward pressure. In contrast, food inflation is expected to remain elevated in the coming quarters.

HICP inflation is expected to be stable at 1.8% in both 2023 and 2024. This conceals a slight increase in the HICP excluding food and energy (from 1.7% to 1.8%), while food inflation and energy inflation are foreseen to decline in line with the downward-sloping profile of the oil price futures curve and a declining impact of fiscal measures. HICP inflation excluding energy and food is projected to gradually strengthen over the latter part of the projection horizon, supported by a tightening in product markets, increasing unit labour cost growth and higher inflation expectations, which have been moving closer to the ECB’s inflation target of 2%. In particular, the expected tightening in the labour market should support wage growth and push up HICP inflation excluding energy and food in 2023-24.

Growth in compensation per employee is expected to be still distorted by the take-up of job retention schemes in 2022, but to remain robust thereafter. Growth in compensation per employee has been subject to large swings in the presence of job retention schemes safeguarding employment. This pushed down the annual growth rate of compensation per employee in 2020 and caused a subsequent rebound in the first three quarters of 2021. This impact is expected to persist into the first half of 2022, leading to only a slight reduction in the annual average growth rate from 4.2% in 2021 to 3.8% in 2022. Thereafter, wage growth is expected to ease but to remain robust at 2.9% in both 2023 and 2024. Robust wage growth in the later years of the projection horizon is mainly related to tightness in the labour market, with the unemployment rate expected to fall to historic lows, while second-round effects from the current high level of inflation on wage growth are projected to remain contained in line with the low prevalence of formal wage indexation schemes in the euro area.[8] Some minimum wage increases are expected over the whole projection horizon, but particularly in 2022. Such increases will lead to a direct mechanical impact of minimum wages on aggregate wage growth but could also have spillover effects on the whole wage structure.[9] Wage growth in the public sector is projected to be consistently below that in the private sector – suggesting that any positive spillovers from the public to the private sector are unlikely.

Unit labour costs are expected to increase over the projection horizon, driven by slower growth in productivity per person employed and robust wage growth. As the impact of job retention schemes fades, the decline in the growth of compensation per employee between 2022 and 2023 is expected to be matched by a similar decline in labour productivity per person employed, leading to unit labour cost growth of around 1% in both 2022 and 2023. However, the continued normalisation of labour productivity growth in 2024, combined with continued robust wage growth implies a notable increase in unit labour costs which will contribute to the uptick in HICP inflation excluding food and energy.

Chart 3

Euro area HICP

(annual percentage changes)

Note: The vertical line indicates the start of the projection horizon.

External price pressures are expected to be significantly stronger than domestic price pressures in 2022 but to drop to considerably lower levels in the later years of the projection horizon. The annual growth rate of the import deflator is expected to rise from -2.6% in 2020 to 6.7% in 2021, largely reflecting increases in oil and non-energy commodity prices but also some increases in input costs related to supply shortages and the depreciation of the euro. From 2022 import price growth is expected to moderate and stand at 0.8% in 2024.

Compared with the September 2021 projections, the outlook for HICP inflation has been revised upwards by 0.4 percentage points for 2021, 1.5 percentage points for 2022 and 0.3 percentage points for 2023. Just over half of the cumulated revision relates to the HICP energy component (mainly concentrated in 2022), just under one-third relates to HICP inflation excluding food and energy and the rest relates to the HICP food component. These revisions reflect recent upward data surprises, higher upward direct and indirect effects from the recent surge in energy commodity prices, stronger and more persistent upward pressures from supply disruptions, stronger wage growth and a depreciation of the euro exchange rate.

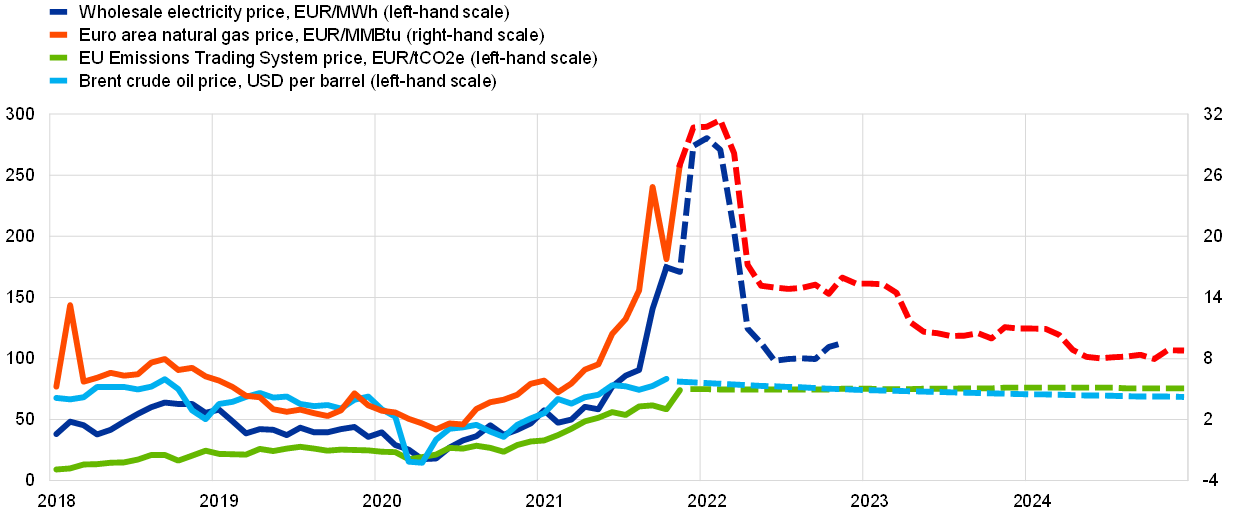

Box 3

Developments in energy commodity prices and their implications for HICP energy price projections

Energy commodity prices have increased notably from the trough reached during the pandemic, driven by demand and supply factors (Chart A). The global economic recovery has pushed up demand for oil and gas. Demand for gas was further supported by the cold weather last winter and by the calm winds in the summer which dampened the production of wind power and led to the substitution with gas. At the same time, supply cuts by OPEC+ and a slow pick-up in shale production in the United States supported oil prices, while in European gas markets, supply from Norway and Russia has been low. EU wholesale electricity prices rose primarily because of higher gas prices, as electricity prices are based on the short-run marginal costs of power plants.[10] Higher allowance prices under the EU Emissions Trading Scheme (ETS) also played a role.

The assumptions underlying the baseline projection for HICP energy prices, which are based on futures prices, envisage energy commodity prices declining in 2022. While in past projections rounds the technical assumptions relied mainly on oil price future curves, these have been complemented in the December 2021 projections with futures for gas and electricity prices given the observed delinking of gas contracts from oil prices. Currently the oil futures curve is downward-sloping (Chart A). This is often the result of a tightening oil market, as oil carries a “convenience yield” which captures the benefits of holding inventories. But the declining path may also reflect the market expectation that oil demand and supply might reach a balance by early 2022 with supply outpacing demand thereafter, as currently projected by the International Energy Agency.[11] Based on futures prices in the wholesale markets, gas and electricity prices are also expected to drop after this winter, as gas consumption depends on the need for heating.

Chart A

Oil, gas, electricity and ETS prices and futures

Sources: Eurostat, Refinitiv, Intercontinental Exchange - ICE, Bloomberg, Gestore Mercati Energetici, Fraunhofer ISE and ECB staff calculations.

Notes: Wholesale electricity prices (and futures) for the euro area are calculated as a weighted average (using electricity generation as weights) of prices observed in the five biggest markets. Solid lines refer to wholesale/spot prices whereas dashed lines refer to futures of the respective price series. The latest observation is for November 2021 (October 2021 for electricity prices). The cut-off date for futures is 25 November 2021.

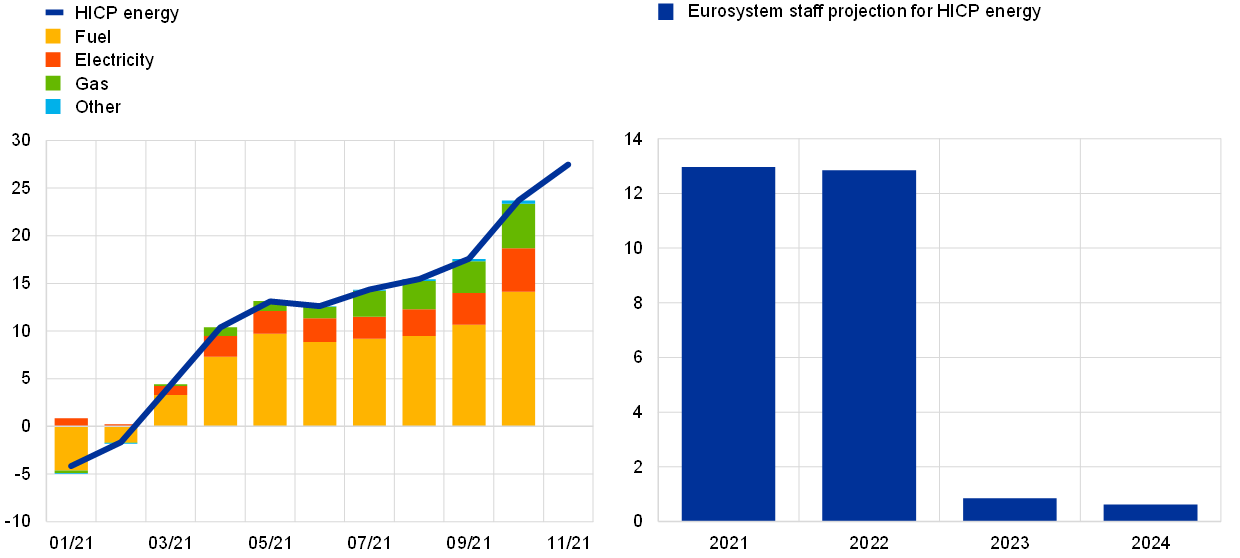

HICP energy inflation reached an annual rate of 27.4% in November 2021, with an increasing contribution from gas and electricity prices in recent months (Chart B, left-hand panel). Historically, the largest contribution to HICP energy inflation is made by transport fuel prices. While still being the dominant driver, the relative role of fuel prices for HICP energy inflation has recently declined somewhat. Specifically, fuel prices contributed 14.1 percentage points to the annual rate of change in energy prices in October, while electricity and gas prices jointly contributed 9.3 percentage points, reaching a historical high. Developments in gas and electricity prices are however very heterogeneous across euro area countries. This is due to differences in the pass-through of wholesale prices, which depends on the price composition, the price-setting mechanism, and the energy mix used to produce electricity. In addition, various euro area countries have introduced, or plan to introduce, temporary fiscal measures to cushion the impact of rising energy prices on consumers. While in some countries these measures have a direct impact on consumer prices (e.g. via lower indirect taxes) others take the form of transfers (e.g. for low income households) and therefore do not have a direct impact.

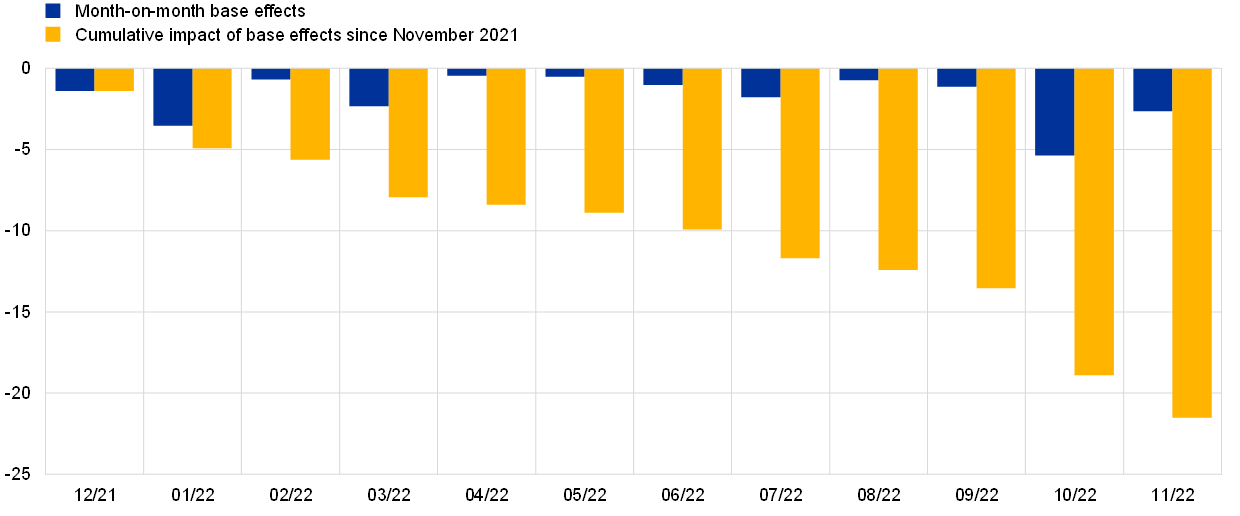

The December 2021 projections suggest that energy inflation will remain high on average in 2022, keeping headline inflation rather elevated, but should be muted in 2023 and 2024 (Chart B, right-hand panel). Energy inflation is projected to peak around the turn of 2022. In addition to elevated fuel prices, this high level is expected to be supported by gas and electricity prices, reflecting inter alia lagged effects on consumer prices from increases in wholesale prices in recent months, as well as high energy futures prices over the winter. Thereafter energy inflation is expected to gradually decline, reflecting downward-sloping oil and gas futures curves and downward base effects from the high monthly increases in energy prices in 2021. In particular, these base effects are expected to have strong downward effects on energy inflation in January, March, July and October next year (blue bars in Chart C). Cumulatively over the year, downward base effects are expected to subtract more than 20 percentage points from energy inflation by November 2022 compared with its rate in November 2021 (yellow bars in Chart C).[12] For 2023 and 2024 the contribution of energy inflation to overall HICP inflation is very small, reflecting the downward-sloping oil price futures curve. However, it will be supported by the reversal of temporary fiscal measures to reduce energy prices, and by national climate change measures.

Chart B

HICP energy inflation: past and projected figures

(annual percentage changes and percentage point contributions)

Sources: Eurostat, December 2021 projections and ECB staff calculations.

Note: The latest observation is for November 2021 for HICP energy and October 2021 for the individual components.

Chart C

The impact of base effects on energy inflation

(percentage points)

Sources: Eurostat and ECB staff calculations.

Notes: Month-on-month base effects show the contribution of the base effect to the change in the annual energy inflation rate from one month to the next. The cumulative impact of base effects is calculated by summing month-on-month base effects and is always shown relative to a specific reference month. For example, around 10 percentage points of the decrease in energy inflation in June 2022 compared with the inflation rate in November 2021 is due to base effects.

Policy uncertainty about the future use of gas and oil might contribute to volatility in commodity prices during the green transition. Demand for oil and gas crucially depends on the policy strategy adopted across the globe for tackling the challenges related to climate change as well as on the availability of renewable energy resources. Until such time as energy efficiency and the production capacity of renewable energy sources are scaled up sufficiently, demand for fossil fuels such as gas could remain high and volatile.

In addition to national climate change policies, EU climate change policies and increasing carbon prices may also have an impact on energy price developments. Allowance prices under the EU ETS increased to above €70 per tonne of CO2 equivalent in November. While the curve of ETS futures prices only has a slight upward slope (Chart A), most estimates of the level of carbon prices required to meet EU emission-reduction targets are higher than current prices. Carbon prices are likely to increase in the EU as the European Commission has proposed to reform the EU ETS, in particular by widening the scope of the ETS, and to review the EU Energy Taxation Directive. This may have a gradual impact on energy prices, with the phasing-in of proposed measures.

Box 4

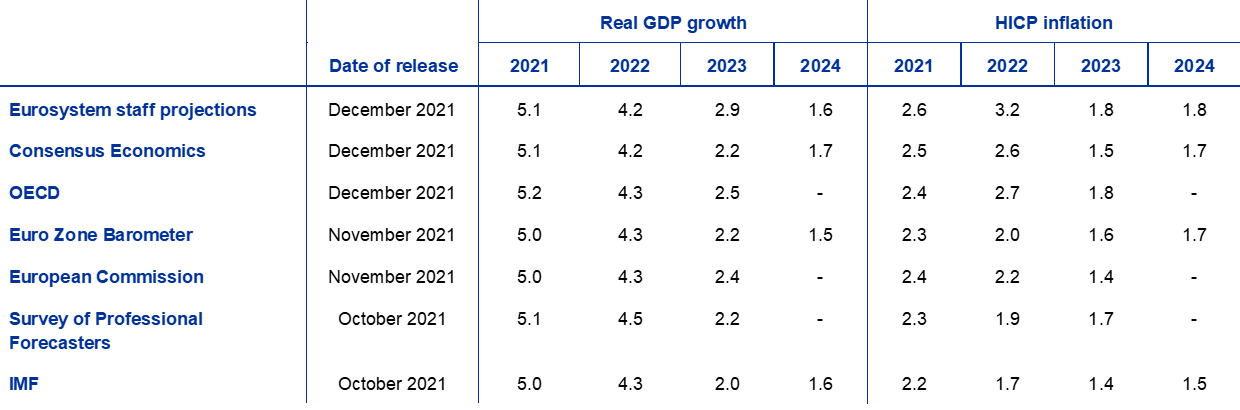

Forecasts by other institutions

A number of forecasts for the euro area are available from both international organisations and private sector institutions. However, these forecasts are not directly comparable with one another or with the Eurosystem staff macroeconomic projections, as these were finalised at different points in time. They were also likely based on different assumptions about the future evolution of the COVID-19 pandemic. Additionally, these projections use different methods to derive assumptions for fiscal, financial and external variables, including oil and other commodity prices. Finally, there are differences in working day adjustment methods across different forecasts (see the table).

Comparison of recent forecasts for euro area real GDP growth and HICP inflation

(annual percentage changes)

Sources: Consensus Economics Forecasts, 9 December 2021, data for 2023 and 2024 are taken from the October 2021 survey; OECD December 2021 Economic Outlook 110; MJEconomics for the Euro Zone Barometer, 18 November 2021, data for 2023 and 2024 are taken from the October 2021 survey; European Commission Autumn 2021 Economic Forecast; ECB Survey of Professional Forecasters, for the fourth quarter of 2021, conducted between 1 and 11 October; IMF World Economic Outlook, 12 October 2021.

Notes: The Eurosystem staff macroeconomic projections report working day-adjusted annual growth rates, whereas the European Commission and the IMF report annual growth rates that are not adjusted for the number of working days per annum. Other forecasts do not specify whether they report working day-adjusted or non-working day-adjusted data. Historical data may differ from the latest Eurostat publications due to data releases after the cut-off date for the projections.

The December 2021 Eurosystem staff projection for real GDP growth is below those of other forecasters for 2022 but notably above them for 2023, while the inflation projection is well above those of other institutions for 2022 and at the top of the range for 2023. The December 2021 growth projection is below the other forecasts for 2022, but only marginally below the more recent projections which include the latest information on the intensification of supply bottlenecks and on the pandemic and related restrictions. A sharper rebound as supply bottlenecks are resolved can partly explain the higher projection for growth in 2023. As regards inflation, the December 2021 projection for 2022 is higher than the other forecasts. This can be largely explained by the inclusion of the November 2021 HICP data and by higher expected inflation in the more volatile components. Differences compared with other forecasts for 2024 are limited for both growth and HICP inflation.

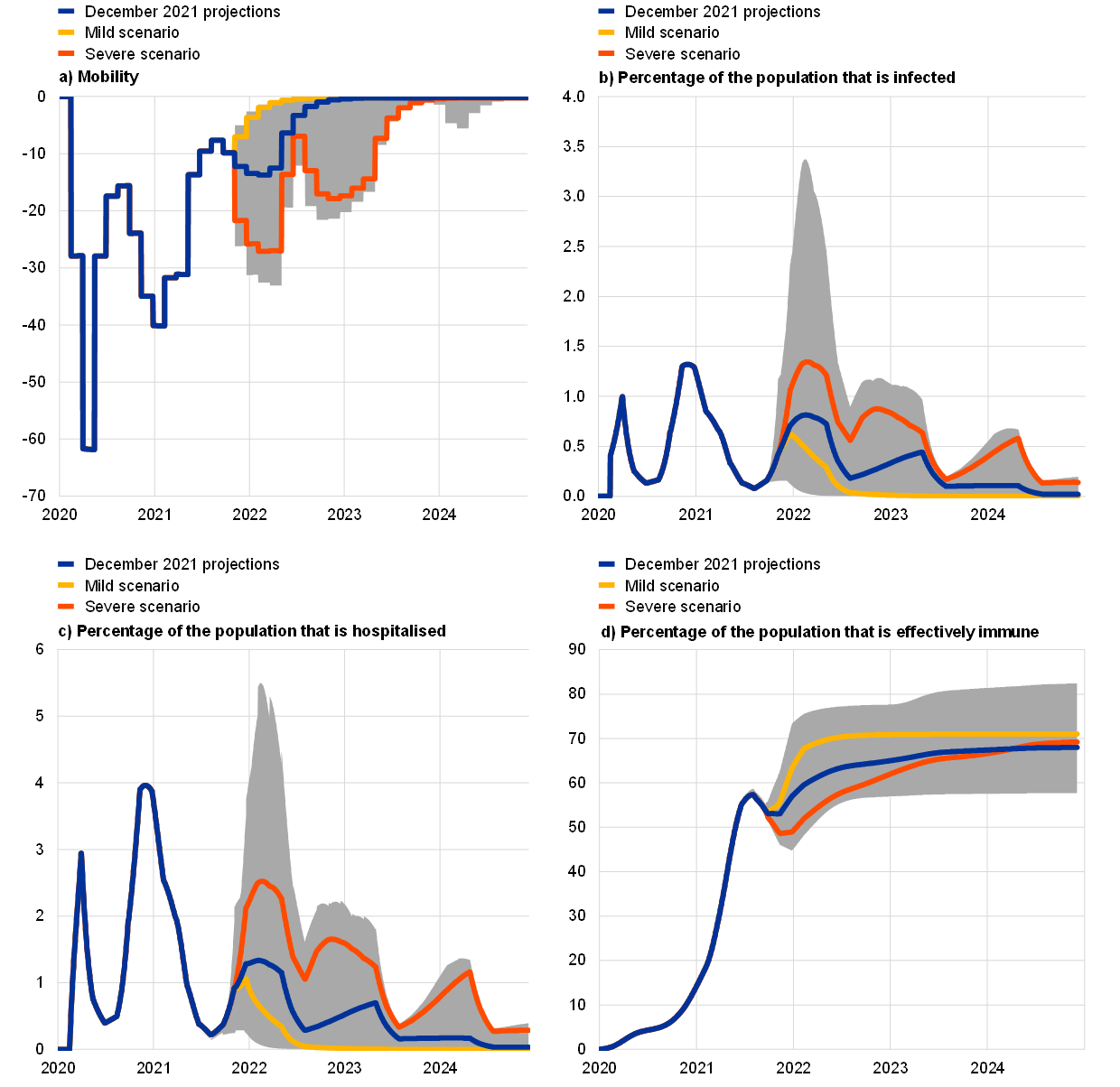

Box 5

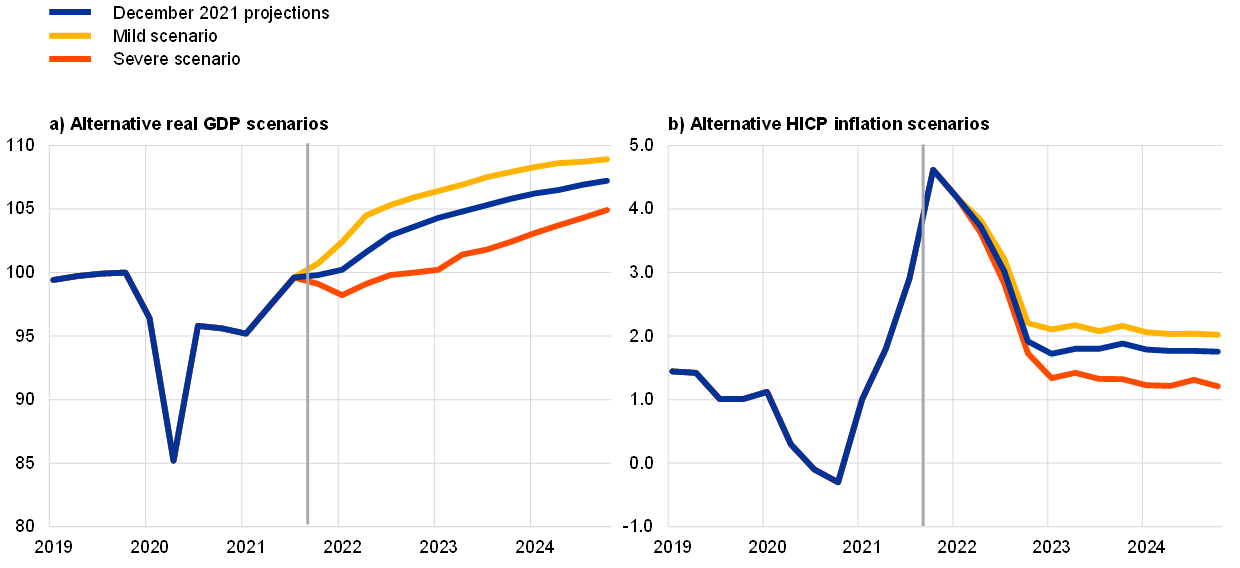

Alternative scenarios for the euro area economic outlook

As significant uncertainty about the future evolution of the pandemic and its economic consequences persists, as highlighted by the new Omicron variant, this box presents two alternative scenarios around the December 2021 baseline.[13] Compared with the baseline, a mild scenario envisages a faster resolution of the pandemic in the course of 2022 – especially in emerging market economies on account of assumed faster vaccination rates. Under this scenario, infection rates would be lower, the effectiveness of vaccines would be higher and reinfection risks would be lower (Chart A). This would expedite the loosening of restrictions, inducing strong positive confidence effects and leading to very limited economic costs. In contrast, the severe scenario envisages a prolonged health crisis characterised by recurrent pandemic waves (with new virus variants, a risk highlighted by the emergence of the Omicron variant) and a lower proportion of the population being effectively protected. The ensuing strong resurgence in infections and hospitalisations is foreseen to induce a tightening of restrictions on mobility and hence economic activity in early 2022, albeit to a smaller degree than in early 2021. The health crisis is assumed to continue until mid-2023, thus dampening activity and resulting in economic scarring, amplified by increased insolvencies.

Chart A

Pandemic simulations with the ECB-BASIR model

(percentage deviations from the first five weeks of 2020 (top left-hand panel); percentages of the population (all other panels))

Sources: Google Mobility reports, the European Centre for Disease Prevention and Control and ECB calculations.

Note: The distribution is obtained by random simulations considering uncertainty about: i.) rate of vaccination U~[0.8% - 1.2%], ii.) efficiency of vaccination U~[30%-70%], efficiency of vaccination (hospitalisations) U~[65%-85%] and reinfection uncertainty U ~[0%-15%] , iii.) increase in infection rate due to a new Delta virus variant N~(60%, 10%std), iv.) SIR parameter uncertainty v.) learning uncertainty N~(52%, 10%std) and vi.) historical uncertainty captured in residuals.

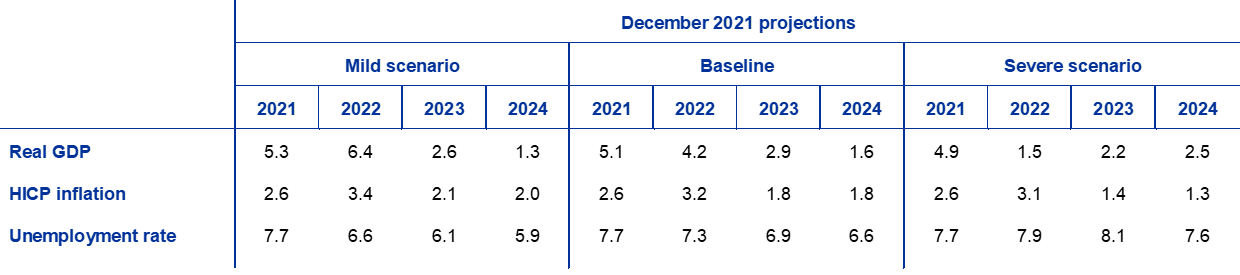

Real GDP would recover strongly in 2022 in the mild scenario, but only modestly in the severe scenario, while its level would fall within a narrowing range across the scenarios by the end of the projection horizon (Chart B). The mild scenario entails strong growth in early 2022, supported by effective vaccines and economic resilience with respect to restrictions, especially in emerging market economies, which, compared with the baseline, leads to higher euro area foreign demand and hence higher exports, instilling strong positive confidence effects. These effects, together with the stronger than expected pick-up in high-contact services, induce a stronger increase in consumption, a more pronounced decline in the saving ratio, and a steeper decline in unemployment compared with the baseline. In the mild scenario, economic activity is projected to overshoot the pre-pandemic path by mid-2022. Under the severe scenario, the euro area would enter a technical recession, with a contraction in economic activity in the fourth quarter of 2021 and the first quarter of 2022, as restrictions are tightened. Economic growth would underperform the baseline until early 2023 owing to the only gradual relaxation of restrictions and significant uncertainty in the severe scenario. With households remaining cautious and maintaining an elevated saving ratio, persistently high unemployment highlights labour market risks, as corporate vulnerabilities and insolvencies would intensify labour reallocation needs.

Alternative macroeconomic scenarios for the euro area

(annual percentage changes, percentage of labour force)

Notes: Real GDP figures refer to seasonally and working day-adjusted data. Historical data may differ from the latest Eurostat publications due to data releases after the cut-off date for the projections.

Despite being almost identical across the scenarios in the short term, HICP inflation would stand at 2.0% in the mild scenario in 2023-24, while it would decline significantly in the severe scenario in the later years of the projection horizon (Chart B). Both scenarios see inflation peaking in the fourth quarter of 2021 on account of largely temporary factors, including base effects from higher energy prices and supply bottlenecks, but differences emerge between the two scenarios thereafter owing to the different real economic conditions. In particular, strong upward pressure from tightening product and labour markets leads to a significant increase in underlying inflation in 2024 in the mild scenario, while it would remain subdued in 2023-24 in the severe scenario.

Chart B

Alternative scenarios for real GDP and HICP inflation in the euro area

(chain-linked volumes, Q4 2019 = 100 (left-hand panel); annual percentage changes (right-hand panel))

Notes: Data for real GDP are seasonally and working day-adjusted. The vertical line indicates the start of the current projection horizon. Historical data may differ from the latest Eurostat publications due to data releases after the cut-off date for the projections.

One caveat with regard to these simulations is that no impact on supply bottlenecks and their macroeconomic consequences is assumed in either scenario. This is due to the uncertainty of the impact of the future evolution of the pandemic on supply bottlenecks. On the one hand, the worsening of the pandemic and lower demand could alleviate constraints as a large part of them is caused by the increased demand exceeding supply capacities. On the other hand, further disruptions to supply chains owing to lockdowns and/or a compositional shift in demand away from consumer services into goods could intensify supply bottlenecks. An increase in bottlenecks in either scenario could dampen economic activity while putting upward pressure on prices, while the opposite effects would occur if bottlenecks were to ease.

Box 6

Sensitivity analysis

Projections rely heavily on technical assumptions regarding the evolution of certain key variables. Given that some of these variables can have a large impact on the projections for the euro area, examining the sensitivity of the latter to alternative paths of these underlying assumptions can help in the analysis of risks around the projections.

This sensitivity analysis aims to assess the implications of alternative oil price paths. The technical assumptions for oil price developments are based on oil futures. Several alternative paths of the oil price are analysed. The first is based on the 25th percentile of the distribution provided by the option-implied densities for the oil price on 25 November 2021, which is the cut-off date for the technical assumptions. This path implies a gradual decrease in the oil price to about 40% below the baseline assumption for 2024. Using the average of the results from a number of staff macroeconomic models, this path would have a small upward impact on real GDP growth and a more pronounced downward impact on HICP inflation throughout the projection horizon. The second path is based on the 75th percentile of the same distribution and implies an increase in the oil price to around 32% above the baseline assumption for 2024. This path would have a very small downward impact on real GDP growth and a somewhat stronger upward impact on HICP inflation in 2022-24. The third path is based on the assumption that the oil price remains at its level on the cut-off date of USD 83.1 per barrel, which by 2024 is around 20% higher than the baseline assumption for that year. This path would have a marginal downward impact on real GDP growth in 2023-24, while HICP inflation would be 0.2-0.3 percentage points higher in 2022-24.

Impacts of alternative oil price paths

Notes: The 25th and 75th percentiles refer to the option-implied neutral densities for the oil price as at 25 November 2021. The constant oil price takes the value as at the same date. The macroeconomic impacts are reported as averages from a number of staff macroeconomic models.

© European Central Bank, 2021

Postal address 60640 Frankfurt am Main, Germany

Telephone +49 69 1344 0

Website www.ecb.europa.eu

All rights reserved. Reproduction for educational and non-commercial purposes is permitted provided that the source is acknowledged.

For specific terminology please refer to the ECB glossary (available in English only).

PDF ISSN 2529-4687, QB-CF-21-002-EN-N

HTML ISSN 2529-4687, QB-CF-21-002-EN-Q

- The cut-off date for technical assumptions, such as those for oil prices and exchange rates, was 25 November 2021 (Box 1). The macroeconomic projections for the euro area were finalised on 1 December 2021. The current projection exercise covers the period 2021-24. Projections over such a long horizon are subject to very high uncertainty, and this should be borne in mind when interpreting them. See the article entitled “An assessment of Eurosystem staff macroeconomic projections” in the May 2013 issue of the ECB’s Monthly Bulletin. See http://www.ecb.europa.eu/pub/projections/html/index.en.html for an accessible version of the data underlying selected tables and charts. A full database of past ECB and Eurosystem staff macroeconomic projections is available at https://sdw.ecb.europa.eu/browseSelection.do?node=5275746.

- Given the very high uncertainty around the key epidemiological features of the new Omicron virus variant, the projections only include the impact of containment measures taken or announced by the time the projections were finalised.

- See “The impact of supply bottlenecks on trade”, Economic Bulletin, Issue 6, ECB, 2021, and “Sources of supply chain disruptions and their impact on euro area manufacturing”, forthcoming, Economic Bulletin, Issue 8, ECB, 2021.

- See also Box 2 entitled “Household saving ratio dynamics and implications for the euro area outlook”, Eurosystem staff macroeconomic projections for the euro area, June 2021.

- The assumption for euro area ten-year nominal government bond yields is based on the weighted average of countries’ ten-year benchmark bond yields, weighted by annual GDP figures and extended by the forward path derived from the ECB’s euro area all-bonds ten-year par yield, with the initial discrepancy between the two series kept constant over the projection horizon. The spreads between country-specific government bond yields and the corresponding euro area average are assumed to be constant over the projection horizon.

- See Labour supply developments in the euro area during the COVID-19 pandemic, Economic Bulletin, Issue 7, ECB, 2021.

- By convention, in the Eurosystem/ECB staff projections, HICP weights are held constant over the projection horizon. Given the large changes in consumption patterns brought about by the COVID-19 pandemic and the possible reversion of these changes over the coming years, future changes in HICP weights may lead to additional volatility in HICP annual rates of change which are not factored into the staff projections. The impact on average inflation rates for the calendar years of the projection horizon is however expected to be small.

- See “The prevalence of private sector wage indexation in the euro area and its potential role for the impact of inflation on wages”, Economic Bulletin, Issue 7, ECB, 2021.

- Due to uncertainty with regard to its timing and implementation, the recently announced minimum wage increase in Germany is not yet included in the baseline projections.

- The price-setting mechanism implies that the wholesale electricity price is set by the most expensive technology that is needed to meet electricity demand. During times of peak demand gas-fired power plants usually set the price, thereby linking wholesale electricity and gas prices.

- See the International Energy Agency, “Oil Market Report”, 16 November 2021.

- For more information on the concept of base effects and their role in inflation dynamics, see the box entitled “Recent dynamics in energy inflation: the role of base effects and taxes”, Economic Bulletin, Issue 3, ECB, 2021

- The scenarios are constructed using the ECB-BASE model (see Angelini, E., Bokan, N., Christoffel, K., Ciccarelli, M. and Zimic, S., “Introducing ECB-BASE: The blueprint of the new ECB semi-structural model for the euro area”, Working Paper Series, No 2315, ECB, September 2019). In addition, the ECB-BASIR model (an extension of the ECB-BASE model, see Angelini, E., Damjanović, M., Darracq Pariès, M. and Zimic, S., “ECB-BASIR: a primer on the macroeconomic implications of the Covid-19 pandemic”, Working Paper Series, No 2431, ECB, June 2020) is used to generate pandemic outcomes corresponding to the two scenarios (shown in Chart A). Given the uncertainty regarding the impact of alternative evolution paths of the pandemic on the technical assumptions, these are unchanged with respect to the baseline.

- 16 December 2021

- 3 January 2022