Institutional investors and house price growth

Published as part of the Financial Stability Review, May 2023.

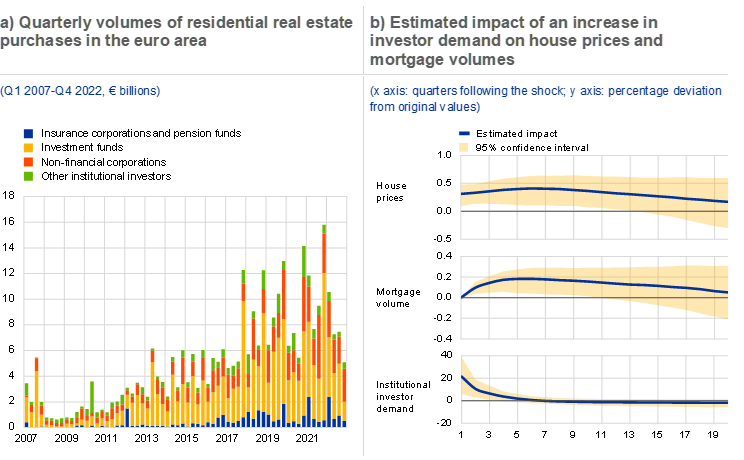

The presence of institutional investors, particularly investment funds, in euro area residential real estate (RRE) markets has increased markedly in recent years. This growth may be attributed to a range of factors, including persistent flows into riskier asset classes such as real estate over the prolonged period of low interest rates (Chart A, panel a).[1] Yet the implications for housing markets, as well as for financial stability more broadly, remain largely unstudied. This issue is becoming more pressing as the real estate cycle turns and as rising interest rates reverse the dynamics of flows into real estate funds. It also raises concerns that vulnerabilities in the investment fund sector may amplify any real estate market correction.[2] This box provides an initial empirical examination of the role of institutional investors in euro area RRE markets and the possible implications for financial stability.

Fluctuations in the demand from institutional investors for RRE assets are associated with changes in house prices. Purchases of euro area RRE by institutional investors are linked to changes in house prices between the first quarter of 2007 and the fourth quarter of 2021 in an empirical framework which also includes policy interest rates and variables to capture wider demand and supply dynamics in RRE markets. The results from the model suggest that a positive (negative) demand shock from institutional investors has a positive (negative) and persistent impact on RRE prices (Chart A, panel b).[3] Specifically, a one standard deviation increase in investor demand is associated with an increase in house prices of about 0.4%. It is also followed by an increase of 0.2% in mortgage lending, suggesting that there may be spillovers between the non-bank financial sector and bank activity in RRE markets. The model also shows that a tightening (loosening) monetary policy shock is associated with a drop (increase) in institutional investors’ demand for real estate.

Chart A

Increasing demand from institutional investors may be associated with rising euro area house prices and mortgage volumes

Sources: RCA, Eurostat and authors’ calculations.

Notes: Panel a: data shown are aggregated from transaction-level data provided by RCA. This is not a complete sample of purchases of residential real estate by institutional investors, so total values may underestimate total purchases. However, the steady increase in activity remains clear. Panel b: results of a BVAR(2), with normal-Wishart prior and optimised hyperparameters, fitted on euro area aggregate data including the following endogenous variables: real RRE prices, real lending for house purchases, lending rate on new loans for house purchases, shadow policy interest rate, real residential investments, real disposable income and institutional investors’ gross RRE purchases, for an estimation sample from Q1 2007 to Q4 2021. The shadow rate estimates are generated regressors proposed as a proxy for policy interest rates during unconventional monetary policy periods; see, for example, Wu and Xia* and Krippner**. The shadow rate used in this exercise is sourced from the Leo Krippner website.

*) Wu, J.C. and Xia, F.D., “Measuring the Impact of Monetary Policy at the Zero Lower Bound”, Journal of Money, Credit and Banking, Vol 48, Issue 2-3, 2016, pp. 253-291.

**) Krippner, L., “Measuring the stance of monetary policy in zero lower bound environments”, Economics Letters, Vol. 118, No 1, 2013, pp. 1135-138.

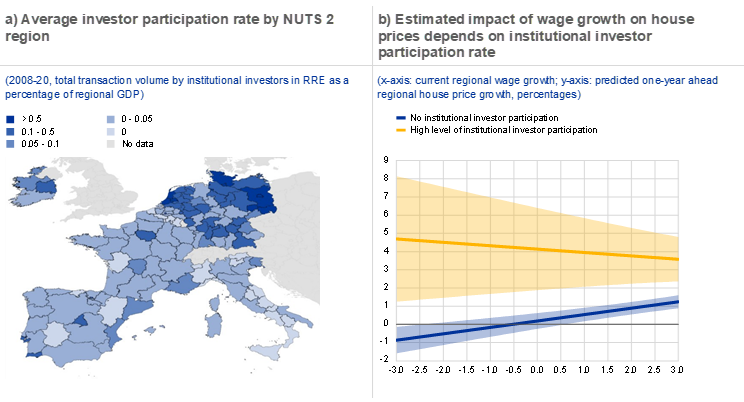

The link between local economic fundamentals and house price growth appears to weaken in regions with a greater presence of institutional investors, which may reinforce the build-up of financial vulnerabilities. The importance of institutional investors varies greatly across the euro area and is concentrated in certain countries and regions (Chart B, panel a). Regions in which institutional investors have limited presence are characterised by a clear positive link between local wage growth and house price growth (Chart B, panel b). This relationship weakens as the presence of institutional investors increases, while house price growth is typically also higher in such regions. During periods of high investor demand and low wage growth, this may support certain RRE markets but the disconnect between local economic fundamentals and house prices may also contribute to overvaluation. Regions with a strong presence of institutional investors may, therefore, be more vulnerable as investor demand falls and the cycle turns.

Chart B

Institutional investor presence varies across regions and can weaken the link between economic fundamentals and house price growth

Sources: RCA, European Data Warehouse, Eurostat and ECB calculations.

Notes: Panel a: Eurostat’s NUTS classification is a system for dividing up economic territories in the EU. NUTS 2 refers to basic regions for the application of regional policies.

Investor participation rate defined as total transaction volume by institutional investors in RRE divided by regional GDP. Only regions where both transaction data and regional price data (taken from European Data Warehouse, a dataset of securitised mortgage loans) are shown, as these are the regions which are included in the regressions shown in panel b. Panel b: predicted one-year ahead house price growth based on a panel regression for NUTS 2 regions as shown in panel a, for the years 2008 to 2020. Estimates include controls for regional GDP per capita and current house price growth and are robust to the inclusion of country-fixed effects. “High level of institutional investor participation” corresponds to the 75th percentile in the NUTS 2-level distribution. Shaded areas indicate 95% confidence intervals.

Institutional investments made via real estate investment funds may amplify the RRE cycle, which raises the importance of developing policies to reduce structural vulnerabilities in such funds. Real estate investment funds play a prominent role among institutional investors. They are subject to a structural liquidity mismatch when they offer daily redemptions to their investors while holding illiquid real estate assets. This makes them particularly vulnerable to the effects of large-scale investor redemptions, which could lead to reduced demand or forced asset sales by funds. Where this results in further real estate price corrections and subsequent additional redemptions, adverse feedback loops can develop, amplifying the initial RRE market shock and its implications for the financial resilience of banks, households and exposed firms. Policies aimed at enhancing the resilience of real estate investment funds could include liability-side measures to reduce liquidity mismatch, such as lower redemption frequencies, longer notice and settlement periods, and longer minimum holding periods.[4]

See the box entitled “Explaining cross-border transactions in euro area commercial real estate markets”, Financial Stability Review, ECB, November 2019; Giuzio, M., Kaufmann, C., Ryan, E. and Cappiello, L., “Investment funds, risk-taking, and monetary policy in the euro area”, Working Paper Series, No 2605, ECB, October 2021; “The rise of non-bank financial intermediation in real estate finance: Post-COVID-19 trends, vulnerabilities and policy implications”, OECD, 2021; Schnabel, I., “Monetary policy and inequality”, speech at a virtual conference on “Diversity and Inclusion in Economics, Finance, and Central Banking”, 9 November 2021.

Amplification effects particularly depend on the prevalence of open-ended real estate funds, which varies across countries.

Structural shocks are identified with zero and sign restrictions. We identify household demand shocks and housing supply, as well as mortgage supply and monetary policy shocks. We distinguish between an institutional investors’ demand shock and a households’ preference-driven demand shock by the different reactions of mortgage lending volume and mortgage lending rates, relying on the assumption that institutional investors do not take out mortgages to finance their purchases. Moreover, we distinguish between the demand from investors and an income-driven demand shock by households by the different reaction in household incomes.

See also the article entitled “The growing role of investment funds in euro area real estate markets: risks and policy considerations”, Macroprudential Bulletin, ECB, April 2023.