Economic developments and outlook for contact-intensive services in the euro area

Published as part of the ECB Economic Bulletin, Issue 7/2021.

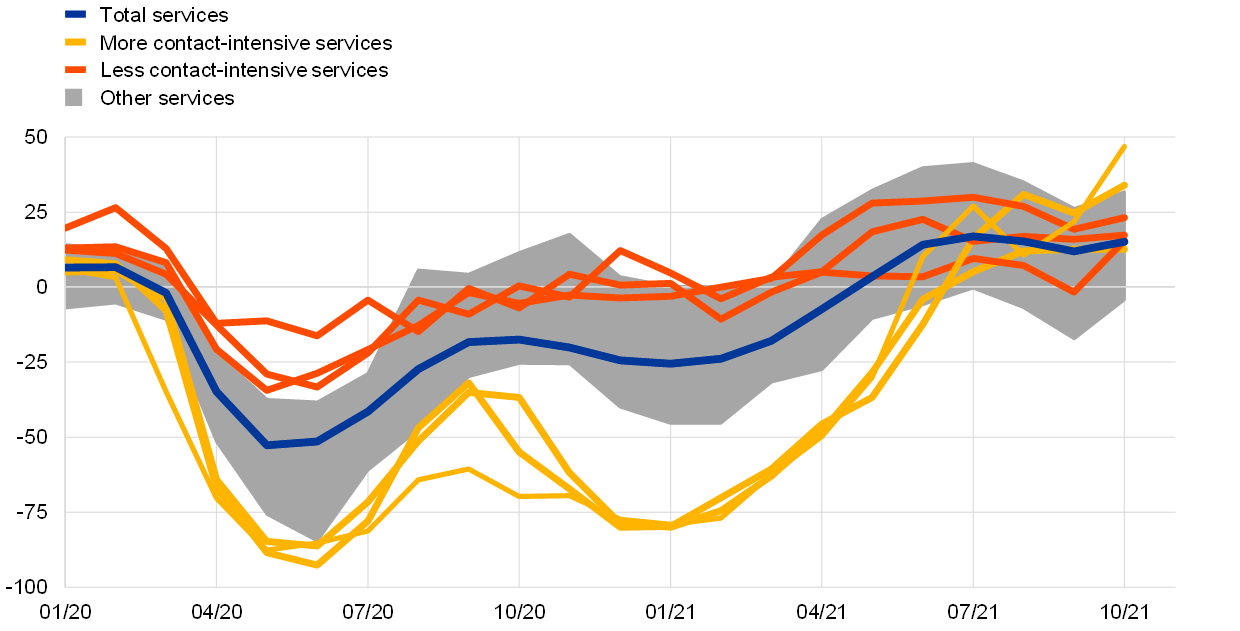

This box takes stock of the development of economic activity in euro area contact-intensive services that were adversely affected by the pandemic. During the first wave of the coronavirus (COVID-19) pandemic, value added in the manufacturing and services sectors behaved very similarly, contracting by more than 15% in the second quarter of 2020 compared with pre-pandemic levels. However, since then the recovery paths of the two sectors have been markedly different. The rebound in services activity was interrupted around the turn of the year, as some consumer services (henceforth “more contact-intensive services”) were largely shut down as a result of the resurgence of the pandemic and the tightening of COVID-19 restrictions, while other consumer services (henceforth “less contact-intensive services”) and manufacturing continued to recover (Chart A, panel a).[1]

After a bumpy 2020, more contact-intensive services began to rebound in spring 2021 and have been driving GDP growth since then. Preliminary flash GDP and production data imply a continued recovery in services value added in the third quarter of 2021. As the euro area economy reopened, tourism was a key driver of the strong upswing in more contact-intensive services activity. Together with the progress of vaccination campaigns, this has led to confidence in more contact-intensive sectors returning to and even overshooting pre-pandemic levels in recent months (Chart A, panel b). In addition, strong rises in credit card spending suggest more frequent use of more contact-intensive services like hospitality. However, despite this restored confidence, activity in these sectors has not fully regained its pre-crisis levels and there is still ample slack. Although perceived capacity utilisation has risen strongly since the second quarter of 2021, in the fourth quarter it amounted to only around 75% in the travel subsector and 85% in both the accommodation and food subsectors, which are the three most-affected subsectors. By the end of the third quarter, value added in more contact-intensive services was estimated to be approximately 8% below its pre-pandemic level.

Chart A

Services sector developments

a) Value added by sector

(Q4 2019 = 100)

b) Services sector confidence

(net percentage balances)

Sources: ECB calculations using Eurostat and ECFIN data.

Notes: Panel a): data for the third quarter of 2021 are based on quarterly data for value added in (1) manufacturing and other industry (referred to as “manufacturing” in the text), (2) construction and (3) other sectors. These data are imputed from available monthly data up to September for (1) industrial production excluding construction, (2) construction production and (3) residual with respect to real GDP according to the flash release. Panel b): the grey area refers to the interval between the maximum and minimum values of 17 other NACE services subsectors series covered by the European Commission’s Economic Sentiment Indicator. Yellow lines refer to three selected more contact-intensive services sectors: accommodation, travel, and food and beverage. Red lines refer to three less contact-intensive services sectors: telecommunication, information and programming. The latest observations are for the second quarter of 2021 (value added) and October 2021 (confidence).

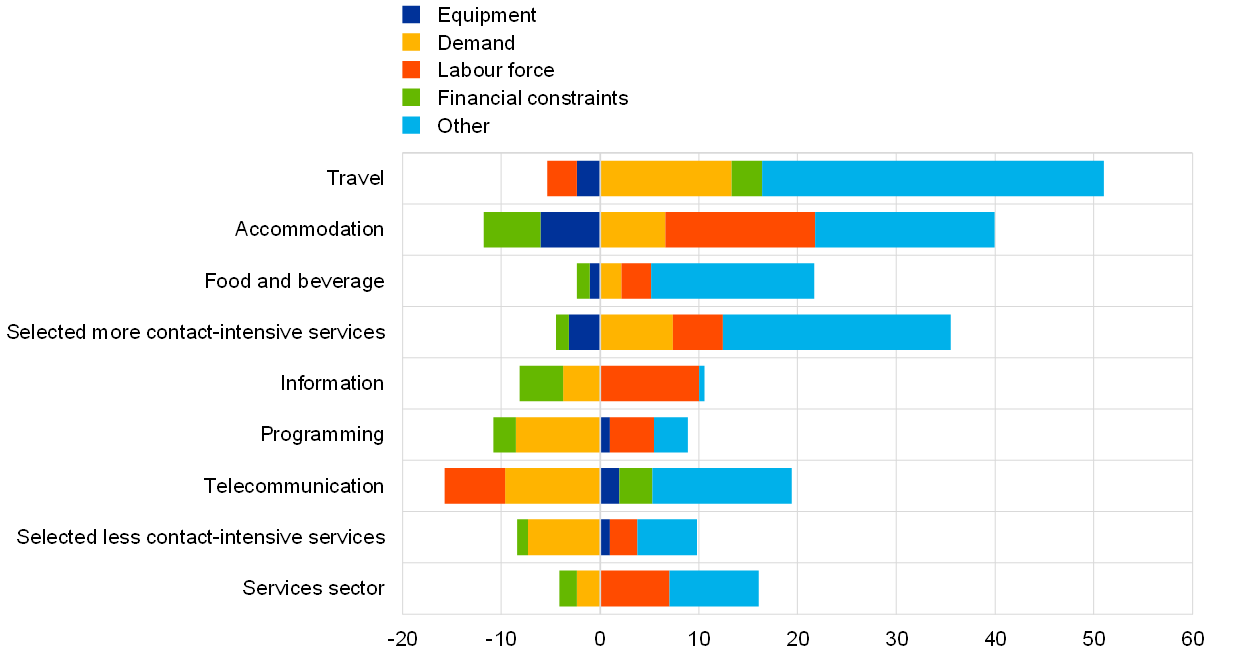

This notable slack in more contact-intensive services is confirmed by evidence that demand has been a more important factor limiting activity during the pandemic than it was before the pandemic. The limits on activity in more contact-intensive services are perceived as stemming largely from ‘other’ factors, which are mostly related to preventive pandemic containment measures,[2] and also to some extent from demand and labour input, while financial constraints played a broadly similar role in the fourth quarter of 2021 as they did before the pandemic (Chart B). Labour is perceived as an increasingly limiting factor to activity in more contact-intensive services, such as in the accommodation and the food and beverage subsectors. Unlike the manufacturing sector, the services sector is not experiencing shortages of materials, but it is more sensitive to pandemic-related constraints. From a cyclical perspective, the entire services sector is now in an expansionary phase. A majority of surveyed firms in more contact-intensive services report rising past and expected demand, suggesting an ongoing expansion (Chart C). These subsectors saw very strong expansions following the two pronounced dips during the earlier pandemic waves, which is also reflected in accelerating price pressures. In comparison, the less contact-intensive services subsectors exhibited much more contained cyclical variation over the past 18 months.

Chart B

Limits on activity in the services sector in the fourth quarter of 2021

(deviations from fourth quarter of 2019 in net percentage balances)

Source: ECFIN data.

Notes: Values for both more and less contact-intensive services refer to the average of the values for the three subsectors shown immediately above them. The latest observations are for the fourth quarter of 2021 (survey undertaken in October).

Chart C

Cycles across selected services sectors

(percentage balances; x-axis: demand over past three months; y-axis: demand over next three months)

Sources: ECB calculations using ECFIN data.

Notes: Yellow dots refer to the period from January 2011 to January 2019. Blue lines refer to the period from February 2020 to September 2021. “Less contact-intensive ” and “more contact-intensive” refer to the selected subsectors exhibited in Chart B. The latest observations are for October 2021 (red dot).

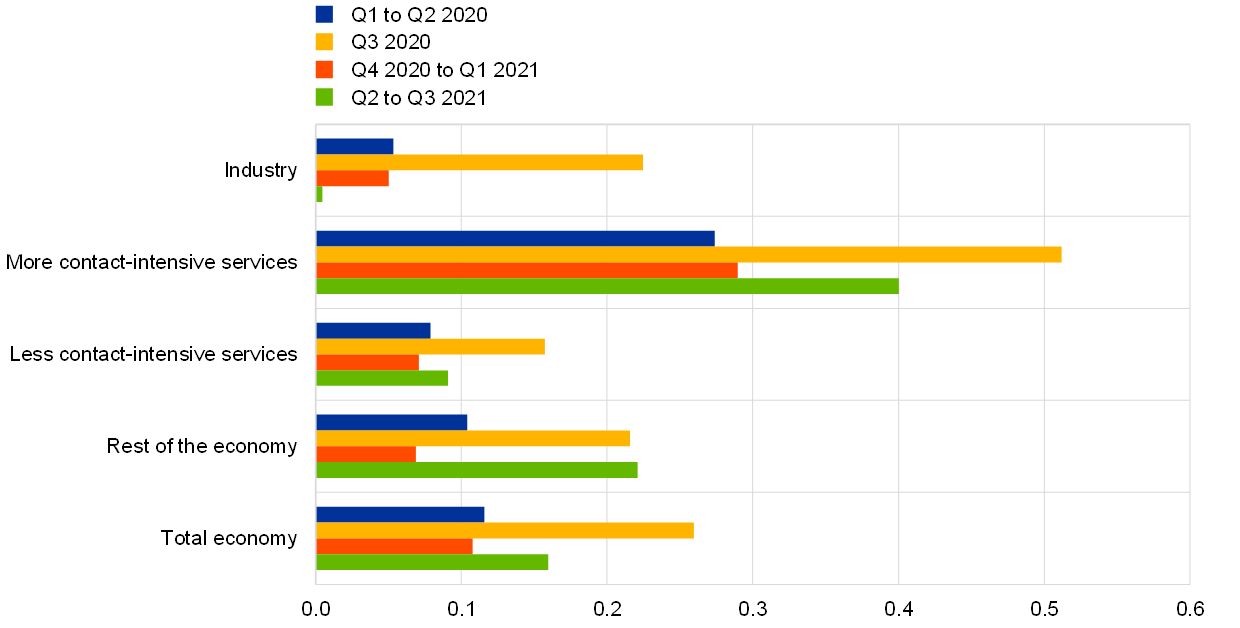

The stringency of containment measures has been an important factor affecting activity in more contact-intensive services since spring 2021. Model-based results suggest that the estimated sensitivity of aggregate economic growth to changes in the stringency of restrictions in the middle of 2021 increased from its average level at the turn of the year, but remained below the level reached in the third quarter of 2020 (Chart D).[3] The pattern observed for the total economy was largely driven by services, in particular more contact-intensive services subsectors, while the responsiveness of industry declined throughout recent quarters. Activity in more contact-intensive services appears to be more responsive to a loosening of containment measures than to a tightening, as shown by the relatively higher average estimated elasticities in the third quarter of 2020 and the second and third quarters of 2021, when the stringency of containment measures was relaxed. Overall, this evidence suggests that the continued reopening of the economy over the coming quarters will remain a key factor in the recovery of more contact-intensive services.

Chart D

Estimated elasticities of sectoral activity to the stringency of containment measures

(impact of a one point decrease in the Oxford Stringency Index on real gross value-added quarter-on-quarter growth; percentage points)

Sources: Eurostat and authors’ calculations.

Notes: Estimated sectoral elasticities for the third quarter of 2021 are based on quarterly data for value added in (1) manufacturing and other industry, (2) construction and (3) other sectors. These data are imputed from available monthly data for (1) industrial production excluding construction, (2) construction production and (3) residual with respect to real GDP according to the flash release. “Rest of the economy” refers to agriculture and public services.

As the public health crisis abates and economies reopen further, activity in more contact-intensive services is expected to continue to expand, but the medium-term outlook remains uncertain. The need to replace obsolete productive capacity, expand labour input and reallocate resources across subsectors could durably alter the trend growth of more contact-intensive services. At the same time, if containment measures are long-lasting or policy support is withdrawn abruptly, there may be an increase in insolvencies.[4],[5] Moreover, changes in preferences, such as moving away from business travel and long-distance tourism towards hybrid working solutions and local vacation destinations, could cause permanent shifts in consumption patterns necessitating the sectoral reallocation of activity.[6]

To summarise, the COVID-19 pandemic has had a marked impact on more contact-intensive services in the euro area. While these subsectors made a significant contribution to economic growth in the middle of 2021, their growth potential will be determined by the evolution and containment of the pandemic in the near term, coupled with a number of structural factors in the medium term. The likely need for sectoral reallocation and the possible increase in company insolvencies might impair a quick and full recovery of more contact-intensive services.

- More contact-intensive services, representing 22% of the total economy before the pandemic, refer to wholesale and retail trade, transport, accommodation and food services (NACE2 Rev2 classification: G, H, I) as well as arts and entertainment (R, S, T, U). Less contact-intensive services, representing 33% of the total economy before the pandemic, cover information and communication (J), financial and insurance activities (K), real estate (L), professional, scientific and technical activities (M), and administrative and support service activities (N).

- It is worth noting that in recent months mobility indices related to recreational activities (e.g. Google mobility index for retail and recreation) – which broadly reflect the extent of voluntary social distancing – recovered to pre-crisis levels, while indices related to more regulated activities (e.g. Google mobility index for workplaces) remained below pre-crisis levels. Based on data for the United States, much of the shift in mobility appears voluntary and lifting constraints may yield a quick recovery, provided the reduction in COVID-19 risk is deemed credible (see Maloney, W. and Taskin, T., “Determinants of Social Distancing and Economic Activity during COVID-19: A Global View”, Policy Research Working Paper Series, No 9242, World Bank Group, May 2020). The reduction in voluntary social distancing and the improvement in confidence would therefore point to a continued recovery.

- For further details on the model, see the box entitled “The impact of containment measures across sectors and countries during the COVID-19 pandemic”, Economic Bulletin, Issue 2, ECB, 2021.

- For instance, bankruptcies in the accommodation and food services sector increased by 23% between the fourth quarter of 2019 and the second quarter of 2021, according to data from Eurostat. In other more contact-intensive services bankruptcies were lower in the second quarter of 2021 than at the onset of the crisis, in an environment where policy support remained strong.

- In a study by the Federal Reserve Bank of New York, each additional week of closure in more contact-intensive services subsectors reduces the probability of a business reopening by 2 percentage points. Recent evidence from Banca d’Italia suggests that the COVID-19 pandemic has not significantly affected the number of active Italian firms in the tourism sector, but their relatively higher recourse to bank lending than before the pandemic will undermine their recovery when policy support is eventually withdrawn.

- See IMF, “Managing Divergent Recoveries”, World Economic Outlook, April 2021 and de Vet, J.M, et al., “Impacts of the COVID-19 pandemic on EU industries”, Policy Department for Economic, Scientific and Quality of Life Policies, European Parliament, Luxembourg, 2021.