The heterogeneous economic impact of the pandemic across euro area countries

Published as part of the ECB Economic Bulletin, Issue 5/2021.

While the coronavirus (COVID-19) pandemic has been a common shock, its economic impact has been heterogenous across countries. This box describes how activity and demand have been affected in the euro area countries since the start of the pandemic and highlights some elements which may help to explain the heterogeneous performance across countries. It also points out the risks of persistent divergences and the important role of the Next Generation EU plans in reducing them. Differences across euro area countries include the degree of containment measures in response to the varying intensity of the health crisis, the different sectoral compositions and economic structures, and the quality of institutional settings. As fiscal support has been proportional to the depth of the health crisis, fiscal positions in euro area countries diverged in 2020.

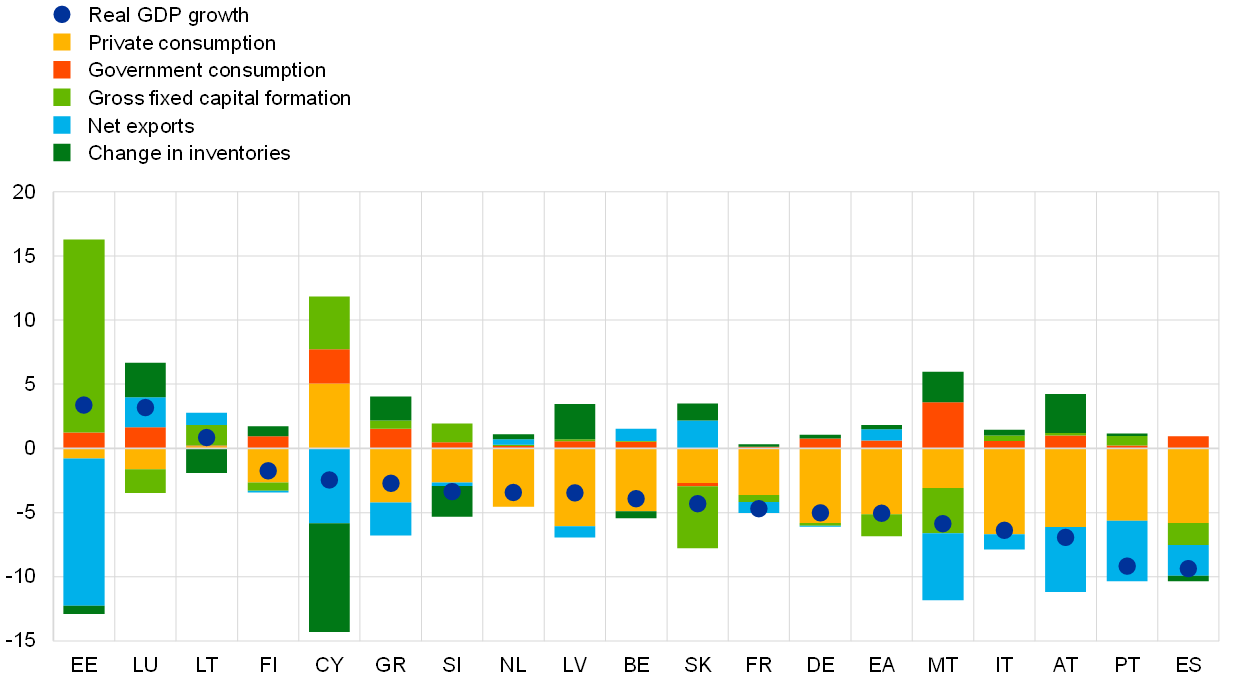

In the first quarter of 2021 euro area real GDP was 4.9% below its pre-pandemic level, having declined by 6.5% in 2020. Across the euro area countries, the comparison with pre-pandemic levels ranges from +13.2% (Ireland) to -9.3% (Spain). Whereas the deepest recession was seen in 2020, the total real GDP level in the first quarter of 2021 was still well below its pre-crisis level in all countries except Estonia (3.4%), Ireland (13.2%), Lithuania (1.1%) and Luxembourg (3.2%) (Chart A).[1] By contrast, Spain, Italy, Malta, Austria and Portugal saw the most significant drop in real GDP, with Portugal and Spain bearing the largest losses (9.1% and 9.3% respectively). As in these countries, the tourism sector is of particular importance for aggregate activity, they were strongly affected by international travel bans.[2]

While the pandemic-induced recession was mostly consumption-driven, the relative importance of the contributions to growth by demand components varied substantially across countries. In most countries, the largest negative contribution to the recession came from the biggest demand component: the cutback in private consumption. This occurred against the backdrop of significantly reduced spending opportunities for households coupled with uncertainty, which prompted larger precautionary savings (see Chart A).[3] Notably in Germany, Belgium and the Netherlands, the decrease in real GDP was entirely accounted for by private consumption, showing the resilience of their external sector on the back of their less vulnerable exports composition. The more volatile GDP components, total investment and net exports growth, while less important in their relative size, further amplified cross-country heterogeneities by fostering GDP growth in some countries but suppressing it in others.

Chart A

Decomposition of the change in real GDP from the fourth quarter of 2019 to the first quarter of 2021 by demand components

(percentage, percentage points contributions)

Sources: Eurostat and authors’ calculations.

Notes: Ireland is not shown as its real GDP growth and domestic demand components were strongly distorted by activities of multi-national enterprises. The exceptionally large contributions from total investment growth and net exports to growth with opposing signs in Estonia was attributable to a sizeable operation by an international automobile firm which invested in new software in Estonia. The operation was simultaneously recorded as equipment investment and imports, with no impact on GDP.

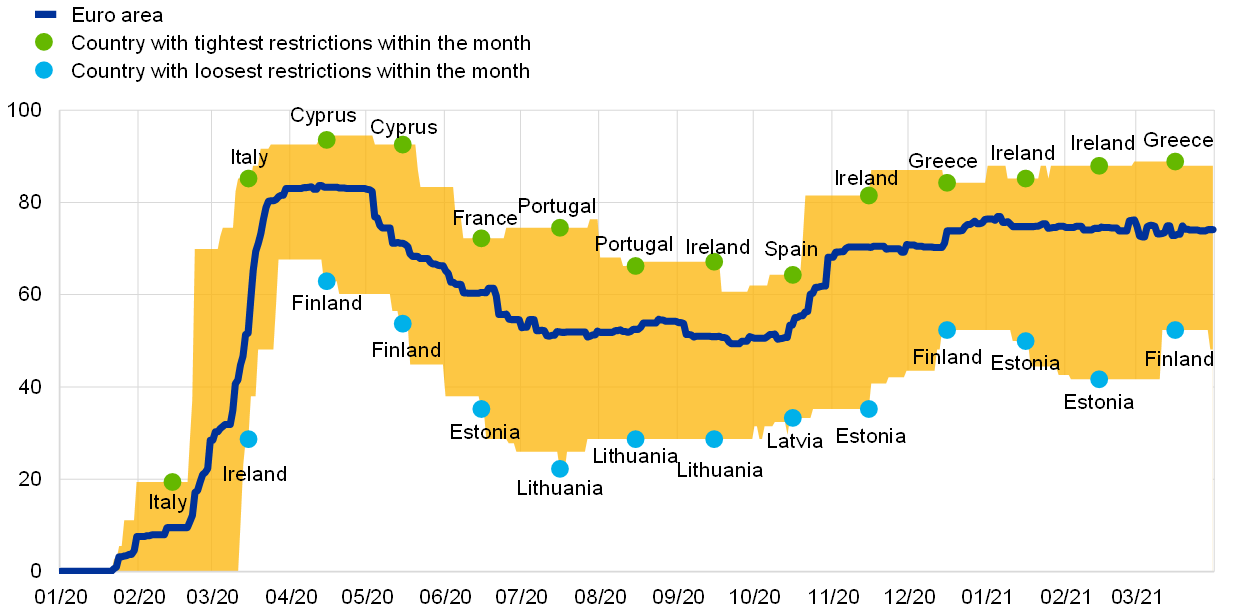

The stringency of the containment measures needed to fight the health crisis varied substantially across countries and time. The design of the containment measures, as well as their evolution over time as summarised in the Oxford stringency index (OSI), depended primarily on the country-specific pandemic developments. Chart B, panel a shows the evolution of the euro area average OSI and the range spanned by euro area countries since the outbreak of the pandemic in the first quarter of 2020. By 12 March 2020 all euro area countries had put in place a set of containment measures, with Italy reacting first and Estonia last. Throughout the pandemic period, a large gap persisted between the country with the tightest restrictions and the country with the loosest, contributing to the increase in cross-country heterogeneities in economic developments.[4]

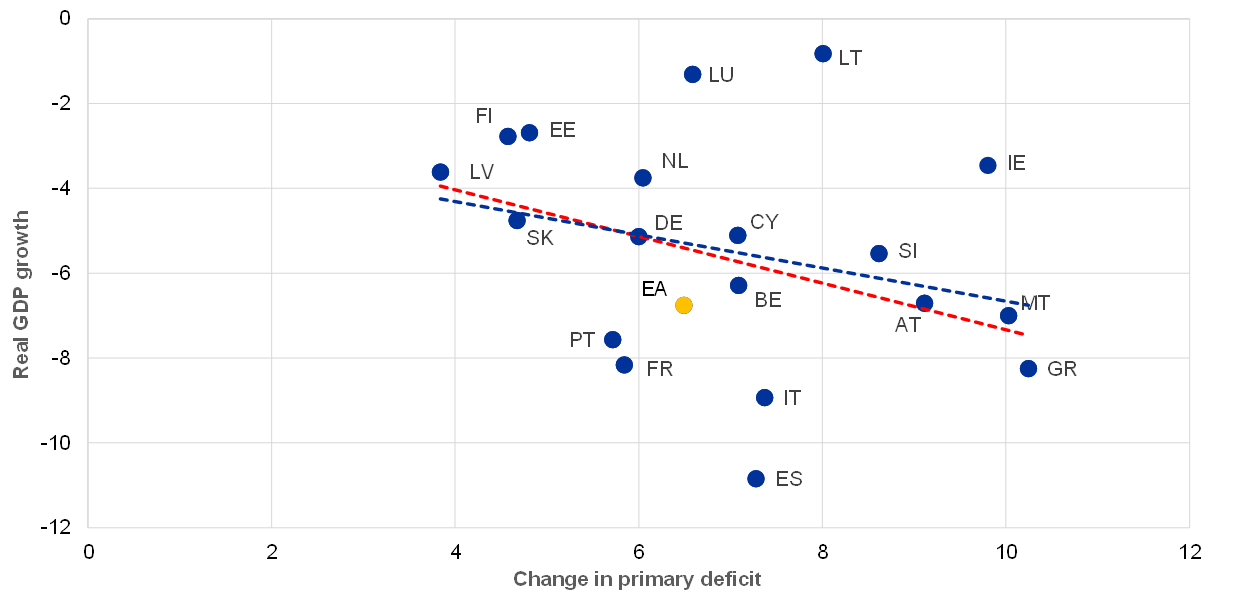

The impact of lockdown measures was heterogeneous across countries and time, largely depending on the sectoral composition. Finland, Estonia, Lithuania and Latvia had the least stringent measures for the extended pandemic period, whereas Italy, Spain and Portugal implemented relatively stringent measures. While the stringency level was generalised across the different sectors during the first lockdown at the start of the first wave in March 2020, it became more targeted towards specific sectors and varied more substantially across countries during the second wave starting in October 2020. More targeted containment measures lent more importance to the sectoral composition of the economy. The share of high-contact services may play a role in explaining the heterogenous economic impact of certain lockdown measures (Chart B, panel b).[5] The sectoral composition is only one of several structural drivers of potential output growth (such as quality of institutions, labour and product market regulation, and trade linkages). These factors, which helped to explain cross-country differences in growth potential and the different recovery pace from common shocks over the last few decades, may also be relevant to this pandemic.[6]

Chart B

Containment measures and economic structures in cross-country comparison

a) Evolution of Oxford stringency index across euro area

(index)

b) Share of high-contact services sector and change in value added during the COVID-19 crisis period

(percentage, percentage changes)

Sources: Oxford Government Response Tracker, Eurostat and ECB staff calculation.

Notes: In panel a, the Oxford COVID-19 Stringency Index is a composite measure based on nine response indicators including school closures, workplace closures and travel bans, rescaled to a value from 0 to 100 (100 = strictest). For the euro area, the index corresponds to the GDP-weighted average of the Stringency Index for all euro area countries. The latest observation is for 31 March 2021. In panel b, change in gross value added refers to cumulative change from the fourth quarter of 2019 to the first quarter of 2021. High-contact sectors include retail trade, transport, accommodation, food service activities, arts, entertainment, recreation and other activities. The high-contact sectors' pre-COVID-19 share of value added has been computed as the 2019 quarterly average of the percentage shares in total value added.

The impact of the crisis was cushioned by substantial fiscal support provided by all euro area governments; though similar in terms of composition, the support was rather different in size.[7] By providing quick and critical support in the first phase of the pandemic, national governments addressed and mitigated the immediate health and economic consequences of the crisis.[8] The emergency packages in 2020 were broadly similar across countries in terms of their measures, with the largest shares assigned to job retention schemes, liquidity support to firms[9] such as state guarantees[10], tax deferrals and subsidies, as well as measures to address the medical emergency. However, the overall size of the fiscal support differed considerably across countries. In Greece and Malta the fiscal impulse in 2020 − as measured by the change in budget balance net of interest payments, which reflects the automatic response of the government budget balance to the cycle (automatic stabilisers) and discretionary fiscal measures − amounted to more than 10% of pre-crisis GDP, while in Estonia, Latvia and Finland, which have been relatively less affected by the health crisis, it was around 4%.

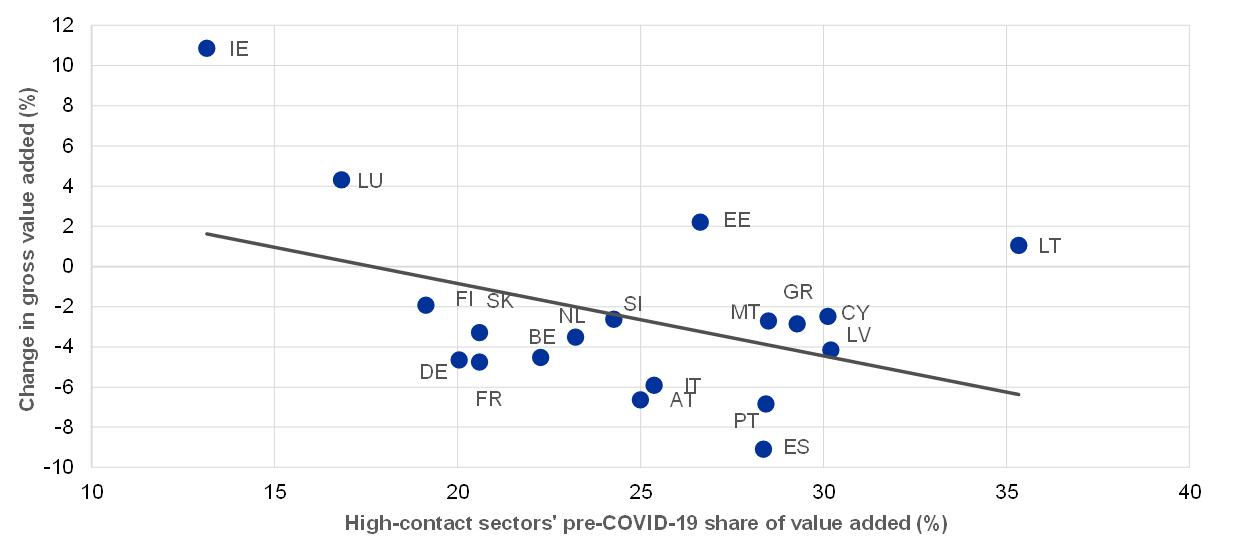

Overall, the fiscal impulse has tended to be proportional to the GDP losses. Across euro area countries, the change in the budget balance net of interest payments has tended to be larger where GDP declined more strongly (Chart C, panel a). At the same time, several euro area countries in which the fiscal impulse in 2020, and thus the effect on budget deficits, had been larger, also entered the pandemic with higher debt levels (Chart C, panel b). This further increased the level of heterogeneity in fiscal positions in 2020 when compared with the pre-crisis period.

Chart C

Fiscal impulse against drop in real GDP growth in 2020 (panel a) and debt-to-GDP level in 2019 (panel b)*

a) Fiscal impulse against drop in real GDP growth in 2020

(real GDP in percentage changes; change in primary deficit as a percentage of 2019 GDP)

b) Debt-to-GDP level in 2019

(debt level as a percentage of GDP; change in primary deficit as a percentage of 2019 GDP)

Sources: Eurostat, ESCB June 2021 Broad Macroeconomic Projection Exercise, Central Statistics Office and ECB calculations.

Notes: The fiscal impulse is measured as the change in the primary deficit in 2020 as a percentage of 2019 GDP.

*For Ireland, modified gross national income (GNI*) at constant market prices is used instead of real GDP and government debt and change in primary deficit is expressed as a percentage of 2019 GNI*. The red line shows the trendline excluding Ireland. For Germany, the primary deficit figure for 2020 has been updated after the EDP notifications, which also affects the euro area aggregate for 2020.

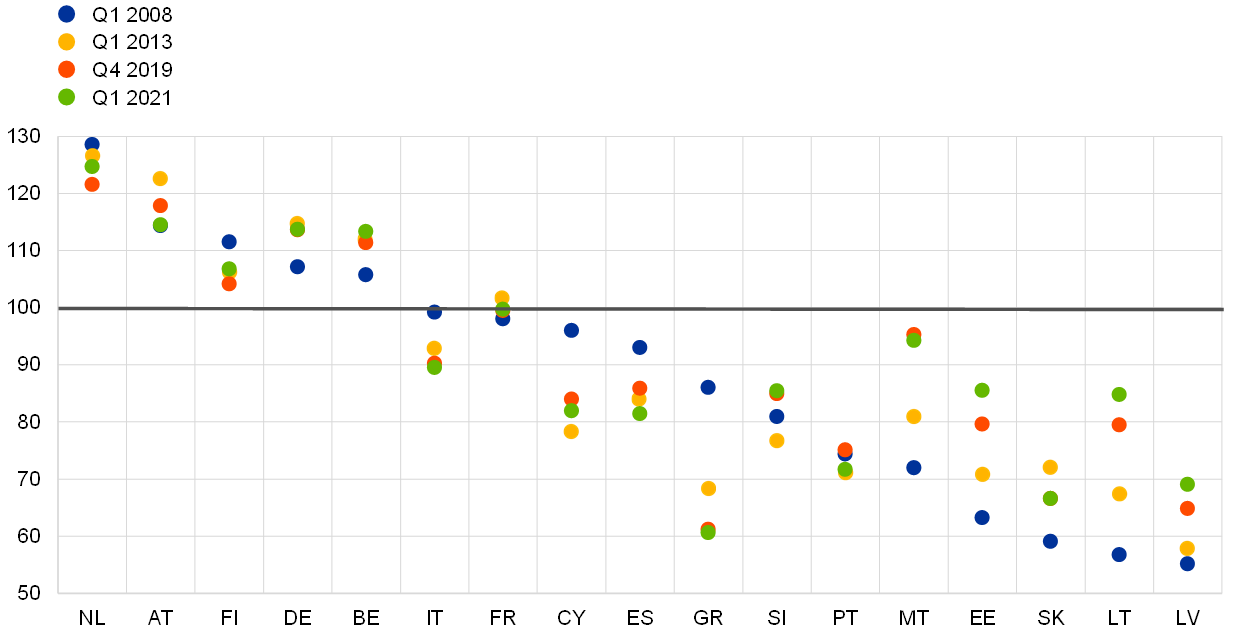

The COVID-19 crisis has at least temporarily disrupted the cross-country convergence process in living standards seen since the global financial and euro area sovereign debt crisis. Chart D shows the position of countries relative to the euro area average in GDP per capita in purchasing power parities (PPP), a popular measure for comparing living standards. The global financial and euro area sovereign debt crisis resulted in sizeable cross-country divergences, building up between the first quarter of 2008 and the first quarter of 2013, followed by a convergence process. The COVID-19 shock has triggered renewed, yet overall smaller, divergences, hitting some countries below the euro area average in terms of per capita income more severely than those above. Germany, the Netherlands and all other countries above the euro area average, with the exception of Austria, have seen their living standards deteriorate by less than, or the same as, that average, whereas those of countries below it, i.e. Greece, Italy, Spain and Portugal, have drifted away. By contrast, with the exception of Cyprus and Malta, countries which joined the euro area between 2007 and 2015[11], have continued their catching-up process towards the euro area average despite the COVID-19 pandemic.

Chart D

GDP per capita in purchasing power standards compared to euro area average at different points in time

(index, euro area=100)

Sources: European Commission, Eurostat, the World Bank, ECB staff calculations

Notes: Periods correspond to the peaks and troughs of euro area GDP per capita in the global financial and sovereign debt crisis and COVID-19 pandemic, respectively. Ireland and Luxembourg appear as outliers and are not shown in the chart. Countries are sorted by their index value in the first quarter of 2008.

While the extraordinary policy reaction has contained the economic impact of the pandemic, risks of scarring effects in the countries most affected remain high. Given the importance of structural factors in explaining the increased heterogeneity, the initial impact of the pandemic shock may lead to longer-lasting growth divergences in the future. These could be explained by, for example, cross-country differences in the pace of re-allocation between sectors and in fiscal space.

The Next Generation EU is expected to help reduce the rise in economic divergence in the euro area. It is aimed at improving the structural underpinnings of the economies and promoting a more inclusive recovery. This is supported by, among other things, the distribution of the recovery and resilience funds favouring countries with the largest economic losses from the pandemic.[12]

- The strong growth in Ireland mainly reflects the performance of the sectors dominated by foreign-owned multinational enterprises.

- For details on the impact of travel restrictions, see “Impact of the COVID-19 lockdown on trade in travel services”, Economic Bulletin, Issue 4, ECB, 2020.

- For details on the estimate of forced (involuntary savings) vs. precautionary savings, “COVID-19 and the increase in household savings: precautionary or forced?”, Economic Bulletin, Issue 6, ECB, 2020.

- In the euro area, the cross-country variation of the OSI spanned a range of 40 on average (with a maximum of 93 reached in April 2020) from the least to the most stringent country score, with a standard deviation of around 10 over the entire period.

- See for a detailed analysis “The impact of containment measures across sectors and countries during the COVID-19 pandemic”, Economic Bulletin, Issue 2, ECB, 2021.

- See Sondermann, D., “Towards more resilient economies: the role of well-functioning economic structures”, Working Paper Series, ECB, No 1984, November 2016.

- This box refers mostly to fiscal support with an impact on the budget balance. However, some of the support measures, such as government guarantees and other contingent liabilities, did not have an immediate impact on public finances but provided important support to facilitate companies’ access to external financing and preserve pre-crisis structures of the economy.

- For an overview, see “The initial fiscal policy responses of euro area countries to the COVID-19 crisis”, Economic Bulletin, Issue 1, ECB, 2021.

- See “The impact of fiscal support measures on the liquidity needs of firms during the pandemic”, Economic Bulletin, Issue 4, ECB, 2021.

- See “The role of government for the non-financial corporate sector during the COVID-19 crisis”, Economic Bulletin, Issue 5, ECB, 2021.

- Estonia, Cyprus, Malta, Latvia, Lithuania, Slovenia and Slovakia.

- European Commission’s proposal for a regulation establishing a Recovery and Resilience Facility (RRF) and European Council conclusions of 21 July 2020.