10 August 2022

By Ursel Baumann, Christophe Kamps and Manfred Kremer

As part of our monetary policy strategy review we adopted a new symmetric 2% inflation target. One year on, we examine how the strategy review has helped anchor financial analysts’ inflation expectations. We also show that recent policy normalisation is grounded in our strategy.

A year ago the Governing Council of the ECB published its new monetary policy strategy.[1] Since then, the monetary policy environment has changed completely. The war in Ukraine and the reopening of the economy as the pandemic abates have contributed to a shift from an era of subdued price increases to a period of elevated inflation. Given the importance of inflation expectations to monetary policy and price stability, in this post we address two key questions. To what extent have inflation expectations become more firmly anchored at the 2% inflation target since the new strategy was announced? And how has the strategy laid the groundwork for monetary policy normalisation in the current phase of undesirably high inflation?[2]

The strategy review challenge: how to re-anchor expectations at target when inflation is low?

In 2020-21 we needed to review our monetary policy strategy to grapple with the structural economic changes over the preceding decades. The most fundamental of these was a decline in the equilibrium real interest rate, which keeps the economy balanced between inflationary or disinflationary forces.[3] The estimated equilibrium rate dropped from close to 3% at the start of the monetary union to levels close to or even below zero in the period before the pandemic. This decline reduced the space available for central banks to carry out monetary easing using conventional interest rate policy.

The new strategy addresses this challenge with an explicitly symmetric 2% inflation target over the medium term, which is slightly higher than our previous target. Being “symmetric” means that it is equally undesirable for inflation to rise above or drop below the target. The strategy also acknowledges that, when the economy is operating close to the lower bound on nominal interest rates, especially forceful or persistent monetary policy action is required. This may also imply a transitory period in which inflation is moderately above target.

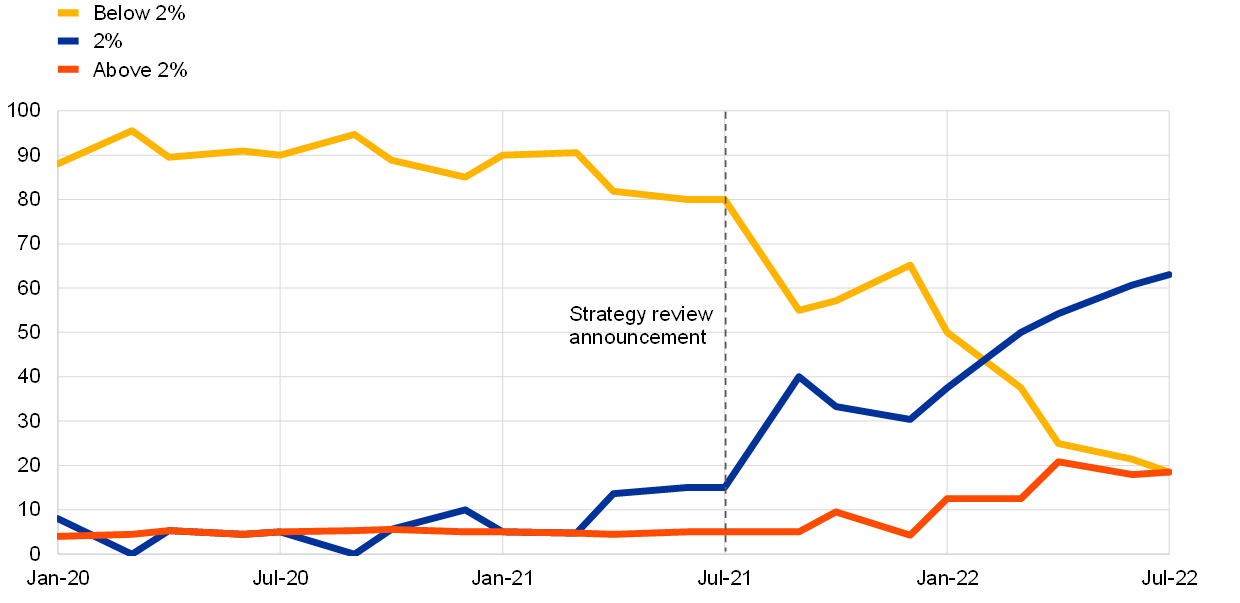

Bringing low inflation up to our target was the key monetary policy challenge until the summer of 2021. The new target of 2% was expected to help with this by contributing to anchoring longer-term inflation expectations more solidly. There is evidence to confirm that this has indeed happened. Following the announcement of the new strategy, the ECB Survey of Monetary Analysts showed a noticeable increase in the percentage of respondents expecting long-run inflation at 2%, together with a decline in the percentage of respondents expecting inflation below 2% (see Chart 1). According to the latest survey round, the median respondent expects inflation to be exactly 2.0% as of the fourth quarter of 2024, suggesting that both medium-term and long-term inflation expectations are firmly anchored at our new inflation target. Other indicators broadly support this assessment. For instance, according to a special Survey of Professional Forecasters aimed at evaluating our new strategy, survey respondents, on balance, revised their longer-term inflation expectations moderately upwards, with the balance of risks surrounding these expectations coming closer to symmetry.[4]

Today’s challenge: how to keep inflation expectations anchored at 2%?

Only 12 months after publishing our new strategy, the world has changed. The pandemic and the war in Ukraine have fostered inflationary forces. So central banks have had to shift their focus from tackling low inflation to combating high inflation. The ECB’s monetary policy response to the higher inflation outlook can clearly be rationalised based on the new strategy – in particular its symmetric inflation target.

Two aspects of the ECB’s strategy support the continued accommodative monetary policy stance during the initial phase of rising inflation in the second half of 2021.

The first is the flexible medium-term orientation, which allows for inevitable short-term deviations of inflation from target, as well as lags and uncertainty in the transmission of monetary policy to the economy and to inflation. Initially, the unexpected rise in inflation was largely seen as transitory and mainly caused by supply bottlenecks, such as the temporary closure of port terminals. Such supply shocks tend to push inflation higher and economic activity and employment lower. In cases like this, the medium-term orientation enables a lengthening of the horizon over which inflation is brought back to target. This avoids pronounced falls in economic activity and employment, which, if persistent, could jeopardise medium-term price stability. Lengthening this horizon is a viable option as long as inflation expectations remain well-anchored.

The second aspect supporting the policy stance in the second half of 2021 is that the euro area is emerging from a long period with policy interest rates at the lower bound. This is a situation for which our strategy prescribes that monetary policy accommodation should be “especially persistent” and adjustments gradual, so that inflation expectations do not settle below the 2% target.

From the end of 2021 onwards, inflationary pressures broadened and intensified, with core inflation rising above 2% as of October 2021 and more significantly so as of February 2022. This was driven by a sequence of supply shocks, in particular disruptions in energy markets following Russia’s unjustified aggression towards Ukraine, combined with a rebound in demand reflecting pandemic restrictions being lifted. A succession of supply-side shocks has the potential to destabilise inflation expectations, with the risk that the increase in inflation becomes self-sustained. In response, the ECB began normalising monetary policy in December 2021, with the decision to end net purchases under the pandemic emergency purchase programme at the end of March 2022.

In early 2022 concerns increased that inflation expectations might become unanchored from the 2% target. Our April monetary policy statement reflected those concerns, stating “initial signs of above-target revisions in those measures [of inflation expectations] warrant close monitoring”. Data and analysis in the following months raised the need for further steps to be taken on the path towards policy normalisation, most importantly the ending of net asset purchases to pave the way for an increase – by 50 basis points – in the ECB’s key policy rates at the July Governing Council meeting. This ended an eight-year period of negative rates.[5]

To sum up, the new ECB strategy has contributed to a more solid anchoring of inflation expectations at 2%. Monetary policy decisions taken by the ECB’s Governing Council since July 2021 have been firmly grounded in the strategy. In the light of rising inflationary pressures, in December 2021 the Governing Council decided to embark on a path of monetary policy normalisation. Since then the Governing Council has repeatedly emphasised that it will ensure inflation returns to the 2% target over the medium term, in line with its commitment to symmetry.

It is always worth noting that, at any point in time, it is likely that several monetary policy options are each consistent with the overall strategy. While a strategic framework provides a fundamental anchor for the medium-orientation of monetary policy, meeting-by-meeting decisions still require considerable judgement in terms of assessing the latest conjunctural information and determining the appropriate speed in adjusting the monetary policy stance.

Chart 1

Evolution of long-run inflation expectations over survey rounds

(Percentage of respondents)

Source: ECB Survey of Monetary Analysts (SMA) (all vintages from January 2020 until July 2022 results).

Notes: The three groups are based on the Harmonised Index of Consumer Prices long-run point forecasts provided by respondents on the macroeconomic projections question of the SMA. 2% is calculated as inflation expectations between 1.95% and 2.05%. The number of respondents to the July 2022 SMA was 27. The latest observation (SMA) is for July 2022.

The views expressed in each blog entry are those of the author(s) and do not necessarily represent the views of the European Central Bank and the Eurosystem.

See the ECB’s monetary policy strategy statement and an overview of the ECB’s monetary policy strategy.

The decision on the ECB monetary policy strategy also covered: the measurement of inflation; the inclusion of owner-occupied housing; the proportionality of monetary policy measures; the instruments within the ECB’s toolkit; the role of fiscal and other policies; considerations relating to balanced growth; employment; financial stability and climate change; the analytical framework; and the communication of ECB policies. An assessment of these topics goes beyond the scope of this blog. For an assessment of the ECB’s first milestone when it comes to incorporating climate change considerations into its monetary policy, see Elderson, F. and Schnabel, I. (2022),“A catalyst for greening the financial system”, The ECB Blog, 8 July.

The concept of the equilibrium real interest rate is explained in the ECB Monetary Policy glossary.

See European Central Bank (2021), “Results of a special survey of professional forecasters on the ECB’s new monetary policy strategy”, Economic Bulletin, ECB, Issue 7.

See Lagarde, C. (2022), “Ensuring price stability”, The ECB Blog, 23 July. To support the effective transmission of monetary policy across all euro area countries, at its July 2022 meeting the ECB’s Governing Council also approved the establishment of the Transmission Protection Instrument.