- THE ECB BLOG

- 28 April 2020

Beyond monetary policy – protecting the continuity and safety of payments during the coronavirus crisis

Blog post by Fabio Panetta, Member of the Executive Board of the ECB

The coronavirus (COVID-19) pandemic is disrupting the lives of millions of Europeans. Many of them are suffering from its tragic human consequences: the absolute priority remains to support healthcare systems and those who are sparing no effort to defeat the pandemic.

Europeans are also concerned about their economic situation as incomes and revenues dry up. To support families and firms, the European Central Bank (ECB) has taken exceptional and comprehensive monetary policy measures, lowering the cost and improving the availability of financing for all sectors of the economy. For example, we recently decided to allow banks for the first time to obtain liquidity from the ECB using as collateral loans to self-employed workers and households which benefit from government or public sector guarantees (such as those provided by euro area countries in response to the coronavirus pandemic). This will incentivise banks to extend such loans.

Our bold actions complement and reinforce the national and European measures to provide relief to the economy. They help to protect jobs and production, and thereby price stability.

But the role of the ECB is not confined to monetary policy. A number of our activities go largely unnoticed, although they are no less important and require hard work and dedication.

Take payments, for example. All citizens need to buy food and medicines, pay bills, and receive salaries or pensions. Some need to transfer money to family members who live far away. Even in crisis periods, firms must continue to remunerate employees and pay suppliers, and they also face additional costs stemming from the accumulation of unsold products. For these activities access to cash and the payment system is critical.

Guaranteeing the availability of payment services is an important part of the central bank’s mission, one that is essential not only for monetary policy implementation but also for citizens’ everyday lives. Accordingly, the ECB is working to ensure the continuity and safety of firms’ and families’ transactions, and the integrity of the euro area payment and financial system.

The provision of banknotes

Adequate availability of cash is crucial for the functioning of the economy. Even in normal times, three-quarters of consumer transactions in the euro area are made in cash, with large countries such as Germany, Spain and Italy using cash at rates that are around or even well above the euro area average. Cash thus remains the dominant means of payment for consumers, and is of fundamental importance for the inclusion of socially vulnerable citizens, such as elderly or lower-income groups.

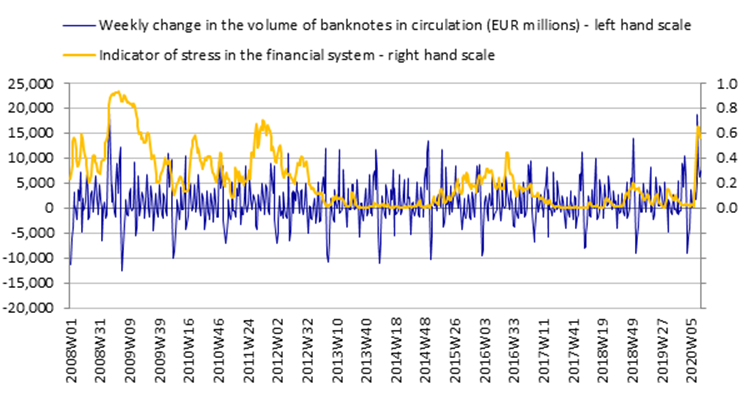

During the crisis the demand for cash has become less predictable. As the pandemic spread across Europe, we saw a spike in demand for cash: in mid-March the weekly increase in the value of banknotes in circulation almost reached the historical peak of €19 billion (see Chart 1). This increase partly reflected higher spending in supermarkets and shops – especially from 13 to 20 March, when the demand for cash was similar to that in the week before Christmas. But it also reflects people’s impulse to hoard cash during a crisis. The rising demand for cash in times of extreme uncertainty is not a new phenomenon; such increases were seen during the financial crisis in 2008 (see Chart 1), and there is generally co-movement between the volume of banknotes in circulation and indicators of financial tension (see Charts 2). In early April cash demand returned to normal levels, and several countries are now seeing cash withdrawals below expected levels for the time of year; this is partly due to the lockdown, which has limited the opportunities for spending.

Weekly growth of banknotes in circulation and stress in the financial sector

(January 2008 - March 2020)

The indicator used in the charts was developed by Holló, D., Kremer, M. and Lo Duca, M. (2012), “CISS – A composite indicator of systemic stress in the financial system”, Working Paper Series, No 1426, ECB, March.

Daily growth of banknotes in circulation and stress in the financial sector

Note: Eurosystem net issuance (i.e. issued minus returned banknotes) is normally negative at the beginning of the year, because after the December peak lodgements of banknotes at national central banks are higher than cash demand. Source: ECB data; five-day moving average.

The Eurosystem – the ECB and the 19 euro area national central banks (NCBs) – plans the activities related to the cash supply chain (production, storage, distribution and re-circulation) well in advance. It is thus well-prepared to ensure the continued availability of banknotes in crisis times: the NCBs have large stocks of cash, including a strategic contingency stock to cope with unexpected developments. The levels of such stocks in each country and for all banknote denominations are continuously monitored, and scenario analyses are used to foresee any risk of depletion and react accordingly.

However, the current lockdown is hampering many activities and preventing others altogether. As a result, we are adapting our processes on an ongoing basis to ensure that the banknotes supply chain remains intact. We have intensified the (virtual) contacts that take place between the ECB – acting as coordinator – and the NCBs and, at national level, between the NCBs and external partners such as cash-in-transit companies and banks.

For example, possible bottlenecks in printing – including the availability of raw materials – and processing banknotes for circulation are being swiftly addressed, at the same time ensuring that all necessary health and safety precautions are observed. Measures are also being taken to address problems in the transportation and processing of banknotes caused by staff being confined to their homes. And when the usual cross-border transportation systems – especially air transport – are disrupted due to the limited number of available flights or concern that NCB couriers and carrier personnel might need to be quarantined after travelling abroad, the transfer of banknotes among NCBs is re-scheduled.

Moreover, to ensure that handling cash remains as safe as possible, we are working closely with top-tier European laboratories to assess the behaviour of coronaviruses on different surfaces. The results indicate that coronaviruses can survive more easily on a stainless steel surface (e.g. door handles) than on our cotton banknotes, with survival rates approximately 10 to 100 times higher in the first few hours after contamination. Other analyses indicate that it is much more difficult for a virus to be transferred from porous surfaces such as cotton banknotes than from smooth surfaces like plastic.

Overall, banknotes do not represent a particularly significant risk of infection compared with other kinds of surface that people come into contact with in daily life. However, our cooperation with scientific laboratories will continue in the coming weeks to preserve public trust in the safety of banknotes.

Electronic payments

The COVID-19 crisis is reinforcing an existing trend: the rising demand from consumers and merchants for efficient payment schemes. Now more than ever European consumers want safe, low-cost and easy-to-use electronic payment solutions to cope with the lockdown and to transfer money electronically to firms or family across Europe. Likewise, efficient payment systems are necessary to quickly mobilise the resources made available to support small companies, self-employed workers and social institutions. The Eurosystem has always been at the forefront of efforts to facilitate innovative payment solutions for European citizens – and continues its work in this area in these difficult times.

Even before the outbreak of the pandemic, the ECB stressed that Europe must be able to supply fundamental services such as electronic payments autonomously, in order to strengthen its sovereignty in the global economy. With this in mind, the Eurosystem’s retail payment strategy aims to foster pan-European market solutions for instant payments[1] at the point-of-sale (to pay in brick-and-mortar shops) and online payments (for e-commerce). We are actively supporting initiatives that allow European users to reap the benefits of the Single Market and that can fulfil certain key objectives.[2] Work in this field is continuing despite current events, with regular contact between the ECB, the European Commission and private payment service providers.

The ECB is also exploring possible future avenues by assessing the case for issuing a “digital euro”. A high-level task force is currently examining the pros and cons of introducing a digital currency, which could be used by intermediaries or even by citizens through their electronic devices (such as smartphones or tablets) for their day-to-day spending needs. However, our analysis of the opportunities and challenges of central bank digital currencies – which will consider the experience of the COVID-19 crisis – should not discourage or crowd out market-led initiatives aimed at introducing private electronic means of payment with similar features in terms of user needs.

Market infrastructures

Such innovations in the field of payments have been made possible by advances in the infrastructures underlying financial transactions. A noteworthy example is the Eurosystem’s TARGET Instant Payment Settlement (TIPS) service, a powerful infrastructure which allows funds to be transferred in real time around the clock every single day of the year. The system, which went live in November 2018, finalises instant payments in central bank money, meaning that it does not entail financial risk for either the payer or the payee. It can also handle payments in other currencies; indeed, earlier this month, the Swedish central bank, Sveriges Riksbank, decided to adopt TIPS as of May 2022, relying on the Eurosystem to process the 1.5 million instant payments made daily in Swedish krona. TIPS is designed to settle a regular load of more than 43 million instant payment transactions a day, and could handle up to 2,000 transactions per second in peak times.

In a bank-financed economy like the euro area, banks must be able to negotiate huge amounts of liquidity in a safe, fast and efficient way in order to keep the real economy going. To this end, the Eurosystem operates a real-time gross settlement (RTGS) system called TARGET2.[3] Through TARGET2, large payments in euro by central banks and commercial banks are processed and settled in central bank money, i.e. in accounts held with a central bank. More than 1,000 banks currently use TARGET2 to initiate transactions in euro, and 52,000 banks worldwide and their customers can be reached via TARGET2. In recent weeks we have been monitoring the performance of TARGET2 particularly closely: the system registered an increase in the number of transactions (around 361,500 on a daily basis on average in March, as against 346,000 on average in March 2019) and has continued to perform efficiently.

During crises, investors typically modify the composition of their securities portfolios in order to respond to changes in the economic and financial environment and to weather shocks to their income and wealth. This is only possible if citizens and the financial institutions that serve them (such as banks and insurance companies) can rely on high-performing infrastructures which allow financial assets, such as bonds and shares, to be bought and sold quickly, safely and efficiently. In the euro area, the platform where these transactions are processed – known as TARGET2-Securities, or T2S – is managed by the Eurosystem. Currently 20 countries across Europe use T2S, following harmonised rules and practices.[4]

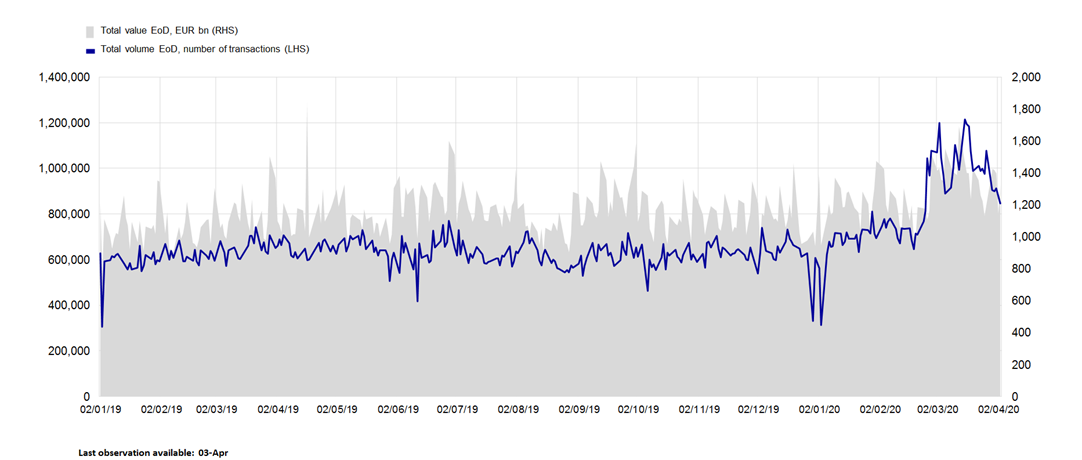

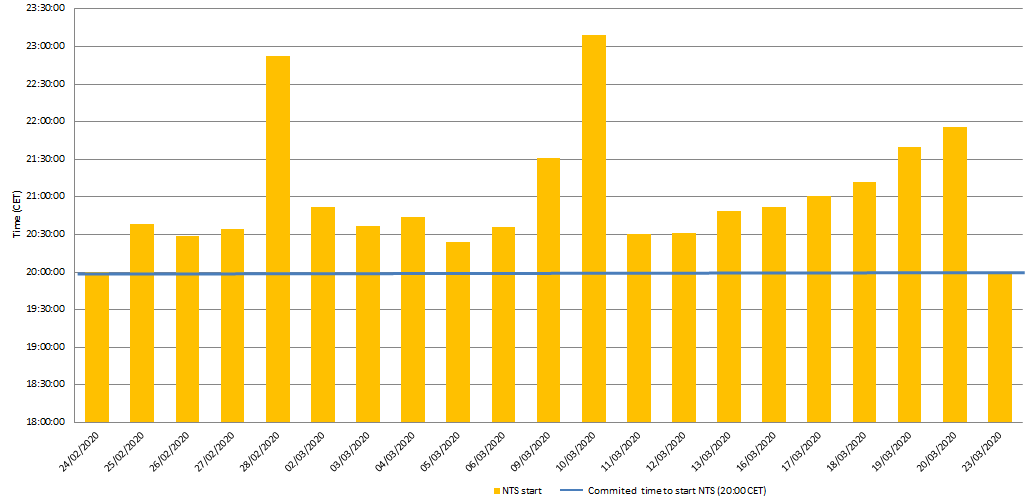

Throughout the market turbulence of recent weeks, the resilience of T2S has allowed it to smoothly handle the exceptionally high volumes of trading in European bonds and shares, ultimately protecting the assets and savings of citizens. In March the volume of daily transactions settled almost doubled, from a previous average of 600,000 to 1,000,000, with a peak of more than 1,200,000 (see Chart 3). Even under these high volumes, T2S continued to operate smoothly, although it did experience slowdowns and delays especially during the critical end-of-day phase of the settlement process (see Chart 4). This required the prompt implementation of mitigation measures, which involved strengthening the hardware resources and fine-tuning the organisation of the different phases of the T2S settlement procedures. As a result, the performance of the system improved rapidly with no more delays in the start of the night time settlement as of 23 March.

The payment infrastructures operated by the Eurosystem rely on smooth technical and institutional cooperation with privately run market infrastructures. These include central counterparties (entities which facilitate the trading of derivatives and equities and reduce counterparty, operational, settlement, market, legal and default risk for traders, and hence for investors) and central securities depositories (entities which provide a central point for depositing financial instruments such as bonds and shares).

All infrastructures, private or public, are of systemic importance as they ultimately protect our economies and the savings of citizens. But they share the destiny of all utilities: they have to function without incident but below the surface of public recognition. Our systems remain well-prepared to cope with possible additional trading volumes, although such increases will require vigilance and close coordination among the ECB and NCB staff involved in managing the system.

Volume and number of transactions settled in T2S

Delays in the start of night-time settlement (NTS) in T2S

Cyber resilience

The crisis has also increased the risks for cybersecurity. Corona-themed phishing campaigns are spreading in a world where, for many, working from home may become the new normal. This also exposes financial market infrastructures, private and public alike, to increased cyber threats, creating a need for such infrastructures to work together to find ways of preventing and responding effectively to such attacks. The ECB recently established the Euro Cyber Resilience Board (ECRB) for pan-European Financial Infrastructures, in which Europol and the European Union Agency for Cybersecurity also participate. The ECRB provides a forum for the sharing of knowledge to increase systemic resilience against cyber risks. In recent weeks its members agreed to share cyber information and intelligence to a greater degree, with the aim of identifying cyber threats and exchanging best practices to prevent attacks.[5] This has the potential to serve as a model for the exchange of information and intelligence internationally with a view to increasing global resilience.

We are living through times of unprecedented challenges and risks. We are seeking to identify those risks at an early stage so that we can provide a timely and effective response. Many of the measures we take will go unnoticed by the public. But European citizens can trust in our commitment to support them throughout this crisis.

- [1]Instant payments are electronic retail payment solutions that process payments in real time, 24 hours a day, 365 days a year, where the funds are made available for immediate use by the recipient

- [2]The Eurosystem has identified five key objectives for its pan-European retail payment strategy: full pan-European reach and unified customer experience; convenience and cost efficiency; safety and security; European identity and governance; and, in the long run, global acceptance.

- [3]RTGS systems finalise the settlement of interbank funds transfers on a continuous, transaction-by-transaction basis throughout the working day

- [4]The transactions finalised in T2S are settled in central bank money (that is, banks use their account with the central bank to pay). As a consequence, settlement risk is greatly reduced.

- [5]See Panetta, F. (2020), “Protecting the European financial sector: the Cyber Information and Intelligence Sharing Initiative”, https://www.ecb.europa.eu/press/key/date/2020/html/ecb.sp200227~7aae128657.en.html.