- BLOG

- 1 May 2020

The monetary policy response to the pandemic emergency

Blog post by Philip R. Lane, Member of the Executive Board of the ECB

In this blog post, I have three aims.[1] First, the elevated uncertainty about the duration of the macroeconomic impact of the COVID-19 pandemic means that policies must be framed in the context of a wide range of possible macroeconomic scenarios: accordingly, I wish to review recent macroeconomic indicators and outline some key features of the scenarios developed by ECB staff that have been published this morning. Second, I will explain the current monetary policy of the ECB, as updated by yesterday’s Governing Council meeting. Third, I will outline our approach to setting the future course of monetary policy.

The macroeconomic environment

The European and world economies are currently experiencing an extraordinary and severe shock, as public health measures to contain the spread of the coronavirus have halted many economic activities across the globe. In the first quarter of this year, according to preliminary flash estimates, the euro area economy declined by 3.8 percent quarter on quarter: this marks the first quarterly reversal in growth in seven years.

The contraction will be much more pronounced in the second quarter, since lockdown measures were in full force by April across the euro area and in many other countries. There has been a profound deterioration in labour market conditions, with a sudden and extreme decline in total hours worked, which is reflected in rising unemployment and lower labour market participation, together with extensive employment subsidy schemes in many countries in order to maintain worker-firm relationships where feasible. Furthermore, the sharp falls in consumer and business sentiment indicators in April are leading indicators of protracted adverse demand in the coming months. In addition to the negative outlook for aggregate demand, macroeconomic prospects also turn on the extent of the short-term and long-term damage to the productive capacity of the euro area economy.

Assessing the most likely future path for the economy is even more difficult than usual on account of the exceptional nature of the shock, which has few precedents in modern economic history. Scenario analysis is the best approach: today, the ECB has published an Economic Bulletin box on our website that outlines staff analysis of a range of possible macroeconomic trajectories as the pandemic crisis unfolds.[2] Although these scenarios in no way pre-empt the June Eurosystem staff macroeconomic projections, this analysis does offer insight into the potential magnitude of the economic fallout from the coronavirus. The scale and duration of the pandemic macroeconomic shock depends on how long the lockdown measures remain in place, their impact across sectors and the speed at which economic activity normalises.[3]

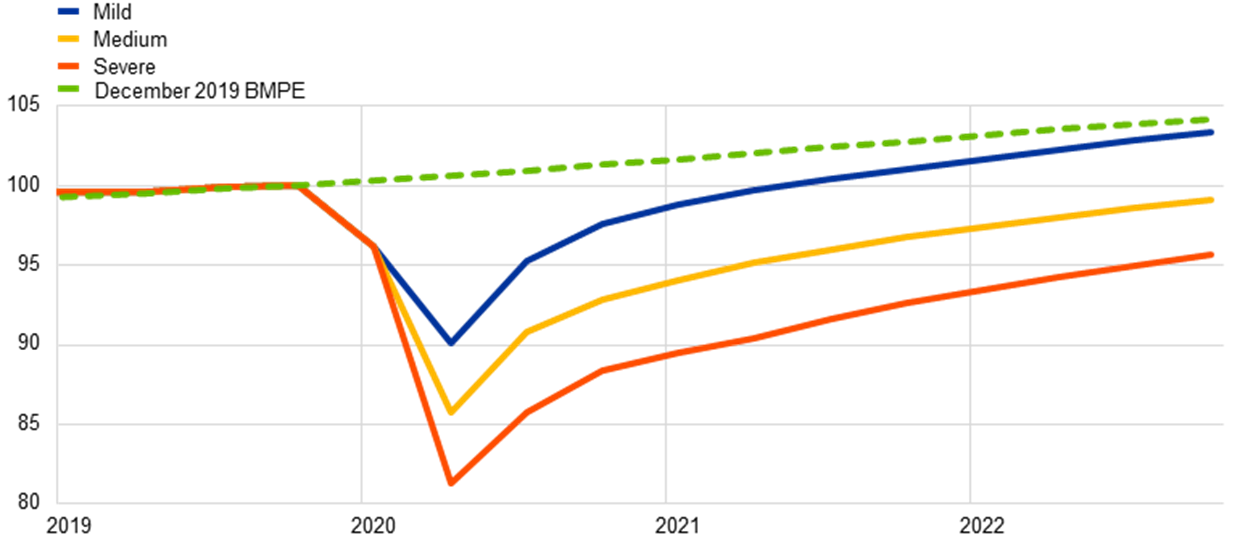

Even in the most benign scenario, a deep recession is envisaged, amounting to a contraction in real GDP of 5 percent this year. In the severe scenario, real GDP would fall by 12 percent in 2020. At the same time, these scenarios foresee some initial rebound in economic activity in the second half of 2020 as the containment measures are gradually lifted, even if the speed and scale of the recovery over the medium term are highly uncertain. For instance, in the severe scenario developed by ECB staff, real GDP remains below the level observed at the end of 2019 throughout 2022 (Chart 1).

The current environment is also marked by substantial uncertainty concerning the outlook for inflation. Oil prices, which plunged following the COVID-19 outbreak, have strongly pushed down headline inflation. The reaction of underlying inflation to the downturn is projected to remain relatively muted in the short term. However, in the coming months, downward price pressures will be generated by weaker economic activity and lower aggregate demand. The overall net impact on medium-term inflation dynamics will depend on the balance between rising slack and lower aggregate demand on the one side and the possible long-term adverse impact of the virus shock on aggregate supply capacity on the other side.

Euro area real GDP under the mild, medium and severe scenarios

(index, 2019 Q4 = 100)

Source: ECB calculations.

Notes: For details on the scenarios, see Battistini and Stoevsky (2020), op. cit.

In addition to the duration of the necessary public health measures to contain the virus, the dynamics of household consumption and business investment will be central in determining macroeconomic outcomes. The high intrinsic uncertainty about the evolution of the pandemic and its implications for the level and composition of future output suggest that the precautionary saving motive will be prominent and many investment plans will be revised or cancelled.

At the same time, the fiscal measures that have been introduced to support workers during this period mean that the aggregate hit to household disposable income will be much less than would have been the case in the absence of these programmes. In the aggregate, household balance sheets are also stronger today compared to the previous crisis: for instance, the ratio of deposits to disposable income for euro area households stands at nearly 450 percent compared with around 350 percent in early 2008. Of course, these aggregate indicators obscure significant variation across different cohorts and this heterogeneity is also relevant in determining aggregate consumption dynamics.

Historical comparisons suggest that elevated uncertainty, reduced demand and lower earnings will hamper investment prospects for an extended period of time. Moreover, the loss of productive capacity due to bankruptcies and firm exits also has negative implications for investment: this mechanism will become more powerful, the longer the disruption to economic activity.

It follows that, in the current environment, it is critical that financing conditions remain highly accommodative, so that households and firms are not only able to weather the impact of lockdowns but can also obtain funding on favourable terms to finance consumption and investment once we enter a recovery phase.

The monetary policy of the ECB

Our monetary policy is playing a vital role. While monetary policy cannot anticipate the point at which the economy will reopen, it can make sure that the necessary monetary and financial conditions for the restoration of economic activity are in place, in line with the easing of the containment measures. In particular, our measures are helping to preserve the flow of credit to households and firms. The range of measures we have taken since March reinforce each other and work as a package to ensure the transmission of our monetary policy to bank lending rates, to all segments of market-based financing and, ultimately, to households and firms in all sectors and countries.[4]

The rapidly-evolving situation requires a sufficiently-accommodative monetary policy stance. To this end, we continuously evaluate all of our tools to make sure that these are adequately calibrated. In particular, our assessment of both the scale and the tail risks associated with the current macro-financial crisis has substantially deteriorated since our March monetary policy meetings.

Accordingly, we decided yesterday to ease further the conditions of our targeted longer-term refinancing operations (the TLTRO III programme). First, we lowered the interest rate by an additional 25 basis points from June 2020 to June 2021. Taking into account the current levels of our key policy rates, the entry rate over this time period will now equal -0.5 percent, while the rate for banks that meet their lending benchmark can be as low as -1.0 percent. Second, we brought forward the start of the lending assessment period by one month to 1 March 2020: including this additional month in the measurement of the lending benchmark recognises the credit support that banks have already provided to firms in March in the first weeks of the crisis.

The TLTRO programme complements our asset purchases and negative interest rate policy by ensuring the smooth transmission of our monetary policy stance through banks. In particular, it funnels the monetary easing associated with negative rates to firms and households that rely on access to bank credit. The TLTRO programme is an especially powerful tool to counter credit contraction dynamics in the current environment, since it directly addresses the elevated credit requirements of many firms, especially the SME sector which lacks access to capital markets. The in-built incentive scheme makes it attractive for banks to call on TLTRO III funding in order to the extend credit to firms and households.

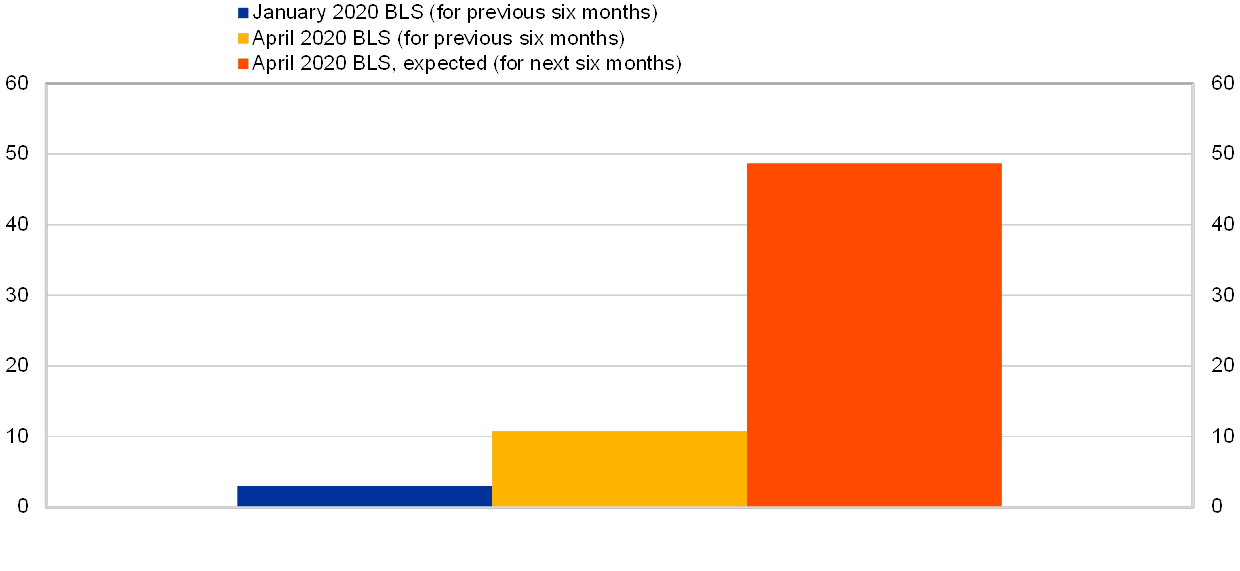

Incoming information suggests that TLTRO III is supporting credit provision. According to the Bank Lending Survey (BLS) published earlier this week, banks are largely using TLTRO III liquidity to grant loans to the non-financial private sector. Moreover, banks have indicated that TLTRO III is having a net easing impact on the terms and conditions offered to borrowers and a positive net impact on their lending volumes, particularly on their expected lending volumes over the next six months (Chart 2). On balance, the very mild tightening of credit standards for firms (up to now) shown in the BLS is significantly less pronounced compared to the credit squeeze that amplified the financial and sovereign debt crises between 2008 and 2012. This is a sign that our measures (together with the contribution from the announcement of public credit guarantees in many countries and other direct and indirect support for firms and households) are protecting bank-based credit flows.

Our targeted collateral-easing package, which focuses on SMEs, the self-employed and households, will ensure that banks can make full use of TLTRO III funding.[5] The effectiveness of TLTRO III is further supported by the temporary capital relief measures announced by ECB Banking Supervision.[6]

Impact of TLTRO-III on bank lending volumes to enterprises

(net percentage of banks, over the past and next six months)

Sources: ECB, Bank Lending Survey (BLS).

Notes: Net percentages are defined as the difference between the sum of the percentages for “contributed considerably to an increase” and “contributed somewhat to an increase” and the sum of the percentages for “contributed somewhat to a decrease” and “contributed considerably to a decrease”.

To complement our TLTRO III programme, we also decided to launch a series of pandemic emergency longer-term refinancing operations (PELTROs). By providing a well-priced liquidity backstop, the PELTROs are designed to further support liquidity conditions in all segments of the euro area financial system and contribute to preserving the smooth functioning of money markets. In addition, the PELTROs provide an additional source of longer-term funding for banks, which is especially valuable for those banks with business models that focus on lending to sectors not covered by the TLTRO programme.

The PELTROs consist of seven additional refinancing operations, beginning in May 2020 and maturing in a staggered sequence between July and September 2021. These operations will be carried out as fixed-rate tender procedures with full allotment, with an interest rate that is 25 basis points below the average rate on the main refinancing operations prevailing over the life of each PELTRO.

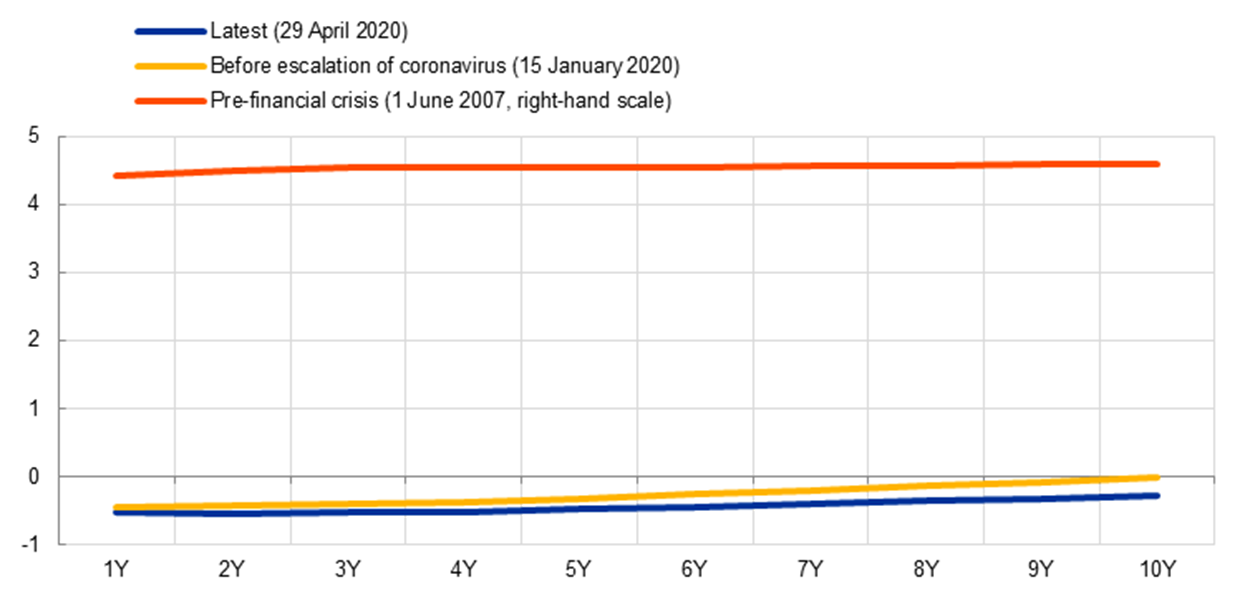

Together with the substantial monetary policy stimulus already in place, the additional TLTRO adjustments and the PELTROs will support liquidity and funding conditions and help to preserve the smooth provision of credit to the real economy. As such, these measures reinforce the accommodative effect of our negative interest rate policy. In this respect, let me recall that the risk-free yield curve (as captured by overnight index swap (OIS) rates) is the cornerstone of area-wide financial conditions. Our negative policy rates and our forward guidance on the expected path of policy rates anchor short- to medium-term risk-free rates, while our asset purchases and forward guidance on reinvestment steer long-term rates by extracting duration risk from the financial system.

In combination with the global forces that have contributed to a sharp trend decline in the equilibrium real interest rate and the extended phase of low inflation, our package of monetary policy measures underpins a risk-free yield curve that is at record low levels (Chart 3).[7] In addition to their intertemporal impact on consumption and investment decisions, very low interest rates also operate through a cash flow mechanism, with lower interest payments reducing the outgoings of debtors (which, of course, is offset by lower interest income paid to creditors). Chart 3 also highlights that the level of the yield curve today is substantially below the level observed at the start of the global financial crisis: the nominal balance sheet dynamics in the current crisis are likely to be quite different to the 2008-2012 crisis.

Euro area OIS curve

(percentages per annum)

Source: Thomson Reuters.

Globally, a potential source of upward pressure on the risk-free yield curve is the prospective scale of public debt issuance: although there is a wide range of empirical estimates, the international historical evidence suggests that an increase in public debt is associated with an increase in real interest rates.[8] Under conditions in which macroeconomic stability and price stability call for an easing of financial conditions, central banks are reacting to this upward pressure by easing the monetary policy stance, including through quantitative-easing measures.

In a crisis environment, central banks also have a crucial market stabilisation role since the dislocation of financial intermediation runs the risk of giving rise to illiquidity and market freezes in securities and money markets, impeding the conduct of monetary policy and endangering financial stability. In addition to providing liquidity backstops, central banks can also stabilise markets through (direct and indirect) asset purchases across the markets for commercial paper, corporate bond and sovereign bonds. This pattern is also evident across many countries during this crisis.

Finally, there is an additional market stabilisation role for the common central bank in a multi-country monetary union. In the absence of the stabilising presence of the central bank, a crisis environment can give rise to self-fulfilling flight-to-safety dynamics and illiquidity in individual sovereign bond markets, on account of the high substitutability across sovereign bond markets in the absence of currency risk. Such non-fundamental volatility in spreads impairs the smooth transmission of monetary policy across countries and it is a basic task for the central bank to counter such destabilising forces.

The PEPP serves these roles by providing additional monetary accommodation to lower the risk-free yield curve and by contributing to market stabilisation across private-sector securities markets and sovereign bond markets. The overall size of the PEPP is a key factor in determining the risk-free yield curve, while the flexibility embedded in the design of the PEPP enables the ECB to play its market stabilisation role and implement its monetary policy in an efficient manner.

Accordingly, the successful implementation of the PEPP is critical in delivering the favourable financial conditions that are necessary to support the economy, in view of the severe risks both to the monetary policy transmission mechanism and the outlook for the euro area posed by the pandemic.

The future course of monetary policy

As a mandate-driven, goal-oriented institution, the ECB will make its future monetary policy decisions on the basis of what is required in order to secure price stability under all circumstances. In the context of the current extraordinary and severe macro-financial environment, this requires a monetary stance that provides sufficient accommodation and guards against the escalation of tail risks associated with procyclical financial amplification mechanisms.

We continuously examine each of our measures (individually and as a package) to assess whether these are still adequately calibrated and appropriately sized to provide the necessary degree of accommodation in this uncertain economic environment. Accordingly, we will further adjust our instruments if warranted. This includes increasing the size of the PEPP and adjusting its composition as much as necessary and for as long as needed.

At the same time, the actions of policymakers in other domains will be pivotal in determining the overall macroeconomic impact of the pandemic emergency. The measures taken by euro area governments and European institutions to ensure sufficient health sector resources and to provide support to affected companies, employees and households are essential. Additional, bold and sustained policy action remains essential to guard against downside risks and support the recovery.

Joint and coordinated policy action has a crucial role. In particular, we welcome the European Council agreement to work towards establishing a recovery fund dedicated to dealing with this unprecedented crisis.

- [1]I am grateful to Danielle Kedan for her assistance in writing this blog post.

- [2]See Battistini, N. and Stoevsky, G. (2020), “Alternative scenarios for the impact of the COVID-19 pandemic on economic activity in the euro area”, Economic Bulletin, Issue 3, European Central Bank.

- [3]There is a wealth of new academic research on the macroeconomic effects of pandemics. See, amongst many other contributions, Guerrieri, V., Lorenzoni, G., Straub, L. and Werning, I. (2020), “Macroeconomic Implications of COVID-19: Can Negative Supply Shocks Cause Demand Shortages”?, NBER Working Paper, No 26918. For an overview of the literature, see Boissay, F. and Rungcharoenkitkul, P. (2020), “Macroeconomic effects of Covid-19: an early review”, BIS Bulletin, No 7, April.

- [4]For an overview, see the blog post I published on 13 March 2020 entitled “The Monetary Policy Package: An Analytical Framework”.

- [5]See the ECB press releases on collateral easing measures entitled “ECB announces package of temporary collateral easing measures”, 7 April 2020, and “ECB takes steps to mitigate impact of possible rating downgrades on collateral availability”, 22 April 2020. In addition, see the blog post by Luis de Guindos and Isabel Schnabel entitled “Improving funding conditions for the real economy during the COVID-19 crisis: the ECB’s collateral easing measures”, 22 April 2020.

- [6]See the ECB Banking Supervision press release entitled “ECB Banking Supervision provides temporary capital and operational relief in reaction to coronavirus”, 12 March 2020. In addition, see the blog post by Andrea Enria entitled “Flexibility in supervision: how ECB Banking Supervision is contributing to fighting the economic fallout from the coronavirus”, 27 March 2020.

- [7]For a discussion of the factors determining the evolution of the real interest rate over time see my speech entitled “Determinants of the real interest rate” at the National Treasury Management Agency in Dublin, 28 November 2019. The evolution of nominal interest rates is covered in my speech entitled “The yield curve and monetary policy” at the Centre for Finance and the Department of Economics at University College London, 25 November 2019.

- [8]For a recent review, see Gamber, E. and Seliski, J. (2019), “The Effect of Government Debt on Interest Rates”, Working Paper No 2019-01, Congressional Budget Office.