Financing conditions through the lens of euro area companies

Published as part of the ECB Economic Bulletin, Issue 8/2021.

This box explores new indicators of the financing conditions faced by euro area companies, based on firm-level survey data. Since the beginning of the pandemic, and especially since December 2020, the Governing Council has committed itself to preserving favourable financing conditions for the duration of the pandemic, seeing them as the compass guiding monetary policy.[1] The ECB uses a holistic approach to measure financing conditions, covering a broad spectrum of indicators over the entire transmission chain of monetary policy. These indicators range from “upstream” stages, with interest rates that are at the beginning of the transmission process (i.e. risk-free interest rates and sovereign yields), to “downstream” stages, with indicators which measure the effects on the cost and volume of external finance available to firms and households. This box focuses on new indicators of the downstream financing conditions faced by non-financial corporations in the euro area, derived from information taken from the survey on the access to finance of enterprises (SAFE). Such information complements an analysis of financial conditions based on quantitative bank-based and market-based indicators.

Based on the rich SAFE dataset, three synthetic indicators encapsulate how firms have perceived financing conditions in the euro area since 2009. The SAFE survey includes questions divided into four groups. The first group covers changes in price terms and conditions, and is related to bank interest rates and other costs of bank financing (charges, fees and commissions), while the second focuses on changes in non-price terms and conditions and covers collateral and other factors such as required guarantees, information requirements, procedures, time required for loan approval, and loan covenants. The third group of questions relates to the financial position of firms and focuses on changes in profits, own capital and credit history, insofar as these variables are perceived to affect a firm’s access to credit. Changes in these variables reveal information on the financial solidity of borrowers’ balance sheets and are used by banks to decide whether or not to provide credit. The fourth group of questions covers firms’ perceptions of changes in the “willingness” of banks to provide credit and also provides significant information on the supply of external financing. Such questions can indirectly signal the extent to which monetary policy operations are helping to ease access to bank funding and therefore to maintain lending to the real economy. Starting from the individual responses of about 35,000 firms to the four groups of questions above,[2] it is possible to capture various aspects of overall financing conditions by applying factor analysis.[3] The analysis detects three “principal components”, which can be interpreted as relating to the financial position of firms, non-price terms and conditions, and price terms and conditions. These are presented in Chart A, in the order of their importance in explaining the total variance of overall financing conditions. A positive value for a principal component signals a tightening in financing conditions.

Overall, the three indicators suggest there have been several important phases in firms’ perceptions of their financing conditions, which closely align with the monetary policy measures taken by the ECB over time (Chart A, all panels). The indicators suggest that there has been a general easing of financing conditions over the last decade, which is consistent with the accommodative monetary policy stance in place during the period and with the measures taken to restore the transmission mechanism since the global financial crisis.[4] While financing conditions were generally tighter for small and medium-sized enterprises than for large companies throughout most of the period, conditions eased for companies of all sizes, and this easing continued with only temporary periods of reversal.

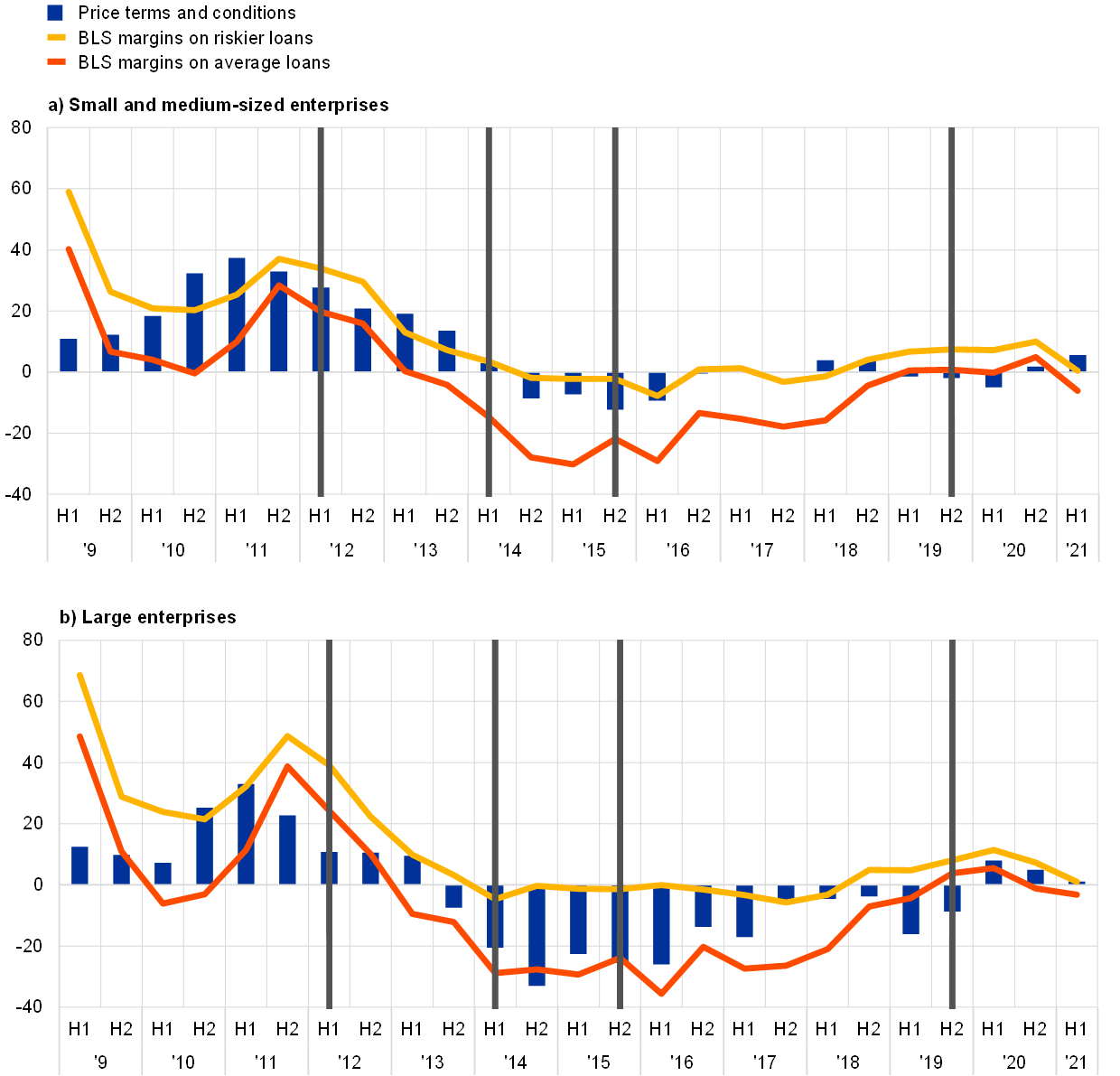

Chart A

Indicators of financing conditions based on factor analysis

(weighted scores in percentages)

Source: ECB and European Commission survey on the access to finance of enterprises (SAFE).

Notes: Positive values indicate a tightening in financing conditions, as measured by the principal components. Small and medium-sized enterprises have fewer than 250 employees. The individual scores for each principal component are weighted by size class, economic activity and country to reflect the economic structure of the underlying population of firms. The individual scores are standardised so they have a range of between -1 and 1 and are multiplied by 100 to obtain weighted balances in percentages. The first vertical grey line denotes the announcement of Outright Monetary Transactions; the second vertical grey line denotes the start of the first series of targeted longer-term refinancing operations (TLTRO I) and the negative interest rate policy; the third vertical grey line denotes the start of TLTRO II and the corporate sector purchase programme; and the last vertical grey line denotes the start of the pandemic emergency purchase programme and TLTRO III. The dotted lines show the 95% confidence bands. The latest observations are for April 2021 to September 2021.

The most recent phase in firms’ perceptions of changes in financing conditions coincided with the launch of the pandemic emergency purchase programme (PEPP) and the easing of conditions for the third series of targeted longer-term refinancing operations (TLTRO III). The latest survey results, which cover the period April 2021 to September 2021, show that, following the rapid economic downturn, access to finance improved to the extent that the availability of external finance was considered to exceed demand. However, during this latest phase the three principal components offered diverging assessments of financing conditions, given the specific nature of the pandemic-induced economic crisis.

The first indicator of financing conditions emphasises the role played by changes in firms’ balance sheet quality (profits, own capital and creditworthiness) in determining their access to external finance (financial position: Chart A, panel a). Focusing on the period just before and during the pandemic (the last four survey rounds), after a significant deterioration at the beginning of the pandemic the financial position of firms has improved in tandem with the recent rebound in economic activity. From April 2020 to March 2021, small and medium-sized enterprises reported a pronounced fall in profits as well as some erosion of their capital positions. Since both indicators are important determinants of banks’ lending decisions, this deterioration was perceived by firms as an impediment to their access to external finance. In the latest survey round (April 2021 to September 2021) small and medium-sized enterprises signalled a return to an easing of conditions, which reflected their optimistic perceptions of long-term turnover growth, despite their continuing lacklustre performance in terms of profits. Large companies also saw a deterioration in their profit situation, but it was short-lived.

The second component focuses mainly on factors related to changes in collateral requirements and other guarantees (non-price terms and conditions: Chart A, panel b). This indicator has been more stable over time, with a trend which is declining overall. The indicator points to an easing in financing conditions during the pandemic for large companies only, while small and medium-sized enterprises signalled a deterioration due to increases in collateral requirements and other requirements such as covenants.

The third component mostly reflects changes in interest rates and other costs of financing (price terms and conditions: Chart A, panel c). This is the component that might best reflect the transmission of monetary policy to firms’ financing conditions during the four phases described earlier. For small and medium-sized enterprises it signals some tightening related to banking costs since October 2020, while for large firms it signals a tightening at the beginning of the pandemic which has moderately considerably in the most recent period (April 2021 to September 2021).

Firms’ perceptions of financing conditions related to price terms and conditions closely follow the trend for terms and conditions reported by euro area banks. Chart B compares the dynamics of the price terms and conditions component with two important aspects of banks’ terms and conditions agreed in loan contracts. These are the margins on average loans and the margins on riskier loans, defined as the spread over relevant market reference rates. Changes in these variables are regularly reported by euro area banks in the quarterly bank lending survey (BLS).[5] Since 2009 a widening (narrowing) of banks’ margins has been reflected in a worsening (improvement) of financing conditions reported by firms. Just before the onset of the pandemic, the signals from the BLS pointed to a broad-based tightening of credit conditions, although bank lending rates remained at historically favourable levels. Banks attributed this tightening to the intensification of risks to the creditworthiness of firms (also captured here by the first indicator) and the prospect of possible loan losses in the future. As the economic recovery increasingly included more firms, the tightening diminished and loan margins were reported as broadly unchanged in the BLS during the latest available SAFE round. At the same time, however, small and medium-sized enterprises perceived a deterioration in financing conditions related to price terms and conditions. This most recent tightening, in the period April 2021 to September 2021, might be due to the reduced use of pandemic-related government guaranteed loans, which have typically been granted by banks under very favourable conditions including more relaxed loan approval criteria.

Chart B

Banks’ lending conditions and the third principal component (price terms and conditions)

(net percentages for margins; weighted scores for price terms and conditions in percentages)

Sources: Euro area bank lending survey (BLS), ECB and European Commission survey on the access to finance of enterprises (SAFE).

Notes: Positive values indicate a deterioration in the principal component and a net widening in loan margins. Small and medium-sized enterprises have fewer than 250 employees. The individual scores for the principal component are weighted by size class, economic activity and country to reflect the economic structure of the underlying population of firms. The individual scores are standardised so they have a range of between -1 and 1 and are multiplied by 100 to obtain weighted balances in percentages. For each (biannual) round of the SAFE survey the corresponding two quarters of BLS responses have been averaged. The first vertical grey line denotes the announcement of Outright Monetary Transactions; the second vertical grey line denotes the start of the first series of targeted longer-term refinancing operations (TLTRO I) and the negative interest rate policy; the third vertical grey line denotes the start of TLTRO II and the corporate sector purchase programme; and the last vertical grey line denotes the start of the pandemic emergency purchase programme and TLTRO III. The latest observations are for April 2021 to September 2021.

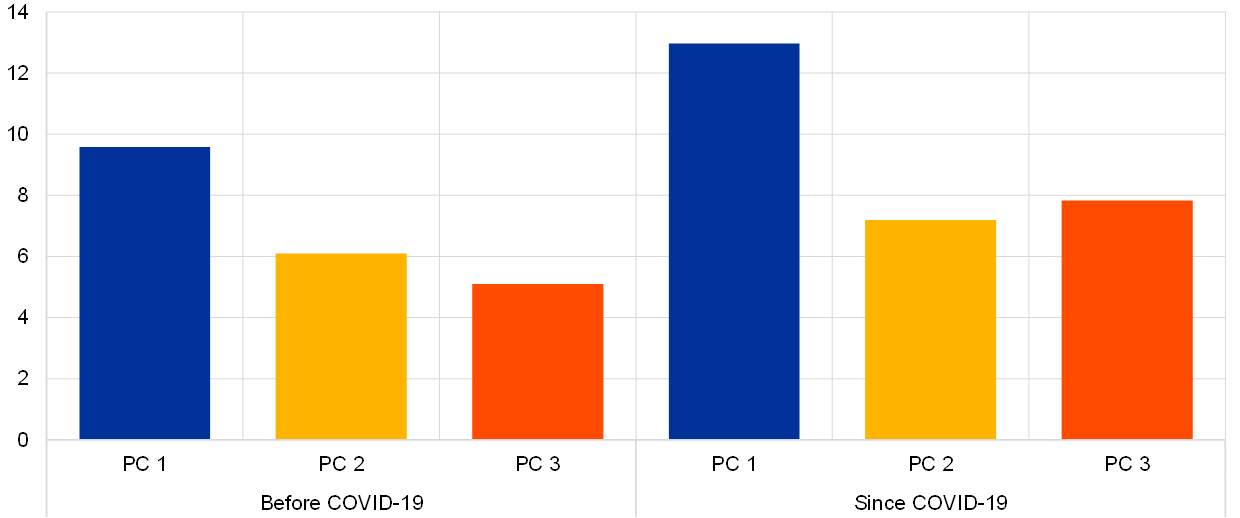

A tightening of financing conditions reflected in an increase in any of the principal components raises the probability of a firm reporting expectations of a deterioration in the future availability of bank loans (Chart C). In the SAFE survey, firms are asked to give their expectations for the future availability of external finance in the six months after the fieldwork is carried out.[6] Following the approach taken by Ferrando and Ganoulis[7], a logit model is used to link the expected deterioration in the future availability of bank loans to the three principal components, a set of dummies controlling for macroeconomic developments separately for each country and time, and a set of firm characteristics (sector and size).[8] Chart C reports the probability of a firm reporting a deterioration in the future availability of bank loans as a result of changes in financing conditions (average marginal effects). The first three columns are based on estimations for the period before the pandemic and the second three on estimations for the period after the beginning of the pandemic. All the reported marginal effects are positive and statistically significant.

Chart C

Contributions of the indicators of financing conditions to a deterioration in perceived future availability of bank loans

(average marginal effects, percentages)

Source: ECB and European Commission survey on the access to finance of enterprises (SAFE).

Notes: Average marginal effects of the increase by one standard deviation in the principal components on a deterioration in the future availability of bank loans based on logit regressions. PC stands for “principal component”. PC 1 refers to firms’ financial positions; PC 2 to non-price terms and conditions; PC 3 to price terms and conditions.

Since the onset of the COVID-19 pandemic, firms have become increasingly concerned that the future availability of bank loans may be reduced if financing costs rise. The importance of the component related to changes in bank interest rates and other costs of financing in predicting the future availability of bank loans has increased the most since the onset of the COVID-19 pandemic. A worsening of this component, which is directly linked to the assessments made by firms of banks’ behaviour, by one standard deviation now increases the probability of a deterioration in the future availability of bank loans by 7.8%. This figure was 5.1% until March 2020. Nevertheless, the expected availability of finance is still most strongly influenced by the financial position of firms (the first principal component), with average marginal effects of 9.6% before COVID-19 and 13% since the onset of the pandemic. For the component related to non-price terms and conditions (the second principal component), the corresponding rise since the onset of the pandemic is 1.1 percentage points to a level of 7.2%.

To conclude, the empirical analysis shows that, since the beginning of the pandemic, the overall financing conditions signalled by firms in the SAFE survey, and distilled via the three principal components, have become more important in gauging the beliefs of firms about the future availability of bank loans.

- See Lane, P., “The compass of monetary policy: favourable financing conditions”, speech at Comissão do Mercado de Valores Mobiliários, 25 February 2021.

- This corresponds to a total of 58,000 observations in the period 2009-21 (until September).

- Technically, the factor analysis provides a greater number of principal components. Using Horn’s parallel analysis, three principal components were retained. These components explain more than 65% of the total variance in the dataset of eight individual variables. After the validity of the data reduction had been assessed using Kaiser-Meyer-Olkin and Cronbach’s alpha statistics, the factor loadings were rotated obliquely in order to produce correlated factors. On the basis of the rotated factor loadings matrix, we assigned each principal component a specific meaning by looking at the highest loadings for each variable.

- For a detailed description of the different phases and the related ECB measures adopted up until the onset of the COVID-19 pandemic, see the article entitled “Access to finance for small and medium-sized enterprises after the financial crisis: evidence from survey data”, Economic Bulletin, Issue 4, ECB, 2020.

- For each (biannual) round of the SAFE survey the corresponding two quarters of BLS responses have been averaged.

- For instance, in the last survey round firms were asked between mid-September and mid-October 2021 about changes in access to finance for the period April 2021 to September 2021, and also about expected changes in access to finance for the period October 2021 to March 2022.

- Ferrando, A. and Ganoulis, I., “Firms’ expectations on access to finance at the early stages of the COVID-19 pandemic”, Working Paper Series, No 2446, ECB, 2020.

- A second specification includes the change in the availability of bank loans. This variable plays a similar role to a lagged dependent variable in a cross-sectional model, although it is reported by firms at the same time as expectations. The econometric results are confirmed under this second specification, although these results are not reported in the box.