Introduction

The results reported in the January 2021 bank lending survey (BLS) relate to changes observed during the fourth quarter of 2020 and expectations for the first quarter of 2021. The survey was conducted between 4 and 29 December 2020. A total of 143 banks were surveyed in this round, with a response rate of 100%. In addition to results for the euro area as a whole, this report also contains results for the four largest euro area countries.[1]

A number of ad hoc questions were included in the January 2021 survey. They address the impact of the situation in financial markets on banks’ access to retail and wholesale funding, the impact of new regulatory and supervisory requirements on banks’ lending policies, the impact of banks’ non-performing loan (NPL) ratios on their lending policies, the change in bank lending conditions and loan demand across the main economic sectors, and the impact of government loan guarantees related to the coronavirus (COVID-19) pandemic on changes in banks’ lending conditions and demand for loans.

1 Overview of results

The January 2021 BLS results show a net tightening of credit standards on loans to firms in the fourth quarter of 2020. The tightening was driven mainly by banks’ heightened risk perceptions, reflecting uncertainty around the economic recovery and concerns about borrowers’ creditworthiness in the context of renewed coronavirus-related restrictions. Banks’ cost of funds and balance sheet situation did not contribute to the tightening. In the first quarter of 2021, banks expect a continued tightening of credit standards for loans to enterprises.

Firms’ demand for loans or drawing of credit lines declined in the fourth quarter of 2020. Banks reported a continued net increase in demand for inventories and working capital, although its positive contribution was lower than in the first half of 2020. This might reflect the fact that firms had already built-up precautionary liquidity buffers in the previous quarters. Demand for fixed investment continued to weigh on loan demand as it declined for the fourth consecutive quarter. Euro area banks expect a moderate net increase in firms’ loan demand in the first quarter of 2021.

Credit standards for housing loans and for consumer credit tightened in the fourth quarter, but at a slower pace than in the previous quarters of 2020. Banks continued to refer to the deterioration of the economic outlook and worsened creditworthiness of consumers as the main factors contributing to the tightening of standards for consumer credit, while for housing loans these factors were less important. Net demand for housing loans continued to increase in the fourth quarter, supported by the low general level of interest rates and, to a lesser extent, improving housing market prospects. By contrast, consumer confidence continued to contribute negatively to the demand for housing loans. Net demand for consumer credit declined. Banks expect a continued net tightening of credit standards and a slight decline in housing loan demand in the first quarter of 2021.

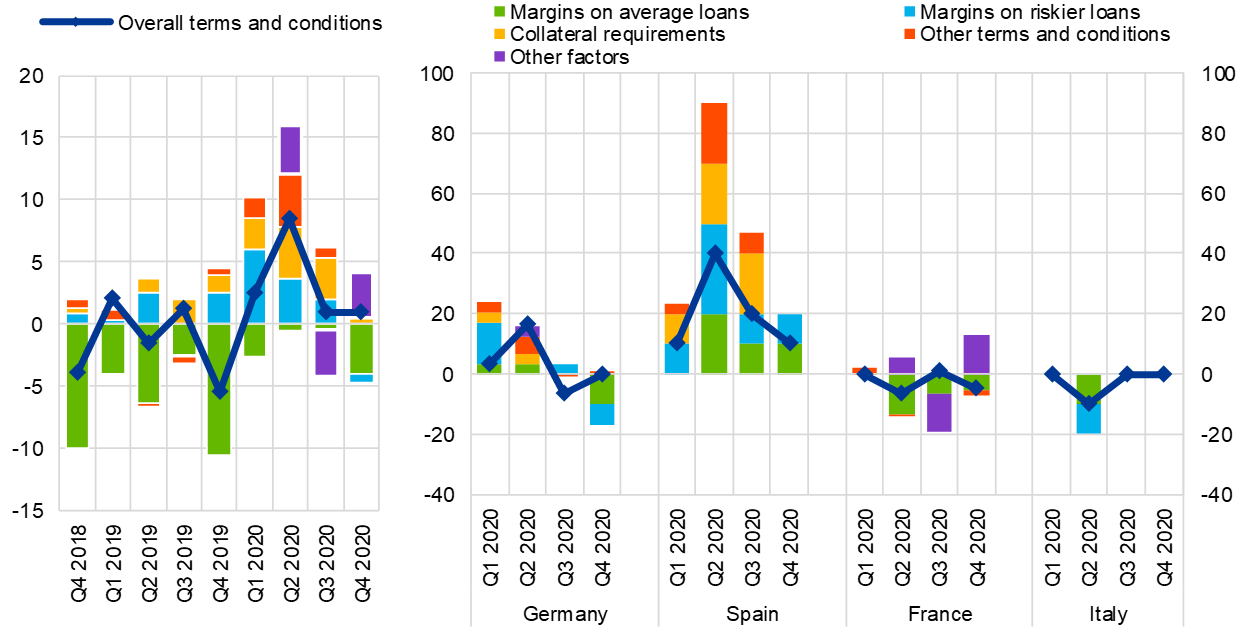

In more detail, credit standards (i.e. banks’ internal guidelines or loan approval criteria) for loans or credit lines to enterprises continued to tighten in the fourth quarter of 2020 (net percentage of reporting banks standing at 25%, after 19% in the third quarter of 2020; see Overview table), which is somewhat above expectations in the previous survey round. Banks reported a stronger net tightening of credit standards for loans to small and medium-sized enterprises (SMEs) (25%) than for loans to large enterprises (16%), as well as a stronger tightening for long-term loans (26% vs. 19% for short-term loans). In the first quarter of 2021, banks expect a continued net tightening of credit standards on loans to firms (20%).

Risk perceptions related to the deterioration in the general economic and firm-specific situation continued to be the main factor contributing to the tightening of credit standards for loans to firms. This reflects banks’ ongoing concerns around the economic recovery and borrowers’ creditworthiness as the stringency of coronavirus-related restrictions increased in most euro area countries in the fourth quarter. Banks also continued to report a lower risk tolerance, while banks’ cost of funds and balance sheet situation had a broadly neutral impact.

Credit standards for loans to households for house purchase (net percentage of 7%, after 20% in the third quarter of 2020) and for consumer credit and other lending to households (3%, after 9%) tightened in the fourth quarter, but at a slower pace than in the previous quarters of 2020. Concerns about the economic outlook, worsened creditworthiness of borrowers, banks’ lower risk tolerance and macroprudential policies targeting housing loans in France contributed to the tightening for housing loans. For consumer credit, banks continued to refer to the deterioration of the economic outlook and worsened creditworthiness of consumers as the main factors contributing to the tightening, but less than in previous quarters, likely reflecting the tighter level of credit standards already reached. Banks’ cost of funds and balance sheet situation, on the other hand, continued to have a broadly neutral impact on loans to households. In the first quarter of 2021, banks expect a continued net tightening of credit standards for housing loans (13%) and consumer credit (5%).

Banks’ overall terms and conditions (i.e. banks’ actual terms and conditions agreed in the loan contract) for new loans to enterprises tightened further in the fourth quarter of 2020 (net percentage of 14%, after 8%). The net tightening was mainly related to a tightening of collateral requirements and widening margins on riskier loans, while margins on average loans contributed less to the tightening. Banks’ overall terms and conditions continued to tighten for housing loans (net percentage of 6%, after 9%), while they remained broadly unchanged for consumer credit and other lending to households (1%, after 1%).

The rejection rate for loan applications increased moderately across loan categories. Euro area banks reported that the net share of rejected applications increased for loans to firms (net percentage of 2%, after 3%), as well as for housing loans (5%, after 8%) and for consumer credit and other lending to households (4%, after 16%).

Firms’ demand for loans or drawing of credit lines declined further in the fourth quarter of 2020 (net percentage of -12%, after -4% in the third quarter of 2020; see Overview table). Banks reported a continued net increase in demand for inventories and working capital, although its positive contribution was lower than in the first half of 2020. This might reflect the fact that firms had already built-up precautionary liquidity buffers in the previous quarters. Demand for fixed investment continued to weigh on loan demand as it declined for the fourth consecutive quarter. In the first quarter of 2021, banks expect that net demand for loans to enterprises will moderately increase (5%).

Banks continued to report a net increase in demand for housing loans in the fourth quarter, after a strong rebound in the previous quarter (net percentage of 16%, after 31%). For consumer credit and other lending to households, banks reported a net decline in demand, after a moderate increase in the previous quarter (net percentage of -9%, after 3%). The net increase in housing loan demand continued to be mainly supported by the low general level of interest rates and, to a limited extent, improving housing market prospects. By contrast, lower consumer confidence continued to contribute negatively to housing loan demand. The decline in demand for consumer credit was largely driven by lower consumer confidence and decreased spending on durable goods in the context of renewed coronavirus-related restrictions in the fourth quarter of 2020. Banks expect a net decline in demand for housing loans (-3%) and a net increase in demand for consumer credit (4%) in the first quarter of 2021.

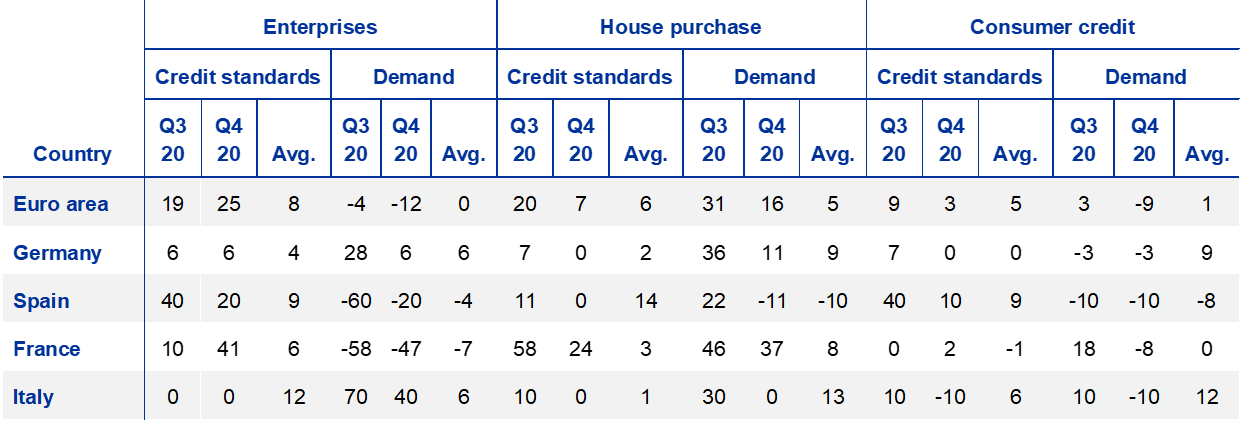

Across the largest euro area countries, credit standards on loans to enterprises tightened in Germany, Spain and France, while they remained unchanged in Italy in the fourth quarter of 2020 (see Overview table). Credit standards for housing loans tightened in France, while they remained unchanged in Germany, Italy and Spain. Credit standards for consumer credit and other lending to households tightened in Spain and slightly in France, while they remained unchanged in Germany and eased in Italy.

Net demand for loans to enterprises increased in Germany and Italy, while it declined in France and Spain in the fourth quarter of 2020. Demand for housing loans continued to increase in Germany and France, while it declined in Spain and remained unchanged in Italy. Demand for consumer credit declined across all four largest euro area countries.

Overview table

Latest BLS results for the largest euro area countries

(net percentages of banks reporting a tightening of credit standards or an increase in loan demand)

Notes: The “Avg.” columns contain historical averages, which are calculated over the period since the beginning of the survey, excluding the most recent round. For France, net percentages are weighted on the basis of outstanding loan amounts for individual banks in the respective national samples. Owing to different sample sizes across countries, which broadly reflect the differences in the national shares in lending to the euro area non-financial private sector, the size and volatility of the net percentages cannot be directly compared across countries.

The January 2021 BLS also included a number of ad hoc questions. Regarding euro area banks’ access to retail and wholesale funding, banks reported in net terms that access generally improved in the fourth quarter of 2020, especially for debt securities, retail funding and money markets, while the reported improvement was smaller, in net terms, for securitisation.

Euro area banks indicated that regulatory or supervisory action continued to strengthen banks’ capital position and had a strong easing impact on their funding conditions in 2020. At the euro area level, banks reported that supervisory or regulatory action continued to have a net tightening impact on their credit standards across all loan categories, with further tightening expected in 2021 for loans to enterprises.

Euro area banks reported a net tightening impact of NPL ratios on credit standards and terms and conditions for loans to enterprises and consumer credit and a broadly neutral impact on housing loans in the second half of 2020. Over the next six months, they expect a somewhat weaker net tightening impact on loans to enterprises and consumer credit and a slightly stronger tightening impact on housing loans. Risk perceptions related to the general economic outlook and borrowers’ creditworthiness and a lower risk tolerance were the main drivers of the tightening impact of NPL ratios.

Euro area banks indicated a net tightening of credit standards and a small net tightening of terms and conditions for loans to enterprises across all main sectors of economic activities over the past six months. Banks expect a lower net tightening of credit standards for new loans to enterprises across all main sectors of economic activities in the first half of 2021. Firms’ net demand for loans or credit lines increased in almost all economic sectors, except real estate, where banks reported a net decline in demand in the second half of 2020.

Euro area banks reported that COVID-19-related government guarantees were important in supporting banks’ credit standards and terms and conditions for loans to firms, both SMEs and large enterprises, in 2020. In line with this, banks indicated a tightening of their lending conditions for loans to enterprises without government guarantees in 2020. Banks reported a very strong net increase in demand for loans or credit lines with government guarantees in the first half of 2020, while the net increase in the second half was moderate. The increase in demand for loans or credit lines with government guarantees was largely driven by firms’ need to build precautionary liquidity buffers and to cover acute liquidity needs. In the first half of 2021, euro area banks expect a limited further impact of government guarantees on their credit standards, while they expect that credit standards for loans without guarantees will continue to tighten. Banks also expect an increase in firms’ demand for loans with and without government guarantees over the next six months.

Box 1

General notes

The bank lending survey (BLS) is addressed to senior loan officers at a representative sample of euro area banks. In the current round, 143 banks were surveyed, representing all euro area countries and reflecting the characteristics of their respective national banking structures. The main purpose of the BLS is to enhance the Eurosystem’s knowledge of bank lending conditions in the euro area.[2]

BLS questionnaire

The BLS questionnaire contains 22 standard questions on past and expected future developments: 18 backward-looking questions and four forward-looking questions. In addition, it contains one open-ended question. Those questions focus on developments in loans to euro area residents (i.e. domestic and euro area cross-border loans) and distinguish between three loan categories: loans or credit lines to enterprises; loans to households for house purchase; and consumer credit and other lending to households. For all three categories, questions are asked about the credit standards applied to the approval of loans, the terms and conditions of new loans, loan demand, the factors affecting loan supply and demand conditions, and the percentage of loan applications that are rejected. Survey questions are generally phrased in terms of changes over the past three months or expected changes over the next three months. Survey participants are asked to indicate in a qualitative way the strength of any tightening or easing or the strength of any decrease or increase, reporting changes using the following five-point scale: (1) tightened/decreased considerably, (2) tightened/decreased somewhat, (3) basically no change, (4) eased/increased somewhat or (5) eased/increased considerably.

In addition to the standard questions, the BLS questionnaire may contain ad hoc questions on specific topics of interest. Whereas the standard questions cover a three-month time period, the ad hoc questions tend to refer to changes over a longer time period (e.g. over the past and next six months).

Aggregation of banks’ replies to national and euro area BLS results

The responses of the individual banks participating in the BLS are aggregated in two steps. In the first step, the responses of individual banks are aggregated to form national results for euro area countries. And in the second step, those national BLS results are aggregated to form euro area BLS results.

In the first step, banks’ replies can be aggregated to form national BLS results by applying equal weights to all banks in the sample[3] or, alternatively, by applying a weighting scheme based on outstanding loans to non-financial corporations and households for the individual banks in the respective national samples. Specifically, for France, Malta, the Netherlands and Slovakia, an explicit weighting scheme is applied.

In the second step, since the numbers of banks in the national samples differ considerably and do not always reflect those countries’ respective shares of lending to euro area non-financial corporations and households, the national survey results are aggregated to form euro area BLS results by applying a weighting scheme based on national shares of outstanding loans to euro area non-financial corporations and households.

BLS indicators

Responses to questions relating to credit standards are analysed in this report by looking at the difference (the “net percentage”) between the percentage of banks reporting that credit standards applied in the approval of loans have been tightened and the percentage of banks reporting that they have been eased. For all questions, the net percentage is determined on the basis of all participating banks that have business in or exposure to the respective loan categories (i.e. they are all included in the denominator when calculating the net percentage). This means that banks that specialise in certain loan categories (e.g. banks that only grant loans to enterprises) are only included in the aggregation for those categories. All other participating banks are included in the aggregation of all questions, even if a bank replies that a question is “not applicable” (“NA”). This harmonised aggregation method was introduced by the Eurosystem in the April 2018 BLS. It has been applied to all euro area and national BLS results in the current BLS questionnaire, including backdata.[4] The resulting revisions for the standard BLS questions have generally been small, but revisions for some ad hoc questions have been larger owing to a higher number of “not applicable” replies by banks.

A positive net percentage indicates that a larger proportion of banks have tightened credit standards (“net tightening”), whereas a negative net percentage indicates that a larger proportion of banks have eased credit standards (“net easing”).

Likewise, the term “net demand” refers to the difference between the percentage of banks reporting an increase in loan demand (i.e. an increase in bank loan financing needs) and the percentage of banks reporting a decline. Net demand will therefore be positive if a larger proportion of banks have reported an increase in loan demand, whereas negative net demand indicates that a larger proportion of banks have reported a decline in loan demand.

In the assessment of survey balances for the euro area, net percentages between -1 and +1 are generally referred to as “broadly unchanged”. For country results, net percentage changes are reported in a factual manner, as differing sample sizes across countries mean that the answers of individual banks have differing impacts on the magnitude of net percentage changes.

In addition to the “net percentage” indicator, the ECB also publishes an alternative measure of banks’ responses to questions relating to changes in credit standards and net demand. This measure is the weighted difference (“diffusion index”) between the percentage of banks reporting that credit standards have been tightened and the percentage of banks reporting that they have been eased. Likewise, as regards demand for loans, the diffusion index refers to the weighted difference between the percentage of banks reporting an increase in loan demand and the percentage of banks reporting a decline. The diffusion index is constructed in the following way: lenders who have answered “considerably” are given a weight (score of 1) which is twice as large as that given to lenders who have answered “somewhat” (score of 0.5). The interpretation of the diffusion indices follows the same logic as the interpretation of net percentages.

Detailed tables and charts based on the responses provided can be found in Annex 1 for the standard questions and Annex 2 for the ad hoc questions. In addition, BLS time series data are available on the ECB’s website via the Statistical Data Warehouse.

A copy of the questionnaire, a glossary of BLS terms and a BLS user guide with information on the BLS series keys can all be found at: https://www.ecb.europa.eu/stats/ecb_surveys/bank_lending_survey/html/index.en.html

2 Developments in credit standards, terms and conditions, and net demand for loans in the euro area

2.1 Loans to enterprises

2.1.1 Credit standards for loans to enterprises tightened

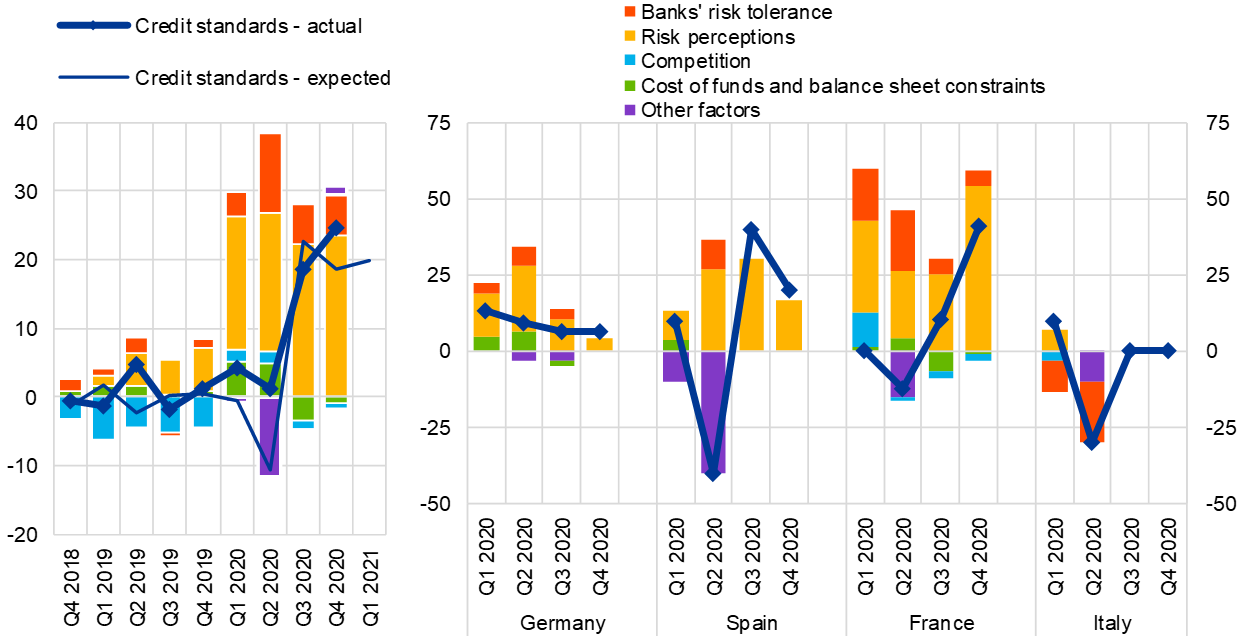

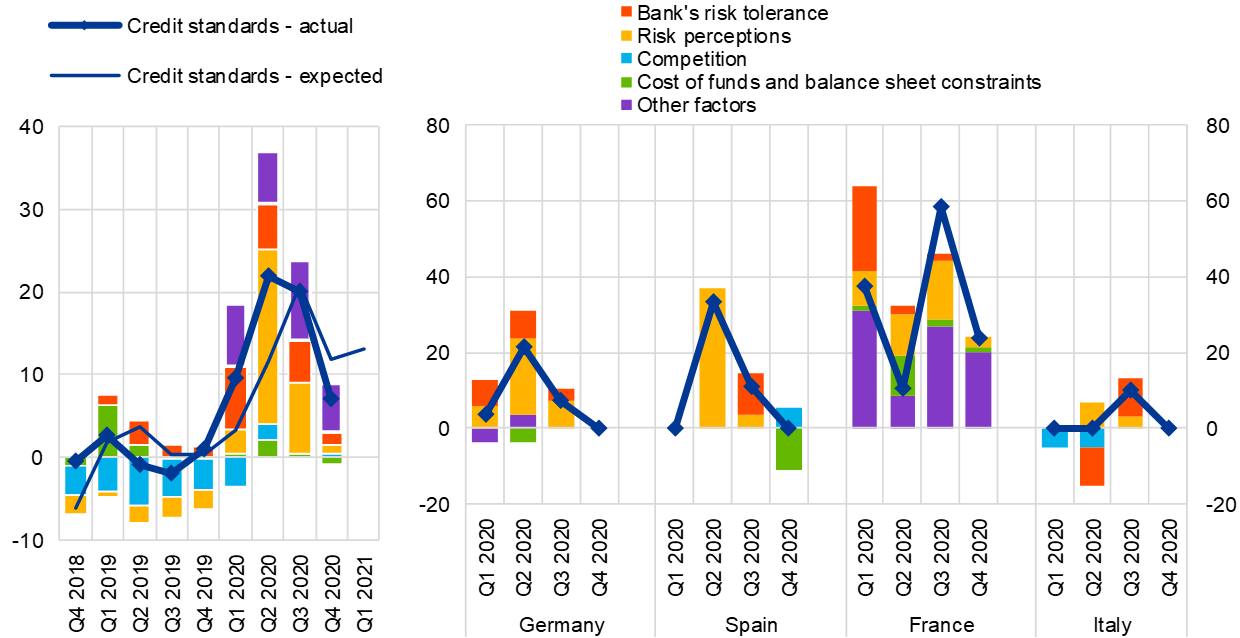

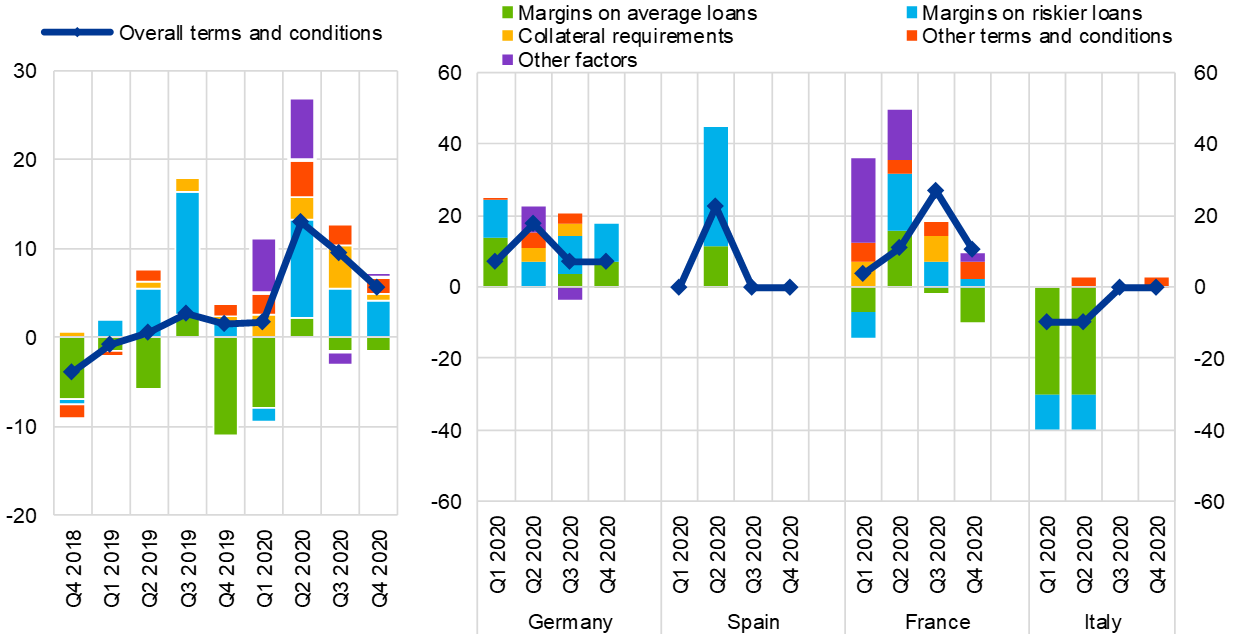

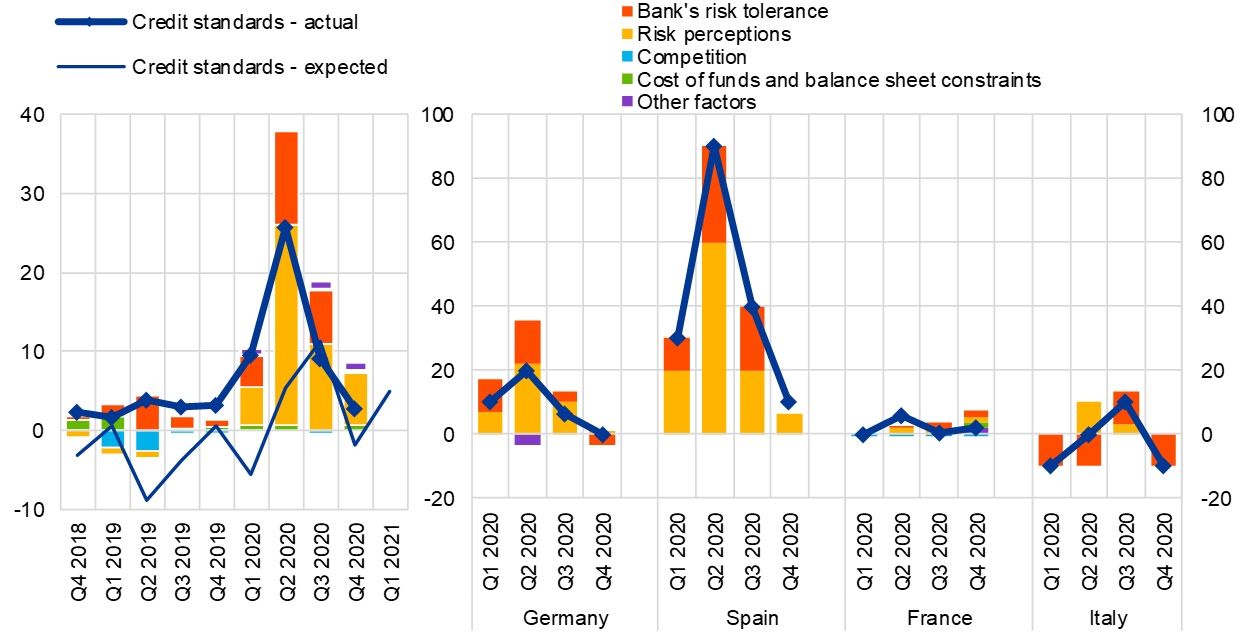

Credit standards (i.e. banks’ internal guidelines or loan approval criteria) for loans to enterprises continued to tighten in the fourth quarter of 2020, which was somewhat higher than expected in the previous round (net percentage of 25%, after 19% in the third quarter of 2020; see Chart 1 and Overview table). While the tightening was above the historical average (8%), it remained below the peaks observed during the great financial crisis and the sovereign debt crisis (average tightening of 52% from the fourth quarter of 2007 to the first quarter of 2009; peak of 30% in the fourth quarter of 2011). The smaller net tightening over the course of the pandemic compared to previous crises is likely related to supportive monetary and fiscal policy actions. Notably, banks reported a significant easing of credit standards on loans with COVID-19-related government guarantees in 2020 (see Section 3.5). The stronger net tightening in the last two quarters of the year is also consistent with the observed decline in the actual take-up of guaranteed loans and the moderation of overall loan flows to non-financial corporations. The net tightening in the fourth quarter of 2020 was stronger for loans to SMEs (25% vs. 16% for large enterprises) and for long-term loans (26% vs. 19% for short-term loans).

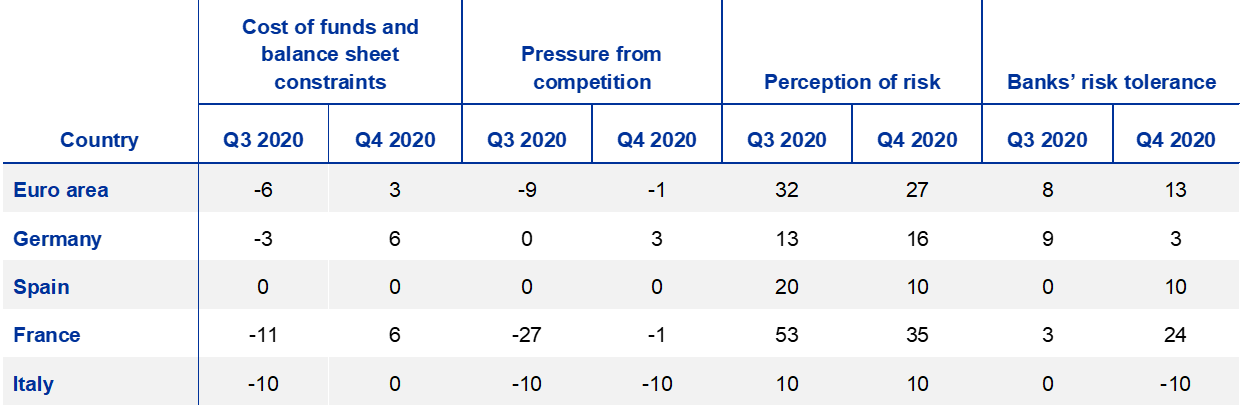

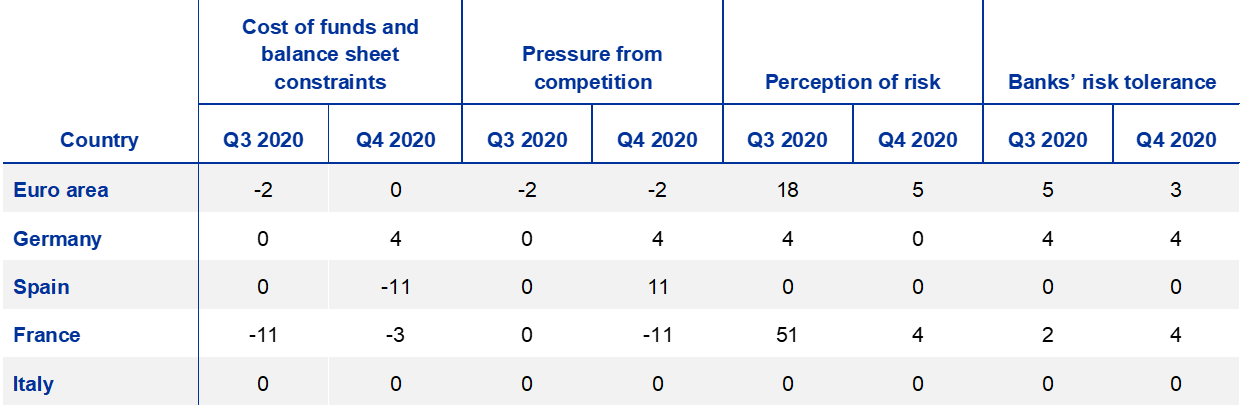

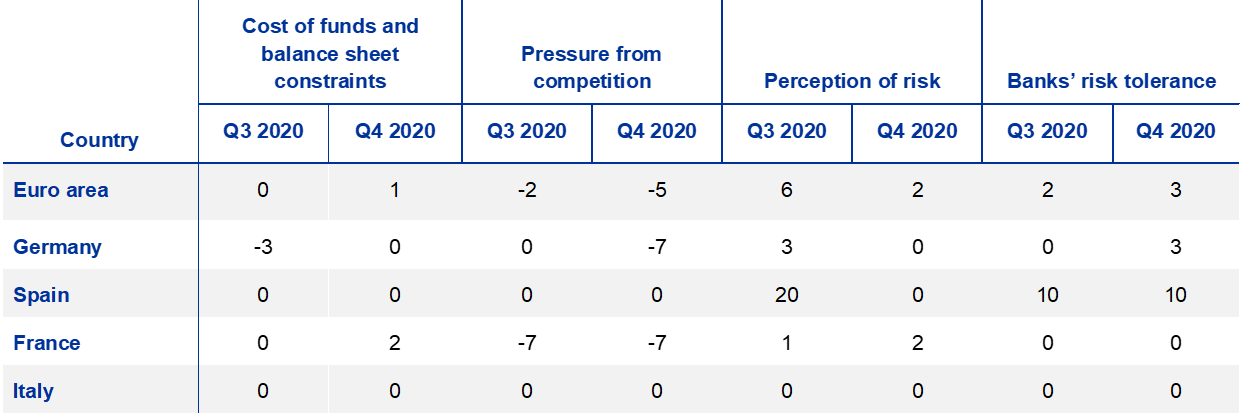

Banks continued to refer to risk perceptions related to the deterioration in the general economic and the firm-specific situation as the main factor contributing to the tightening of credit standards (see Chart 1 and Table 1). This reflects banks’ continued concerns around the economic recovery and borrowers’ creditworthiness as the stringency of coronavirus-related restrictions increased again in most euro area countries. Moreover, banks’ lower risk tolerance continued to contribute to a net tightening, while banks’ cost of funds and balance sheet situation had a broadly neutral impact.

Across the largest euro area countries, credit standards on loans to enterprises tightened in Germany, Spain and France, while they remained unchanged in Italy in the fourth quarter of 2020. This is consistent with the continued increase in realised loan flows to Italian firms in the autumn of 2020. Banks in Germany, Spain and France referred to the heightened perception of risk as the main factor contributing to the tightening. The impact of risk perceptions was particularly strong in France, possibly reflecting banks’ concerns about the indebtedness of French firms. Banks’ lower risk tolerance only contributed to a tightening in France. Banks’ cost of funds and balance sheet situation and pressure from competition had a broadly neutral impact in all the largest euro area countries.

Euro area banks expect a continued net tightening of credit standards on loans to firms (net percentage of 20%) in the first quarter of 2021, reflecting the continued uncertainties around the further development of the pandemic and its effects on borrowers’ credit risk.

Chart 1

Changes in credit standards applied to the approval of loans or credit lines to enterprises, and contributing factors

(net percentages of banks reporting a tightening of credit standards and contributing factors)

Notes: “Actual” values are changes that have occurred, while “expected” values are changes anticipated by banks. Net percentages are defined as the difference between the sum of the percentages of banks responding “tightened considerably” and “tightened somewhat” and the sum of the percentages of banks responding “eased somewhat” and “eased considerably”. The net percentages for responses to questions related to contributing factors are defined as the difference between the percentage of banks reporting that the given factor contributed to a tightening and the percentage reporting that it contributed to an easing. “Cost of funds and balance sheet constraints” is the unweighted average of “costs related to capital position”, “access to market financing” and “liquidity position”; “risk perceptions” is the unweighted average of “general economic situation and outlook”, “industry or firm-specific situation and outlook/borrower’s creditworthiness” and “risk related to the collateral demanded”; “competition” is the unweighted average of “competition from other banks”, “competition from non-banks” and “competition from market financing”. The net percentages for “other factors” refer to further factors which were mentioned by banks as having contributed to changes in credit standards, currently mainly related to the policy interventions in response to the COVID-19 pandemic.

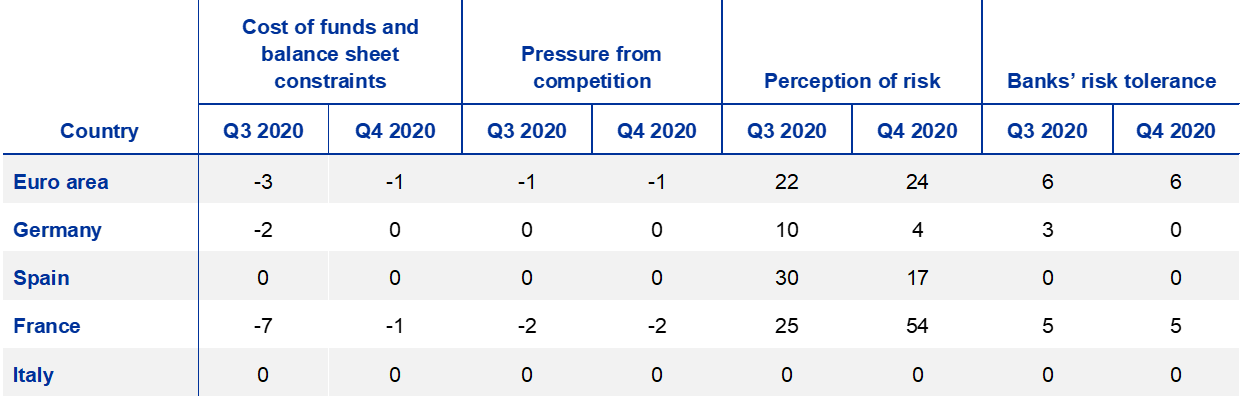

Table 1

Factors contributing to changes in credit standards for loans or credit lines to enterprises

(net percentages of banks)

Note: See the notes to Chart 1.

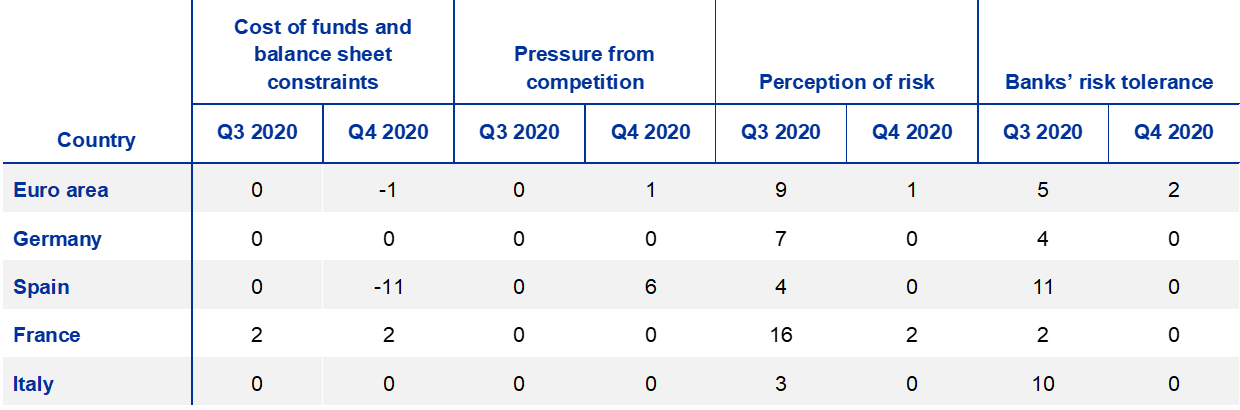

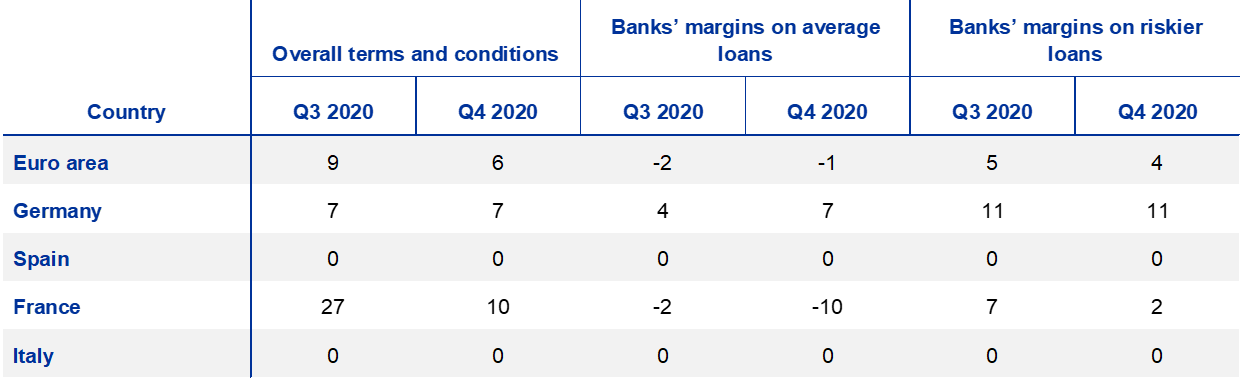

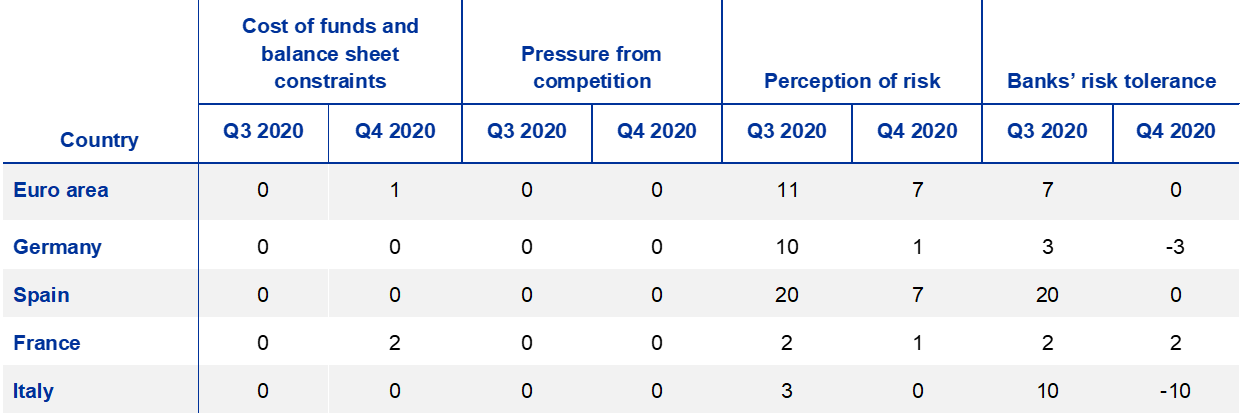

2.1.2 Terms and conditions on loans to enterprises continued to tighten

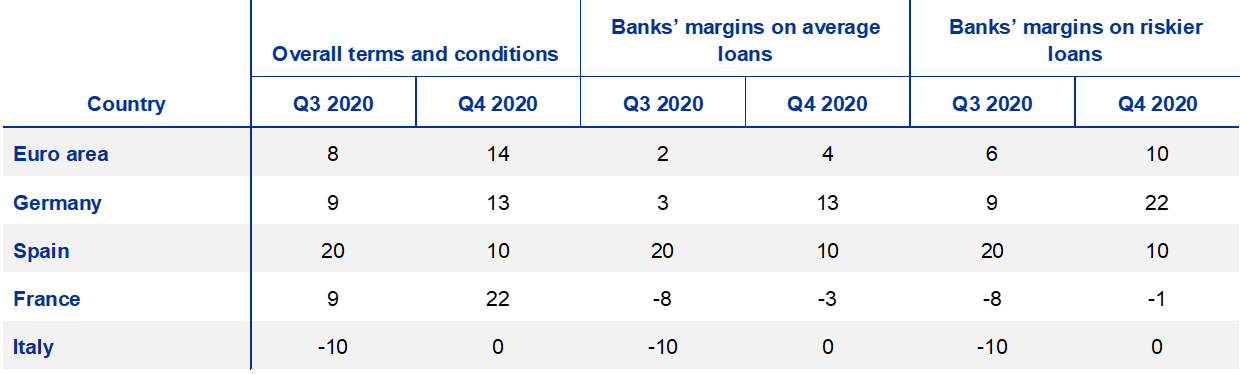

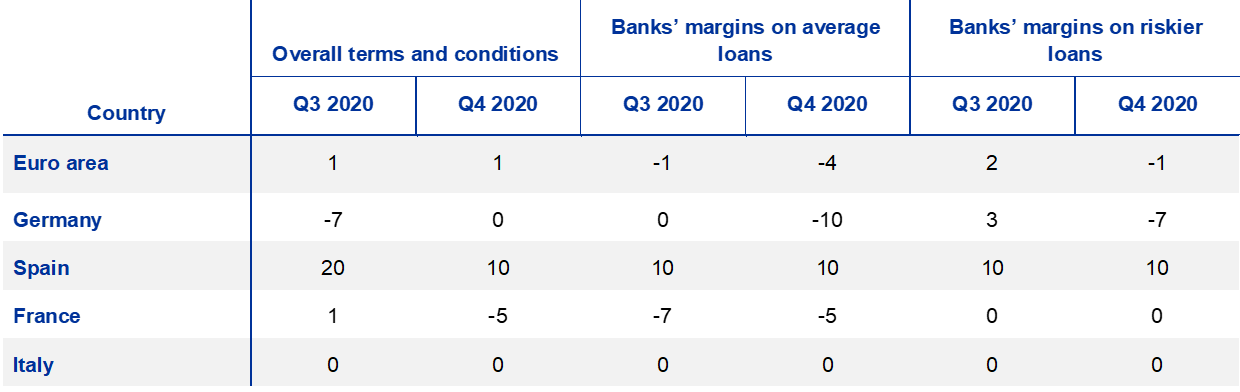

Banks’ overall terms and conditions (i.e. banks’ actual terms and conditions agreed in the loan contract) for new loans to enterprises continued to tighten in the fourth quarter of 2020 (net percentage of 14%, after 8%; see Chart 2 and Table 2). Collateral requirements continued to tighten significantly, reaching the highest value since the third quarter of 2009. Margins on average loans to firms (defined as the spread over relevant market reference rates) tightened moderately, while margins on riskier loans continued to tighten more strongly. However, the widening of margins on both average and riskier loans in recent quarters remained limited compared to previous crises. Regarding other components of terms and conditions, banks reported a small net tightening for loan size, covenants and maturity, while non-interest rate charges remained broadly unchanged. These developments reflect the tightening of some components of banks’ terms and conditions, while bank lending rates remain historically low.

Chart 2

Changes in terms and conditions on loans or credit lines to enterprises

(net percentages of banks reporting a tightening of terms and conditions)

Notes: “Margins” are defined as the spread over a relevant market reference rate. “Other terms and conditions” is the unweighted average of “non-interest rate charges”, “size of the loan or credit line”, “loan covenants” and “maturity”. The net percentages for “other factors” refer to further factors which were mentioned by banks as having contributed to changes in terms and conditions.

Table 2

Changes in terms and conditions on loans or credit lines to enterprises

(net percentages of banks)

Note: See the notes to Chart 2.

Risk perceptions continued to be the main contributor to the net tightening of banks’ overall terms and conditions (see Table 3). Banks’ risk tolerance again contributed to the net tightening, and the contribution was larger than in the previous quarter. Banks’ cost of funds and balance sheet constraints also contributed to a tightening, while the impact of competition was broadly neutral.

Across the largest euro area countries, overall terms and conditions on new loans or credit lines to enterprises tightened in Germany, France and Spain, while they remained unchanged in Italy. The net tightening in Germany and Spain was related to wider loan margins and stricter collateral requirements. Banks in France reported a continued net easing of margins for average loans, but a strong net tightening of collateral requirements. In all large euro area countries, risk perceptions contributed to a tightening of terms and conditions. Banks’ risk tolerance contributed to a tightening in Germany, Spain and France, while it contributed to an easing in Italy.

Table 3

Factors contributing to changes in overall terms and conditions on loans or credit lines to enterprises

(net percentages of banks)

Note: The net percentages for these questions relating to contributing factors are defined as the difference between the percentage of banks reporting that the given factor contributed to a tightening and the percentage reporting that it contributed to an easing.

2.1.3 Rejection rate for loans to enterprises slightly increased

In the fourth quarter of 2020, the net rejection rate for loans to euro area enterprises continued to increase slightly (net percentage of banks reporting an increase standing at 2%, after 3% in the third quarter of 2020; see Chart 3). However, this followed a considerable decline in the second quarter of 2020 and was still lower than the increases observed in the quarters prior to the coronavirus pandemic.

Across the largest euro area countries, the net rejection rate increased in Germany and Spain, while it decreased in Italy and remained unchanged in France.

Chart 3

Changes in the rejection rate for loans to enterprises

(net percentages of banks reporting an increase in the share of rejections)

Notes: The net percentages of rejected loan applications are defined as the difference between the percentages of banks reporting an increase in the share of loan rejections and the percentages of banks reporting a decline. Banks’ responses refer to the share of rejected loan applications relative to the total volume of applications in that loan category.

2.1.4 Lower net demand for loans to enterprises

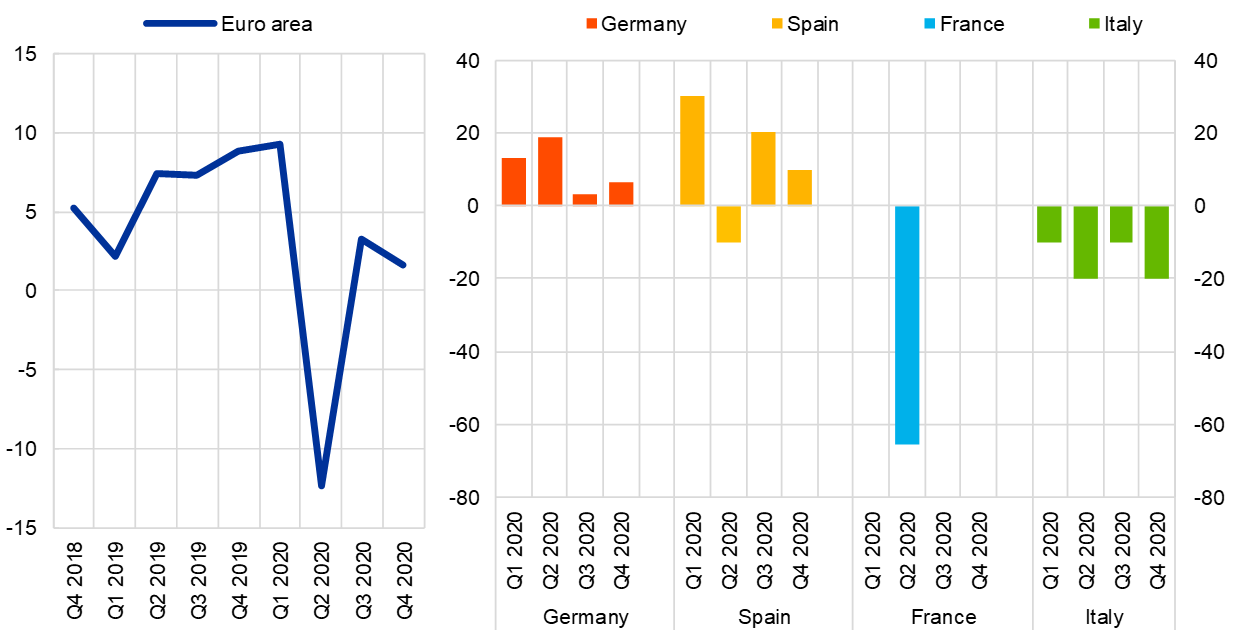

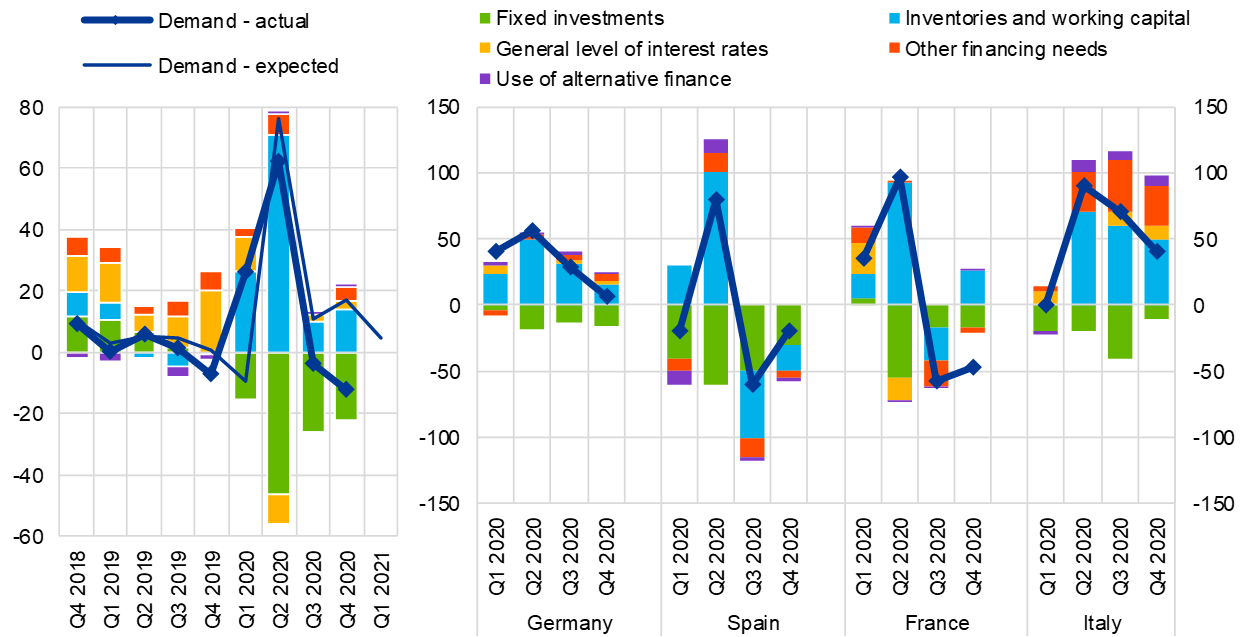

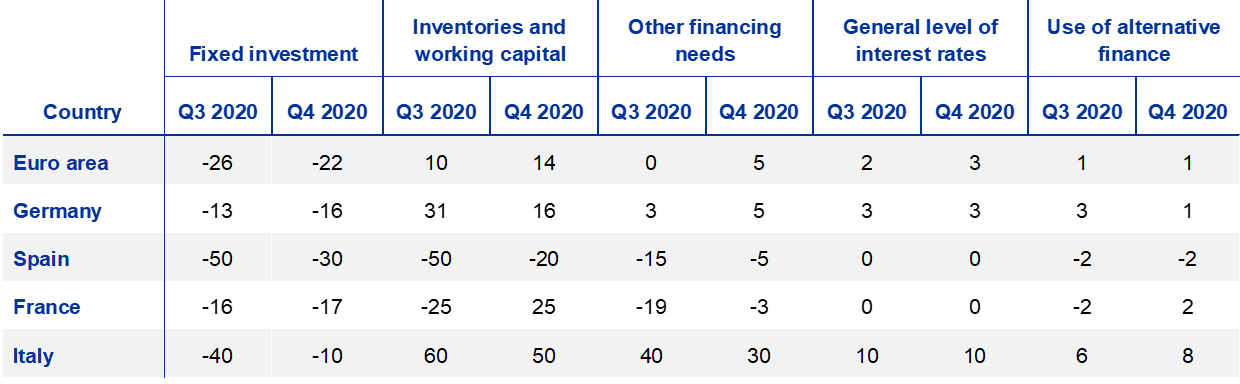

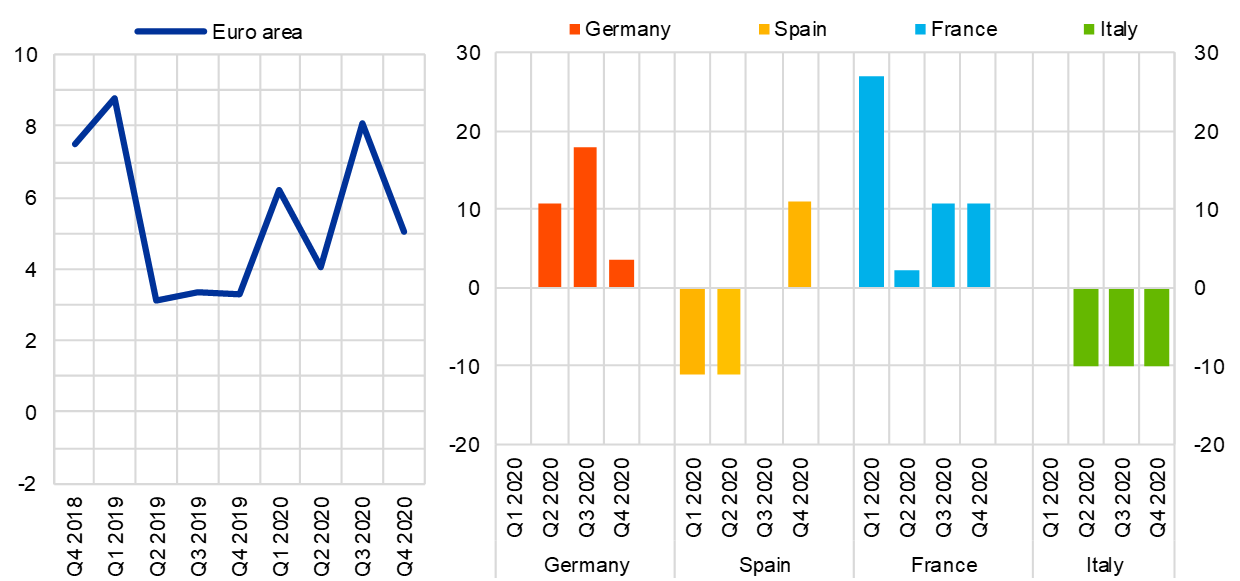

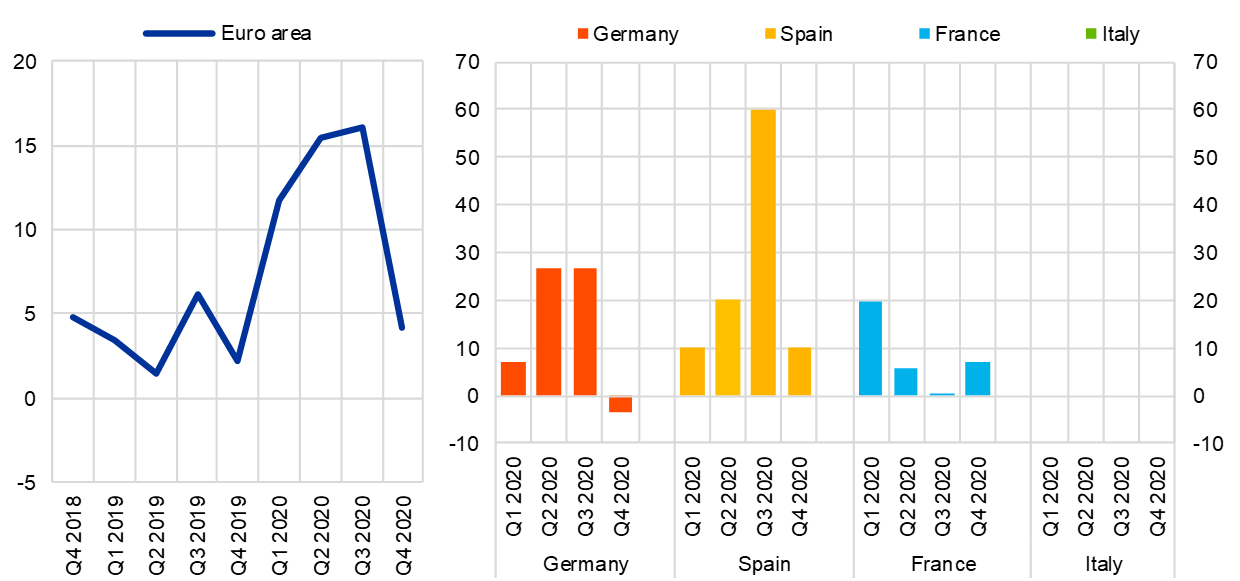

Banks reported a continued net decline in firms’ demand for loans or drawing of credit lines in the fourth quarter of 2020 (net percentage of banks reporting an increase in loan demand of -12%, after -4% in the third quarter of 2020; see Chart 4 and Overview table). The reported net decline is consistent with the observed lower realised loan flows to non-financial corporations in recent months. The dispersion of banks’ responses remained elevated, which is also reflected in differences across countries and different maturities. While the net decline in loan demand was similar for SMEs (net percentage of -10%) and large firms (-8%), it was significantly larger for long-term loans (-16%) than short-term loans (-3%).

Banks reported that demand for inventories and working capital continued to contribute positively to net demand for loans, although its contribution was smaller than in the first half of 2020 (see Chart 4 and Table 4). Given aggregate data on deposit inflows from non-financial corporations as well as anecdotal evidence from banks, this likely reflects the fact that firms had already built-up precautionary liquidity buffers in previous quarters. Meanwhile, demand for fixed investment contributed negatively to firms’ loan demand for the fourth consecutive quarter. The general level of interest rates and debt refinancing and restructuring contributed positively to demand, while mergers and acquisitions contributed negatively.[5]

Chart 4

Changes in demand for loans or credit lines to enterprises and contributing factors

(net percentages of banks reporting an increase in demand and contributing factors)

Notes: “Actual” values are changes that have occurred, while “expected” values are changes anticipated by banks. Net percentages for the questions on demand for loans are defined as the difference between the sum of the percentages of banks responding “increased considerably” and “increased somewhat” and the sum of the percentages of banks responding “decreased somewhat” and “decreased considerably”. The net percentages for responses to questions relating to contributing factors are defined as the difference between the percentage of banks reporting that the given factor contributed to increasing demand and the percentage reporting that it contributed to decreasing demand. “Other financing needs” is the unweighted average of “mergers/acquisitions and corporate restructuring” and “debt refinancing/restructuring and renegotiation”; “use of alternative finance” is the unweighted average of “internal financing”, “loans from other banks”, “loans from non-banks”, “issuance/redemption of debt securities” and “issuance/redemption of equity”.

Table 4

Factors contributing to changes in demand for loans or credit lines to enterprises

(net percentages of banks)

Note: See the notes to Chart 4.

Across the largest euro area countries, banks reported a net increase in demand for loans to firms in Germany and Italy, while they reported a net decline in France and Spain. Demand for fixed investment contributed negatively in all countries, while demand for inventories and working capital had a positive impact in all countries apart from Spain. In Italy, other financing needs – mainly debt refinancing and renegotiation – also contributed strongly to the net increase in loan demand. This may be related to firms substituting existing loans with government guaranteed loans, as substitution of loans was an important factor contributing to demand for guaranteed loans according to Italian banks (see Section 3.5).

In the first quarter of 2021, banks expect a moderate net increase in demand for loans to firms (net percentage of 5%). The increase is expected to be larger for short-term loans (13%) and for SMEs (5%).

2.2 Loans to households for house purchase

2.2.1 Credit standards for loans to households for house purchase tightened

Credit standards for loans to households for house purchase continued to tighten in the fourth quarter of 2020 (net percentage of 7%, after 20% in the third quarter; see Chart 5 and Overview table). The net tightening was smaller than in previous quarters of 2020 and close to the historical average since 2003 (6%).

Chart 5

Changes in credit standards applied to the approval of loans to households for house purchase, and contributing factors

(net percentages of banks reporting a tightening of credit standards and contributing factors)

Notes: See the notes to Chart 1. “Risk perceptions” is the unweighted average of “general economic situation and outlook”, “housing market prospects, including expected house price developments” and “borrower’s creditworthiness”; “competition” is the unweighted average of “competition from other banks” and “competition from non-banks”. The net percentages for “other factors” refer to further factors which were mentioned by banks as having contributed to changes in credit standards. For France, banks reported that this also relates to macroprudential policy recommendations.

Banks’ risk tolerance as well as risk perceptions regarding the general economic outlook and borrowers’ creditworthiness contributed slightly to a net tightening, while risk perceptions related to housing market prospects had a small easing impact. Banks continued to report a tightening contribution from other factors, such as macroprudential policies targeting housing credit in France (see Chart 5 and Table 5).

Across the largest euro area countries, credit standards tightened in France, while they remained unchanged in Germany, Spain and Italy. Banks in Spain reported a notable net easing contribution from cost of funds and balance sheet constraints, while pressure from competition contributed to a net tightening of credit standards. Banks in France continued to refer to the macroprudential recommendations by the French High Council for Financial Stability adopted in December 2019, according to which banks were asked to tighten their lending conditions for mortgage credit, as the main factor contributing to the tightening.

Looking ahead, euro area banks expect a continued net tightening of credit standards for housing loans (a net percentage of 13%) in the first quarter of 2021.

Table 5

Factors contributing to changes in credit standards for loans to households for house purchase

(net percentages of banks)

Note: See the notes to Chart 5.

2.2.2 Terms and conditions on loans to households for house purchase continued to tighten

Banks’ overall terms and conditions continued to tighten for housing loans (net percentage of 6%, after 9% in the previous quarter). The net tightening was mainly related to a widening of margins on riskier loans and the maturity of loans, while margins on average loans and collateral requirements remained broadly unchanged (see Chart 6 and Table 6).

Chart 6

Changes in terms and conditions on loans to households for house purchase

(net percentages of banks reporting a tightening of terms and conditions)

Notes: “Margins” are defined as the spread over a relevant market reference rate. “Other terms and conditions” is the unweighted average of “loan-to-value ratio”, “other loan size limits”, “non-interest rate charges” and “maturity”. The net percentages for “other factors” refer to further factors which were mentioned by banks as having contributed to changes in terms and conditions.

Table 6

Changes in terms and conditions on loans to households for house purchase

(net percentages of banks)

Note: See the notes to Chart 6.

Higher risk perceptions and lower risk tolerance contributed to the net tightening of overall terms and conditions on housing loans. Banks’ cost of funds and balance sheet situation had a neutral impact, while competitive pressures contributed to a slight net easing (see Table 7).

Across the largest euro area countries, overall terms and conditions on housing loans tightened in Germany and France, while there was no change in Spain and Italy. In Germany, the tightening was related to wider margins on both average and riskier loans. Meanwhile, in France margins on average loans narrowed considerably, while other terms and conditions tightened.

Table 7

Factors contributing to changes in overall terms and conditions on loans to households for house purchase

(net percentages of banks)

Note: The net percentages for these questions relating to contributing factors are defined as the difference between the percentage of banks reporting that the given factor contributed to a tightening and the percentage reporting that it contributed to an easing.

2.2.3 Rejection rate for housing loans increased

In the fourth quarter of 2020, a net percentage of 5% of banks reported an increase in the share of rejected loan applications for housing loans, which was lower than the net percentage of 8% reporting an increase in the previous quarter (see Chart 7). Overall, the net increases in rejection rates over the course of 2020 correspond well to the changes in credit standards.

Across the largest euro area countries, the rejection rate for housing loans increased in France, Spain and, to a lesser extent, Germany, while it declined in Italy.

Chart 7

Changes in the rejection rate for loans to households for house purchase

(net percentages of banks reporting an increase in the share of rejections)

Notes: Net percentages of rejected loan applications are defined as the difference between the percentages of banks reporting an increase in the share of loan rejections and the percentages of banks reporting a decline. Banks’ answers refer to the share of rejected loan applications relative to the total volume of applications in that loan category.

2.2.4 Net demand for housing loans continued to increase

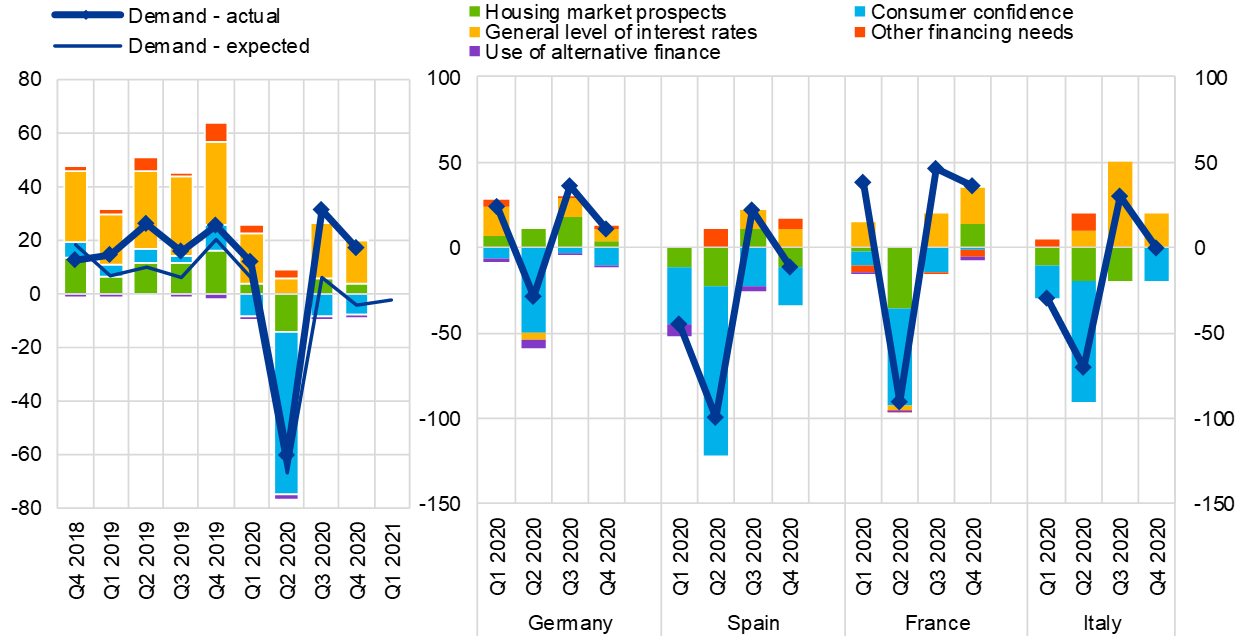

Banks continued to report a net increase in demand for housing loans in the fourth quarter, after a strong rebound in the previous quarter (net percentage of banks reporting an increase in loan demand of 16%, after 31% in the third quarter of 2020; see Chart 8 and Overview table). The continued net increase in housing loan demand likely reflects the fact that it is still catching up after the collapse in the second quarter and is consistent with the actual developments in mortgage lending flows observed in recent months.

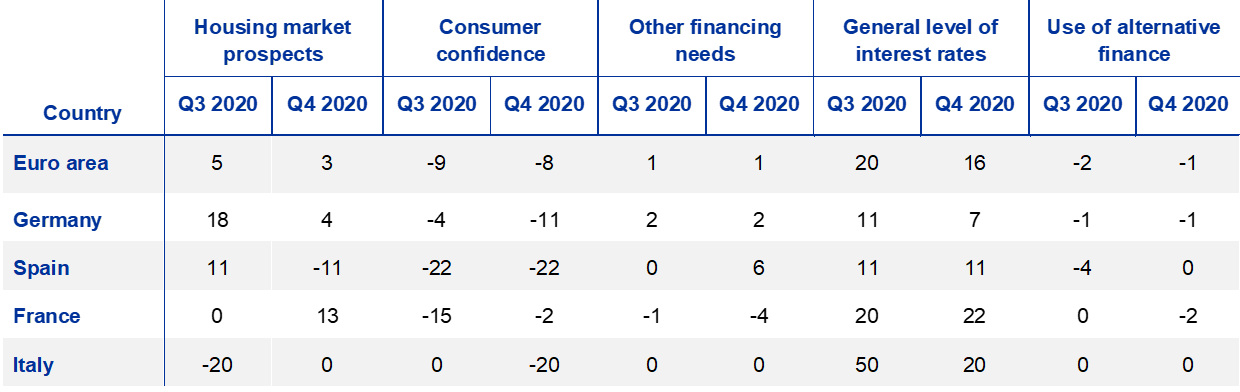

The rebound in housing loan demand was driven mainly by the low general level of interest rates and, to a lesser extent, improved housing market prospects (see Chart 8 and Table 8). By contrast, lower consumer confidence continued to dampen loan demand.

Across the largest euro area countries, banks in Germany and France reported a net increase in housing loan demand, while banks in Spain reported a net decline, and demand remained unchanged in Italy. The general level of interest rates contributed positively to loan demand in all countries. The impact of housing market prospects was positive in Germany and France, while it was negative in Spain and neutral in Italy. Lower consumer confidence had a negative impact on demand in all four countries, but its contribution was relatively small in France. Other financing needs contributed positively to loan demand in Spain and negatively in France.

In the first quarter of 2021, banks expect a small net decline in demand for housing loans (net percentage of -3%).

Chart 8

Changes in demand for loans to households for house purchase, and contributing factors

(net percentages of banks reporting an increase in demand and contributing factors)

Notes: See the notes to Chart 4. “Other financing needs” is the unweighted average of “debt refinancing/restructuring and renegotiation” and “regulatory and fiscal regime of housing markets”; “use of alternative finance” is the unweighted average of “internal finance of house purchase out of savings/down payment”, “loans from other banks” and “other sources of external finance”.

Table 8

Factors contributing to changes in demand for loans to households for house purchase

(net percentages of banks)

Note: See the notes to Chart 8.

2.3 Consumer credit and other lending to households

2.3.1 Credit standards for consumer credit and other lending to households tightened

In the fourth quarter of 2020, credit standards for consumer credit and other lending to households continued to tighten moderately (3%, after 9% in the previous quarter; see Chart 9 and Overview table). The net tightening was smaller than in the previous quarters of 2020 and below the historical average (5%).

Higher risk perceptions related to the economic outlook and creditworthiness of households affected by the coronavirus pandemic continued to be the main factor contributing to the net tightening of credit standards on consumer credit (see Chart 9 and Table 9). Banks’ cost of funds and balance sheet situation had a broadly neutral impact on credit standards for consumer credit and other lending to households. Finally, banks’ risk tolerance had a neutral impact following a net tightening contribution in the previous quarters of 2020.

Across the largest euro area countries, credit standards for consumer credit and other lending to households tightened in Spain and, to a lesser extent, in France, while they remained unchanged in Germany and eased in Italy. The net tightening in Spain was related to higher risk perceptions, while banks’ increased risk tolerance had a net easing impact in Germany and Italy.

Looking ahead to the first quarter of 2021, euro area banks expect a continued net tightening of credit standards on consumer credit and other lending to households (5%).

Chart 9

Changes in credit standards applied to the approval of consumer credit and other lending to households, and contributing factors

(net percentages of banks reporting a tightening of credit standards and contributing factors)

Notes: See the notes to Chart 1. “Risk perceptions” is the unweighted average of “general economic situation and outlook”, “creditworthiness of consumers” and “risk on the collateral demanded”; “competition” is the unweighted average of “competition from other banks” and “competition from non-banks”. The net percentages for “other factors” refer to further factors which were mentioned by banks as having contributed to changes in credit standards.

Table 9

Factors contributing to changes in credit standards for consumer credit and other lending to households

(net percentages of banks)

Note: See the notes to Chart 9.

2.3.2 Terms and conditions on consumer credit and other lending to households remained broadly unchanged

In the fourth quarter of 2020, banks’ overall terms and conditions applied when granting new consumer credit and other lending to households remained broadly unchanged (net percentage of 1%, after 1% in the previous quarter). The broadly unchanged terms and conditions were supported by narrower margins on average loans, while other factors, mainly related to the coronavirus pandemic, contributed to a net tightening (see Chart 10 and Table 10).

Chart 10

Changes in terms and conditions on consumer credit and other lending to households

(net percentages of banks reporting a tightening of terms and conditions)

Notes: “Margins” are defined as the spread over a relevant market reference rate. “Other terms and conditions” is the unweighted average of “size of the loan”, “non-interest rate charges” and “maturity”. The net percentages for “other factors” refer to further factors which were mentioned by banks as having contributed to changes in terms and conditions.

Table 10

Changes in terms and conditions on consumer credit and other lending to households

(net percentages of banks)

Note: See the notes to Chart 10.

Increased risk perceptions and lower risk tolerance continued to contribute moderately to a net tightening of overall terms and conditions, while pressure from competition had an easing impact. Banks’ cost of funds and balance sheet constraints had a broadly neutral impact (see Table 11).

Across the largest euro area countries, overall terms and conditions on consumer credit and other lending to households continued to tighten in Spain, while they eased in France and remained unchanged in Germany and Italy. The continued tightening in Spain was mainly due to wider loan margins, while loan margins narrowed in Germany. Margins on average loans also narrowed in France.

Table 11

Factors contributing to changes in overall terms and conditions on consumer credit and other lending to households

(net percentages of banks)

Note: The net percentages for these questions relating to contributing factors are defined as the difference between the percentage of banks reporting that the given factor contributed to a tightening and the percentage reporting that it contributed to an easing.

2.3.3 Rejection rate for consumer credit and other lending to households increased

In the fourth quarter of 2020, banks indicated a net increase in the share of rejected loan applications for consumer credit and other lending to households (net percentage of 4%, after 16% in the previous survey round; see Chart 11). The net increase was considerably smaller than in the previous quarter and similar to levels in 2019.

Across the largest euro area countries, the rejection rate increased in Spain and France, while it decreased in Germany and remained unchanged Italy.

Chart 11

Changes in the rejection rate for consumer credit and other lending to households

(net percentages of banks reporting an increase in the share of rejections)

Notes: Net percentages of rejected loan applications are defined as the difference between the percentage of banks reporting an increase in the share of loan rejections and the percentage of banks reporting a decline. Banks’ responses refer to the share of rejected loan applications relative to the total volume of applications in that loan category.

2.3.4 Net demand for consumer credit and other lending to households declined

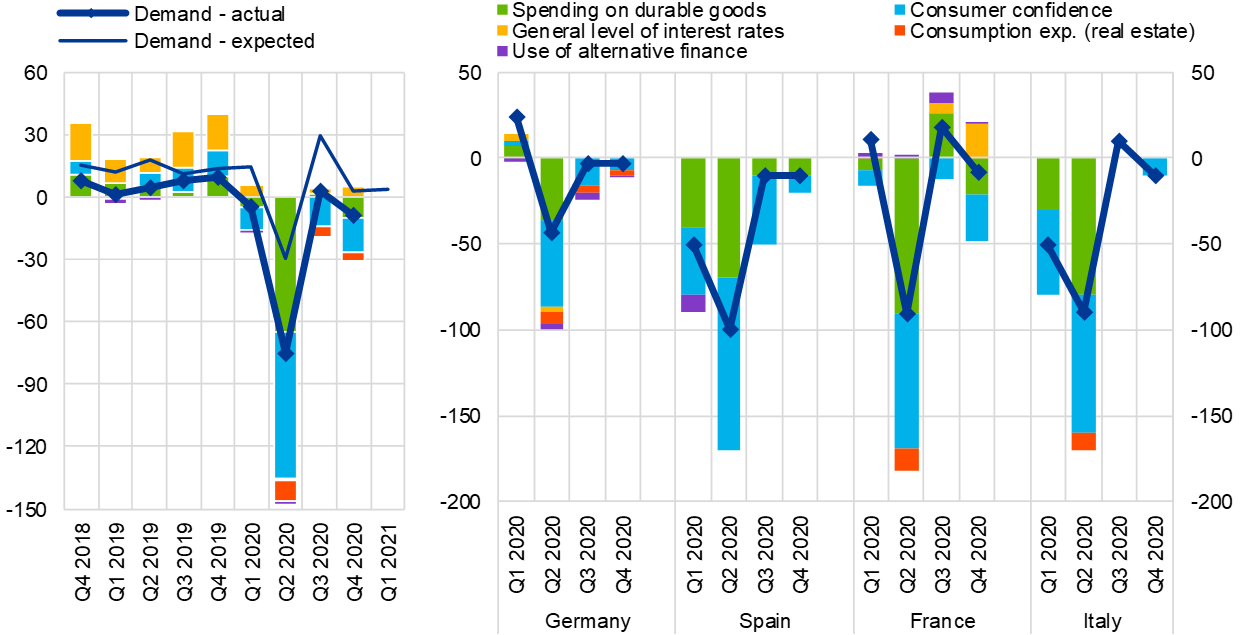

In the fourth quarter of 2020, banks reported a net decline in demand for consumer credit and other lending to households (net percentage of banks standing at -9%, after a net increase of 3% in the previous quarter; see Chart 12 and Overview table). The net decline indicates that demand for consumer credit remains subdued due to the coronavirus pandemic after only a moderate recovery in the previous quarter, which followed the record decline in demand in the second quarter of 2020. Net demand for consumer credit is again below the historical average since 2003 (1%). In line with the recent data on realised monthly consumer credit flows, the results for the fourth quarter of 2020 highlight the sensitivity of consumer credit to the stringency of coronavirus-related restrictions.

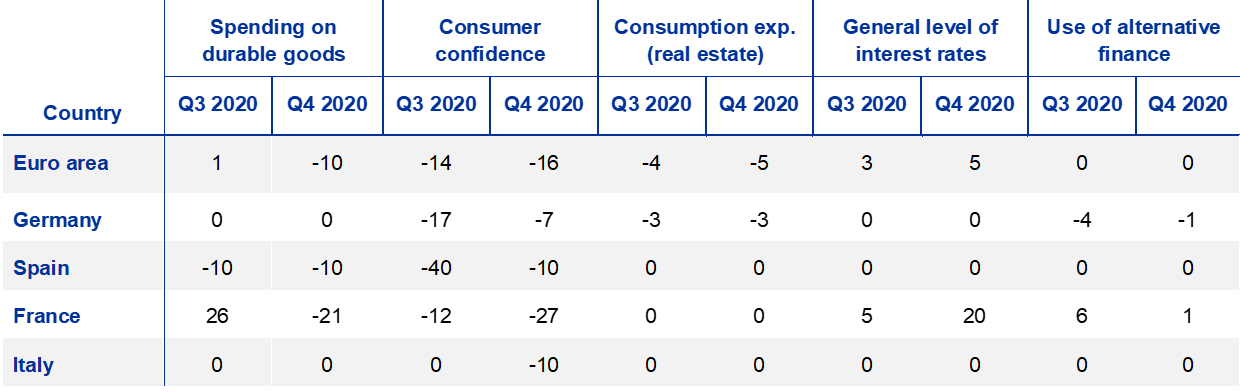

Banks reported lower consumer confidence and decreased spending on durable goods as the main factors contributing to the decline. This likely reflects increased precautionary savings and reduced spending possibilities for households in the context of renewed coronavirus-related restrictions in recent months (see Chart 12 and Table 12). The general level of interest rates continued to contribute to an increase in demand, while consumption expenditures financed through real estate guaranteed loans contributed to lower demand.

Chart 12

Changes in demand for consumer credit and other lending to households, and contributing factors

(net percentages of banks reporting an increase in demand and contributing factors)

Notes: See the notes to Chart 4. “Use of alternative finance” is the unweighted average of “internal financing out of savings”, “loans from other banks” and “other sources of external finance”. “Consumption exp. (real estate)” denotes “consumption expenditure financed through real estate-guaranteed loans”.

Table 12

Factors contributing to changes in demand for consumer credit and other lending to households

(net percentages of banks)

Note: See the notes to Chart 12.

Across the largest euro area countries, banks reported a net decline in demand for consumer credit. Lower consumer confidence contributed to the net decline in demand in all countries, while decreased spending on durable goods had a negative impact in Spain and France. In addition, the low general level of interest rates contributed to an increase in demand in France.

In the first quarter of 2021, banks expect a net increase in demand for consumer credit and other lending to households (net percentage of 4%).

3 Ad hoc questions

3.1 Banks’ access to retail and wholesale funding

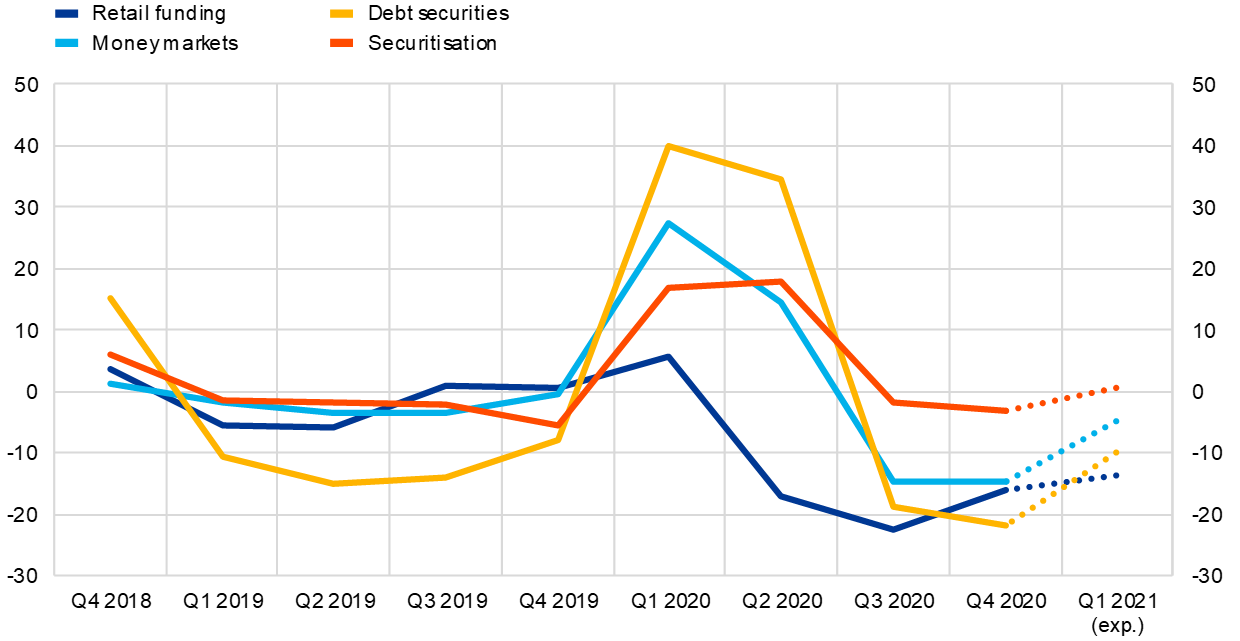

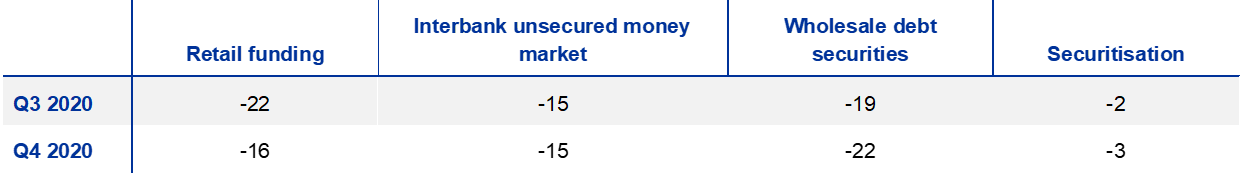

The January 2021 survey included a question assessing the extent to which the situation in financial markets had affected banks’ access to retail and wholesale funding. Banks were asked whether their access to funding had deteriorated or eased over the past three months, as well as about their expectations for the next three months. Here, negative net percentages indicate an improvement, while positive figures indicate a deterioration in net terms.

In the fourth quarter of 2020, banks reported in net terms that their access to retail and wholesale funding continued to improve (see Chart 13 and Table 13). Banks continued to report an improvement in access to funding via short-term and long-term debt securities and to money markets, while access to securitisation improved only slightly.[6] This shows that tightened coronavirus-related restrictions did not have a significant impact on the risk sentiment in bank bond and money markets, reflecting also a favourable impact of the December 2020 monetary policy decisions. Regarding retail funding, access continued to improve for both short-term and long-term funding, albeit to a lesser extent than in the previous round. The improvement was driven by short-term deposit funding, suggesting a continued increase in overnight deposits. Recent data on monthly flows show that the inflow was driven by households’ overnight deposits, while firms’ deposit inflows continued to moderate.

Chart 13

Banks’ assessment of funding conditions and the ability to transfer credit risk off the balance sheet

(net percentages of banks reporting a deterioration in market access)

Note: The net percentages are defined as the difference between the sum of the percentages for “deteriorated considerably” and “deteriorated somewhat” and the sum of the percentages for “eased somewhat” and “eased considerably”.

Looking ahead to the first quarter of 2021, euro area banks expect that their access to retail and wholesale funding, except securitisation, will continue to improve, but to a lesser degree than in the fourth quarter of 2020.

Table 13

Banks’ assessment of funding conditions and the ability to transfer credit risk off the balance sheet

(net percentages of banks reporting a deterioration in market access)

Note: See the notes to Chart 13.

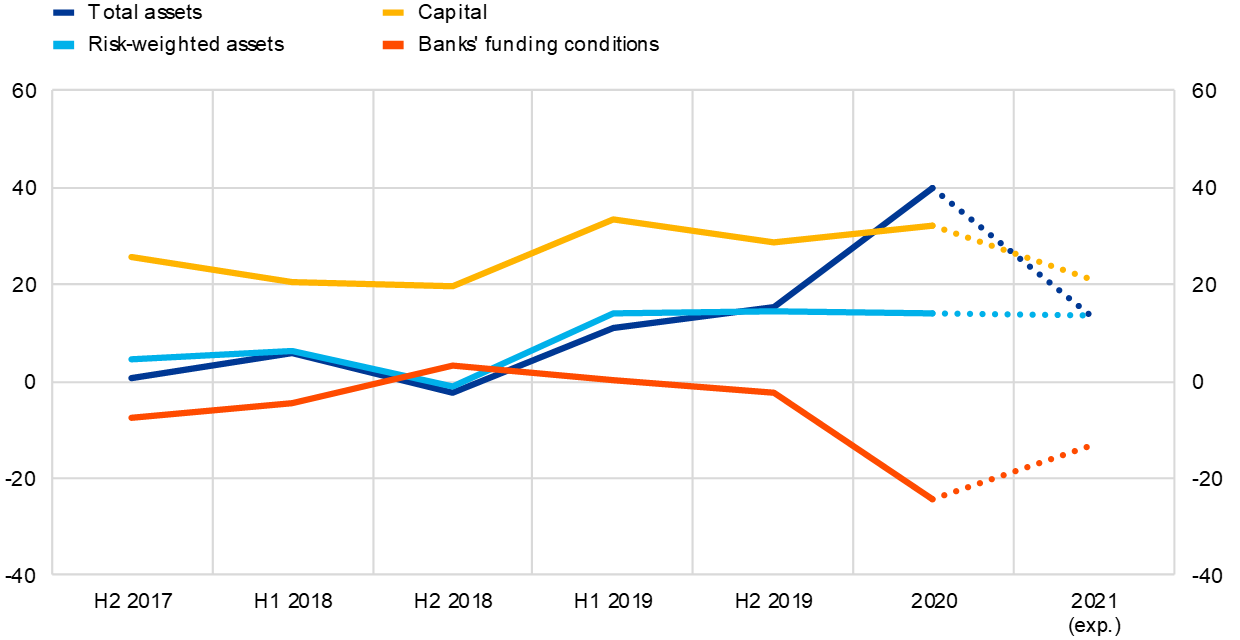

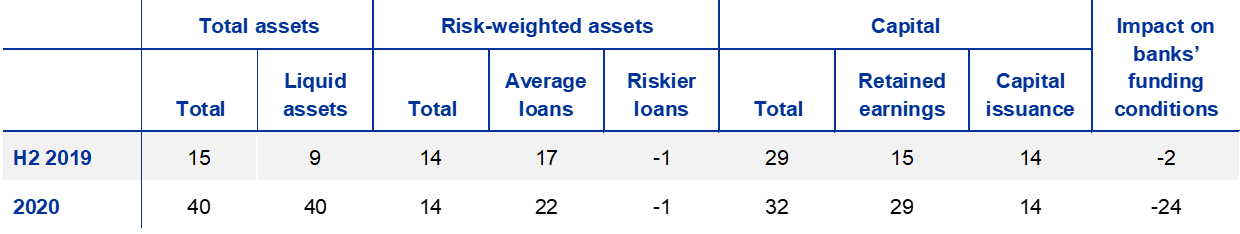

3.2 Banks’ adjustment to regulatory and supervisory actions

The January 2021 BLS questionnaire included an annual[7] ad hoc question to assess the extent to which new regulatory or supervisory requirements had affected banks’ lending policies via the potential impact on their capital, leverage, liquidity position or provisioning and the credit conditions that they apply to loans. These new requirements cover regulatory or supervisory actions that have recently been implemented or that are expected to be implemented in the near future. Furthermore, banks were also asked to indicate the effects on their funding conditions.

Euro area banks reported a continued strengthening of their capital position in response to new regulatory or supervisory requirements in 2020 (see Chart 14 and Table 14), with that strengthening being driven more by retained earnings than by capital issuance. In addition, banks indicated that regulatory or supervisory relief measures implemented in the context of the coronavirus pandemic had led to a significant increase in banks’ total assets, driven largely by liquid assets. Banks also reported that risk-weighted assets had continued to increase, mainly owing to an increase in average loans, while the contribution of riskier loans remained broadly unchanged. At the same time, banks indicated that regulatory or supervisory action had had a strong easing impact on their funding conditions.

Chart 14

Impact of regulatory or supervisory action on banks’ risk-weighted assets, capital and funding conditions

(net percentages of banks)

Notes: For “total assets”, “risk-weighted assets” and “capital”, the net percentages are defined as the difference between the sum of the percentages for “increased considerably” and “increased somewhat” and the sum of the percentages for “decreased somewhat” and “decreased considerably”. For “banks’ funding conditions”, the net percentages are defined as the difference between the sum of the percentages for “experienced a considerable tightening” and “experienced a moderate tightening” and the sum of the percentages for “experienced a moderate easing” and “experienced a considerable easing”.

Table 14

Impact of regulatory or supervisory action on banks’ risk-weighted assets, capital and funding conditions

(net percentages)

Note: See the notes to Chart 14.

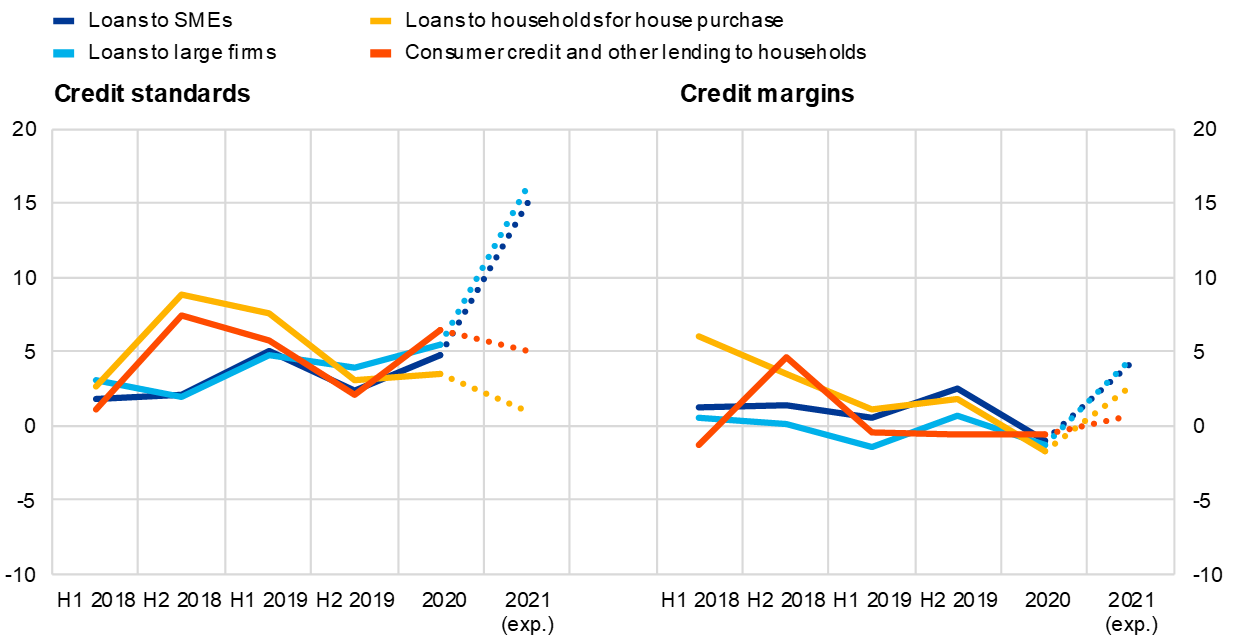

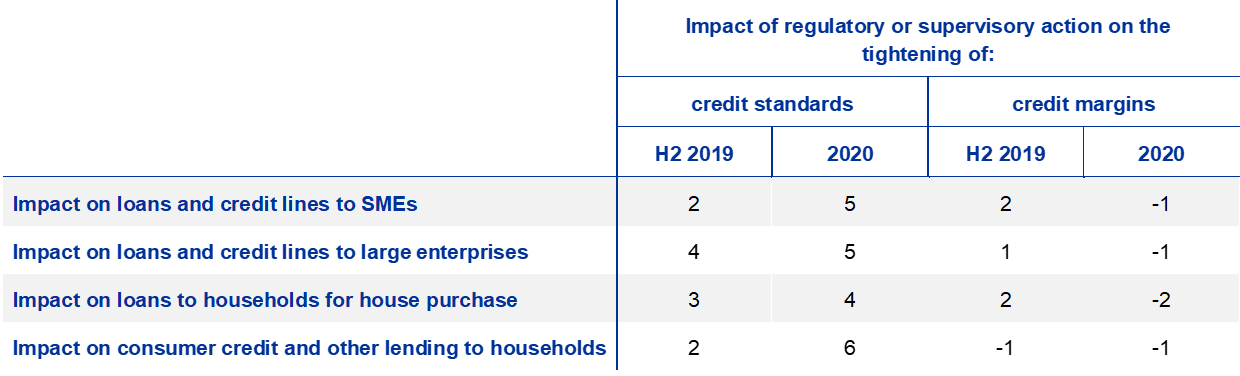

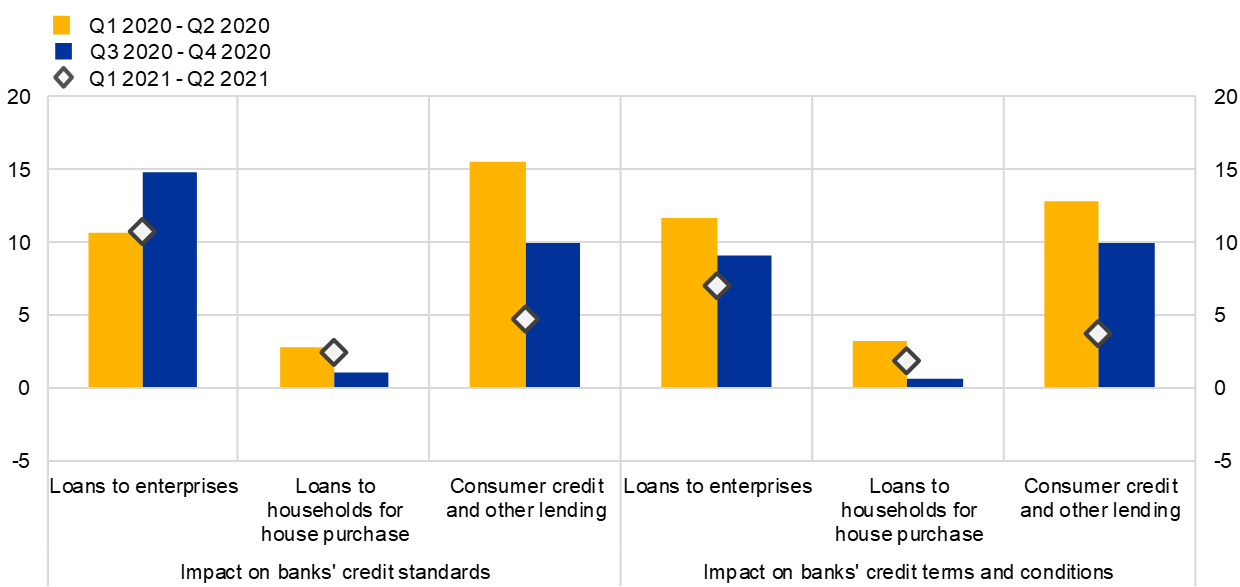

Supervisory or regulatory action continued to have a net tightening impact on banks’ credit standards across all loan categories in 2020, and the reported impact was somewhat stronger than it had been in the second half of 2019 (see Chart 15 and Table 15). This was not the case for credit margins, for which the impact was broadly neutral apart from a slight easing for loans to households for house purchase.

Looking ahead to 2021, euro area banks expect that regulatory or supervisory action will support their capital positions and will lead to an increase in their total assets, although to smaller extent than in 2020. For their funding conditions, banks expect another net easing impact. In addition, they also expect regulatory or supervisory action to have a stronger tightening impact on credit standards for loans to enterprises and a smaller tightening impact on credit standards for consumer credit. Finally, banks expect that regulatory or supervisory action will have a widening impact on credit margins across all loan categories, except consumer credit.

Chart 15

Contribution of regulatory or supervisory action to the tightening of banks’ credit standards and margins

(net percentages of banks)

Notes: The net percentages are defined as the difference between the sum of the percentages for “tightened considerably” and “tightened somewhat” and the sum of the percentages for “eased somewhat” and “eased considerably”.

Table 15

Contribution of regulatory or supervisory action to the tightening of banks’ credit standards and margins

(net percentages)

Note: See the notes to Chart 15.

3.3 The impact of banks’ NPL ratios on their lending policies

The January 2021 survey included a biannual ad hoc question about the impact that banks’ NPL ratios have on their lending policies and the factors through which NPL ratios contribute to changes in lending policies. Banks were asked about the impact on loans to enterprises, loans to households for house purchase, and consumer credit and other lending to households over the past six months and over the next six months.

Euro area banks indicated a net tightening impact of their NPL ratios on credit standards for loans to enterprises and consumer credit (net percentages of 15% and 10%, respectively), and a broadly neutral impact for credit standards on housing loans in the second half of 2020 (see Chart 16), following a net tightening impact across all loan categories in the first half of 2020. Similarly, banks indicated a net tightening impact of NPL ratios on terms and conditions for loans to firms and consumer credit (net percentages of 9% and 10%, respectively), and a broadly neutral impact for terms and conditions on housing loans over the past six months. The reported tightening impact of banks’ NPL ratios on banks’ lending conditions across all loan categories in the second half of 2020 was smaller than expected by banks in the July 2020 BLS.

Chart 16

Impact of banks’ NPL ratios on credit standards and terms and conditions

(net percentages of banks)

Notes: The NPL ratio is defined as the stock of gross NPLs on a bank’s balance sheet as a percentage of the gross carrying amount of loans. Changes in credit standards and/or terms and conditions can be caused by changes to the NPL ratio or by changes to regulations or the bank’s assessment of the level of the NPL ratio. Net percentages are defined as the difference between the sum of the percentages for “contributed considerably to tightening” and “contributed somewhat to tightening” and the sum of the percentages for “contributed somewhat to easing” and “contributed considerably to easing”. The diamonds denote expectations indicated by banks in the current round.

Chart 17

Contributions of factors through which NPL ratios affect banks’ policies on lending to enterprises and households

(net percentages of banks)

Note: See the notes to Chart 16.

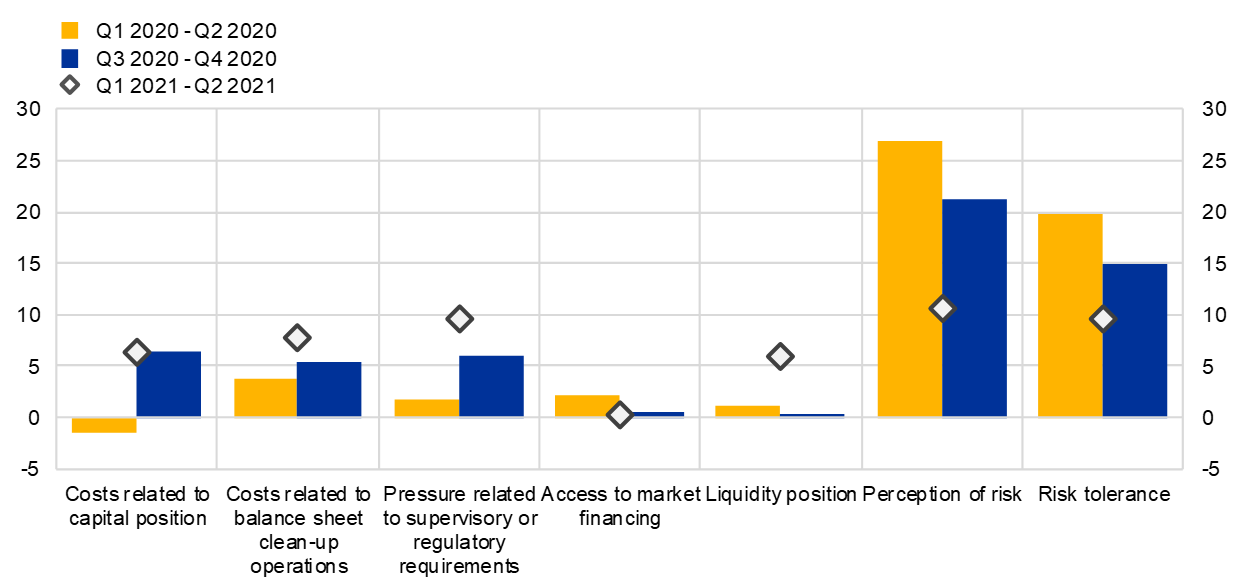

Euro area banks continued to refer mainly to a tightening impact of their NPL ratios on bank lending conditions via higher risk perceptions (net percentage of 21%) related to the general economic outlook and borrowers’ creditworthiness and via a lower risk tolerance (15%) in the second half of 2020 (see Chart 17). Other factors, such as costs related to capital position, balance sheet clean-up operations and pressure related to supervisory or regulatory requirements, also contributed to the tightening of bank lending conditions via NPL ratios. Banks’ liquidity position and access to market financing had a broadly neutral impact on lending conditions via NPL ratios.

Over the next six months, euro area banks expect their NPL ratios to have a somewhat weaker net tightening impact on credit standards and on terms and conditions for loans to enterprises and consumer credit, but they expect a slightly stronger tightening impact for housing loans. Banks expect that heightened risk perceptions, lower risk tolerance, increased pressure related to supervisory or regulatory requirements, higher costs related to balance sheet clean-up and capital position as well as deteriorated liquidity position are going to contribute to the tightening of lending conditions via NPL ratios over the next six months.

3.4 Bank lending conditions and loan demand across main sectors of economic activities

The January 2021 survey questionnaire included a biannual ad hoc question aimed at collecting information on changes in banks’ credit standards, overall terms and conditions and loan demand across main economic sectors over the past and next six months. Banks were asked to collect information covering the following sectors: manufacturing, construction (excluding real estate), services (excluding financial services and real estate), wholesale and retail trade, and real estate (including both real estate construction and real estate services) broken down into commercial and residential real estate.

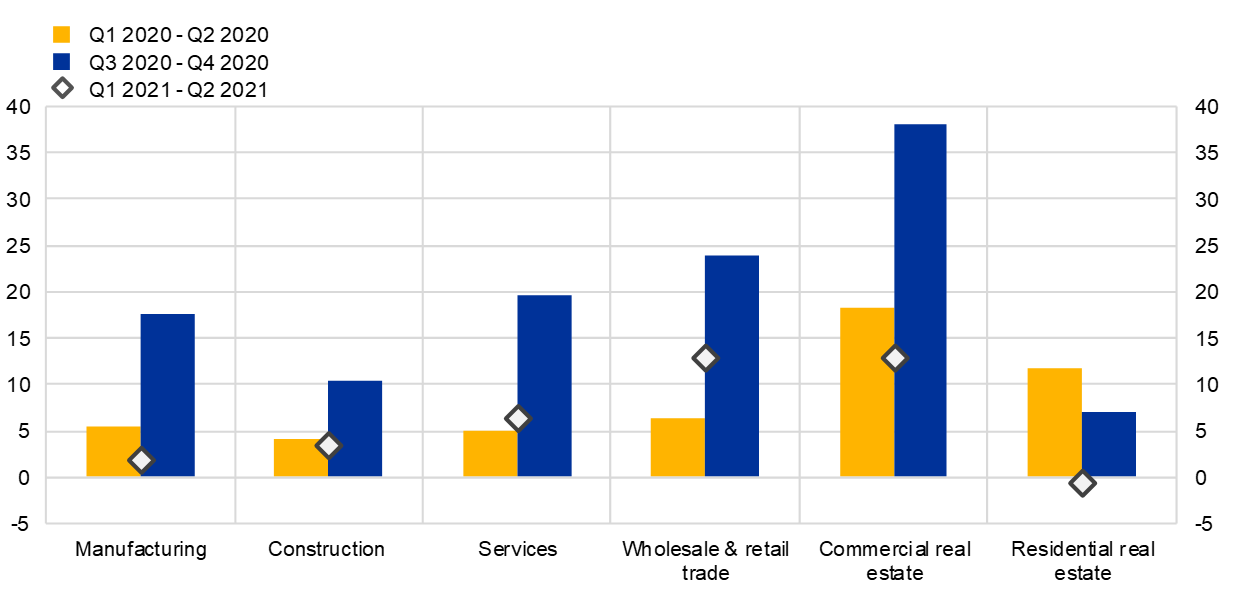

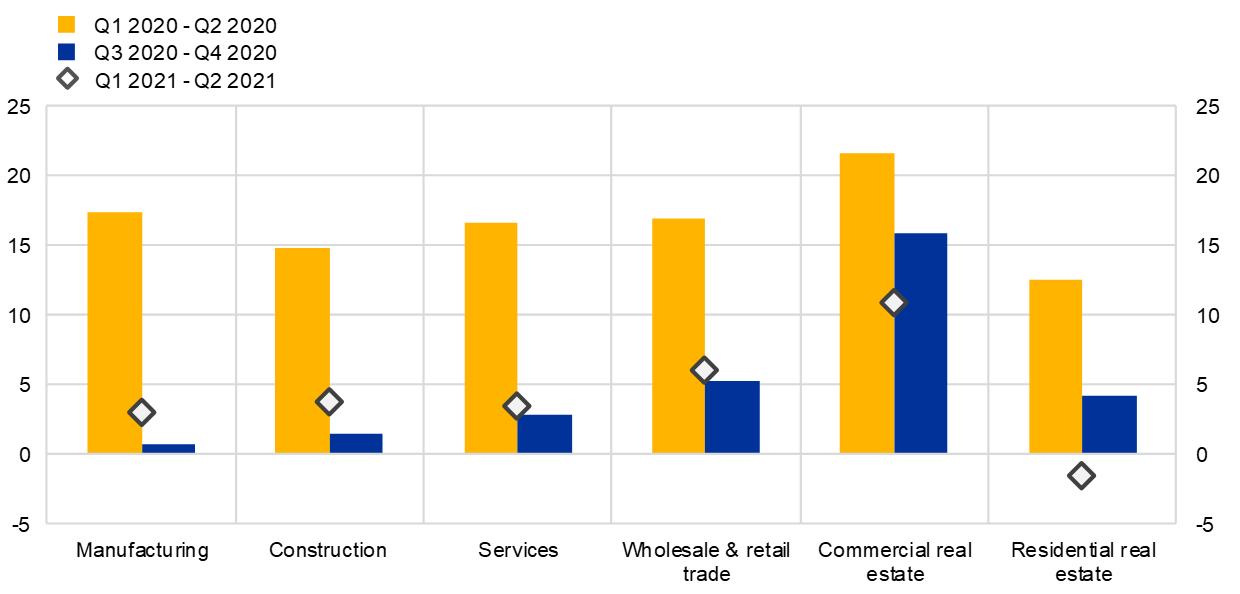

Euro area banks indicated a net tightening of credit standards and a small net tightening of terms and conditions for new loans to enterprises across all main economic sectors over the past six months (see Charts 18 and 19). The net tightening of credit standards was most pronounced for loans to firms in the real estate sector (net percentage of 30%), mainly driven by commercial real estate, while the tightening in the residential real estate sector was relatively contained. Among the other sectors, the net tightening was lowest for loans to firms in the construction sector (11%). Banks’ overall terms and conditions tightened most strongly for new loans to firms in the real estate sector (14%), which was also driven by commercial real estate.

Over the next six months, euro area banks expect a lower net tightening of credit standards and continued net tightening of overall terms and conditions for new loans to enterprises across all main economic sectors.

Chart 18

Changes in credit standards for new loans to enterprises across main economic sectors

(net percentage of banks; over the past and next six months)

Notes: The net percentage refers to the difference between the sum of the percentages for “deteriorated considerably” and “deteriorated somewhat” and the sum of the percentages for “eased somewhat” and “eased considerably". The diamonds denote expectations indicated by banks in the current round.

Chart 19

Changes in terms and conditions for new loans to enterprises across main economic sectors

(net percentage of banks; over the past and next six months)

Note: See the notes to Chart 18.

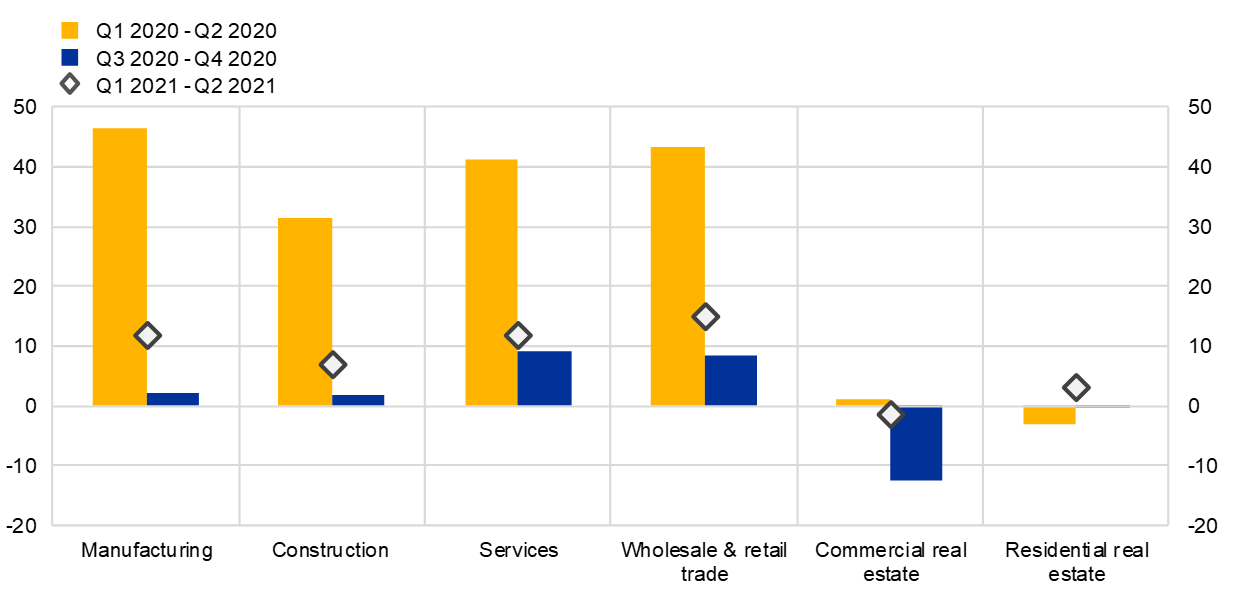

Firms’ net demand for loans or credit lines increased in almost all economic sectors, except real estate, where banks reported a net decline in demand in the second half of 2020 (see Chart 20). The net increase in demand was stronger for firms in the services and the wholesale and retail trade sectors, while demand increased only slightly in the manufacturing and construction sectors. The net decline in demand from firms in the real estate sector was driven by firms in the commercial real estate sector, as demand from firms in the residential real estate sector remained unchanged. The decline in demand also partly reflects a more pronounced tightening of credit standards and terms and conditions by banks over the past six months.

Over the next six months, euro area banks expect that firms’ loan demand will increase in almost all economic sectors, except the real estate sector, where banks expect demand to remain broadly unchanged.

Chart 20

Changes in demand for loans or credit lines to enterprises across main economic sectors

(net percentages of banks)

Notes: The net percentage refers to the difference between the sum of the percentages for “increased considerably” and “increased somewhat” and the sum of the percentages for “decreased somewhat” and “decreased considerably". The diamonds denote expectations indicated by banks in the current round.

3.5 The impact of government loan guarantees related to the coronavirus pandemic

The January 2021 survey questionnaire included a new biannual ad hoc question aimed at collecting information on changes in banks’ lending conditions and demand for loans with COVID-19-related government guarantees and for loans without government guarantees over the first half of 2020, the past six months and the next six months. In addition, the question asked about the factors affecting demand for loans with COVID-19-related government guarantees.

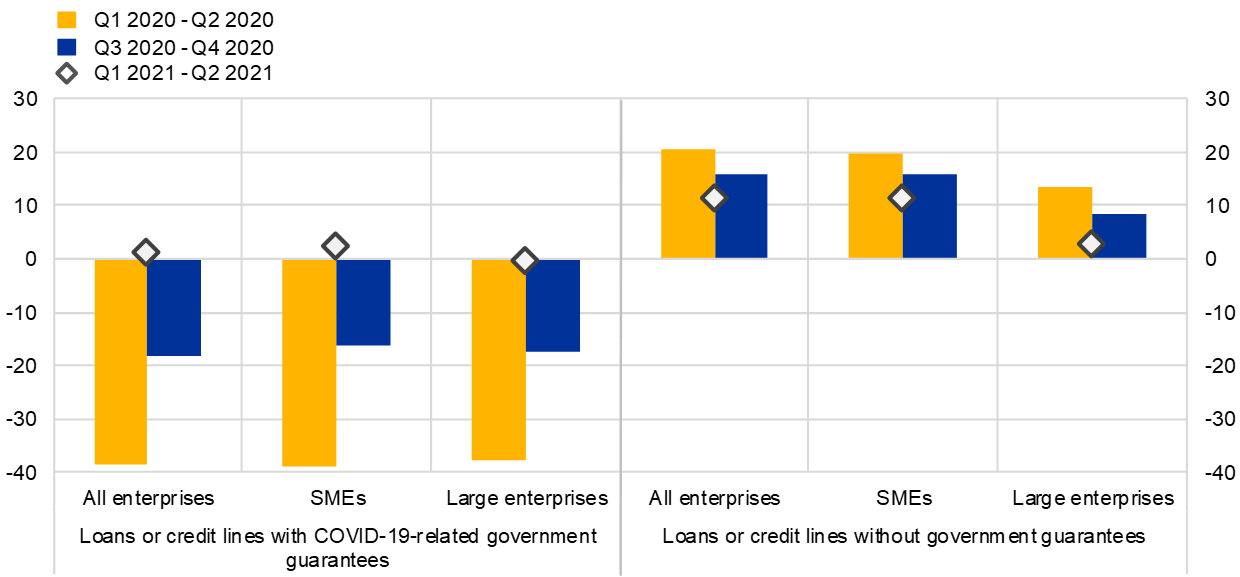

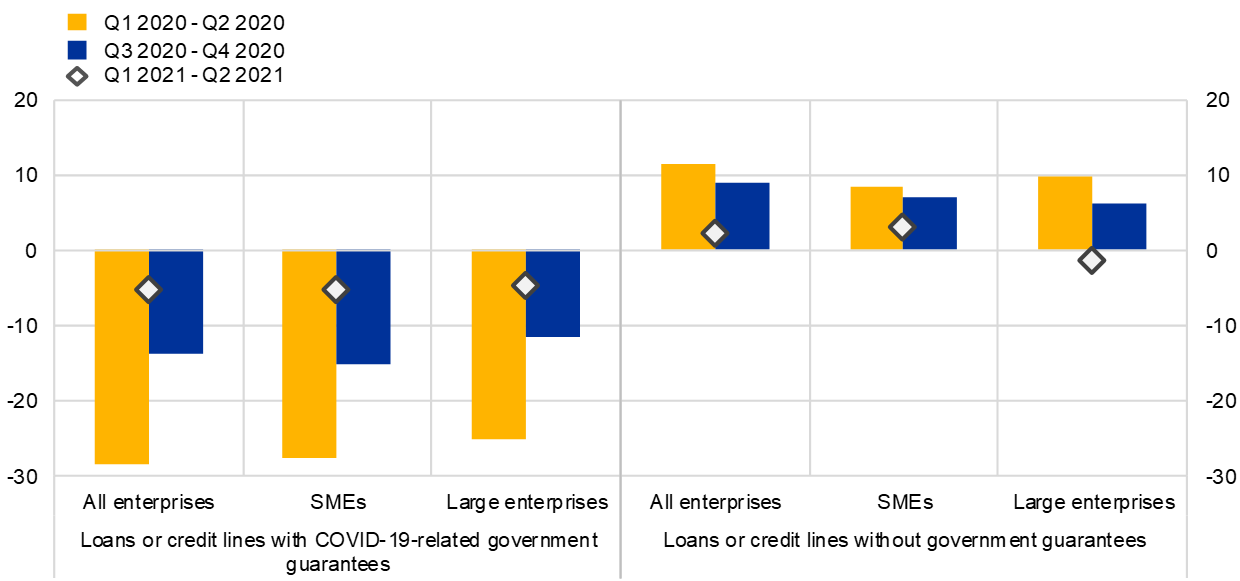

Euro area banks reported that COVID-19-related government guarantees were important in supporting banks’ credit standards for loans to firms in 2020 (see Chart 21). Credit standards for loans to firms with COVID-19-related government guarantees continued to ease over the past six months, after a strong easing when the measures were introduced (net percentage of -18%, after -38% in the first half of 2020). The easing impact was almost identical for loans to SMEs and to large enterprises. Euro area banks expect any further impact of government guarantees on their credit standards to be limited: they expect credit standards to tighten for SMEs (3%) and to remain unchanged for large enterprises in the first half of 2021. By contrast, credit standards for loans to enterprises without government guarantees tightened in 2020 (net percentage of 16% over the past six months, after 20% in the first half of 2020). The tightening was stronger for loans to SMEs than to large enterprises throughout 2020, likely reflecting a larger credit risk of SMEs. Banks expect that credit standards will continue to tighten for these loans in the next six months (11%), with the tightening being stronger for loans to SMEs (11%) than for large enterprises (3%).

Chart 21

Changes in credit standards for loans to enterprises with and without COVID-19-related government guarantees

(net percentages of banks)

Notes: The net percentage refers to the difference between the sum of the percentages for “tightened considerably” and “tightened somewhat” and the sum of the percentages for “eased somewhat” and “eased considerably". The diamonds denote expectations indicated by banks in the current round.

Chart 22

Changes in terms and conditions for loans to enterprises with and without COVID-19-related government guarantees

(net percentages of banks)

Notes: The net percentage refers to the difference between the sum of the percentages for “tightened considerably” and “tightened somewhat” and the sum of the percentages for “eased somewhat” and “eased considerably". The diamonds denote expectations indicated by banks in the current round.

Banks’ terms and conditions eased for loans to firms with COVID-19-related government guarantees (net percentage of -14%, after -28% in the first half of 2020), while they tightened for loans without guarantees in 2020 (9%, after 11% in the first half of 2020; see Chart 22). The net easing on loans with guarantees was stronger in the first half of the year than in the second half. The corresponding easing and tightening of banks’ terms and conditions was similar for loans to SMEs and to large enterprises. Over the next six months, banks expect their terms and conditions to continue to ease for loans with guarantees (-5%), while for loans without guarantees banks expect a slight tightening (2%).

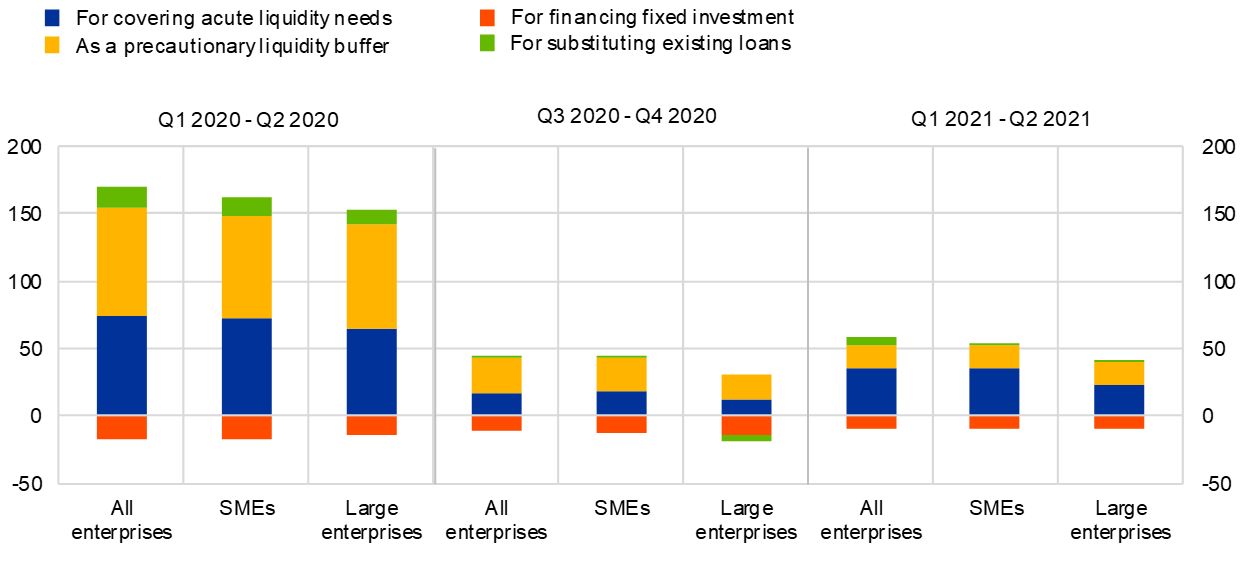

Banks reported a very strong increase in demand for loans or credit lines with COVID-19-related government guarantees in the first half of 2020, while the increase in the second half was moderate (net percentage of banks reporting an increase in loan demand of 4%, after 83% in the first half of 2020; see Chart 23). The increase in demand for loans or credit lines with guarantees was strong among both SMEs and large enterprises at the onset of the pandemic (84% and 74%, respectively, in the first half of 2020). However, over the past six months net demand from large firms declined (-4%), while it continued to moderately increase for SMEs (6%). Euro area banks expect a further increase in demand for loans with guarantees over the next six months, largely driven by SMEs. Banks also indicated that demand from firms (both SMEs and large enterprises) for loans or credit lines without government guarantees declined in 2020 (net percentage of -6% in the second half of 2020, after -18% in the first half of 2020). Over the next six months, banks expect an increase in demand for loans without government guarantees.

Chart 23

Changes in demand for loans to enterprises with and without COVID-19-related government guarantees

(net percentages of banks)

Notes: The net percentage refers to the difference between the sum of the percentages for “increased considerably” and “increased somewhat” and the sum of the percentages for “decreased somewhat” and “decreased considerably". The diamonds denote expectations indicated by banks in the current round.

Banks reported that the very strong demand for loans or credit lines with COVID-19-related government guarantees was largely driven by firms’ need to build a precautionary liquidity buffer and to cover acute liquidity needs in the first half of 2020 (see Chart 24). Banks also reported that substitution of existing loans had a positive impact, while the need to finance fixed investment contributed negatively to firms’ loan demand in the first half of 2020. Over the past six months, banks continued to indicate that the need to build precautionary liquidity buffers and to cover acute liquidity needs were the most relevant factors for firms’ loan demand, although to a much smaller extent than in the first half of 2020. Banks expect that firms’ demand for loans or credit lines will also be driven by acute liquidity needs in the next six months, in the context of renewed coronavirus-related restrictions.

Chart 24

Factors affecting the demand for loans or credit lines with COVID-19-related government guarantees

(net percentages of banks)

Notes: The net percentage refers to the difference between the sum of the percentages for “increased considerably” and “increased somewhat” and the sum of the percentages for “decreased somewhat” and “decreased considerably". Banks can select more than one factor that affects loan demand. Therefore, the sum of the net percentages can exceed 100 in this chart. The last period denotes expectations indicated by banks in the current round.

Annexes

See more.

© European Central Bank, 2021

Postal address 60640 Frankfurt am Main, Germany

Telephone +49 69 1344 0

Website www.ecb.europa.eu

All rights reserved. Reproduction for educational and non-commercial purposes is permitted, provided that the source is acknowledged.

For specific terminology please refer to the ECB glossary.

PDF ISSN 1830-5989, QB-BA-21-001-EN-N

HTML ISSN 1830-5989, QB-BA-21-001-EN-Q

- The four largest euro area countries in terms of GDP are Germany, France, Italy and Spain.

- For more detailed information on the bank lending survey, see the article entitled “A bank lending survey for the euro area”, Monthly Bulletin, ECB, April 2003; Köhler-Ulbrich, P., Hempell, H. and Scopel, S., “The euro area bank lending survey”, Occasional Paper Series, No 179, ECB, 2016; and Burlon, L., Dimou, M., Drahonsky, A. and Köhler-Ulbrich, P., “What does the bank lending survey tell us about credit conditions for euro area firms?”, Economic Bulletin, Issue 8, ECB, December 2019.

- In this case, the selected sample banks are generally of similar size or their lending behaviour is typical of a larger group of banks.

- The non-harmonised historical data differ from the harmonised data mainly as a result of heterogeneous treatment of “NA” (Not Applicable) replies and specialised banks across questions and countries. Non-harmonised historical BLS data are published for discontinued BLS questions and ad hoc questions.

- The calculation of a simple average when combining factors in broader categories assumes that all factors have the same importance for banks. This helps to explain some inconsistencies between developments in demand for loans and developments in the main underlying factor categories.

- For the results on securitisation, a large number of banks replied “Not Applicable” as this source of funding is not relevant for them (between 46% and 59%, depending on the type of securitisation, in the fourth quarter of 2020).

- Until the January 2020 BLS, this question referred to the changes over the past/next six months. As of the January 2021 BLS, it refers to the changes over the past/next 12 months.

- 19 January 2021