How persistent supply chain disruptions could affect euro area potential output

Published as part of the ECB Economic Bulletin, Issue 1/2022.

This box investigates potential long-term effects that current supply shortages could have on euro area potential output growth. Although initially assumed to be short-lived and confined to a few products (e.g. microprocessors) or countries (e.g. those that are manufacturing intensive), the supply shortages have been building up over time. Depending on the persistence of global value chain disruptions, firms might consider finding new suppliers, transport routes, locations of production and more broadly new supply chains. If this happens, sectors that have greatly benefited from international exposure and globalisation in terms of productivity growth might experience a decline in trend total factor productivity. All else being equal, this could lead to a trend decline in potential output growth for the most affected countries.

Neither economic theory nor empirical evidence provide clear-cut conclusions on the long-term effects supply shortages may have on businesses restructuring their supply chain. On the one hand, companies would only be prepared to bear the high cost of setting up new global supply chains if they were to consider supply shortages to be sufficiently long-lasting as to justify the expenditure. So far, when looking at survey data, business leaders have not anticipated much long-term change in their supply chains. However, recent developments in value chains may force them to reconsider their views on this.[1] On the other hand, a substantial change in the geography of supply chains may happen because persistent supply chain disruptions are inevitably very costly for firms. The challenges presented by this reorganisation process could be exacerbated if the pandemic encourages an increase in protectionism and de-globalisation. Reorganising company supply chains is ultimately a question of arbitrage between reshoring expenses and the cost of persistent supply disruptions – both of these can be very high and difficult for firms to anticipate.[2]

As the euro area is tightly integrated into global value chains, current disruptions and possible supply reorganisations are highly important for euro area economies. Euro area countries remain extensively involved in cross-border production chains and their participation in global value chains is relatively high compared with most other economies, including those of China and the United States.[3] Different degrees of participation and positions in the value chain imply heterogenous effects of the coronavirus (COVID-19) pandemic across euro area countries. Larger euro area economies tend to be more upstream in the global production chain than smaller euro area countries. In upstream economies, the impact of global value chains on total factor productivity and potential output depends on efficiency gains achieved by dividing tasks according to comparative advantage. Conversely, smaller euro area countries – notably some eastern European countries – are, for instance, generally more downstream and rely heavily on global value chains for technology adoption and total factor productivity growth. It is also worth noting that euro area global value chains are typically regional, which makes them somewhat less sensitive to extra-European shocks.[4]

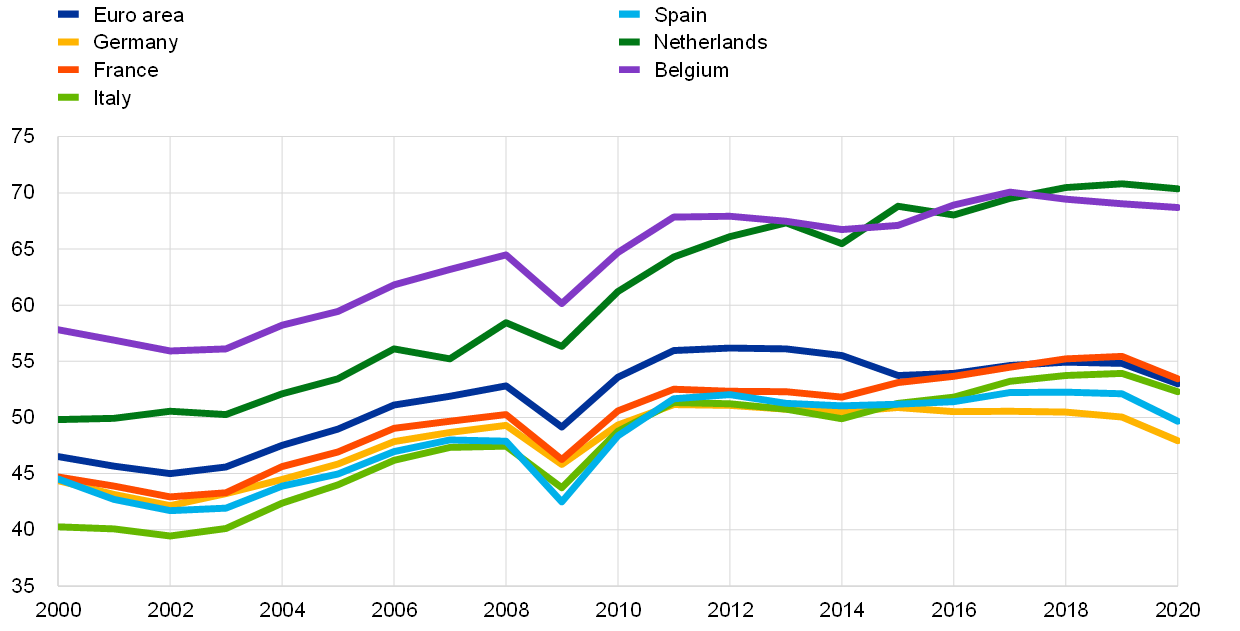

It is important to consider whether present shortages are likely to constitute a structural shift in global value chains. Participation rose sharply in the early 2000s before falling temporarily in 2009. It then returned to its pre-crisis level the following year. In recent years, global value chain participation has flattened out (Chart A). Since the start of the coronavirus pandemic, there has been some evidence of firms reorganising themselves and their value chains but, so far, this remains mainly anecdotal and is not yet broad-based.[5] Notwithstanding this anecdotal evidence, the long-term effects of the pandemic on trade and value chains are still largely uncertain. It remains unclear whether or not the pandemic has ended the protracted period of stagnation in global value chain participation, leading to a further decline.[6]

Chart A

Global value chain participation in the largest euro area countries

(percentage of gross exports)

Source: ECB staff calculations based on the World Input-Output Database (WIOD, see: www.wiod.org).

Note: Global value chain participation is measured as the share in gross exports of the sum of: (i) domestic value added in third country exports (forward global value chain participation); and (ii) the foreign value added in own exports (backward global value chain participation). The latest data from the WIOD is for 2014. From 2015 onwards, global value chain participation is estimated with a small panel regression of global value chain participation growth over trade openness (measured in volume by the sum of import and export as a share of gross domestic product). The estimation is carried out for the period 2000-2014 for the six largest euro area countries, including country fixed effects. The regression coefficients are statistically significant at the 1% level.

The effect of supply chain disruptions on potential growth is likely to depend on the duration of these disruptions. Theoretically, if supply chain disruptions are temporary these may not affect euro area potential growth. Temporary product or labour shortages lead to a decrease in firms’ capacity utilisation, which will affect the cyclical component of total factor productivity.[7] The trend in total factor productivity is only affected if shortages lead to producers changing their supply chains, although there is still some debate on whether the overall economic effect would be negative or positive. Production onshoring and reduction in supply chain length is likely to reduce potential growth, as globalised production processes presumably reflect a more efficient allocation of resources that benefits from comparative advantages across countries. Long-lasting supply chain disruptions may also force companies to revise or postpone their investment plans and therefore alter the evolution of their stock of capital. On the other hand, global firms may reconfigure and optimise their global value chains. Greater resilience that comes with shorter supply chains and local access to strategic goods, spurred by digitalisation, the adoption of e-commerce, videoconferencing and robots, may revive trade flows, structurally change their composition (more towards services) and ultimately have a positive impact on trend total factor productivity.[8]

A back-of-the-envelope calculation, using historical elasticities between global value chain participation and total factor productivity growth, suggests that the impact of current supply shortages on potential output would be limited. If supply bottlenecks persist over time and are not temporary, as currently assumed in the December 2021 Broad Macroeconomic Projection Exercise (BMPE)[9], euro area potential output could be adversely affected. The estimated effect of a possible reorganisation of global value chains on total factor productivity is based on a recent paper which highlighted the nexus between the development of global value chain participation and total factor productivity growth.[10] It is assumed that a reorganisation of global value chains would have a negative impact mainly via total factor productivity. To highlight the effects of possible reshoring, we propose two illustrative adverse scenarios.

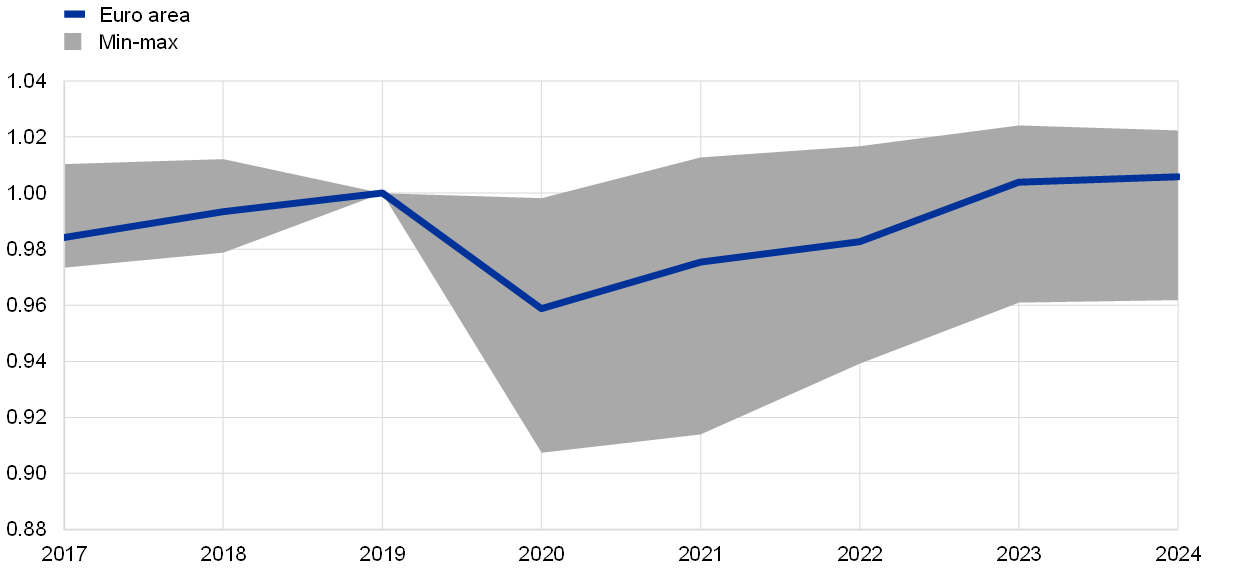

We analyse two scenarios based, on the one hand, on the expected decline in trade following the coronavirus crisis and, on the other hand, on the decline in trade observed during the great financial crisis. In the first scenario, we estimate the impact of the coronavirus crisis on euro area trade using the trade openness ratio.[11] Although slightly different in concept, trade openness is an empirically valid and timely proxy for global value chain participation.[12] We depart from the assumed recovery of trade openness over the projection horizon (as assumed in the December 2021 BMPE) in this scenario and instead assume that global value chain participation is permanently affected in proportion with the decrease in the trade openness observed in 2021 and compared with the level that was anticipated in the December 2019 BMPE (Chart B). This represents a -0.6% deviation in euro area trade openness, with a large heterogeneity across countries (Chart B). The second scenario works directly with global value chain participation and assumes a permanent decline in participation equivalent to half of the shock observed during the great financial crisis. In this case, this represents a 1.8 percentage point decline in euro area global value chain participation. The disparity of shocks across countries is smaller in the second scenario than in the first. This stems from a more homogeneous decline in trade across euro area countries during the great financial crisis.

Chart B

Trade openness in the euro area and in the largest euro area countries

Ratio of the December 2021 projection over the December 2019 projection

(index)

Source: ECB staff calculations based on the December 2019 and 2021 BMPEs.

Note: The grey area denotes the min-max for the largest euro area countries (Belgium, Germany, Spain, France, Italy, Netherlands, Austria, Portugal and Finland) which are subject to less volatility in the revision of their annual national accounts than other countries. The December 2019 BMPE has been extended in 2023 and 2024, assuming the same growth rates for trade and GDP as those expected for 2022.

For both scenarios, the effect of declining global value chain participation on potential output would be of a limited magnitude. In the two scenarios, elasticities, as calculated in an ECB Working Paper in 2018[13], are applied to establish the effect on total factor productivity. The effect of the shocks is assumed to be one-half permanent and thus passes for half in the trend. As a result, trend total factor productivity would suffer a loss in the euro area ranging between -0.1 and -0.3 percentage points. Potential output would suffer a similar setback. This represents a limited impact in a context where trend total factor productivity of the euro area is expected to grow over the period 2021-2023, in cumulated terms, by 2.1% according to the European Commission’s Autumn 2021 Economic Forecast. This estimate obscures some heterogeneity across countries (Table A). For some countries, a more negative impact on total factor productivity and on potential output may materialise if trade were to be lastingly affected by the pandemic.

Table A

Impact of a reversal of global value chain participation on the level of trend total factor productivity

(percentage points)

Source: ECB staff calculations.

Note: Overall, the orders of magnitude of the two scenarios are fairly similar in the different countries. However, in Scenario 1, France appears as an outlier. This is because of the persistent weakness of trade in France since the start of the coronavirus crisis, which is linked to its sectoral specialisations. (See Berthou, A. and Gaulier, G., “French exports in 2020: aerodependence”, Eco Notepad, Banque de France, August 2021.)

- When asked about the persistence of supply-side constraints, almost 45% of non-financial companies expect a duration of supply bottlenecks of less than one year, while more than 30% of them anticipate shortages to persist beyond one year. The uncertainty is reflected by the 25% that did not respond. (See the box entitled “Main findings from the ECB’s recent contacts with non-financial companies”, Economic Bulletin, Issue 7, ECB, 2021.) For more on this topic, see “Global Trade Report – Battling Out of Supply-Chain Disruptions”, Allianz Research, Euler Hermes, 2021.

- For more on these two sides of the debate, see Antràs, P., “De-globalisation? Global Value Chains in the post-COVID-19 age” and Lund, S., “De-globalisation? The Recent Slowdown of Global Trade and Prospects for Future Rebalancing” in “Central Banks in a Shifting World”, Proceedings of the 2020 ECB Forum on Central Banking, ECB, November 2020, pp. 28-89.

- Global value chain participation is a commonly used indicator that measures the degree of value chain integration. The position of a country in value chains can be qualified as upstream (downstream) if the foreign content of the country’s production is larger (lower) compared with the inputs supplied by this country to other economies. For further definitions, see “The impact of global value chains on the euro area economy”, Occasional Paper Series, No 221, ECB, Frankfurt am Main, April 2019.

- See Cigna, S., Gunnella, V. and Quaglietti, L., “Global value chains: measurement, trends and drivers”, Occasional Paper Series, No 289, ECB, Frankfurt am Main, January 2022.

- For example, at the start of the pandemic, the scramble for personal protective equipment led to relocation of production to European countries, which was as sudden as it was short-lived. As another example, the firm IKEA® is considering moving part of its production devoted to its European market to Turkey. (See “IKEA to shift more production to Turkey to shorten supply chain”, Reuters, October 2021.) The firms in the textile industry reportedly have similar intentions. (See “Hugo Boss moves production closer to home to shorten supply chain”, Financial Times, December 2021.)

- Past events, although limited in number, can shed light on the present situation. For instance, the earthquake in Japan in 2011 did not lead to significant reshoring, nearshoring, or diversification. (See Freund, C., Mattoo, A., Mulabdic, A., Ruta, M., “Natural Disasters and the Reshaping of Global Value Chains”, Policy Research Working Papers, No 9719, World Bank, Washington, DC, June 2021.) This is despite the fact that initially it may have been briefly thought that the earthquake would lead to such outcomes. (See “Interconnected Economies: Benefiting from GVCs – Synthesis Report”, OECD Publishing, 2013.) However, it is worth noting that, in contrast with the situation today, global supply chain shocks have tended to be concentrated geographically and/or on a sectoral basis.

- For the link between total factor productivity and capacity utilisation, see, for instance, Planas, C., Roeger, W., Rossia, A., “The information content of capacity utilization for detrending total factor productivity”, Journal of Economic Dynamics and Control, Volume 37, Issue 3, March 2013, pp. 577‑590.

- See Baldwin, R., Freeman, R., “Risks and Global Supply Chains: What We Know and What We Need to Know”, Working Paper Series, No 29444, National Bureau of Economic Research, Cambridge, MA, October 2021.

- See “Eurosystem staff macroeconomic projections for the euro area, December 2021”, ECB, Frankfurt am Main, 16 December 2021.

- See Chiacchio, F., Gradeva, K., Lopez-Garcia, P., “The post-crisis TFP growth slowdown in CEE countries: exploring the role of Global Value Chains”, Working Paper Series, No 2143, ECB, Frankfurt am Main, April 2018.

- We choose to base the size of the shock on trade openness rather than on global value chain participation because the latest values for global value chain participation end in 2014. However, the link between trade openness and global value chains is strong: we estimate, in a panel, an elasticity of 0.6 between trade openness and global value chain participation growth over the period 2000-2014. The estimation is carried out for the six largest euro area countries, with country fixed effects. The regression coefficients are statistically significant at the 1% level.

- Using the trade openness ratio as an indicator of global value chain participation enables us to have a counterfactual scenario, namely the Eurosystem's projection established in December 2019. However, it is possible that, owing to several factors (trade normalisation following the coronavirus shock, inventory rebuilding, etc.), in the current period this is a less accurate predictor of global value chains than it would be in normal times.

- See Chiacchio, F., Gradeva, K., Lopez-Garcia, P., op. cit.