The prevalence of private sector wage indexation in the euro area and its potential role for the impact of inflation on wages

Published as part of the ECB Economic Bulletin, Issue 7/2021.

Shocks to inflation can have longer-lasting effects in the presence of second-round effects and second-round effects are more likely in the presence of wage indexation. Second-round effects can occur if households and/or firms attempt to compensate the loss of real income incurred by higher inflation when setting wages and/or prices. The potential effects of wage indexation mechanisms on wage setting and inflation developments depend not only on the prevalence of wage indexation to inflation, but also on the inflation indicator used for indexation. This box investigates the prevalence of wage indexation mechanisms in the private sector.[1] As wage-setting mechanisms differ considerably across euro area countries, regulations across countries are analysed and a euro area indicator is derived by aggregating characteristics of national wage indexation schemes using country shares in euro area private sector employment as weights.

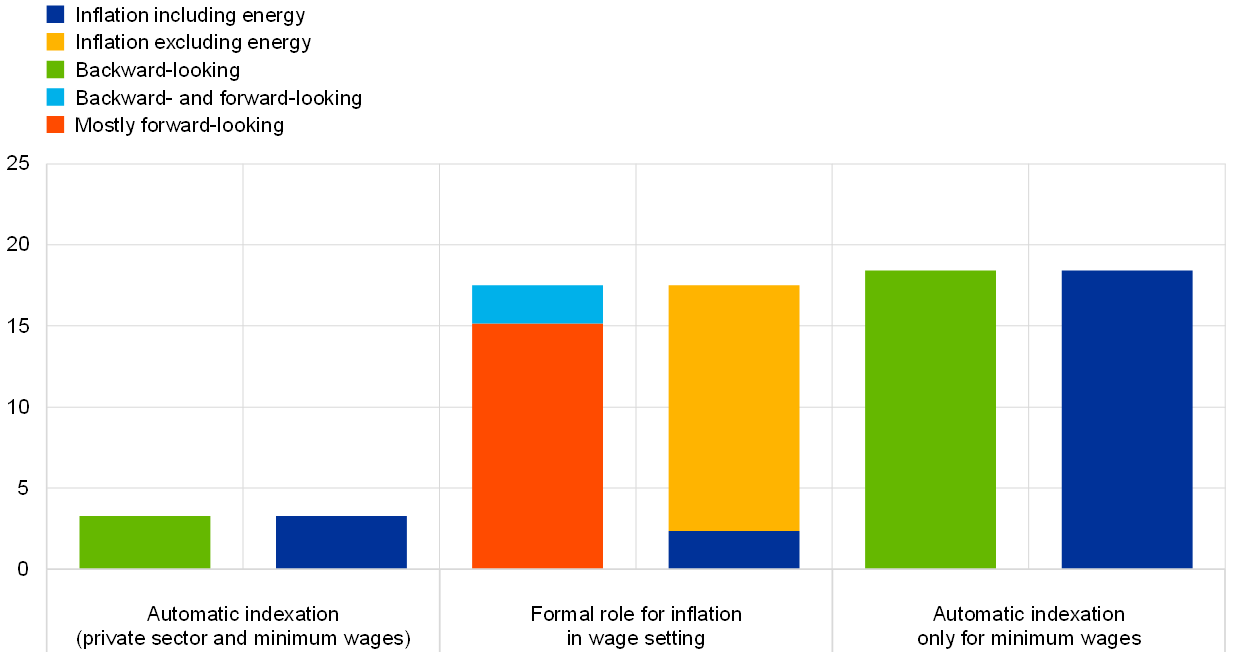

Across euro area countries, four different wage indexation regimes can be identified, ranging from automatic wage indexation schemes to regimes with no formal role for inflation in wage setting (Chart A). The first, more general automatic wage indexation scheme functions in a way that inflation developments automatically feed into wage setting – therefore aiming to neutralise the effects of inflation on the purchasing power of labour incomes. Under the second regime, inflation plays a formal role in wage negotiations, for example in the form of an explicit inflation benchmark guiding wage negotiations. However, this may only apply to some sectors of the economy and the effects of inflation on wage setting is also often less direct and less automatic than under automatic wage indexation. The third regime deploys inflation indexation for minimum wages only – therefore aiming to neutralise the effects of inflation on purchasing power for employees on the lowest labour incomes. All other regimes which have no formal role for inflation indexation in wage setting fall into the fourth category.

Chart A

Prevalence of wage indexation to inflation in the euro area

(share of total private sector employees in the euro area in percentages; 2021)

Sources: Eurosystem and ECB staff calculations.

With regard to the inflation indicator, wage indexation can be forward- or backward-looking and can include or exclude energy prices. Backward-looking indicators imply a lagged adjustment of wages to observed inflation, while forward-looking indicators need to rely on forecasts. There is evidence that wage indexation based on backward-looking inflation measures makes the effect of inflationary shocks longer-lasting and inflation stabilisation harder than wage indexation that is based on forward-looking measures.[2] In some cases, backward- and forward-looking indicators are combined – linking wage growth to inflation forecasts but incorporating, for example, ex post compensation for inflation forecast errors. Where the inflation measure used for wage indexation includes energy, global oil price shocks can have persistent effects on domestic underlying inflation through wage indexation and the possibly resulting wage-price spiral.

In the euro area, general automatic wage indexation schemes only apply to a very small share of employees. All in all, only around 3% of private sector employees in the euro area have their wages and minimum wages automatically indexed to inflation.[3] For most of the employees covered by these regimes, the inflation measure is backward-looking and includes energy (first two columns of Chart A).[4]

Indexation regimes with a formal role for inflation developments in wage negotiations apply to around 18% of employees in the euro area. In these cases, they consider mostly forward-looking inflation measures that exclude energy.[5]

Around 18% of euro area private sector employees work in countries where only the minimum wages are automatically indexed to inflation. These indexation mechanisms are usually backward-looking with an inflation measure that includes energy. While usually only a relatively small share of employees in euro area countries earns the minimum wage,[6] the indexation of minimum wages to inflation usually acts as a floor in other wage agreements. Furthermore, increases in minimum wages often play an important role as a general benchmark for sectoral wage agreements.[7]

For more than half of the private sector employees in the euro area, inflation does not play a formal role in wage setting but can be an important factor in wage negotiations. That said, where there is no formal role for inflation, inflation developments have often been of little importance (compared with regimes where inflation does play a formal role), for example, during times of high uncertainty or large external shocks, with the focus instead being on job security.

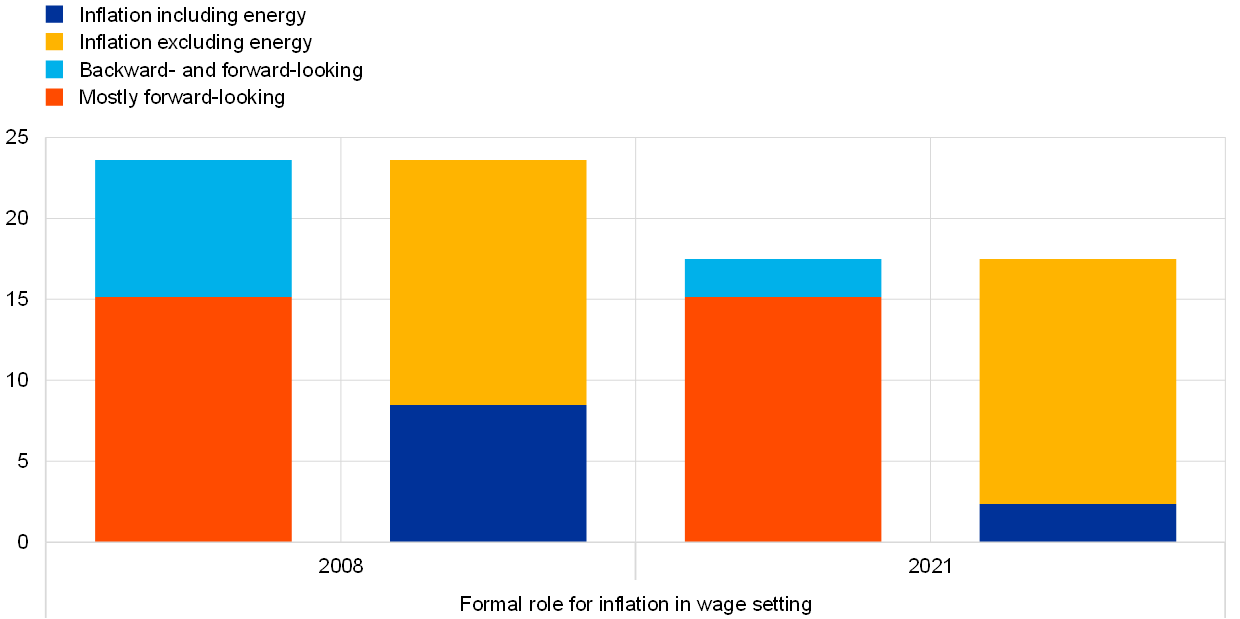

Since the Great Financial Crisis, indexation regimes with a formal role for inflation in wage setting have become somewhat less prevalent (Chart B).[8] The share of private sector employees with a formal role for inflation in wage setting has decreased in the euro area by around 6 percentage points since 2008, with the decline in the share of workers covered by contracts with backward-looking inflation indexation in Spain playing a key role. The remaining share of contracts for which a formal role for inflation is foreseen now refer predominantly to forward-looking inflation measures that exclude energy.[9] As a consequence of the fall in the share of indexation regimes with a formal role for inflation in wage setting, the share of private sector employees for which inflation plays no formal role in wage setting has increased in the euro area since the Great Financial Crisis. As for more general automatic indexation regimes that cover private sector wages and regimes that only index the minimum wages to inflation, there have been no significant changes in their importance since the Great Financial Crisis, and the type of inflation measures used for the indexation has not altered much either.

Chart B

Prevalence of wage indexation in the euro area in 2008 compared with 2021

(share of total private sector employees in the euro area in percentages; 2021)

Sources: Eurosystem and ECB staff calculations.

Note: Only regimes with a formal role for inflation in wage setting are shown in this chart, as there were no significant changes to the other regimes shown in Chart A.

Overall, the likelihood of wage-setting schemes triggering second-round effects based on inflation indexation is relatively limited in the euro area, particularly when it comes to energy inflation. In some countries, the recent hikes in energy inflation could therefore be expected to lead to automatic increases predominantly in minimum wages, since the corresponding indexation mechanisms usually consider an inflation measure that includes energy. These minimum wage increases could then be passed through to generally higher wage agreements, given that minimum wage increases can serve as a benchmark for wage structures in the overall economy. For wage indexation regimes with a formal role for inflation in wage negotiations, only very limited direct effects from the recent energy inflation hikes are to be expected, since these regimes predominantly use an inflation measure that excludes energy. Overall, unless the shock to inflation leads to a significant increase in wage indexation, a broadly based and automatic pass-through of recent inflation hikes to wage growth seems rather unlikely given the prevailing mechanisms.[10]

- This box focuses primarily on inflation effects through the indexation of private sector wages to inflation. Additional effects could stem from the public sector, for example, through the indexation of public sector pensions to inflation or through other special indexation schemes.

- See, for example, Crowley, J., “The Effects of Forward-Versus Backward-Looking Wage Indexation Price Stabilization Programs”, IMF Working Papers, Issue 38, IMF, April 1997.

- Automatic wage indexation applies to a large share of private sector employees in Belgium, Cyprus, Malta and Luxembourg.

- In Belgium, the relevant inflation index excludes petrol, tobacco and alcohol.

- The most prominent example is Italy, where the Italian National Institute of Statistics’ annual three-year forecast of the Consumer Price Index excluding energy is the central benchmark for wage agreements at the sectoral level.

- For the share of minimum wage earners, see “Eurostat’s minimum wage statistics” and the box entitled “Recent developments in social security contributions and minimum wages in the euro area”, Economic Bulletin, Issue 8, ECB, 2019.

- For further details on France, see Fougère, D., Gautier, E and S. Roux, “Wage floor rigidity in industry-level agreements: Evidence from France”, Labour Economics, Vol. 55, September 2018.

- For further details on wage indexation regimes at the time of the Great Financial Crisis, see the box entitled “Wage indexation mechanisms in euro area countries”, Monthly Bulletin, ECB, May 2008.

- These regimes are prevalent in Italy.

- See the discussion in Nickel, C. et al., “Understanding low wage growth in the euro area and European countries”, Occasional Paper Series, No 232, ECB, September 2019.