The fiscal implications of the EU’s recovery package

Published as part of the ECB Economic Bulletin, Issue 6/2020.

The EU’s recovery package represents an important milestone in European economic policy integration. On 21 July 2020 the European Council agreed on an exceptional temporary recovery instrument known as Next Generation EU (NGEU). Together with the regular Multiannual Financial Framework (MFF), NGEU will ensure a coordinated European fiscal response to the economic fallout from the coronavirus (COVID-19) pandemic. While the 2008 European Economic Recovery Plan[1] was only intended to coordinate national budgetary stimulus packages to be financed by each Member State, NGEU establishes a joint funding model to support government spending and reform in the EU.

For NGEU, the European Commission has been authorised to raise up to €750 billion on the capital markets on behalf of the European Union. The funds can be used to provide loans of up to €360 billion and grants of up to €390 billion. These will be disbursed up to the end of 2026 and repaid by 31 December 2058 at the latest. The NGEU issuance will increase outstanding Union debt by a multiple of around 15, constituting the largest ever euro-denominated issuance at supranational level. While the loans will be repaid by the beneficiary Member States, the European Council agreed to reform the own resources system and ensure that grant repayments will be covered by gross national income-based contributions and new EU own resources.

The Recovery and Resilience Facility (RRF) constitutes the core of NGEU. The entire loan portfolio and 80% of the grants will be assigned to the RRF, the purpose of which is to support investment and reform in Member States to pave the way for a sustainable, resilient recovery, while promoting the Union’s green and digital priorities. The remaining part of NGEU will mainly be used to reinforce EU-wide spending programmes under the MFF.

To receive financial support under the RRF, EU Member States need to prepare national recovery and resilience plans setting out their reform and investment agenda for the years 2021-23. These plans are expected to feature coherent packages of reforms and public investment projects and address the challenges identified in the context of the European Semester. They should also strengthen the growth potential, job creation and economic and social resilience of the Member State concerned. The financial support will be disbursed in instalments when milestones and targets identified in these plans are reached.

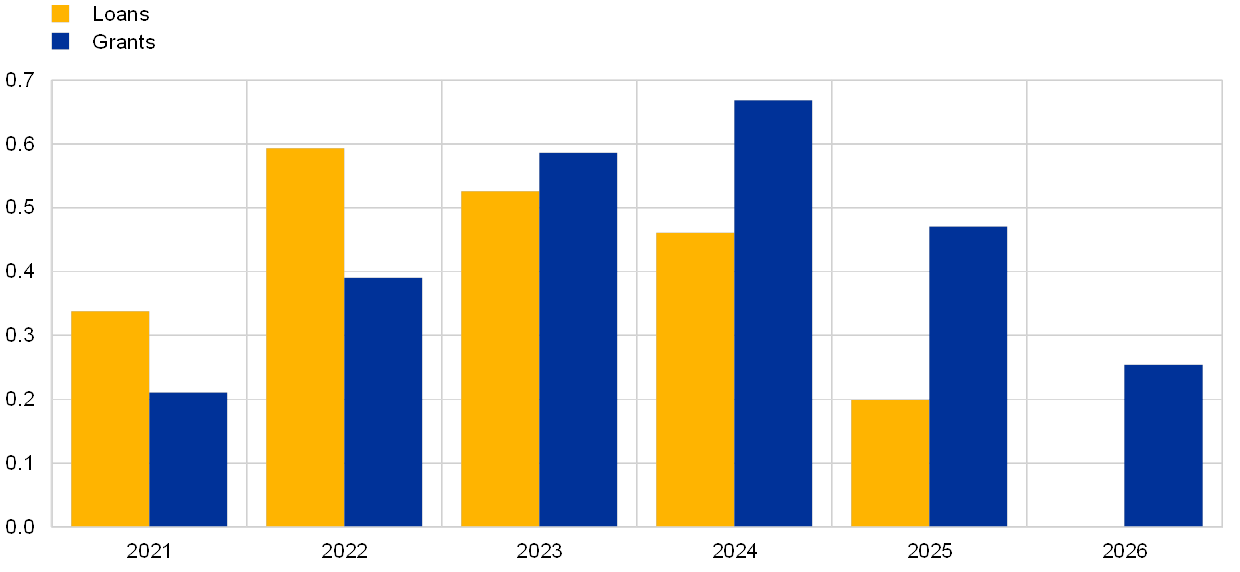

The financial support to be provided under NGEU is intended to have a meaningful volume in macroeconomic terms, totalling almost 5% of euro area GDP. The idea is for the financial support under NGEU to be fully committed by the end of 2023 and largely disbursed over the period from 2021 to 2024 (see Chart A).[2] Based on currently available information, the grants will have a more back-loaded time profile than the loans. While there is still uncertainty regarding the implications for national budgets, NGEU would imply a debt-based fiscal expansion of around 1% of GDP on average in the euro area over the period from 2021 to 2024, assuming that the support is used at the national level to finance additional expenditure. Provided it is deployed for productive spending and accompanied by growth-enhancing reforms, NGEU would not only help to underpin the recovery but also increase the resilience and growth potential of Member State economies going forward.

Chart A

NGEU: expected disbursements of funds to euro area countries

(percentages of GDP)

Sources: European Council conclusions of 21 July 2020, European Commission and ECB calculations.

Notes: The allocation of grants to euro area countries is assumed to follow agreed allocation keys. Only countries with a cost of borrowing above the expected interest rate on NGEU loans are assumed to draw loans up to the ceiling of 6.8% of gross national income. The time profile is based on the estimates presented in the European Commission’s proposal for establishing NGEU.

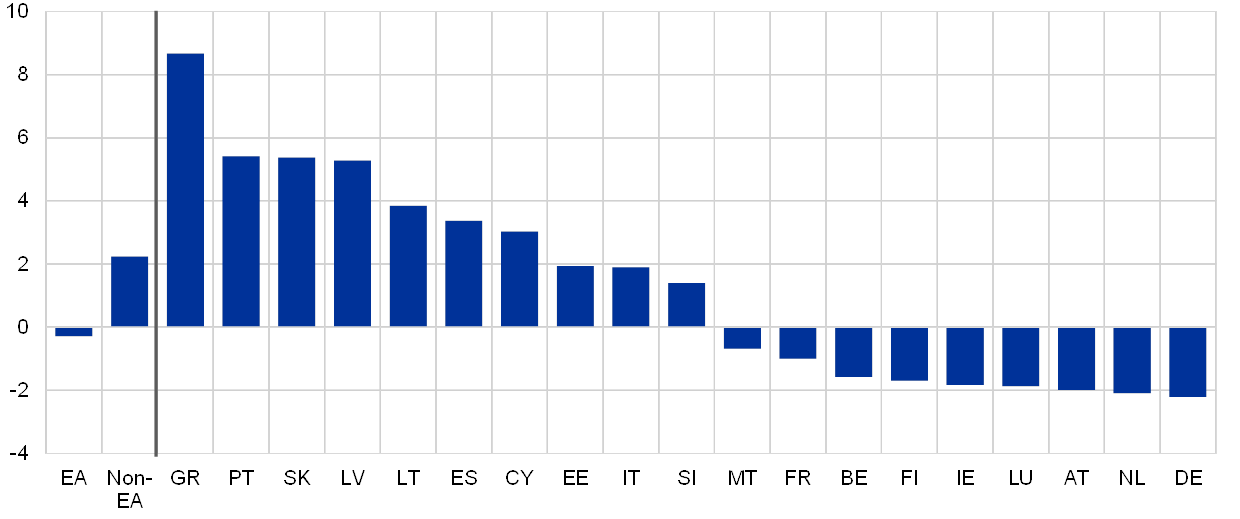

The RRF allocation key ensures stronger macroeconomic support for more vulnerable countries. In 2021-22 funds will be distributed on the basis of income per capita and past unemployment developments; for 2023 the past unemployment developments will be replaced by the observed declines in real GDP in 2020-21. The agreed distribution of funds will imply sizeable net financial support for those euro area countries that face the biggest economic and fiscal challenges after the pandemic (see Chart B)[3]. Greece will be the largest net recipient of support from the RRF relative to GDP, but Spain and Italy, which are expected to be among most heavily affected states in terms of both deaths and economic fallout, will also receive sizeable fiscal support.

Chart B

RFF: allocation of grants, net of expected repayments

(percentages of 2019 GDP)

Sources: European Council conclusions of 21 July 2020, European Commission and ECB calculations.

Note: 70% of grants are expected to be allocated in 2021-22 based on the allocation key proposed by the European Commission (taking into account population, inverse GDP per capita and average unemployment rate in 2015-19). For the 30% of grants allocated in 2023, average unemployment is replaced by GDP losses in 2020 (15%) and over 2020-21 on a cumulative basis (15%) as currently projected by the European Commission. Repayments are assumed to correspond to countries’ shares in EU gross national income.

A coordinated European policy response to COVID-19 is essential to avoid an uneven recovery and economic fragmentation, while promoting economic resilience in Member States. NGEU comes in addition to the regular MFF worth around €1 trillion over the next seven years and the three European “safety nets” worth €540 billion agreed in April 2020.[4] As such, the European response to the crisis is ambitious and commensurate to the challenge the continent faces. Moreover, it is important that monetary and fiscal policies, although implemented independently in the euro area, are currently acting in a mutually reinforcing way.

It will be essential to ensure that the fiscal support provided through NGEU is not counteracted by the premature withdrawal of fiscal support funded at the national level. In view of the depth of the pandemic shock and the associated uncertainty, the general escape clause set out in the Stability and Growth Pact was activated in March 2020 with extension through 2021 considered likely. This allows governments to take the measures needed to combat the pandemic, deviating from the adjustment requirements that would normally apply under the pact while not endangering fiscal sustainability.

While macroeconomic stabilisation remains a priority, it will be important to maintain fiscal sustainability throughout the recovery. The ongoing crisis has highlighted how very high levels of government debt may imply vulnerabilities and fiscal constraints when a country is hit by a large economic shock. It is therefore essential that fiscal support is used effectively to boost growth potential and resilience, which in turn improves fiscal sustainability. EU funding should be spent in line with country-specific needs and reform priorities agreed at the European level.

The way that the EU has responded to the crisis also has implications for the future design and implementation of the European governance framework. First, while expansionary fiscal policy is necessary to sustain the recovery, going forward it will be important for the fiscal rules to effectively support the reduction of high government debt in good economic times. Second, NGEU constitutes a new and innovative element of the European fiscal framework. It will result in the issuance of sizeable supranational debt over the coming years, and its establishment has signalled a political readiness to design a common fiscal tool when the need arises. This innovation, while a one-off, could also imply lessons for Economic and Monetary Union, which still lacks a permanent fiscal capacity at supranational level for macroeconomic stabilisation in deep crises. The review of the economic governance framework,[5] which was launched by the Commission in February 2020 and postponed because of the pandemic, provides a good opportunity to incorporate these important considerations.

- See A European Economic Recovery Plan COM(2008) 800 final, 26 November 2008

- The European Council agreed that 70% of the grants provided by the RRF would be committed in 2021 and 2022. The remaining 30% would be fully committed by the end of 2023. It should be noted that a key characteristic of the EU budget is that decisions on commitments are separate from those on payments. The timing of the two is therefore different. The reported timing of payments is based on the estimates in the European Commission’s proposal for a regulation establishing a Recovery and Resilience Facility, adjusted to reflect the European Council conclusions of 21 July 2020.

- Table 1 in the European Commission Staff Working Document “Identifying Europe's recovery needs” suggests that those countries with below average GDP per capita and high debt (notably Cyprus, Greece, Spain, Italy and Portugal) would receive 50% of the support (under the Commission’s allocation key that will be used in 2021 and 2022) while their share in EU GDP (used as proxy for the contributions to the EU budget) is quantified at around 25%.

- See the box entitled “The COVID-19 crisis and its implications for fiscal policies”, Economic Bulletin, Issue 4, ECB, 2020.

- For details, see https://ec.europa.eu/info/business-economy-euro/economic-and-fiscal-policy-coordination/eu-economic-governance-monitoring-prevention-correction/economic-governance-review_en