Country-specific recommendations for fiscal policies under the 2018 European Semester

Published as part of the ECB Economic Bulletin, Issue 4/2018.

On 23 May the European Commission issued its 2018 European Semester Spring Package of policy recommendations for Member States. The package includes country-specific recommendations (CSRs) for economic and fiscal policies for all EU Member States.[1] It also covers recommendations regarding the implementation of the European Union’s Stability and Growth Pact (SGP) for a number of countries.[2] With regard to fiscal policies, the recommendations focus in particular on Member States’ compliance with the SGP on the basis of the Commission’s 2018 spring forecast and the Commission’s assessment of countries’ policy plans as reflected in the updates of the stability and convergence programmes released in April. This year’s European Semester exercise is important particularly with a view to avoiding any repetition of mistakes made prior to the financial crisis when sufficient fiscal buffers were not built up in economic good times and the ensuing recession was aggravated by the sudden necessity of pro-cyclical fiscal tightening. Against this background, this box examines the fiscal policy recommendations that are addressed to 18 euro area countries (i.e. excluding Greece).

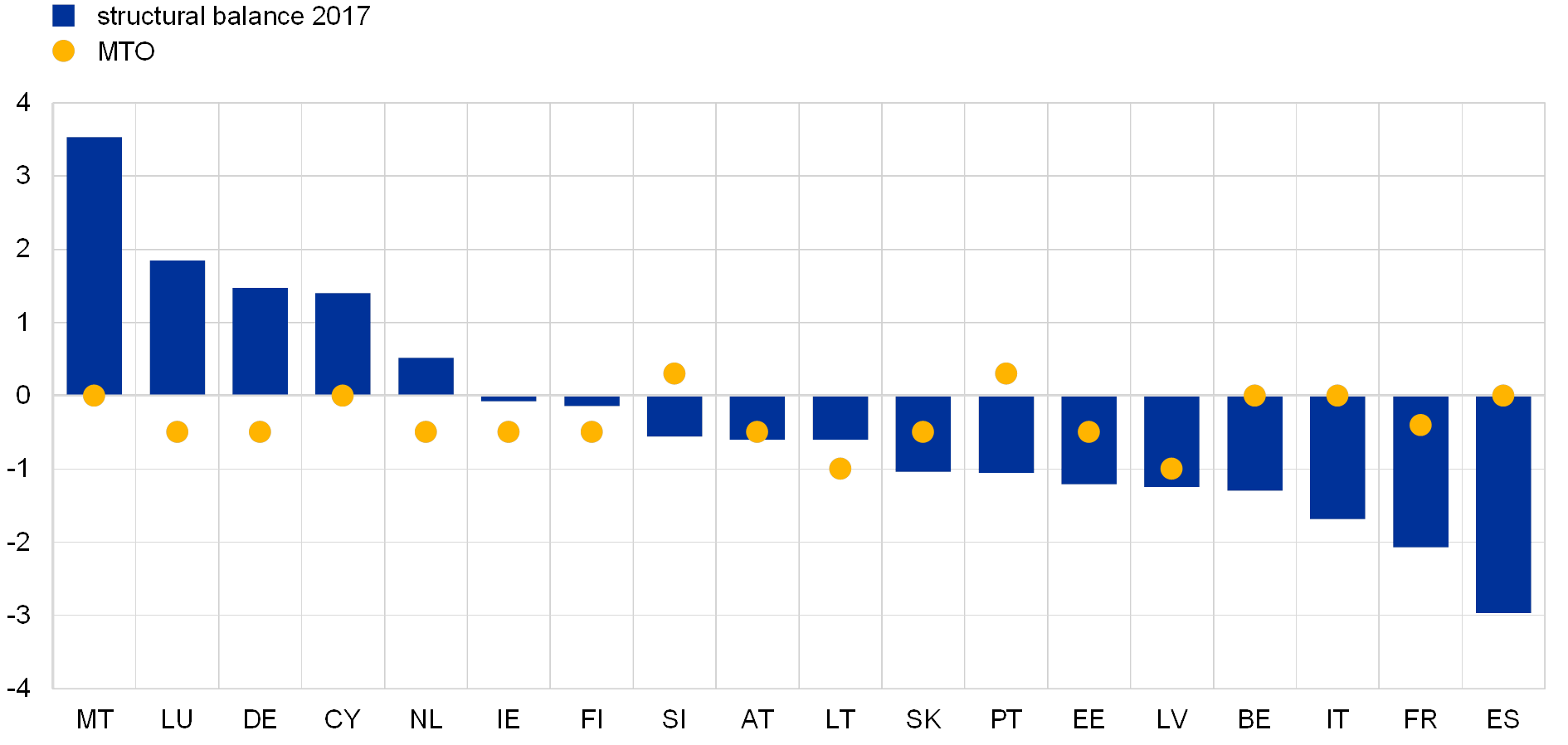

The Spring Package points to improved budgetary positions in euro area countries, but also to considerable cross-country divergence, as high government debt ratios still leave some countries vulnerable to shocks. According to the European Commission’s 2018 spring forecast, ten euro area countries were at or above their medium-term budgetary objectives (MTOs) or posted underlying budgetary positions in the vicinity of their MTOs in 2017 (see Chart A). This should help reduce government debt ratios and bolster public finances ahead of a possible downturn. At the same time, a number of countries still remain distant from their MTOs, most notably countries with government debt-to-GDP ratios of more than 90% of GDP. High government debt levels render public finances vulnerable to future macroeconomic downturns. They entail the risk that fiscal policies may need to be tightened at times when it would be warranted to let the stabilising properties of fiscal policies operate to support the economy.[3]

Chart A

Structural balances in 2017 and MTOs

(percentages of GDP)

Sources: European Commission (AMECO database) and ECB calculations.

Notes: The chart depicts countries’ structural balances in 2017 and their MTOs. According to the Commission’s Vade Mecum on the Stability and Growth Pact, countries with a structural balance within the 0.25% of GDP margin of tolerance of the MTO are considered as having achieved their MTO.

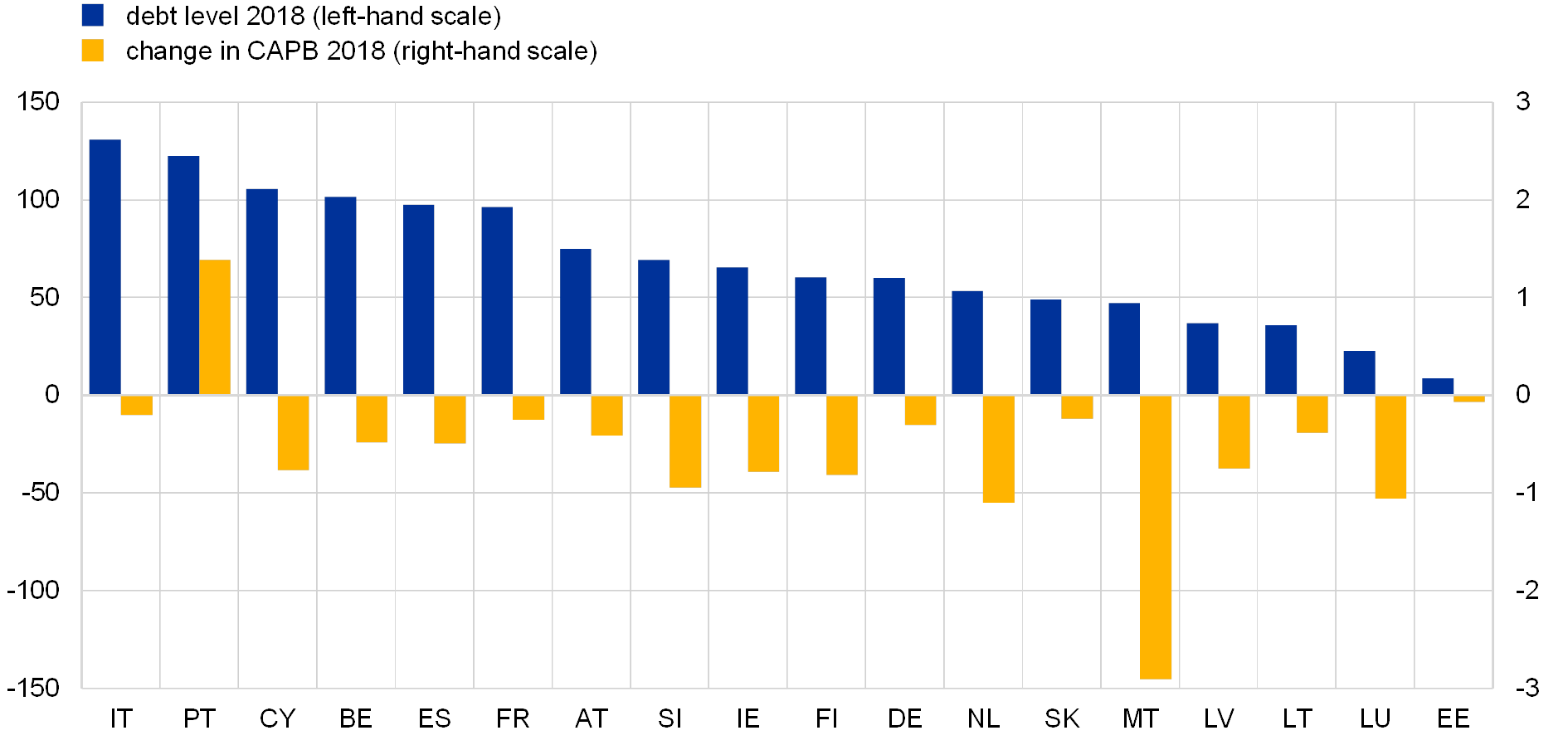

Fiscal policies are expected to be expansionary in the vast majority of Member States in 2018, including in countries with high government debt. According to the European Commission’s forecast, the fiscal stance as measured by the change in the cyclically adjusted primary balance (CAPB) is expected to be expansionary in almost all euro area countries this year (see Chart B). This reflects the fact that a number of countries that achieved their MTOs in 2017 are expected to spend part of their fiscal surpluses. However, the forecast expansionary stance is also a reflection of fiscal loosening in countries with still high debt ratios and further consolidation needs.

Chart B

Government debt-to-GDP and the fiscal stance: 2018

(left-hand scale: percentages of GDP; right-hand scale: percentage points of GDP)

Sources: European Commission (AMECO database) and ECB calculations.

Note: The fiscal stance is measured as the change in the CAPB.

Indeed, according to the European Commission projections, most of the countries that have not yet reached sound budgetary positions are expected to miss their commitments under the SGP in 2018. Among the seven euro area countries that are assessed by the Commission to be at risk of a significant deviation from the SGP’s preventive arm in 2018, four countries – Belgium, France, Italy and Portugal – have debt ratios above 90% of GDP. In addition, while Spain, which is the only country subject to an excessive deficit procedure (EDP) in 2018, is projected to meet its 2018 EDP correction deadline, this achievement masks a significant deterioration in the structural balance, as opposed to the recommended improvement.[4]

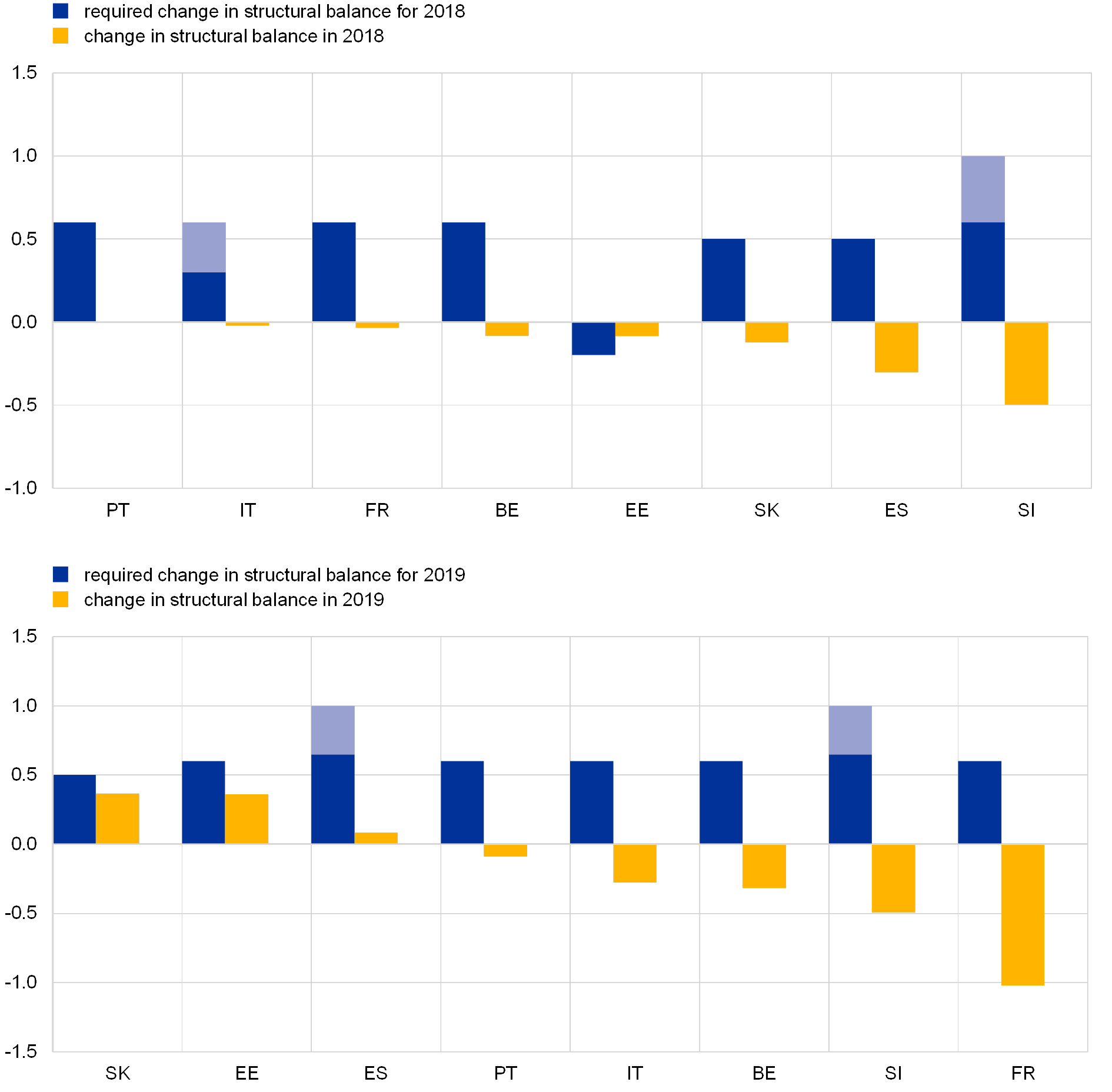

While, overall, the CSRs reflect the guiding principle of using good economic times to rebuild buffers, some exceptions from the standard approach are being applied.[5] For Spain and Slovenia, the CSRs foresee structural effort requirements for 2019 below those agreed under the SGP’s preventive arm matrix, namely 0.65% of GDP rather than 1% of GDP.[6] The deviation from the matrix requirement is based on economic judgement, notably with reference to high unemployment. The ex post assessment of compliance with the SGP in 2019 will acknowledge a margin of deviation for the outcomes in 2018. This approach follows the “discretionary” lowering of adjustment requirements for two countries in 2018, from 0.6% to 0.3% of GDP for Italy, and from 1% to 0.6% of GDP for Slovenia (see Chart C), in this case without any additional margin of deviation. This application of the SGP comes at the cost of lowering the framework’s transparency, consistency and predictability.

Chart C

Adjustment requirements under the SGP in 2018 and 2019 for euro area countries not at their MTO in 2017

(percentage points of GDP)

Sources: European Commission (AMECO database) and ECB calculations.

Notes: The structural effort requirements for the individual years are those enshrined in the CSRs. For 2019 they are quantified in the CSRs for fiscal policies under the 2018 European Semester. The areas shaded light blue within the respective bars reflect the fact that adjustment requirements are lower than those foreseen under the preventive arm matrix. For 2019, the Commission forecast is based on a “no policy change” scenario in the absence of a budget for that year.

The CSRs recommend countries which are at or above their MTOs to make use of the fiscal space to increase potential output. Caution is, however, warranted to the extent that fiscal surpluses also reflect tailwinds from a strong cycle that will reverse in the future. This is why expenditure developments should be monitored carefully.

On 23 May the European Commission also issued recommendations for some euro area countries regarding the implementation of the SGP. The Commission adopted reports for Belgium and Italy under Article 126(3) of the Treaty on the Functioning of the European Union in which it assesses their compliance with the Treaty’s debt criterion. In the case of Italy, the Commission concluded that the debt criterion “should be considered as currently complied with” because fiscal policies are found to be broadly compliant with the SGP’s preventive arm for 2017. For Belgium, the Commission report concludes that there is no sufficiently robust evidence to conclude that Belgium did not comply with the preventive arm requirements. It therefore does not fully conclude whether the debt criterion is or is not complied with. In the light of both countries being expected to deviate significantly from the SGP’s preventive arm requirements this year, the Commission will reassess their compliance with the fiscal rules on the basis of the ex post data for 2018. However, treating “broad compliance” with the preventive arm as a prime relevant factor, while disregarding gaps in compliance with the debt reduction benchmark, lowers the effectiveness of the debt rule. This entails the risk that high debt will not be reduced sufficiently rapidly.[7] Finally, the Commission recommended abrogating the EDP for France by its 2017 deadline, and the Council adopted a corresponding decision on 22 June.

Recent financial market volatility underlines the need to use the current favourable macroeconomic environment more decisively to create fiscal buffers and reduce high debt. The EU’s agreed fiscal rules must therefore be complied with and applied fully and consistently across countries and over time. This is indispensable for trust in the common currency and for progress towards completing Economic and Monetary Union.

- Except for Greece, where the monitoring of fiscal performance will continue within the framework of the European Stability Mechanism (ESM) programme throughout its duration (i.e. until August 2018). Greece was therefore exempt from the obligation to submit a medium-term budgetary plan (Stability Programme) and a National Reform Programme in April, and did not receive recommendations.

- The CSRs were finalised and approved by the Member States’ economics and finance ministers on 22 June. They are scheduled to be endorsed by the European Council on 28-29 June. The adoption of the CSRs by the Economic and Financial Affairs Council (ECOFIN Council) at the meeting scheduled for 13 July will formally conclude the 2018 European Semester.

- For an overview of the economic consequences of high government debt, see the article entitled “Government debt reduction strategies in the euro area”, Economic Bulletin, Issue 3, ECB, 2016.

- According to the Commission’s 2018 spring forecast, Spain will miss the EDP’s headline deficit target of 2.2% of GDP (by around 0.4 percentage points of GDP) owing to a significant deterioration in the structural balance (by 0.3 percentage points, as opposed to the recommended improvement of 0.5 percentage points).

- See also Communication from the Commission to the European Parliament, the European Council, the Council, the European Central Bank, the European Economic and Social Committee, the Committee of the Regions and the European Investment Bank: 2018 European Semester – Country-specific recommendations, COM(2018) 400 final.

- This matrix differentiates adjustment needs by the levels of the output gap and government debt. It is based on the principle that favourable economic times and high government debt warrant larger adjustment needs. For an assessment, see the box entitled “Flexibility within the Stability and Growth Pact”, Economic Bulletin, Issue 1, ECB, 2015.

- For an assessment of the functioning of the SGP’s debt rule, see the article entitled “Government debt reduction strategies in the euro area”, Economic Bulletin, Issue 3, ECB, 2016.

Europäische Zentralbank

Generaldirektion Kommunikation

- Sonnemannstraße 20

- 60314 Frankfurt am Main, Deutschland

- +49 69 1344 7455

- media@ecb.europa.eu

Nachdruck nur mit Quellenangabe gestattet.

Ansprechpartner für Medienvertreter