Macroprudential space and current policy trade-offs in the euro area

Published as part of the Financial Stability Review May 2019.

The countercyclical capital buffer (CCyB) is one of the centrepieces of the post-crisis reforms that introduced macroprudential policy instruments. Macroprudential instruments aim to protect the resilience of the financial system throughout the financial cycle. While many measures have been implemented to structurally raise capital in the banking sector, only a few euro area countries have activated the CCyB. This implies that macroprudential authorities currently have limited policy space to release buffer requirements in adverse circumstances. Against this background, this special feature provides some insights into the relevant macroprudential policy response under different macroeconomic conditions. It is argued that, barring a severe economic downturn, even under a scenario of moderate economic growth a gradual build-up of cyclically adjustable buffers could be considered to help create the necessary macroprudential space and to reduce the procyclicality of the financial system in an economic and financial downturn.

Introduction

Macroprudential policy has a preventive purpose. Macroprudential policy actions focus on averting the emergence of financial imbalances and building resilience in the financial system in good times, with the aim of supporting financial intermediation and especially lending to the real economy in bad times.

Following the financial crisis, numerous macroprudential instruments have been implemented and some buffers continue to be phased in. While banks’ capital ratios have increased over the last decade due to regulatory and market pressures, there has been only a very moderate build-up of countercyclical capital buffers in the euro area banking sector. This development reflects both the relatively short period for which these policy instruments have been available and the slow recovery of the financial cycle in the aftermath of the financial and sovereign debt crises. This lack of buffers limits the space for macroprudential policy to release the CCyB and thereby relieve the banking system to support the real economy if the financial system were to be hit by an adverse shock.[1]

How should macroprudential policy react to an unanticipated economic slowdown? In order to shed light on this question, this special feature first provides an overview of cyclical systemic risks and the prevailing macroprudential space in the euro area. Second, a counterfactual scenario analysis provides insights into the optimal macroprudential policy stance under different economic outcomes, with the aim of analysing the interaction of the macroprudential stance with different configurations of the macroeconomic outlook.[2]

While noting that macroprudential policy is generally focused on addressing national imbalances, this article evaluates the prevailing overall macroprudential policy trade-off from a more conceptual, and euro area aggregate, perspective. It is important to note that the relative costs and benefits of further building up macroprudential space to safeguard against the materialisation of cyclical systemic risks may vary across euro area countries. Also the macroeconomic implications of capital requirement tightening and release, respectively, may be different at the country level compared with the euro area-wide simulations presented in this special feature.

Cyclical systemic risks at the euro area level

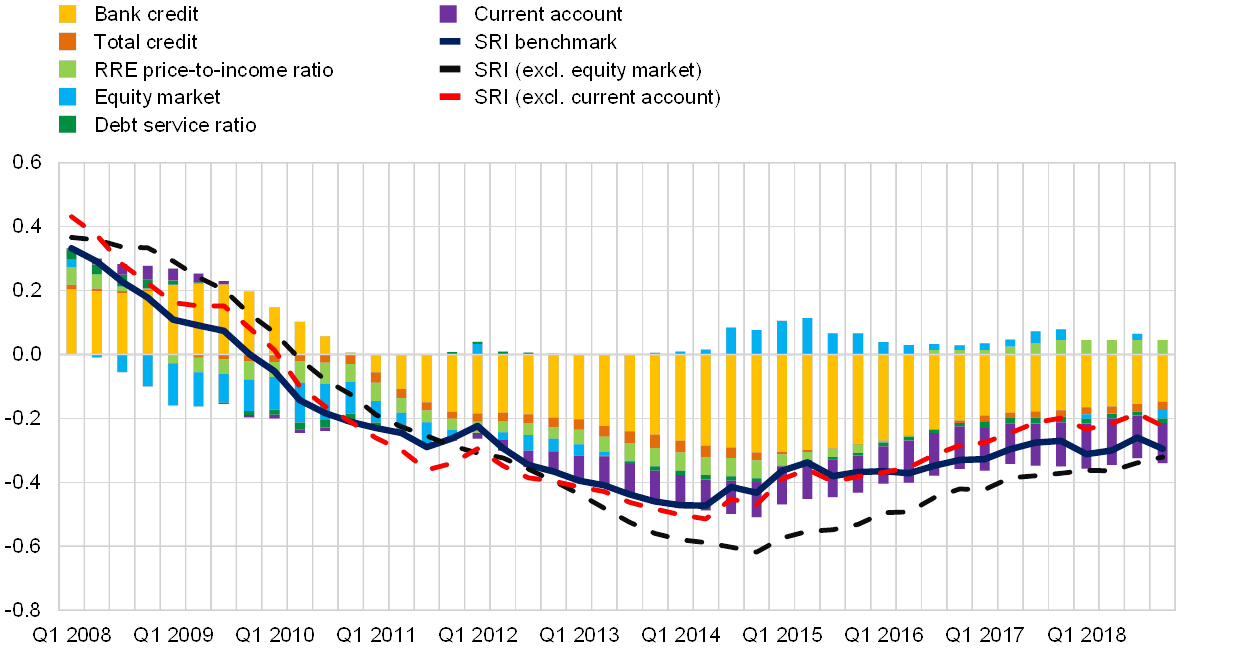

Cyclical systemic risks remain moderate, although they have risen following the trough observed in the aftermath of the financial crisis. At the euro area aggregate level, synthetic measures of cyclical systemic risks have been on an increasing trend since 2014 (see Chart C.1). As the build-up of financial imbalances of a cyclical nature has been only gradual for the euro area as a whole, risks remain contained. Nevertheless, significant cross-country heterogeneity exists and the aggregate figures mask pockets of vulnerability in certain jurisdictions. Beyond the specific dynamics of indicators for credit, asset price and external imbalances, the elevated indebtedness of the non-financial private sector may exacerbate risk measures and loss dynamics should risks materialise.

Cyclical systemic risk as measured by the domestic systemic risk indicator has increased from the 2014 trough

Euro area d-SRI and decomposition into driving factors

(Q1 2008-Q2 2018; deviation from historical median in multiples of standard deviation)

Sources: ECB, Eurostat and ECB calculations.Notes: The coloured bars represent the contributions of different d-SRI sub-indicators to the overall d-SRI value. Positive contributions imply that a given indicator is above the pooled median across countries and over time, while negative contributions imply that a given indicator is below the pooled median. SRI stands for systemic risk indicator and RRE for residential real estate.

Macroprudential authorities in euro area countries have been phasing in capital buffer requirements to structurally strengthen the solvency of the banking sector and to raise resilience to the build-up of systemic risk.[3] The average Common Equity Tier 1 (CET1) capital ratio of systemically important euro area banks had increased to 14.4% by the end of 2018 (see Chart C.2). This reflects pressure from markets, microprudential capital demands and macroprudential requirements. Regarding macroprudential instruments, the capital conservation buffer (CCoB) has been introduced in all euro area countries, as have institution-specific buffers for seven global systemically important institutions (G-SIIs) and 106 other systemically important institutions (O-SIIs). In addition, four euro area countries have introduced a systemic risk buffer (SRB) to address specific structural risks and yet others have increased risk weights on sectoral exposures to ensure that capital requirements remain effective.[4] Overall, these additional capital requirements have significantly increased the resilience of the euro area banking sector. Indeed, besides the fact that it revealed some pockets of vulnerable banks, the results of a recent stress test point to an overall high level of resilience, with the average CET1 ratio under stress standing at 10.1% for the sample of systemic institutions.[5]

Notwithstanding the increase in bank capital ratios, the build-up of countercyclical capital buffers in the euro area as a whole has been moderate and has taken place only recently in a few countries. In particular, the CCyB has not yet been activated in most of the largest euro area countries. In principle, the available capital base, including the part held in excess of requirements, provides banks with substantial buffers which they can draw down in case of need without affecting banks’ ability to continue providing financing to the real economy. However, the main macroprudential instrument meant for countering potential losses from cyclical risks, the CCyB, has only been scarcely implemented. In the first quarter of 2019, CCyB rates were positive for two euro area countries and remained at 0% for all other euro area countries.[6] While this mainly reflects the modest build-up of cyclical risks in the aftermath of the financial crisis, it leaves macroprudential authorities with limited space to release buffers if there were to be an unexpectedly severe turn in the financial cycle. This is all the more important as the prolonged recovery and ample liquidity may have led to an underestimation of credit risk by some financial institutions.

CET1 capital ratios have increased over time, given higher prudential requirements and voluntary buffers

CET1 capital requirements, macroprudential buffers and management capital buffers

(percentage points of risk-weighted assets)

Sources: ECB and ECB calculations.Notes: Based on systemic institutions weighted by risk-weighted assets. AT1 stands for additional Tier 1, T2 for Tier 2 and P2R for Pillar 2 requirement. The microprudential Pillar 2 guidance (P2G) is included in the residual capital. CCyB and SRB requirements are not adjusted for exposures, but are considered at the consolidated level. The annual measure presents the value as at the end of the year (Q4).

For macroprudential authorities, it is crucial to ensure enough macroprudential policy space to support the financial system should risks materialise. At the same time, the specific timing and calibration of macroprudential policy measures need to take into account the broader macro-financial environment and outlook. The next section employs a model-based analysis to illustrate how the macroprudential policy stance interacts with the state of the economic cycle.

State dependency of macroprudential policy: scenario analysis

Model-based scenario analysis illustrates how macroprudential policy implementation interacts with the state of economic and financial conditions. While macroprudential policies aim to address some of the financial sector externalities that might otherwise lead to procyclical behaviour, the implementation of higher capital buffer requirements could have negative real economic implications in the short run.[7] The degree to which macroprudential policy measures have an impact on the macro economy crucially hinges on the state of the economy in the first place and on the ability of the banking sector to adjust to changing requirements.[8] In order to shed more light on how macroprudential policies interact with changing economic conditions, a model-based general equilibrium analysis is carried out to gauge under what conditions macroprudential authorities could “look through” an unanticipated economic slowdown and when to halt the gradual build-up of or when to release the macroprudential capital buffer.

A protracted slowdown could place strains on the financial sector, with potential amplification effects on the real economy. The financial sector may amplify the deterioration in general economic prospects through various channels, owing to financial frictions affecting both the demand and supply sides of credit intermediation.[9] Such a procyclical response of financial intermediaries could significantly amplify the downturn, notably if financial intermediaries become risk averse or capital-constrained.

Evidence from a macro model with a risk-sensitive banking sector can shed some light on the role of adverse financial factors in explaining the growth profile of available Eurosystem economic projections for the next few years. In order to disentangle the quantitative contribution of credit risk and other financial factors to euro area cyclical fluctuations, euro area developments are interpreted through the lens of the dynamic stochastic general equilibrium (DSGE) model of Darracq et al. (2011)[10] (DKR).[11] The contribution of financial factors to euro area GDP growth was supportive through 2018, peaking at around 0.3 p.p. of annual growth (see Chart C.3). Overall, while they do play a role, financial factors still fall short of explaining the growth slowdown from 2017 to 2019, which is projected to be primarily driven by aggregate demand factors.[12]

Financial factors play only a limited role in the recent and forecasted economic slowdown

Historical decomposition of euro area GDP growth between 2017 and 2021: contributions of structural shocks to de-trended real GDP growth (left-hand scale)

(annual growth rates, percentages)

Source: DKR model. Note: Historical decomposition of euro area GDP into structural shocks, based on the latest ECB staff macroeconomic projections baseline (see the article entitled “March 2019 ECB staff macroeconomic projections for the euro area”, published on the ECB’s website on 7 March 2019).

Under these economic conditions and accounting for the uncertainty surrounding the projections, the gradual build-up of macroprudential policy space could still be considered. The previous section has explained the rationale for a gradual and limited increase in macroprudential buffers for the euro area banking system. Based on current macroeconomic prospects and broadly favourable financial conditions and credit intermediation capacity of the banking system, macroprudential policy can further increase the policy space. In this context, a continued further build-up of cyclical buffers could be expected to have relatively subdued macro implications, with limited implications for broad financing conditions. To illustrate this point, we conduct a theoretical experiment and simulate in the DSGE model used previously an arbitrarily chosen 50 basis point (bp) increase in the CCyB rate, phased in from mid-2019 to end-2020.[13] Chart C.4 reports the impact on GDP growth, annual inflation and the short-term interest rate (assuming that standard monetary policy does not face any constraints and reacts in line with the estimated interest rate rule of the model). In this scenario, economic growth would be less than 0.1 p.p. slower in cumulated terms over a three-year horizon, while inflation would be less than 5 bps lower on average over the same period.

A slight tightening of countercyclical buffers at the euro area level would only have limited macroeconomic effects

Macroeconomic impact of tightening the CCyB rate by 0.5 p.p.

(annual growth rates, percentage point deviation from baseline)

Source: DKR model.

A further weakening of economic prospects might trigger a broader reappraisal of credit risk for firms and households, leading to tighter conditions for market and bank-based finance. A more protracted slowdown than currently envisaged could change the assessment of the case for a further build-up of cyclical buffers, depending on the scale of negative feedback effects between the real and financial sectors. As an illustrative example of the relevance of real-financial interactions, a simulation exercise is implemented by comparing the macroeconomic impact of demand-driven negative shocks within the DKR model, when allowing and when not allowing for real-financial feedback effects. In the case of no real-financial amplification, a negative demand shock is assumed to bring about a cumulated downward impact on euro area GDP projections of 0.5 p.p. by the end of the simulation horizon (see Chart C.5, yellow bars). Switching on real-financial feedback channels amplifies the modelled demand-driven growth slowdown by around 40% over the three-year horizon, as external financing conditions would respond to higher credit risk, increasing bank risk aversion, and more binding capital constraints (see Chart C.5).[14]

A more severe downturn could entail more sizeable financial amplification effects

Financial amplification of demand-driven negative shocks to GDP and inflation

(annual growth rates, percentage point deviation from baseline)

Source: DKR model. Note: The monetary policy rate is maintained at the baseline in the simulation.

This scenario exercise implies that macroprudential policy implementation hinges on the degree of financial stress accompanying the projected slowdown in economic growth. To the extent that procyclicality of the banking system remains contained (in line with the yellow bar scenario of Chart C.5), macroprudential policy might consider looking through the economic slowdown and eventually accelerate the build-up of policy space in order to lean against excessive risk-taking which may arise in a low-yield environment. However, should the adverse economic scenario trigger a reappraisal of risk across financial markets and hamper the credit intermediation capacity of the banking system (as in the financial procyclicality scenarios of Chart C.5), macroprudential policy would tread more cautiously so as to support financial intermediation and lending to the real economy.

Faced with a more protracted economic downturn, macroprudential policy might have to balance deteriorating cyclical conditions with building further policy space and address potential side effects of a pervasive low-yield environment. At the current juncture, an adverse demand shock like the simulations in Chart C.5 might imply a longer duration of exceptionally low interest rates across the maturity spectrum. In such a scenario, a gradual, if moderate, tightening of cyclical macroprudential measures might still be preferable in order to counter banks’ incentives to take on excessive risks and to continue to build up space to safeguard against a stronger downturn down the road.

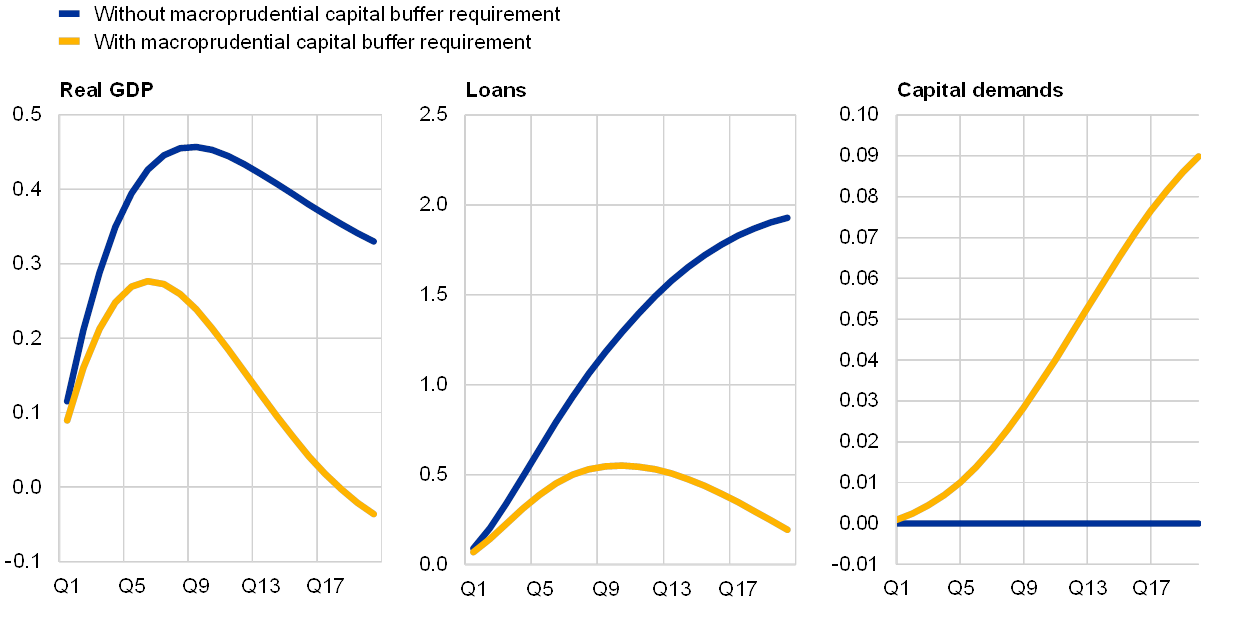

Lower long-term interest rates may induce increased bank risk-taking, while macroprudential interventions may contain it

Impact on real GDP and lending due to a 50 basis point decline in long-term interest rates

(real GDP and loans in percentages, deviation from baseline; capital demands as a percentage point deviation from regulatory ratio)

Source: Model of Darracq, Körner and Papadopoulou (2019).Note: The monetary policy-induced flattening of the yield curve is akin to a central bank asset purchase programme.

The case for continuing the build-up of cyclical buffers in a protracted low interest rate environment will depend on an assessment of banks’ risk-taking incentives. To illustrate the importance of banks’ risk-taking incentives, the model of Darracq et al. (2019)[15] was used to illustrate the case for complementing a monetary policy-induced flattening of the yield curve with tighter macroprudential policy. Chart C.6 presents the macroeconomic impact of a flattening of the yield curve by 50 bps due to lower long-term market interest rates, while the short-term policy rate remains unchanged.

In the absence of macroprudential policy, financial intermediaries would react to the flattening of the yield curve with an increase in risk-taking.[16] The yield curve flattening scenario therefore entails a strong credit easing transmission channel, whereby the effect from a decline in long-term yields is amplified by lower lending rates, which promotes a sizeable and protracted credit origination (see blue lines in Chart C.6).[17] To prevent risk-taking from becoming excessive in this context, a bank capital-based macroprudential rule targeting credit-related imbalances would gradually tighten prudential requirements by around 10%.[18] When banks excessively engage in risk-taking[19], the effectiveness of macroprudential interventions counters financial stability concerns, while largely preserving the macroeconomic stimulus to economic activity (see yellow lines in Chart C.6).

A countercyclical macroprudential policy release may alleviate the burden on monetary policy

Release of 1 percentage point of capital demand under constrained monetary policy

(annual growth rates, percentage point deviation from baseline)

Source: DKR model.Note: The monetary policy rate is maintained at the baseline in the simulation.

However, should the economy precipitate into a more severe downturn scenario where the financial system would be strongly procyclical, a loosening of macroprudential policy could support lending to the real economy. In a situation where the economy would be hit by a more severe shock, the real-financial amplification effects could become large enough to prompt a release of macroprudential buffers, following the original objective of countercyclical macroprudential policies. The magnitude of such a release might nonetheless be constrained by the buffers that have been built up. For illustrative purposes, we simulate the release of 1 p.p. of prudential capital demand over two years in an environment in which financial conditions are tight and assuming unchanged standard and non-standard monetary policy.[20] In this case, Chart C.7 shows that the use of the capital buffer would help ease financial conditions and restore some intermediation capacity in the banking system, with lending rates to non-financial corporations decreasing by 50 bps. This would contribute to an expansionary impact on output and inflation which would also be reinforced through expectation channels, as the perceived constraint on monetary policy would be partly alleviated.

Conclusion

Vulnerabilities in specific jurisdictions or market segments may well warrant macroprudential measures to counter financial imbalances.[21] Nevertheless, countercyclical capital buffers in most euro area countries have not yet been activated, and for those countries which have activated the CCyB, the calibration is limited, leaving little scope for release. This limited macroprudential policy space could be a cause for concern and suggests that barring a material downward revision in the growth outlook a gradual build-up of countercyclical capital buffers remains warranted. However, it should be noted that national specificities have to be taken into account and that this article evaluates the prevailing overall macroprudential trade-off from a more conceptual perspective. This special feature has illustrated that the economic consequences of activating the CCyB in the current environment are expected to be limited, while also highlighting the beneficial effects of creating sufficient macroprudential policy space to allow a meaningful CCyB release to support economic activity through strengthened lending if a severe downturn were to materialise. Finally, while the simulations presented in this special feature are mainly illustrative, it is important to note that the magnitudes are relevant and the policy trade-off warrants a careful evaluation on a case-by-case basis.

- [1]While increases of countercyclical buffers have been seen in some countries, the release of an implemented CCyB has so far not been experienced in the euro area.

- [2]The scenario analysis presented in this special feature is purely hypothetical and illustrative and should not in any way been seen as expectations about future monetary policy and macroprudential policy decisions.

- [3]For an overview, see Macroprudential measures in countries subject to ECB Banking Supervision and notified to the ECB.

- [4]Moreover, in response to rising risks from real estate imbalances in several jurisdictions, numerous macroprudential authorities in euro area countries have introduced borrower-based measures such as limits on debt-to-income, debt service-to-income or loan-to-value ratios.

- [5]See de Guindos, L., “Euro area banking sector – current challenges”, keynote speech at the Annual General Meeting of the Foreign Bankers’ Association, Amsterdam, 15 November 2018.

- [6]Three additional countries have announced that they would introduce the CCyB in the course of 2019.

- [7]For a recent overview of the macroeconomic impact of macroprudential measures, see Cozzi, G., Darracq Pariès, M., Karadi, P., Kok, C., Körner, J., Mazelis, F., Nikolov, K., Rancoita, E., Van der Ghote, A. and Weber, J., “Macroprudential policy measures: Macroeconomic impact and interaction with monetary policy”, ECB technical paper, forthcoming. Covering four ECB macro models, including the one used below, the paper documents that a 1 percentage point (p.p.) increase in capital requirements induces a short-run decline in GDP in the range of 0.15-0.35%.

- [8]Cozzi et al. (op. cit.) show how different modelling assumptions about banks’ behavioural reactions to capital requirements lead to differences in the macroeconomic propagation. Key assumptions relate to how banks manage their voluntary buffers, how flexible they are in adjusting their lending rates, how their funding costs react to higher capital, and how bank dependent their borrowers are.

- [9]Generally speaking, real-financial interactions refer to a situation in which the impact of certain shocks is amplified through the interplay of various financial variables (such as asset prices, firms’ net worth and the external finance premium) with real variables (such as investment and economic activity). One type of real-financial interaction is the “financial accelerator” mechanism whereby a negative shock hitting firms’ net worth, via its adverse impact on creditworthiness and a higher external finance premium, constrains firms’ ability to borrow. The consequent adverse impact on investment leads in turn to a further deterioration in firms’ net worth and thus to a more severe impact on economic activity. In addition, the procyclicality of the financial system may also be exacerbated by a second, “bank balance sheet” channel, related to bank-specific vulnerabilities in the form of a weak capital position and funding constraints.

- [10]See Darracq Pariès, M., Kok, C. and Rodriguez-Palenzuela, D., “Macroeconomic propagation under different regulatory regimes: Evidence from an estimated DSGE model for the euro area”, International Journal of Central Banking, December 2011, pp. 49-113. The model specification with real-financial interactions comprises the two channels discussed above. First, the model includes financial accelerator mechanisms whereby both firms’ and households’ credit contracts factor in external finance premia which depend on borrowers’ net worth. Second, the model formalises a banking sector that faces capital requirements, is subject to capital adjustment costs, and sets lending rates in a staggered fashion (i.e. sluggish retail rate pass-through). The illustrative analysis shown below is of course dependent on the model specification. However, as shown in Cozzi et al. (op. cit.), the macroeconomic propagation in the DKR model is consistent with other recent macro models.

- [11]The DSGE model, which is estimated on euro area data, enables the decomposition of a number of macroeconomic variables into contributions of various structural shocks, including credit risk and bank-related financial shocks.

- [12]Over the projection horizon, these financial contributions are attributed to financial accelerator factors (related to borrowers’ probability of default and the associated external finance premium), while bank balance sheet factors (related to bank capital and the cost of bank funding) are neutral. This is corroborated by still scarce evidence of bank borrower riskiness, such as the cyclical risk indicator described above. Also, market-based measures of corporate defaults (e.g. expected default frequencies from Moody’s KMV), corporate credit ratings, corporate earnings as well as bank lending standards suggest broadly neutral credit risk perceptions.

- [13]The magnitude of the simulated CCyB rate increase is selected for purely illustrative purposes and neither represents a recommendation for macroprudential authorities, nor necessarily reflects the views of the ECB.

- [14]First, financial accelerator mechanisms imply that the decline in economic activity causes a deterioration in borrowers’ net worth and hence induces higher borrower credit risk and a larger external finance premium. The macroeconomic effects are then significantly larger for both GDP and inflation (see Chart C.5, sum of yellow and green bars). This amplification corresponds to an additional decline of around 0.2 p.p. for GDP growth in 2019 and 0.1 p.p. in 2020. Second, when confronted with higher borrower credit risk, it is assumed that banks increase their capital buffers to account for unexpected losses (calibrated in the model through CRD IV risk-sensitive capital requirements). The banks’ capital constraints amplify further the macroeconomic effects of the initial adverse demand shock (see Chart C.5, dark blue bars).

- [15]Darracq Pariès, M., Körner, J. and Papadopoulou, N., “Empowering central bank asset purchases: The role of financial policies”, Working Paper Series, No 2237, ECB, 2019.

- [16]As highlighted above, the overall capital position of euro area banks on average is currently fairly robust. Nevertheless, going forward in an environment of low interest rates, banks may counteract downward pressure on bank profitability and their ability to internally generate capital by increasing risk-taking behaviour. In the model, this effect is captured by the fact that when banks operate under limited liability risk-shifting activities help avoid breaching regulatory requirements.

- [17]Bank loans increase by 2% after five years, while the expansionary effect of the scenario on GDP peaks at less than 0.5% after two years.

- [18]This would correspond to an increase in capital demand by 1 p.p. of risk-weighted assets, for a baseline regulatory ratio of 10%. The macroprudential rule in the model reacts to changes in the credit-to-GDP ratio and is calibrated to maximise the model-consistent welfare criteria.

- [19]The determination of when credit origination reflects excessive risk-taking is obviously not straightforward and requires a case-by-case assessment.

- [20]This mimics conditions in which the key policy interest rates have reached the effective lower bound and no further monetary policy actions are taken. It furthermore provides indications of the contributions by macroprudential policy to supporting lending.

- [21]See also Constâncio, V., “Financial stability risks and macroprudential policy in the euro area”, speech at “The ECB and Its Watchers XIX” conference, 14 March 2018.