Published as part of the Financial Stability Review, November 2023.

The smooth absorption of sovereign debt issuance by the financial sector is essential for financial stability. Sovereign bonds are widely used as high-quality liquid assets and their prices serve as benchmarks for the pricing of various financial contracts. This means that the capacity of investors to absorb additional issuance is key for the orderly functioning of sovereign bond markets. Market conditions may have been impacted by reduced demand for government bonds as net purchases of sovereign debt by the Eurosystem came to a halt at the end of June 2022.[1] At the same time, the supply of government bonds is expected to remain high. Against this background, this box proposes a framework for assessing the potential challenges to financial stability related to the limits of the absorption capacities of different sectors active in sovereign bond markets.

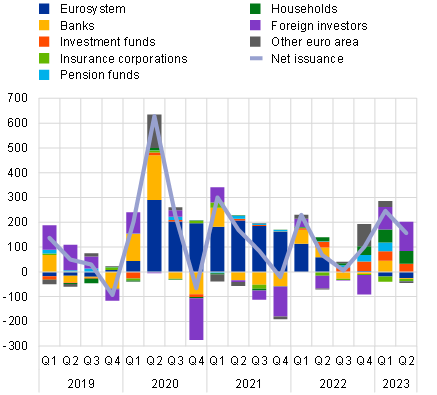

Chart A

Positive net sovereign debt issuance has been absorbed smoothly, with banks’ sovereign bond holdings mostly remaining at historical lows relative to their capital

a) Newly issued debt securities by euro area sovereigns and purchases by sector | b) Bank holdings of euro area sovereign bonds relative to total Tier 1 capital, by holder country |

|---|---|

(Q1 2019-Q2 2023, € billions) | (Q4 2014-Q2 2023, percentages) |

|  |

Sources: ECB (SHS, CSDB, supervisory data) and ECB calculations.

Notes: Panel a: “Other euro area” includes all other euro area sectors. Panel b: based on a balanced sample of 96 euro area significant institutions at the highest level of consolidation. “Other” includes Estonia, Cyprus, Lithuania and Malta. Spanish data are partly distorted by a merger which took place between significant institutions in 2021.

Newly issued government debt has been absorbed smoothly so far in 2023, despite the absence of net central bank purchases. During the first half of the year, banks, investment funds, pension funds and households continued to purchase euro area sovereign bonds, while insurance corporations slightly reduced their exposures (Chart A, panel a). At the same time, foreign investors recommenced taking exposures towards euro area sovereign debt.[2] While euro area banks have recently increased their sovereign debt holdings, overall exposures to euro area sovereigns relative to their regulatory capital remained, on average, at multi-year lows as of mid-2023 (Chart A, panel b).

Sovereign debt absorption patterns in 2023 have been in line with empirical evidence, which suggests that investors tend to increase their bond purchases when yields rise.[3] Demand elasticities in respect of bond yields – which change inversely with prices – tend to be lower for lower-rated sovereign debt (Chart B, panel a). The analysis provides causal evidence that if sovereigns issue large amounts of debt, the absorption of such debt will take place at relatively higher yields. Higher yields may have played a key role in attracting foreign investors, who tend to be especially yield-sensitive, back to investing in higher-rated sovereign debt (Chart A, panel a). By contrast, households tend to show relatively high demand for the debt of lower-rated countries when yields on such debt increase and interest rates on deposits rise gradually.

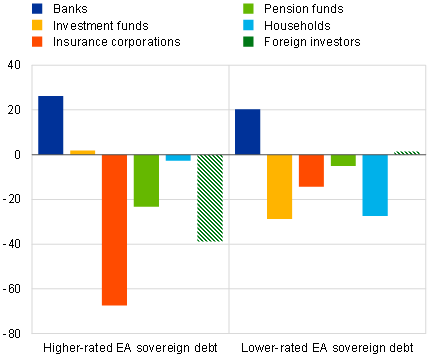

Chart B

Rising euro area yields provide an incentive to absorb an increased net supply of sovereign bonds, while greater financial market uncertainty reduces absorption capacity for most financial sectors

a) Estimated changes in nominal bond holdings after a 1 percentage point increase in yields | b) Estimated changes in nominal bond holdings after a 1% increase in financial market uncertainty |

|---|---|

(Q2 2014-Q4 2022, € billions) | (Q2 2014-Q4 2022, € billions) |

|  |

Sources: ECB (SHS, CSDB) and ECB calculations.

Notes: Bars show estimated absolute changes in sectoral holdings due to a change in yields or in uncertainty. Estimates are obtained from separate regressions for each euro area sector and asset rating class where the dependent variable is the log of nominal bond holdings. Absolute changes are calculated from Q3 2022 levels. Shaded bars indicate statistically insignificant coefficients. “Lower-rated EA sovereign debt” refers to debt issued by euro area countries with a credit rating below AA- (Ireland, Greece, Spain, Italy, Cyprus and Portugal). The sample includes observations between Q2 2014 and Q4 2022. All regressions include a constant, security and holder area fixed effects, yield to maturity, US ten-year yields to proxy returns on alternative foreign assets and “financial market uncertainty”, as measured by the VSTOXX volatility index. Yield to maturity is instrumented by high-frequency yield data on ECB Governing Council meeting dates taken from Altavilla, C. et al., “Measuring euro area monetary policy”, Journal of Monetary Economics, Vol. 108, December 2019, pp. 162-179.

The absorption capacity of non-bank investors tends to decrease in times of elevated financial market uncertainty. Except for banks, all sectors tend to reduce their exposures to euro area sovereign debt when market volatility rises. Volatility often coincides with higher liquidity needs, such as those experienced due to investor outflows, and comparatively risk-averse sectors, such as insurers, may show a stronger reduction in sovereign bond holdings (Chart B, panel b).[4]

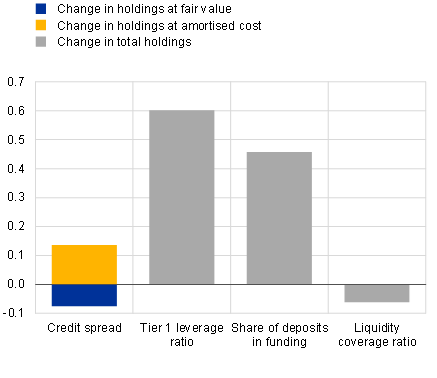

Accounting regimes and leverage requirements influence the capacity of banks to absorb sovereign debt. Unlike most institutional investors, banks can place sovereign bonds in their amortised-cost portfolios to lock in yields. As long as the credit risk of these bonds remains low, this accounting method reduces the volatility of banks’ profits and regulatory capital. This allows banks to invest in sovereign bonds in periods of high market uncertainty, while their aggregate holdings do not seem to be sensitive to yield levels.[5] However, holding government debt at historical values can create a gap between a bank’s economic value and its book value, which could render it vulnerable to confidence shocks. Moreover, a low Tier 1 leverage ratio reflects a bank’s weak financial health and limited balance sheet capacity, and is found to be linked to lower purchases (Chart C, panel a). Nonetheless, this constraint may have been less binding recently than in the past, given the low level of banks’ sovereign bond holdings (Chart A, panel b). A high liquidity coverage ratio indicates that banks have limited need for liquid assets and is associated with lower net purchases of sovereign debt.

Chart C

Banks’ absorption capacity depends on regulatory metrics, while they compensate for other financial investors in times of elevated market volatility

a) Coefficients of a regression of quarterly nominal bank holdings at the group-bond-portfolio level on selected variables | b) Model prediction of sectoral absorption and yield changes after higher issuance announcement and financial market volatility shock |

|---|---|

(Q1 2016-Q4 2022, percentages) | (left-hand scale: percentages, right-hand scale: percentage points) |

|  |

Sources: ECB (SHS, CSDB, supervisory data), Bloomberg Finance L.P. and ECB calculations.

Notes: Panel a: all coefficients are significant at (at least) the 5% level. The dependent variable is the logarithm of nominal amounts held at the group-bond-portfolio level by accounting treatment. Coefficients indicate the percentage change in nominal holdings in response to a one standard deviation increase in the explanatory variables. The credit spread is the bond-specific quarterly yield to maturity over the German government bond yield curve. The coefficient on credit spreads is estimated through an interaction between the accounting treatment and credit spreads. Control variables include an amortised-cost accounting dummy, the logarithm of banks’ total assets and total government bond holdings, GDP growth and the ECB’s deposit facility rate. Panel b: projection of sectoral absorption and expected yield changes using the demand functions estimated in Chart B (panels a and b). The scenario is a hypothetical announcement of additional government bond issuance equivalent to a 1.5% increase in debt outstanding in higher-rated (€90 billion) and lower-rated (€60 billion) countries. The uncertainty shock is proxied by a one standard deviation increase of the VSTOXX volatility index. Projections are calculated on the assumption that the government bond market clears: yields adjust such that total net issuance equals the sum of total purchases or sales of all sectors based on their estimated demand elasticities for given changes in volatility and foreign yields.

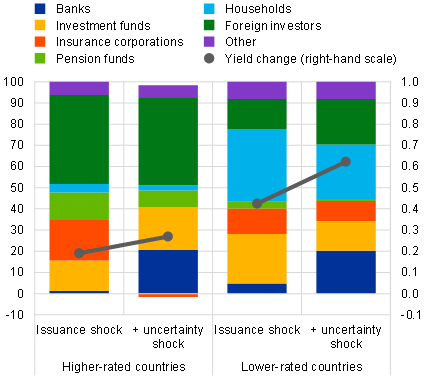

Higher government funding needs, especially in an environment of high market volatility, can imply rising yield levels and spreads. Simulations based on the framework presented in this box[6] (Chart B) show that investors would be willing to absorb additional government bond issuance, equivalent to a 1.5% increase in outstanding debt in the euro area, at a higher yield (Chart C, panel b). They also indicate that the increase in yields would be greater in lower-rated countries than in higher-rated countries. Were such additional issuance to coincide with higher financial market volatility, equivalent to a one standard deviation increase of the VSTOXX volatility index, historical patterns suggest that banks would partially compensate for the reduced demand from other sectors. This would provide support to markets and ensure the ability of sovereigns to place the increased supply of debt. At the same time, it would further increase the close links between the banking system and sovereigns, which could reignite the negative feedback loop between these two sectors. Higher rates on government debt could, in turn, also tighten private sector financing conditions, especially in lower-rated countries. Spreads on lower-rated sovereign debt could rise further, exposing its holders to market risk effects. This box thus highlights the importance of interactions between fiscal policy and financial stability.

The Eurosystem currently has a fully passive run-off of its public sector purchase programme (PSPP), while it intends to reinvest maturing bonds under the pandemic emergency purchase programme (PEPP) until at least 2024.

See the box entitled “Do global investment funds have a stabilising effect on euro area government bond markets?”, Financial Stability Review, ECB, May 2023.

The framework used in this box is an econometric estimation of an asset demand system based on empirical euro area bond holdings data by sector between Q2 2014 and Q4 2022, akin to that in Koijen, R. et al., “Inspecting the mechanism of quantitative easing in the euro area”, Journal of Financial Economics, Vol. 140, 2021, pp. 1-20. See also “The Eurosystem’s asset purchase programme, risk-taking and portfolio rebalancing”, Financial Stability Review, ECB, May 2019.

See Fache Rousová, L. and Giuzio, M., “Insurers’ investment strategies: pro- or countercyclical?”, Working Paper Series, No 2299, ECB, July 2019.

Banks tend to increase their share of holdings measured at amortised cost and reduce their share of holdings marked to market when sovereign spreads are high.

As elasticities are largely calibrated on the low-for-long environment, projections should not be seen as definitive as they may differ in times of lower excess liquidity.