- THE ECB BLOG

Who asks what at the ECB press conference

15 November 2023

When given the chance, what do media ask the ECB about? You might think journalists focus purely on core monetary policy topics, but the reality is more varied, and who is asking plays a role. Here is what we find, and why it matters for the central bank.

The ECB Blog looked at how communication has become a key factor for the transmission of a central bank’s policies in a recent post.[1] Central banks exercise a profound influence on what occurs in the economy through what they say. While banks and financial institutions hang on to their every word as decisions affect financing conditions and the economy, the wider public – which is certainly not less affected by monetary policy decisions - follows the communication of central banks indirectly, if at all.

This is where the news media comes into play. Journalists select and condense information about the activities of central banks for the public. Media coverage thus plays a key role in influencing what the public thinks about monetary policy, and even whether it thinks about it at all.[2]

The ECB regularly offers one occasion during which journalists can address questions directly: the press conference. Eight times a year – immediately after the policy meetings of the Governing Council – the ECB President and the Vice-President are available to answer questions from the media. The Q&A part of the press conference last usually 30 to 45 minutes, during which around 10 journalists get the chance to ask questions. Once they get the floor, the selected journalists are free to ask what they consider appropriate and most interesting.

The press conference is a key communication event: it is closely followed by newspapers, TV and news wires, and it is the basis upon which other media form their own comments and coverage. In this post (and in the ECB Working Paper on which it is based) we take a closer look at who is asking, what kinds of topics they are raising, and we investigate geographic patterns.

Let’s begin with who asks the questions.

Look who’s asking

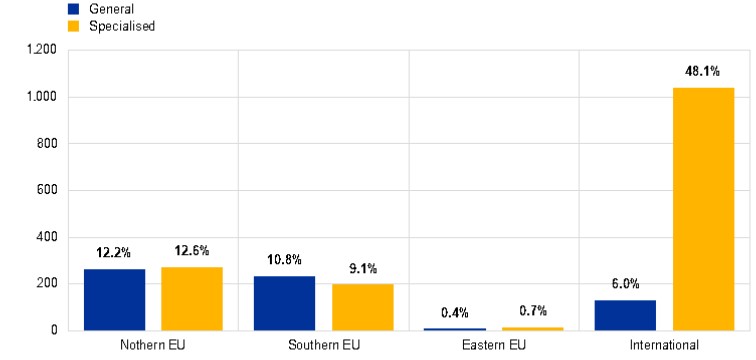

Chart 1 summarises where questions came from across a ten-year period between May 2012 and July 2022. All in all, President Christine Lagarde and her predecessor Mario Draghi answered a total of 2,166 questions posed by 266 journalists representing 124 media outlets.

The lion’s share of these more than 2,000 questions was posed by international media specialising in economic coverage like the Financial Times, Bloomberg, CNBC, Reuters and The Wall Street Journal. Within the European Union, northern and southern EU outlets asked roughly equal shares of questions (25% and 20%, respectively), while enquiries from eastern EU media accounted for only 1% of the total. While the question of why enquiries come from where they do is an interesting one, here we will focus on the distribution as it actually is.

Chart 1

Number of questions asked by region and audience type

y-axis: number of questions, on top of the bars: percentage over the total

Sources: Angino, S., and Robitu, R., (2023), "One question at a time! A text mining analysis of the ECB Q&A session", Working Paper Series, No 2852, ECB

It is not all about monetary policy

We used structural topic modelling (STM) to group the questions into topics. STM is a well-known technique in text analysis. It is based on the idea that each text – in our case each question – is a mixture of different topics, with each topic being a distribution of words. It is then up to the researcher to assign a name to these clusters of words.

We identified nine recurring topics among the journalists’ questions, not all of which are about monetary policy. The topics that do relate to the core of the ECB’s work include “Conventional monetary policy”, “Purchase programmes”, “Inflation and economic outlook” and “Deflation and Zero Lower Bound (ZLB)”. Another frequent topic revolves around the “Banking System”, related to keywords such as the state of the banking union, European banking supervision, and even more specific issues: for instance, non-performing loans, and even the situation of individual banks.

Some questions concern past and potential future crises threatening the existence of the monetary union, and the reversibility of the euro. They are captured by the topic “Sovereign debt crisis and European Monetary Union (EMU)”, which was unsurprisingly very prominent between 2012 and 2015.

“National affairs” captures questions on the economic, financial, and political affairs of Member States. This topic comprises structural reforms and fiscal policy, as well as issues on which the ECB cannot comment, such as national elections or referenda.

We also found two topics connected to the internal processes of the ECB. The first is “Governance”, which is mainly connected to the Governing Council deliberations, including the unanimity, or lack thereof, in their decisions. Other issues captured by this topic are legal ones, for instance the rulings of the German Federal Constitutional court on various ECB programmes (like in 2013 or in 2020). The second operational topic is “Communications”. This topic includes references to forward guidance, a monetary policy tool used to provide information about their future monetary policy intentions, but also comprises words like “announcement”, “signal” and “minutes”. This, in our view, adds to the evidence of the increasing interest in central bank communications.

The next question is: do journalists from different parts of the euro area and the world ask about the same topics? And do questions from outlets catering for general audiences differ from those for expert audiences?

Paese che vai, usanza che trovi[3]

The topics journalists inquire about differ depending on the geographical sphere of their outlet and on the type of audience they report for.

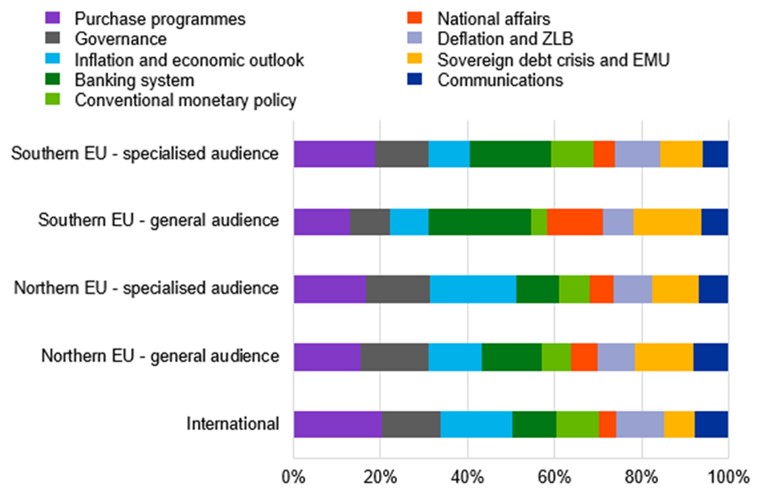

After having identified the nine topics in the questions, we move onto the differences across media types. We consider five outlet groups: “Northern EU – general audience”, “Northern EU – specialised audience”, “Southern EU – general audience”, “Southern EU – specialised audience”, and “International”. Virtually all outlets in the international group specialise in economics and finance so there is no need to differentiate audiences.

What do we find? First, international media tend to focus on technical topics related to monetary policy more than national outlets. In Chart 2, these are the topics like “Purchase programmes”, “Conventional monetary policy”, and “Deflation and ZLB” – more pertinent for expert audiences than the wider public.

Chart 2

Estimated topic proportions by region and audience

Percentage

Sources: Angino and Robitu (2023).

At the same time, international outlets ask very little about national affairs. The share of their questions that these outlets devote to the topic is 8 percentage points smaller than the equivalent share for national media targeting the wider public, in both the Northern and Southern EU groups. This finding suggests that general audiences are more interested in national affairs than in abstract and technical areas of the ECB’s activities like unconventional monetary policy.

The sovereign debt crisis (yellow in the chart) also features more in the questions of general audience outlets. This topic is especially prominent in Southern EU outlets.

The “Banking System” topic (dark green in the chart) is also very salient in the South. In fact, outlets in that region devote a share of their questions to this topic that is between 8 and 14 percentage points larger than that devoted by outlets elsewhere. This appetite for banking supervision topics squares with evidence from other research on the matter.[4] Why might this be? While this is beyond the scope of our analysis, the banking crises of recent decades and the subsequent reforms in Europe’s south may be an important clue.

Coverage of the “Governance” and “Communications” topics, meanwhile, does not change much across different media spheres.

What about differences between general and specialised audience outlets? They are especially important in the Southern EU group. Specialised outlets in the South tend to be quite similar to international outlets. In the Northern EU group, however, the most sizeable difference is in the “Inflation and economic outlook” topic (light blue). The share of their questions that specialised outlets devote to this topic is 8 percentage points larger than the share devoted to it by general outlets.

So what?

When they have the chance, journalists don’t just ask the ECB about its monetary policy. They often stray into topics well beyond what is usually considered the main role of a central bank. What exactly they focus on depends on their geographical scope and the type of audience they cater to.

Outlets targeting the wider public want to focus on more domestic, political and vivid issues that attract the public’s interest. So the ECB faces a trade-off. By granting questions to these outlets, it can broaden the discussion and speak on topics close to citizens’ hearts. The risk, on the other hand, is being confronted with sensitive issues lying beyond the scope of its mandate.

The views expressed in each blog entry are those of the author(s) and do not necessarily represent the views of the European Central Bank and the Eurosystem.

For further info see also Blinder, A., et al. (2008), "Central bank communication and monetary policy: A survey of theory and evidence", Working Paper Series, No 898, ECB or Assenmacher, K., et al. (2021), "Clear, consistent and engaging: ECB monetary policy communication in a changing world", Occasional Paper Series, No 274, ECB.

According to the latest Knowledge and Attitudes survey, whose fieldwork took place in Autumn 2022, 75% of respondents in the euro area have heard about the ECB on television, 45% via printed press, 40% via online press, 37% on radio, and 29% via at least one social media platform.

Italian proverb referring to how different countries have different customs, broadly equivalent to “when in Rome, do as the Romans do”.

See for instance, ECB communication with the wider public.