- THE ECB BLOG

The provision of euro liquidity through the ECB’s swap and repo operations

Blog post by Fabio Panetta and Isabel Schnabel, Members of the Executive Board of the ECB

19 August 2020

Swap and repo lines are well-established instruments in central banks’ toolkits. Since the global financial crisis they have increasingly been employed as stabilising tools in times of stress in global financial markets. The coronavirus (COVID-19) crisis has once again underscored their importance.

This blog post explains the motivation for the Eurosystem granting non-euro area central banks access to euro liquidity through swap and repo facilities. It argues that liquidity arrangements are essential monetary policy instruments for central banks, and for the Eurosystem in particular. By ensuring that euro funding is available to counterparties outside the euro area, the Eurosystem’s swap and repo agreements help the ECB to fulfil its price stability objective, prevent euro liquidity shortages from morphing into financial stability risks, and support the use of the euro in global financial and commercial transactions. Taken together, this contributes to the smooth transmission of monetary policy in the euro area by preventing a possible undesirable tightening of credit provision in all, or part, of the euro area due to financial turmoil, which benefits the entire European economy and all European citizens.

Importantly, swap and repo lines serve as a backstop that should not compete with, or replace, private funding markets in the provision of euro liquidity to non-euro area residents. The mere existence of precautionary liquidity arrangements has a calming effect on investors, and may help to maintain orderly market conditions. Limited recourse to these facilities by financial market participants should therefore not be interpreted as a sign that they are not needed.[1] In fact, the signalling effect of the ECB being willing and able to provide liquidity in case of need has helped to calm market tensions so that the euro liquidity lines granted as a response to the crisis have not been used so far.

The basic functioning of swap and repo lines

Liquidity arrangements between central banks guarantee access to foreign liquidity through two basic types of operations: currency swaps and repos.

A currency swap between two central banks is a contractual agreement in which the borrowing central bank obtains foreign currency against its own currency, with the promise to reverse the transaction at a pre-specified date, adding the agreed interest cost to the borrowed currency. Swap line agreements are generally stipulated among central banks issuing major currencies. They ensure reciprocal access to each central bank’s currency and are considered to be low-risk transactions.[2] Most of these agreements are currently not in use, or are used only in one direction.[3]

Repo lines are arrangements in which the lending central bank provides access to its currency to another central bank, accepting assets denominated in that same currency as collateral to secure the repayment of the funds by the borrowing central bank. To guard against fluctuations in the collateral value, the lending central bank applies a discount to the value of the collateral posted by its counterparties, also known as haircut. This practice mirrors the application of collateral haircuts in regular monetary policy operations.

Chart 1 illustrates the basic structures of swap and repo liquidity arrangements, using the example of the ECB.

Chart 1

Comparison of the ECB’s swap and repo line arrangements.

Source: ECB.

Note: “EUREP” is the Eurosystem repo facility for central banks. The countries mentioned in the overview of the Eurosystem’s repo line arrangements are only examples to illustrate the functioning of these types of agreements. A double line in the swap lines overview indicates that the agreement is reciprocal.

From the viewpoint of the borrowing central bank, swap agreements are more attractive than repo lines for at least two reasons: First, they allow access to a currency issued by another central bank without having to provide collateral denominated in that currency. Second, the pricing of swap lines is typically more favourable than for repo arrangements.

Both types of operations are used as liquidity backstops in times of strained funding conditions in currency markets. That is, the cost of swap or repo arrangements for the borrowing central bank typically renders them more expensive than normal market funding; they only become attractive when market pricing deteriorates due to stressed conditions, which in turn has a stabilising impact on market conditions.

Traditionally, swap arrangements were often used by central banks – as supplements to their foreign reserves – to intervene in foreign exchange markets.[4] Based on lessons from the Global Financial Crisis, they, together with repo agreements, have increasingly been used to address monetary policy and financial stability concerns.[5] Today, major central banks provide swap and repo agreements mostly to alleviate funding strains in their own currency experienced by financial institutions in the jurisdiction of the borrowing central bank.

The role of US dollar and euro liquidity facilities

Given its importance in global financial markets, swap and repo agreements amongst central banks are predominantly denominated in US dollars.

A deterioration of US dollar funding conditions may create difficulties for non-US commercial banks or corporates to fulfil their US dollar payment obligations. The possibility to obtain US dollar funding from the Federal Reserve, through the country’s own central bank, acts as a liquidity backstop, preventing an excessive tightening of credit provision. It thus ensures that the real economy is shielded from strained conditions in US dollar funding markets and avoids possible instability waves from the domestic to the international market.

The COVID-19 crisis is a case in point. At the onset of the crisis, conditions in US dollar funding markets worsened rapidly. Elevated risk aversion led market participants around the world to try to raise their US dollar holdings. The cost of short-term borrowing in US dollars increased sharply, also for market participants in the euro area (see Chart 2).[6] In a concerted move, the Federal Reserve, the ECB and four other major central banks[7] responded by enhancing the provision of US dollar liquidity through their standing US dollar liquidity swap line arrangements.[8] The cost of this swap facility was set significantly below the stressed market conditions prevailing in March. This measure eventually improved market sentiment, resulting in a considerable drop in the costs of US dollar funding.

Chart 2

US dollar funding costs during the COVID-19 crisis (left-hand scale: basis points; right-hand scale: USD bn).

Source: MMSR, Bloomberg, ECB calculations.

Note: Spreads are calculated using transaction data expressed as spreads to market overnight index swap (OIS) rates.

Latest observation: 14 August 2020.

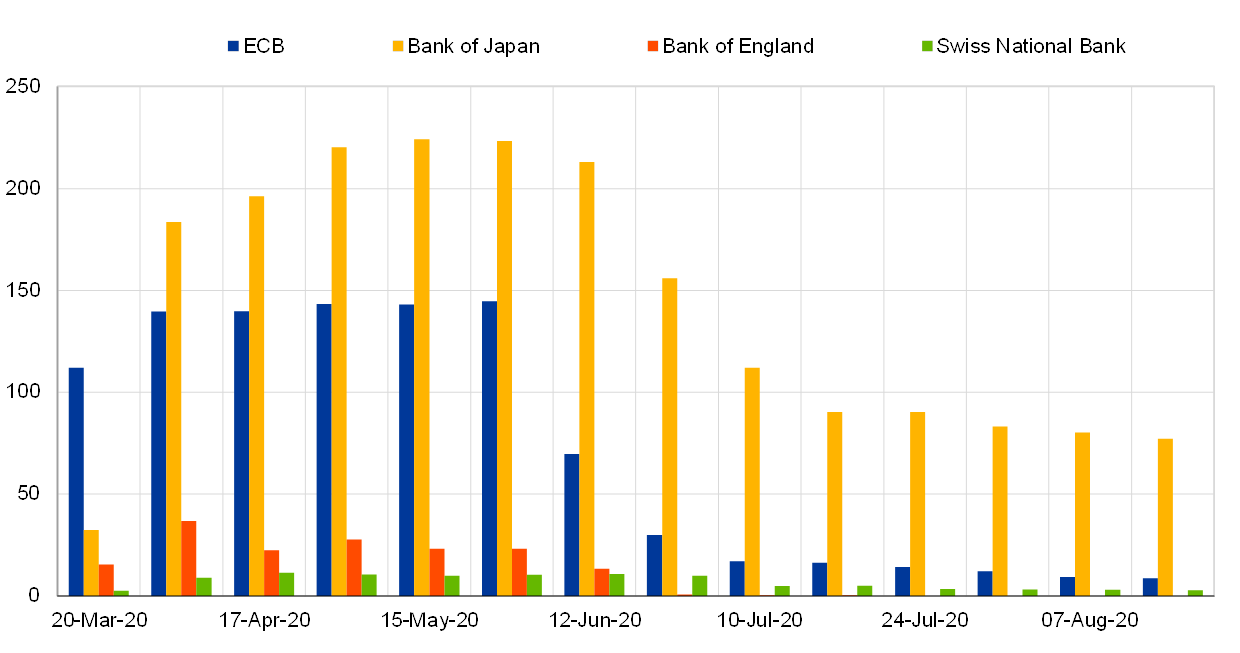

The actual use of liquidity facilities differed widely across central banks, depending on prevailing market conditions. Chart 3 illustrates the evolution of the outstanding amount of US dollar liquidity taken up by several central banks under the standing swap line agreement with the Federal Reserve since the peak of the COVID-19 crisis.

Chart 3

Outstanding amounts in US dollar operations for selected central banks (USD bn).

Source: Official websites of selected central banks

Latest observation: 14 August 2020.

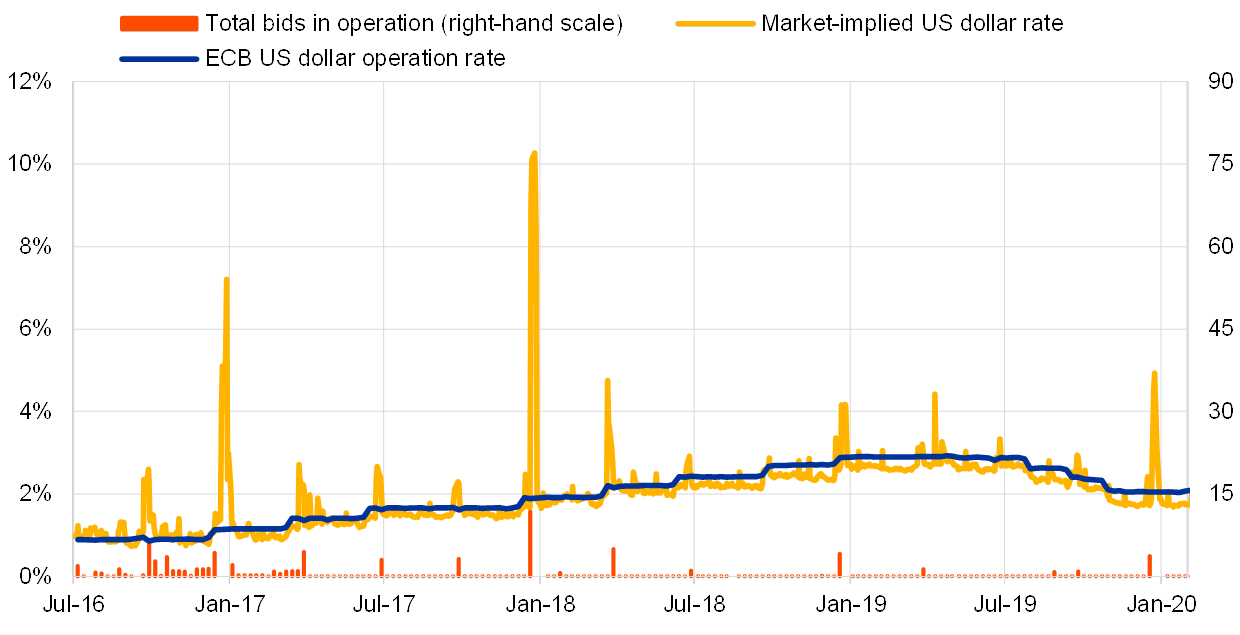

The use of liquidity lines is not limited to crisis periods. One typical feature of US dollar funding markets is the occurrence of liquidity squeezes at the end of each quarter,[9] when market participants are usually less inclined to offer short-term US dollar funding to counterparties. Hence, as the end of a quarter approaches, market rates increase significantly and the pricing of US dollar operations provided by the domestic central bank on the basis of the standing swap line facility with the Federal Reserve becomes more favourable than the prevailing market rate. As a result, the use of the swap facility typically peaks at the end of each quarter, when many market participants are facing difficulties in obtaining short-term currency funding (Chart 4). In such circumstances, just as in times of severe market disturbance, liquidity arrangements between central banks prove to be effective instruments for reducing financial institutions’ liquidity risk and backstopping their funding needs.[10]

Chart 4

Use of the Eurosystem’s US dollar swap liquidity over time.

Source: Bloomberg and ECB calculations.

Notes: The market-implied US dollar rate is derived from the FX swap market, which is the market segment where most non-US banks obtain funding in US dollars. The ECB US dollar rate is based on the OIS rate, and is typically higher than the market rate, provided that funding markets are functioning properly, but remains lower than the market rate in times of market stress.

Latest observation: 31 January 2020 (latest data intentionally excluded to abstract from the effect of the COVID-19 pandemic on funding conditions, as illustrated in Chart 2).

Besides US dollar facilities, liquidity arrangements in euro are playing an increasing role. Already in 2013, the Eurosystem concluded a bilateral currency swap agreement with the People’s Bank of China, reflecting the deepening trade and investment relationship between China and the euro area.

To counter potential market dysfunction in the context of the COVID-19 pandemic, the Eurosystem swiftly reactivated its previous swap line agreement with the Danish National Bank, and set up new precautionary swap line agreements with the Croatian National Bank and the Bulgarian National Bank. In addition, the Eurosystem set up bilateral repo agreements with several other non-euro area central banks (see Chart 1), such as the National Bank of Romania, the Bank of Albania, the National Bank of Serbia and the Hungarian National Bank.

To further broaden the access to the Eurosystem’s liquidity arrangements, the ECB Governing Council recently established the Eurosystem repo facility for central banks (EUREP), which provides a precautionary backstop facility to address euro liquidity needs that might arise outside the euro area.

While markets have calmed somewhat, the overall economic situation and outlook still remain fragile. The establishment of EUREP as a precautionary facility will help to address potential market dysfunctions in case of unfavourable pandemic-related developments, such as a second wave of infections. Under this facility, euro liquidity is accessible to a broad range of non-euro area central banks, in exchange for euro-denominated marketable debt securities issued by euro area central governments and supranational institutions. Like the ECB’s other pandemic-related measures, EUREP is temporary in nature and will be available until June 2021, or longer if an extension is decided upon.

The ECB’s motivation for setting up liquidity arrangements

By providing a backstop, the euro liquidity facilities alleviate strained funding conditions and reduce funding costs for banks in the receiving central bank’s jurisdiction.[11] This at the same time generates advantages for the ECB: it helps to prevent forced asset sales by receiving central banks, mitigates spillover effects and further strengthens the role of the euro in international financial markets. By addressing risks of market dysfunction and liquidity shortages, the liquidity facilities support the smooth transmission of monetary policy in the euro area.

1. Preventing forced asset sales

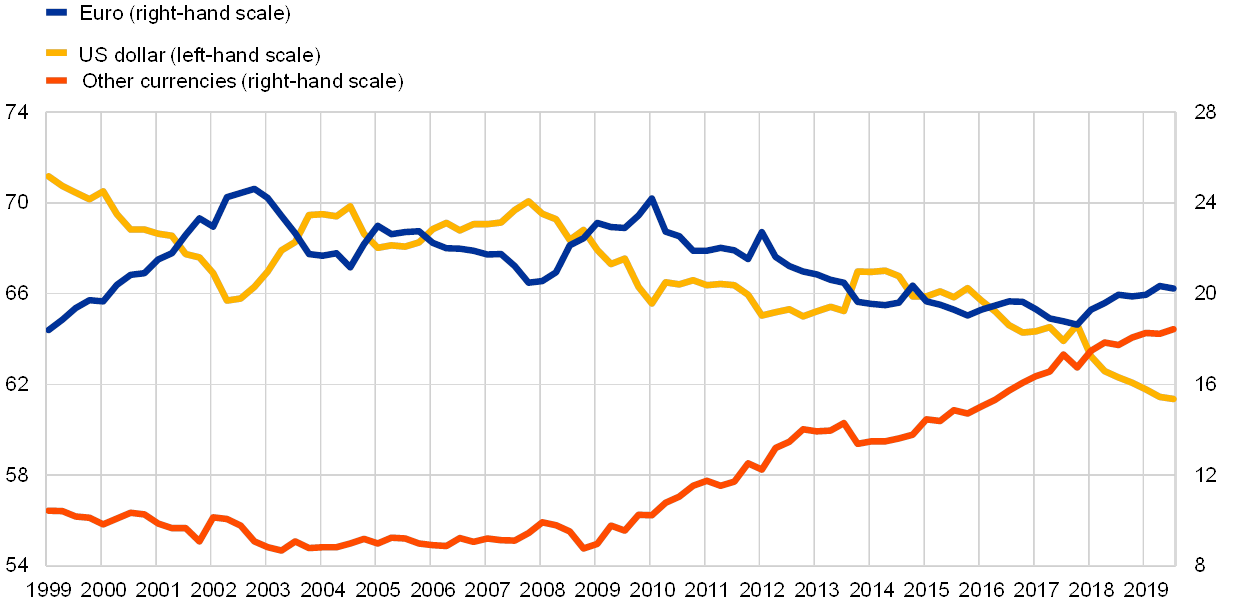

In periods of heightened financial market stress, such as the COVID-19 pandemic or the global financial crisis[12], funding conditions in foreign currency may deteriorate rapidly due to rising risk aversion. As a consequence, market participants may find it difficult to obtain sufficient liquidity in foreign currency to fulfil their payment obligations. Chart 5 shows that a substantial proportion of the foreign reserve holdings of non-euro area central banks is denominated in euro, including sovereign bonds issued by euro area countries. This reflects the important role of the euro in global financial transactions.

Chart 5

Developments in the shares of selected currencies in global official holdings of foreign exchange reserves.

(percentages; at constant Q1 2020 exchange rates)

Sources: IMF and ECB calculations.

Note: The latest observation is for the first quarter of 2020.

In the absence of a liquidity arrangement with the Eurosystem, tensions in euro funding markets may force a non-euro area central bank to sell part of its euro-denominated foreign reserve holdings to provide euro liquidity to its domestic counterparties. If many counterparties rush for euro liquidity at once, several non-euro area central banks may have to simultaneously engage in broad-based asset sales, which may have a negative price impact on euro area bond markets. Liquidating holdings at a discount could result in self-reinforcing “fire sale” dynamics that would lead to abrupt movements in the prices and yields of euro area sovereign bonds.

As sovereign bond yields are often used as a reference for pricing loans to businesses and households, disruptions in sovereign bond markets could adversely affect the funding conditions for the real economy in the euro area. Differences in how asset sales by non-euro area central banks affect the bonds issued by individual Member States could also increase the risk of fragmentation, thereby impairing the smooth transmission of monetary policy to all parts of the euro area.

The establishment of formal liquidity arrangements between the Eurosystem and non-euro area central banks addresses this market dysfunction at its root. Note that even small reserve holders might adversely affect the market conditions for specific euro area sovereign bonds in periods of low market liquidity. This motivates the provision of euro liquidity to a broader set of non-euro area central banks through the temporary repo framework under EUREP in response to the pandemic.

2. Mitigating spillover effects

The existence of liquidity arrangements also reduces the risk of spillover effects across jurisdictions, including through global confidence effects. The euro area’s strong financial and trade interlinkages with other economies imply that spillover and spillback effects can magnify the impact of an economic shock on funding conditions and the economy.[13]

Moreover, market turmoil in other markets can entail risks for euro area financial institutions. Even if exposures are relatively small on an aggregate basis, specialised financial institutions may have a high exposure to certain geographic markets outside the euro area. Through such interconnections, impaired market conditions in these jurisdictions could affect funding markets in the euro area. A broad network of liquidity arrangements can help to interrupt such contagion and confidence effects.

3. Strengthening the role of the euro

The smooth functioning of liquidity arrangements can enhance the euro’s international role, consistent with the objective set by euro area leaders.[14] The case and conditions for strengthening the euro’s role in international financial markets were outlined by Fabio Panetta in a recent ECB blog.

The possibility to stipulate swap and repo lines in euro with the Eurosystem constitutes an important liquidity backstop to non-euro area countries that extensively use the euro for financial and commercial transactions. By providing an effective backstop to private currency markets, a broad framework of reliable central bank liquidity arrangements diminishes the risk of fluctuations in euro funding costs. This increases the attractiveness of financial and commercial contracts based on the euro. Empirical evidence shows that swap lines trigger portfolio inflows from the recipient-country banks into assets denominated in the currency of the central bank providing liquidity.[15] As a result, liquidity arrangements contribute to enhancing confidence in the providing country’s asset markets, while supporting financial stability globally.[16]

Effective liquidity arrangements complement other policy initiatives at European level that also contribute to boosting the euro’s global standing and ensure that all its members share in its advantages. For example, the Eurosystem’s liquidity arrangements and the recovery package agreed by EU leaders on 21 July are mutually reinforcing. While the liquidity arrangements stabilise euro funding conditions in international financial markets, fiscal measures at EU level help counter risks of fragmentation across the euro area, resulting from the differences in national fiscal responses to the COVID-19 pandemic. Importantly, the recovery package marks a further step towards establishing a European safe asset, a crucial step towards strengthening the role of the euro in global financial markets and establishing a capital markets union in the euro area.

Conclusion

In response to the COVID-19 pandemic, the Eurosystem has substantially expanded its network of swap and repo liquidity arrangements with non-euro area central banks, including through the establishment of the temporary EUREP facility. When funding conditions tighten and liquidity dries up, the provision of liquidity lines by major central banks can improve market functioning by offering a liquidity backstop, thereby reducing funding risks, preventing fire sales and effectively containing the risk of market contagion. Importantly, in order to be effective, these liquidity arrangements do not need to be actually used. A limited take-up may indicate that these facilities are working as intended.

For the Eurosystem, liquidity arrangements have the additional role of countering the risk of fragmentation across the euro area. As tensions in currency funding markets may affect national sovereign bond markets differently, market dysfunctions could present a challenge to the singleness of the Eurosystem’s monetary policy. By broadening the scope of liquidity arrangements with non-euro area central banks, the ECB ensures the smooth transmission of its monetary policy to all parts of the euro area. Providing a reliable backstop in distressed market conditions also raises the euro’s attractiveness for global transactions, thereby fostering its role as a leading international currency.

- This interpretation abstracts from the potential stigma that could be associated with accessing central bank liquidity facilities. During the COVID-19 pandemic, there was, however, no evidence of such stigma effects.

- Currency swaps might also be designed to provide only one currency (as opposed to reciprocal currency access) – typically one of the major global currencies – where the second currency is accepted as collateral. Collateralised swap lines are one notable variant of such an arrangement. These allow for the exchange of currencies between two central banks, with additional collateral posted by the borrowing counterparty in order to protect the lending central bank against fluctuations in the value of the currency issued by the borrowing central bank.

- For example, the Federal Reserve has at the time of writing never drawn its swap line agreements to obtain foreign currency.

- See McCauley, R. and Schenk, C. R. (2020), “Swap innovation, then and now”, VoxEU, 12 April.

- The activation of swap lines between the Federal Reserve and the European Central Bank as well as other major central banks in the global financial crisis in December 2007 played an important role in stabilising market disturbances. See Bahaj, S. and Reis, R. (2018), “Central bank swap lines”, VoxEU, 25 September.

- For a detailed description of the tensions in the US dollar funding market during the COVID-19 crisis, and the role of central bank swap lines in calming US dollar funding tensions, see ECB (2020), “US dollar funding tensions and central bank swap lines during the COVID-19 crisis”, Economic Bulletin, Issue 5.

- Bank of Canada, Bank of England, Bank of Japan and Swiss National Bank.

- A temporary network of bilateral swap lines to provide liquidity to domestic counterparties had already been established in 2011. In October 2013, this swap line network was converted into a permanent network of standing swap lines, which has remained operational ever since.

- This is due to US corporate tax calendar effects, accounting or regulatory rules and funding availability constraints due to a higher issuance of short-term securities.

- For a related discussion, see ECB (2016), “The layers of the global financial safety net: taking stock”, Economic Bulletin, Issue 5, as well as the research cited therein: Goldberg, L.S., Kennedy, C. and Miu, J., “Central Bank Dollar Swap Lines and Overseas Dollar Funding Costs”, Economic Policy Review, Federal Reserve Bank of New York, May; and Coffey, N., Hrung, W.B. and Sarkar, A. (2009), “Capital Constraints, Counterparty Risk, and Deviations from Covered Interest Rate Parity”, Staff Reports, No 393, Federal Reserve Bank of New York, September.

- As shown by Bahaj, S. and Reis, R. (2020) “Central bank swap lines during the Covid-19 pandemic”, Covid Economics, Issue 2, central bank swap lines put a ceiling on deviations from covered interest parity during the pandemic.

- For details on the Eurosystem’s experience with liquidity arrangements during the great financial crisis, see ECB (2014), “Experience with foreign currency liquidity-providing central bank swaps”, Monthly Bulletin, August.

- See, for example, Kohlscheen, E., Mojon, B. and Rees D. (2020), “The macroeconomic spillover effects of the pandemic on the global economy”, BIS Bulletin, No 4, Bank for International Settlements, April.

- See Euro Summit Statement of 13 December 2019.

- See Bahai, S. and Reis, R. (2018), “Central Bank Swap Lines”, CEPR Discussion Paper # 13003, Centre for Economic Policy Research, June.

- See Bahaj, S. and Reis, R. (2020), “Central Bank Swap Lines: Evidence on the Effects of the Lender of Last Resort”.