Published as part of the Financial Stability Review, May 2023.

The financing structure of firms has changed markedly over the last few decades as capital markets and non-bank financial intermediaries have evolved.[1] Bond markets became an important source of credit for firms following the deleveraging of banks after the global financial crisis and the launch of the Eurosystem’s asset purchase programme. As of the third quarter of 2022, they channelled around 20% of total credit to euro area non-financial corporations (NFCs). This box investigates whether or not banks step in when market-based credit declines in the face of increased market volatility and rising interest rates. While large and better-rated firms would benefit the most from such a substitution, smaller and riskier firms may find it harder to access credit as their ability to tap bond markets is more limited and they are more reliant on bank loans.

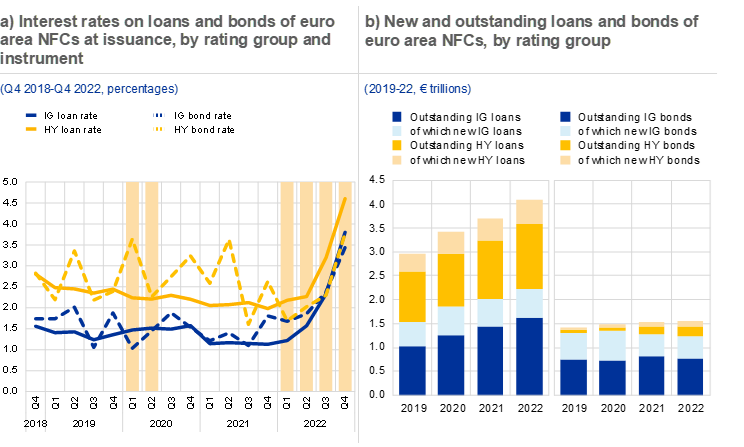

Chart A

Financing costs have increased for firms in the last year, with banks offering cheaper financing than bond markets to better-rated firms

Sources: Dealogic, ECB and ECB calculations.

Notes: IG stands for investment grade; HY stands for high yield. Panel a: loan rates are calculated as the average annualised agreed rate on loans granted to borrowers with a non-null LEI, as reported in AnaCredit. Bond rates are calculated as the average coupon rate of bonds with a fixed coupon. The yellow bars correspond to the outbreak of the pandemic (Q1 and Q2 2020), the start of the war in Ukraine (Q1 and Q2 2022) and the periods of monetary policy normalisation (Q3 and Q4 2022). The maturity profile of bonds and loans for the firms in the sample does not show any significant differences for the two categories, as 50% of outstanding bonds (in terms of nominal value) have a maturity of between seven and ten years, and 50% of outstanding loans (in terms of nominal value) have a maturity of between five and ten years. Panel b: new and outstanding loans also include credit lines, revolving credit and overdrafts, as reported in AnaCredit, while new and outstanding bonds also include medium-term notes, money market instruments and commercial paper, as reported in the ECB’s Centralised Securities Database (CSDB) and Dealogic. Both panels: to preserve consistency between the two samples and to maximise rating availability, we also applied (average) banks’ internal ratings, as reported in AnaCredit, to firms issuing bonds or with outstanding bond financing, even where ratings from credit rating agencies were available.

Banks tend to offer lower rates than bond markets to larger and better-rated firms, but interest rates are not the only factor behind firms’ financial structure decisions. Interest rates have increased markedly in both loan and bond markets in recent quarters, with bond rates being more volatile, particularly at the outbreak of the pandemic, when Russia invaded Ukraine and during the recent monetary policy normalisation (Chart A, panel a). On average, bank loan rates are cheaper than bond rates for better-rated firms in the euro area, while lower-rated firms have recently been able to obtain cheaper credit from the market (Chart A, panel a).[2] During the recent periods of monetary policy rate increases, lower-rated firms could only replace bond financing with loans at a higher cost (the difference averaging around 0.9 percentage points), as bank loans may have been crowded out by large and better-rated firms. Outstanding corporate debt has risen since 2019, driven by strong bank lending (Chart A, panel b).[3] As loans and bonds are not perfect substitutes, firms’ choices of funding sources vary depending on their balance sheet features, the structure of the capital markets in which they are domiciled, and the cost and terms of alternative funding sources.[4] NFCs issuing bonds are, on average, larger and more leveraged. Also, firms are more likely to tap the market if they have issued bonds in the past and if market supply increases or bank credit is constrained.

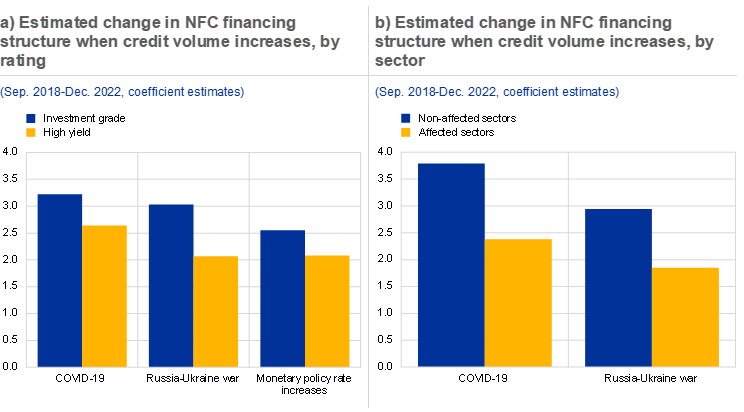

Chart B

Many euro area firms replaced bond funding with bank credit during the market turmoil in 2020 and 2022 and during the recent period of monetary policy normalisation

Sources: Dealogic, ECB and authors’ calculations.

Notes: The charts show the estimated coefficient obtained using a panel regression model where the change in financing structure over two subsequent months is regressed on the change in bond and loan credit volumes, interacted with the periods of analysis. Firms’ financing structure is measured as the share of bank loans in total debt. Panel a: the set of control variables includes firms’ size in t-1, firms’ profitability in t-1 measured as turnover, the difference in firms’ cost of credit in the bond market relative to the loan market, firm-time fixed effects, firms’ demand for loans and bonds and country-level fixed effects. COVID-19 refers to March-April 2020, the Russia-Ukraine war to February-June 2022 and monetary policy rate increases to July-December 2022. Panel b: sectors affected by the outbreak of COVID-19 and the related restrictions in euro area countries include mining, manufacturing, retail and wholesale trade, transport, accommodation, food services, and arts and entertainment. The sectors affected by higher energy prices in 2022 are manufacturing and energy.

Many firms replaced bond funding with bank loans at the start of the pandemic and the onset of the Russia-Ukraine war, but overall credit to riskier firms was crowded out. Euro area firms were using bond and loan financing as complementary sources of credit in 2019 when interest rates were expected to stay low for a long period.[5] In March 2020 the financial conditions in bond markets tightened suddenly as economic uncertainty related to the pandemic increased, while bank lending was supported by government guarantee schemes and loan moratoria. Many NFCs responded by shifting towards bank financing (Chart B, panel a).[6] Bank loans to lower-rated firms increased by 20% while the issuance of high-yield bonds stalled, and better-rated firms borrowed more from banks than lower-rated ones by around 0.6 percentage points. Monetary policy actions helped to improve financial market conditions and bond issuance resumed in the second half of 2020.[7] When Russia invaded Ukraine, firms in those sectors more heavily affected by high energy prices reduced their debt issuance, irrespective of their credit ratings. These firms could not fully replace the reduction in bond financing with an increase in bank loans and borrowed around 1 percentage point less than firms that were less sensitive to energy prices (Chart B, panel b).[8]

Firms have replaced bond funding with bank loans during the recent monetary policy normalisation.[9] The bond rates of investment grade firms have, on average, responded more quickly than bank loan rates to changes in monetary policy. As a result, NFCs have decreased their share of bonds in total debt relative to bank loans, with better-rated firms borrowing 0.5 percentage points more from banks than lower-rated firms (Chart B, panel a). However, this has not crowded out bank loans to lower-rated firms, which increased by around 2 percentage points.

Bank lending to riskier and smaller firms with limited access to different sources of credit may be crowded out when larger, better-rated firms replace bond issuance with bank loan financing. The ability of euro area firms to switch between bank loans and market-based finance varies across firms and depends mainly on their creditworthiness and size. This can have significant financial stability implications. Under normal circumstances, better-rated and larger firms benefit the most from a stable supply of loans and bonds and may have incentives to increase their leverage by relying on both sources of financing jointly. In periods of market distress, a reduction in corporate bond credit leads investment grade and large firms to substitute bonds with loans, partially crowding out bank lending to high-yield and smaller firms which do not have access to bond markets.

For trends in the external sources of funding of euro area firms, see “Non-bank financial intermediation in the euro area: implications for monetary policy transmission and key vulnerabilities”, Occasional Paper Series, No 270, ECB, 2021, and the article entitled “Firm debt financing structures and the transmission of shocks in the euro area”, Economic Bulletin, Issue 4, ECB, 2022.

See Rajan, R., “Insiders and Outsiders: The Choice between Informed and Arm’s-Length Debt”, The Journal of Finance, Vol. 47, Issue 4, September 1992.

The use of short-term credit through credit lines, revolving credit and commercial papers also intensified in 2022, relative to longer-term loans and bonds.

See Crouzet, N., “Credit Disintermediation and Monetary Policy”, IMF Economic Review, International Monetary Fund, Vol. 69, No 1, 2021, pp. 1-67.

At the same time, large firms were substituting loans with bonds between 2014 and 2019. See the box entitled “Market-based finance for corporations – the demand for and supply of credit”, Economic Bulletin, Issue 4, ECB, 2022.

This evidence is consistent with De Fiore, F. and Uhlig, H., “Corporate Debt Structure and the Financial Crisis”, Journal of Money, Credit and Banking, Vol. 47, No 8, 2015, pp. 1571-1598.

Empirical evidence shows some complementarity between NFC loans and bonds in the euro area, when the effects are estimated over a longer time period. See the article entitled “Firm debt financing structures and the transmission of shocks in the euro area”, Economic Bulletin, Issue 4, ECB, 2022.

The results are obtained using firm-level data from AnaCredit, Dealogic and CSDB, controlling for firms’ demand for bonds and loans.

This evidence is consistent with the article entitled “Substitution between debt security issuance and bank loans: evidence from the SAFE”, Economic Bulletin, Issue 1, ECB, 2023.