Automatic fiscal stabilisers in the euro area and the COVID-19 crisis

Published as part of the ECB Economic Bulletin, Issue 6/2020.

1 Introduction

Authorities in the euro area have taken exceptional policy action to stem the economic fallout from the coronavirus (COVID-19) pandemic. The ECB committed to using the full potential of the monetary policy tools at its disposal within its mandate. At the same time, euro area governments implemented sizeable packages of fiscal measures, consisting, in particular, of discretionary fiscal stimulus measures. As of end-May 2020, the discretionary fiscal measures by themselves amounted to about 3.25% of GDP at the aggregate euro area level.[1] Furthermore, leaders at the European level have agreed on a major recovery plan embedded in the EU budget. When implemented, the EU budget will temporarily almost double in size to around 2% of GDP.[2]

In addition to these discretionary measures, automatic fiscal stabilisers in the euro area countries play an important role in cushioning the economic shock caused by the pandemic. Automatic fiscal stabilisers refer to elements, built into government revenues and expenditures, that reduce fluctuations in economic activity without the need for discretionary government actions. Together with discretionary fiscal policy measures, these are especially important in a currency union such as Economic and Monetary Union (EMU), where – alongside the common monetary policy – instruments are needed that address idiosyncratic, country-specific shocks. In principle, automatic stabilisers have the advantage of being timely, targeted and temporary in smoothing the economic cycle. Furthermore, these do not suffer some of the same drawbacks as discretionary fiscal measures, such as the need for measurement of the economic cycle or implementation lags.

This article examines automatic fiscal stabilisers in the euro area and their ability to provide economic stabilisation during the COVID-19 crisis.[3] While the concept is well-established in macroeconomics, the term “automatic fiscal stabilisers” is not used entirely consistently in the literature and may refer to somewhat different concepts, which are presented in Section 2. Estimates made by the European System of Central Banks (ESCB), as presented in Section 3, suggest that automatic fiscal stabilisers are generally sizeable but vary significantly across euro area countries. Box 1 shows that this assessment is also broadly confirmed by other comparable estimates. Even though they are related, the size of automatic fiscal stabilisers should be distinguished from their effectiveness in terms of their impact on reducing fluctuations in economic activity. During the COVID-19 crisis a number of factors may have limited the effectiveness of automatic stabilisers in contributing to macroeconomic stabilisation (Section 4). In this respect, Box 2 provides a model-based quantification of the effectiveness of automatic stabilisers at the euro area level under normal conditions and under conditions akin to the lockdown phase of the COVID-19 crisis. Overall, both the depth and the nature of the COVID-19 crisis provide a strong rationale for additional fiscal measures, as decided and implemented at the national and European level. In this context, the article discusses policy proposals to establish quasi-automatic fiscal instruments that could provide additional timely, targeted and temporary macroeconomic stabilisation for the euro area. The article also reflects on important efficiency considerations over the cycle, and the need to build fiscal buffers in good economic times (Section 5). An overall conclusion can be found in Section 6.

2 Elements of automatic stabilisation in the government budget balance

Faced with a recessionary shock, governments can provide support to the economy in different ways. Most noticeably, governments can decide to take discretionary fiscal policy measures. Typical discretionary measures include policies to boost household and firm confidence, and consumption and investment opportunities. They may also include, among many others things, tax rate cuts, higher tax allowances, car scrapping schemes and support for private investment programmes. Governments can also decide to provide guarantees (or other forms of implicit and explicit contingent liabilities), e.g. to provide liquidity support to the economy, preventing severe supply side disruptions or contagion through financial channels. Less noticeably, most government revenues, and part of government expenditures, also adjust automatically with the economy cycle and without any specific action from the government. Even less obviously, the government contributes implicitly to mitigating the repercussions of a negative macroeconomic shock by keeping a large part of its expenditure at the budgeted level, and not cutting it in a recession.

Automatic fiscal stabilisers refer to those elements built into the government budget that reduce fluctuations in economic activity without the need for discretionary actions. The first source of automatic stabilisation is found in those elements of the government budget that react to the economic cycle. We will refer to these components of the budget balance as cyclical elements of the automatic fiscal stabilisers. The second source is found in non-cyclical components of the budget balance (mainly in the form of public spending) which are characterised by relatively high inertia and can also be considered to provide automatic stabilisation. We will refer to these components of the budget balance as the non-cyclical, implicit elements of the automatic fiscal stabilisers.[4] While this article will focus on recessionary shocks – such as the one presented by the COVID-19 crisis – in principle automatic fiscal stabilisers operate in both directions. They cushion the macroeconomic impact of a downward (e.g. recessionary) as well as an upward (e.g., overheating) shock. These two sources of automatic stabilisation are examined in more detail below.

- First, elements of automatic fiscal stabilisation in the government budget balance are cyclically-sensitive budgetary items. These are the items that closely follow their macroeconomic bases – the macroeconomic variable that determines government revenue and spending; for example, the number of unemployed persons in the case of unemployment benefits – and react immediately to a shock. On the revenue side, the drop in tax and social security contributions, alongside increasing transfers to households, are the source of automatic stabilisation that most economists will have in mind. However, this drop in revenues can be further broken down into two elements: (i) the proportional drop in revenues with respect to GDP as taxes and contributions of households and firms drop in line with their income – this can reduce economic fluctuations compared to, for example, a counterfactual scenario with a poll or lump-sum tax;[5] and (ii) the progressivity of the tax system typically implies that revenues decline in excess of the drop in GDP, e.g. as households fall into a lower tax bracket in the personal income tax system. Tax progressivity is considered to have an important stabilisation effect on demand in case of a negative income shock, as personal income taxes play an important role in reducing volatility of disposable income.[6] On the expenditure side, unemployment benefits represent the most relevant automatic stabiliser of this type.[7]

- Second, the budget balance also provides implicit stabilisation via non-cyclical items, particularly on the spending side. Governments typically do not significantly reduce their spending level (i.e. in millions of euro) in times of a temporary economic downturn. This inertia in government expenditure helps stabilise total output in a downturn because the bulk of government expenditure already approved – such as wages, transfers or intermediate consumption – does not react to the drop in output. In the counterfactual, the government would reduce its expenditure to keep its budget balance unchanged in reaction to the economic slowdown. This would imply no stabilisation. The size of the government is thus often considered a proxy for the size of automatic fiscal stabilisers in a country. It should be noted that the size of the government also contributes to dampening an overheating economy, given that budgeted public expenditures are not immediately increased in times of an economic upswing. Research shows that there is a negative relationship between government size and business-cycle volatility for the Organisation for Economic Co-operation and Development (OECD) economies.[8]

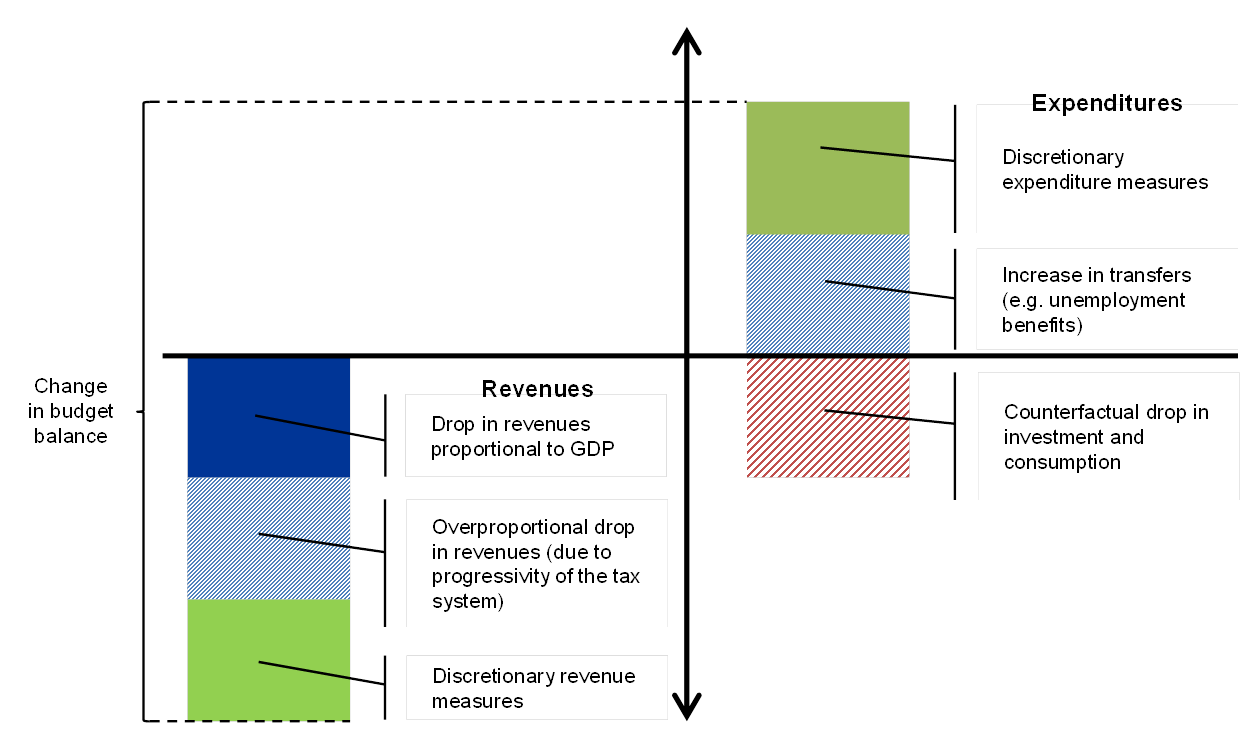

An illustration of these stabilising elements in the government budget balance is presented in Chart 1. Governments provide fiscal support to the economy, which is broadly captured ex post by the change in the general government budget balance as a share of GDP. This total fiscal support through the budget can be decomposed into two main categories: the discretionary and the cyclical components of the budget balance (green and blue bars respectively).[9] The non-cyclical elements of the automatic fiscal stabilisers – which act as a stabilisers vis-à-vis a counterfactual drop in government investment and consumption – are not part of the change in the budget balance (red bar).

Chart 1

Elements of fiscal stabilisation in the government budget balance in reaction to a negative macroeconomic shock

Source: Own illustration.

Notes: The sum of green bars reflects discretionary fiscal policy measures. The sum of blue bars reflects the cyclical elements of automatic fiscal stabilisers. The red bar is a counterfactual scenario where the government reduces investment and consumption during an economic downturn. The size of the bars is illustrative.

Automatic fiscal stabilisers are considered to be particularly efficient in cushioning country-specific shocks. As demonstrated during the COVID-19 crisis, discretionary fiscal measures can provide quick support in times of crisis, helping to stabilise expectations. However, discretionary measures – especially those with the largest positive long-term impact (such as productive government investment) – may only be implemented with lags. Furthermore, governments may find it difficult to reverse spending hikes after the crisis subsides. Automatic fiscal stabilisers have the advantage of providing fiscal support: (i) as the downturn occurs and without delay (this is the “timely” aspect); (ii) to those entities that require it most (the “targeted” aspect); and (iii) only for as long as is needed (the “temporary” aspect).

While automatic fiscal stabilisers provide benefits in terms of macroeconomic stabilisation, they may also have costs in terms of economic efficiency. As described above, large automatic fiscal stabilisers are associated with large government revenues and expenditures as a share of GDP and a progressive tax system. As pointed out by the literature, since taxes generally distort economic decisions, very large governments can be a drag on (potential) growth, especially when accompanied by high public debt ratios. When assessing tax structure effects on output volatility, there is evidence that for high ratios of total taxes to GDP further tax increases can be economically destabilising.[10] Moreover, automatic stabilisers can cushion temporary shocks, while their effectiveness is limited when it comes to persistent or permanent shocks.[11] In such cases, automatic stabilisers may lead to increasing government debt and induce risks to fiscal sustainability. Other types of measures and policies, especially structural reforms (including on the fiscal side) are needed to deal with these long-term or permanent shocks.

3 Estimating the size of automatic fiscal stabilisers in euro area countries

To estimate the size of automatic stabilisers, a microeconomic, a macroeconomic or a statistical approach can be used.[12] The microeconomic approach estimates the extent to which a shock to household market income translates into a change in disposable income, using micro data on the tax and benefits system. The macroeconomic method additionally takes into account feedback effects and the behavioural responses of economic agents – it quantifies the stabilising impact of fiscal policy on total income. Finally, the statistical approach evaluates the automatic stabilisation effect of a budget balance in terms of changes in economic activity. It considers not only stabilisation properties related to the size of the government – as measured by public expenditure ratio – but also direct taxes paid by households, indirect taxes and transfers. The latter approach captures the cyclical component of the budget balance (in percentage of GDP) and is the most widely used approach in institutional fiscal surveillance.

This section focuses on the statistical approach and therefore estimates the size of automatic fiscal stabilisers as the part of the budget balance that automatically adjusts to the economic cycle.[13] The statistical approach can capture both elements of the automatic stabilisers discussed in Section 2. When the elasticities of revenues and cyclical expenditures to the output gap are used, automatic fiscal stabilisers are estimated as changes in cyclical budgetary items.[14] If the focus is shifted to the elasticities of revenues and expenditures as a ratio to GDP (the concept of semi-elasticities[15]), the statistical approach delivers an estimate of the size of automatic fiscal stabilisers, focusing mainly on the stabilising effect of the inert public expenditures and, to a lesser extent, on the other components of a budget balance. These react non-proportionally to the economic cycle, e.g. income tax progressivity induces tax revenues to grow faster than GDP.

The ESCB method of estimating the cyclical component uses the concept of semi-elasticity to gauge the reaction of the budget balance-to-GDP ratio to cyclical conditions.[16] In this approach the budgetary semi-elasticity is measured as the difference between semi-elasticities of revenue and expenditure components. Semi-elasticities of the relevant budgetary categories are estimated considering both a response of the budgetary category to its macroeconomic base and a reaction of the base to the output gap.[17] One of the main novelties of the ESCB method is the incorporation of the lagged response of a budget to macroeconomic shocks. Potential lagged collection of the revenues and lagged responses of macroeconomic bases to the cycle, e.g. a lagged reaction of wages to the business cycle, not only result in a contemporaneous change of the budget balance as a reaction to the economic cycle but also contribute to further adjustments in later years.

According to ESCB estimates, the standardised cumulative size of automatic stabiliser is 0.48 in the euro area but there is a large heterogeneity among the euro area countries (Chart 2).[18],[19] In general, across all countries, the bulk of automatic stabilisation is provided by non-cyclical expenditures, i.e. reflecting spending inertia. The amount of stabilisation is larger in the western European countries such as Belgium or France, while it is noticeably smaller in the central and eastern European countries, e.g. Slovakia or Latvia. The larger size of automatic fiscal stabilisers in western and, to some extent, southern European countries is a consequence of three main factors: (i) larger size of government; (ii) more generous social security system; and (iii) more progressive direct taxes. The generosity of unemployment benefits partly explains the observed cross-country differences in the contribution of this expenditure to the overall semi-elasticity, which is marginal in central and eastern European countries and largest in the case of Belgium. Other aspects of automatic fiscal stabilisers are the progressivity of tax systems and the cyclicality of social security contributions. For example, even if the progressivity of tax systems is comparable among countries, the stabilisation properties of personal income tax could still differ due to the existence of collective wage bargaining, which could increase wage rigidity. Relative stability of wages and employment, as well as a tendency of households to smoothen their consumption over the business cycle, can partly explain the negative impact of cyclical revenues in some countries, such as Germany or Italy.

Chart 2

The size of automatic fiscal stabilisers in euro area countries

Source: ESCB.

Notes: The size of automatic stabilisers is estimated as a semi-elasticity multiplied by a standardised output gap of 1% of potential GDP. Due to the fact that the ESCB method incorporates the lagged response of a budget to macroeconomic shocks and the lagged effect of tax collections, the presented automatic stabilisers are expressed in cumulative terms over three years (T – T+2). The euro area average is indicatively calculated as a weighted average of individual semi-elasticities for all euro area countries, using nominal GDP in 2019.

Automatic fiscal stabilisers during the COVID-19 crisis are expected to be sizeable on in the euro area as a consequence of the significant size of the shock. Automatic stabilisers are forecasted to account for around one-third of the large budget deficit in 2020, namely 2.8% out of 8.5% of GDP. This rises to 5.2% of GDP cumulatively over the 2020-21 period (Chart 3).[20] Most of the size of automatic fiscal stabilisers is accounted for by the inertia of non-cyclical public expenditure, while revenues reduce the overall impact. This is partly explained by lower-than-unity elasticity of social security contributions to output in most euro area countries more than counter-balancing the stabilising effect of the progressivity of income taxes.

Chart 3

The expected size of automatic fiscal stabilisers in the euro area during the COVID-19 crisis

(% of potential GDP)

Source: Eurosystem staff macroeconomic projections for the euro area, June 2020.

Note: The ESCB method of estimating semi-elasticities incorporates the lagged response of a budget to macroeconomic shocks and lagged effect of tax collections. Therefore, the projected output gap cannot be inferred on the basis of values presented in Chart 2 and Chart 3.

In the wake of a severe economic downturn, the precision of the estimated size of automatic stabilisers should be carefully assessed. First, the estimation of the cyclical component relies on one synthetic measure of the business cycle, i.e. the output gap, which is surrounded by uncertainty, notably in real time.[21] Second, the nature of the initial shock may lead to differentiated reaction from the main macroeconomic bases used for the fiscal revenues. Third, as semi-elasticities are estimated based on the past data, these reflect the typical reaction of a general government budget to economic cyclical fluctuations. In the current crisis, the unusual nature of the initial shock, its size and its implication for different macroeconomic variables invite prudency regarding the estimated size of the automatic stabilisers.

Box 1 Comparison of estimates of automatic fiscal stabilisers

The literature offers rather different estimates of the size of automatic stabilisers for the euro area. This box compares the ESCB estimates with those of other studies for both the euro area aggregate and across euro area countries. The results are then put into perspective by both looking at estimates of automatic fiscal stabilisers in the United States, and briefly touching upon differences in the US institutional settings.

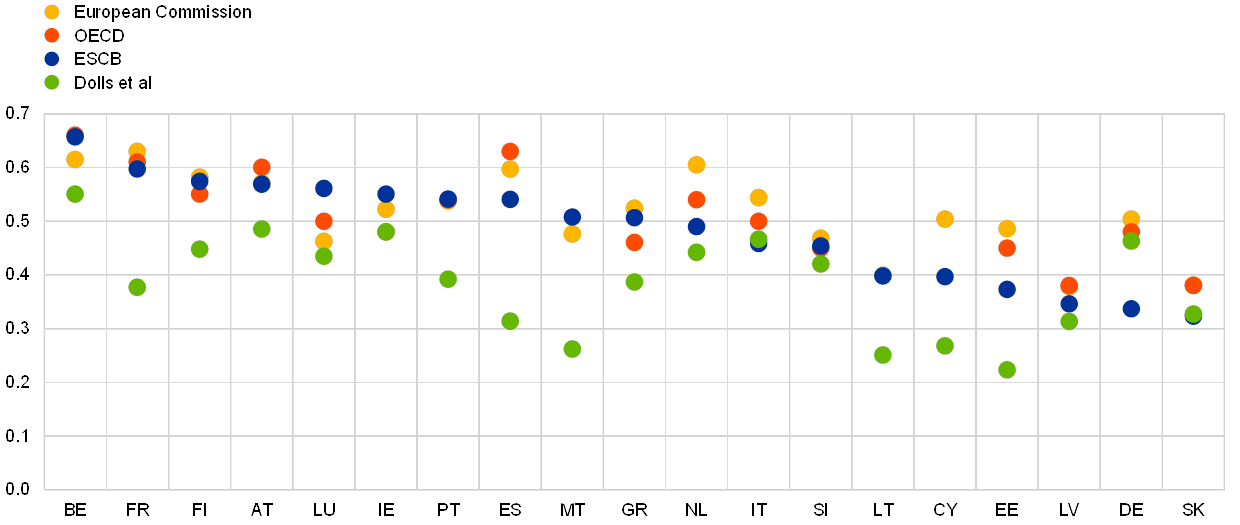

For the euro area aggregate, the estimates of automatic fiscal stabilisers differ across studies. This differentiation results from: (i) differences in approaches to the estimation process; (ii) the underlying source of automatic fiscal stabilisers, as discussed in chapter 2; and (iii) the relevant time horizon under consideration. The European Commission’s estimate is 0.56 for the euro area,[22] which is higher than the estimates from the ESCB and the OECD (which stand at 0.48 and 0.54, respectively).[23] All three institutions use the same measurement concept, i.e. semi-elasticities. Nevertheless, the results may not be fully comparable due to the lagged responses that are included in the ESCB method. In contrast, estimates of automatic stabilisers from Dolls et al. (based on a microsimulation approach) are lower.[24] In this study, the size of the automatic stabiliser is derived by estimating the response in households’ disposable income following a market income shock and an unemployment shock. For the euro area, the results for the income stabilisation coefficient are 0.38 and 0.42, respectively.

Chart A

Size of automatic fiscal stabilisers across euro area countries

Sources: ESCB, European Commission, OECD, and Dolls et al.

Notes: This shows the size of automatic stabilisers, assuming a 1% of potential GDP output gap, depending on the underlying methodology. For Dolls et al. a 5% income shock is assumed – only the results for the income shock scenario are shown. The ESCB estimates shown here include the lagged impact. In the chart, countries are ordered according to the size of their estimates based on the ESCB method.

Looking at the euro area countries, estimates of automatic fiscal stabilisers vary widely across countries and studies. The estimated size by the ESCB ranges from 0.66 in Belgium to around 0.35 in Slovakia (see Chart A). Compared to the ESCB figures, estimates by the European Commission are higher for the majority of countries, most notably for Germany, Estonia, Cyprus and the Netherlands, but considerably lower for Luxembourg. Similarly, OECD estimates are mostly higher than those of the ESCB, notably in Germany, Estonia and Spain.

Compared to euro area countries, automatic fiscal stabiliser estimates appear to be much smaller for the United States. For the United States, most estimates point to a size of around 0.3 to 0.4.[25] The lower size of automatic stabilisers in the United States compared to the euro area results, in particular, from the smaller size of the government, a less progressive personal income tax structure and a less generous benefit system. Consequently, the income stabilisation effect following, for example, an unemployment shock is estimated to be considerably lower in the United States than in the euro area.[26] Moreover, automatic stabilisers in the United States might be less effective because of the strict fiscal frameworks, including the requirements for balanced budget, established in the majority of US states.[27] In fact, these balanced budget rules were found to react in a procyclical manner, therefore largely offsetting the stabilising effect at the federal level.[28]

4 The effectiveness of automatic fiscal stabilisers for macroeconomic stabilisation

Automatic fiscal stabilisers typically translate into the effective cushioning of economic fluctuations by stabilising aggregate demand. The degree to which these automatic fiscal stabilisers translate into demand stabilisation depends on the behaviour of economic agents. Households’ propensity to consume plays an important role. Whether and how individuals adjust their consumption to fluctuations in their disposable income depends on the share of liquidity-constrained and credit-constrained households. Only households limited in their ability to borrow in the market reduce their spending one-for-one in reaction to a temporary fall in income, while an income shock does not affect the consumption behaviour of households without liquidity constraints.

Model simulations for the euro area suggest that automatic fiscal stabilisers cushion around 10 to 30% of a standard GDP shock (see Box 2). That is, the euro area aggregate automatic fiscal stabiliser of 0.48 implies that between 10% and 30% of a standardised shock to the economy is cushioned. The bounds of this range of estimates are determined first and foremost by which elements of automatic fiscal stabilisation are included in the analysis. Including only the cyclical elements of automatic stabilisation reduces the macroeconomic stabilisation significantly vis-à-vis an analysis that also includes the (larger) non-cyclical elements of automatic stabilisation. Further modelling uncertainty arises from the state-dependent nature of economic variables. For example, the share of liquidity-constrained households is not independent of the state of the economy and may increase during a crisis.

Most estimates of the output smoothing effect of automatic fiscal stabilisers in advanced economies fall within the range presented in this article. Estimates depend on the source of the initial shock (e.g. external versus domestic demand). In general, an export-led shock is less tax-rich and, thus, less stabilised by the budget in most models. Automatic stabilisers tend to absorb a private consumption shock much more strongly than a private investment shock and an export shock.[29] Estimates also depend on the model-specific budget elasticities (reaction of budget components to macroeconomic bases) and the embedded fiscal multipliers (reaction of output to a fiscal shock).[30] In addition, estimates depend, not least, on the definition of automatic fiscal stabilisers used (which determines the counterfactual scenario without automatic fiscal stabilisers). According to the cyclical view of automatic fiscal stabilisers, in which taxes and transfers to households play the stabilising role, the degree of output smoothing after the shock is found to be at around 9% to 17%. For a size-of-government view of automatic fiscal stabilisers, assuming that mostly the expenditure side plays the stabilising role, the degree of output smoothing is found to be at 25% to 27%.[31]

The nature of the economic shock has implications for the effectiveness of automatic fiscal stabilisers. The contraction in the COVID-19 crisis is not only faster, and its magnitude greater, than during the great financial crisis, but the current downturn is also of a different nature than in the past. Historically, recessions typically result from economic and financial imbalances. The correction of these imbalances is associated with a drop in economic aggregate demand on account of price and income adjustments, and on account of economic uncertainty. In this situation, a stabilisation of household income through the tax and benefit system in particular can help prop up economic demand. By contrast, the COVID-19 crisis is largely an exogenous shock with strong repercussions not only for demand but also for supply in the economy. In the first phase of the crisis, governments introduced severe restrictions on social and economic activities to contain the spread of the virus. This put severe constraints on the supply side of the economy, where, for example, border closures disrupted global supply chains, factory closures exhausted product stockpiles and the lockdown curtailed high-street retail. As a result, income stabilisation, supported by both automatic stabilisers and discretionary government measures, have not translated into stabilising consumption and investment to the same extent as in past downturns but have instead led to a temporary increase in the private sector’s saving rate. For example, household consumption stabilisation was temporarily inhibited, as even liquidity-constrained households were forced to change their consumption behaviour and increase their savings rate. At the same time, governments in some countries were forced to suspend their investments due to, among others things, restrictions that were introduced on the movement of people.

As the lockdown lifts in most euro area countries, automatic fiscal stabilisers should regain their normal effectiveness. On the one hand, as much of the supply-side and lockdown restrictions on the economy are lifted, households are expected to consume the part of the disposable income they were forced to save during the lockdown. Private and government investment that might have been impaired during that phase are also expected to resume. On the other hand, even if the precautionary saving motive related to the large uncertainty induced by the crisis may persist for longer, the presence of automatic fiscal stabilisers (and other supporting government measures) should cushion such effects.

It should be noted that the COVID-19 crisis may leave a lasting mark on the size of fiscal stabilisers. Tax bases and spending profiles may have shifted with the structure of the economy or in the social security system. For example, the COVID-19 crisis could in many countries act as a catalyst for a quicker digitalisation, which in turn may result in changes in the employment structure of the economy. Some measures implemented by governments – such as short-term work schemes – may remain in place after the crisis, which could have a lasting positive impact on the effectiveness of automatic fiscal stabilisers in stabilising the economy.

Box 2 Simulating the effectiveness of automatic fiscal stabilisers in the euro area

This box assesses, through the lens of macroeconomic models, the effectiveness of automatic stabilisers in smoothing output. The simulations are conducted with two sets of models regularly used in the Eurosystem’s forecasting exercises, namely, the European Central Bank’s New Multi-Country Model (NMCM)[32] and the Basic Model Elasticities (BMEs) – a platform based on national central banks’ macroeconomic models. The focus of these stylised simulations is on the real GDP smoothing effects, at the euro area level, of automatic stabilisers estimated in Section 3. In our simulations, we also attempt to recreate the characteristics of the COVID-19 crisis related to the effects of the lockdown measures that might reduce the effectiveness of automatic stabilisers.

This box employs the semi-elasticities presented in Section 3. That is, assuming a standardised negative GDP shock (opening of the output gap by 1 percentage point in year T), the euro area budget balance-to-GDP ratio is estimated to fall cumulatively by 0.48 percentage points over a three year period (from T to T+2 – see Chart 2), out of which 0.35 percentage points in the year of the shock (T). We focus on the output smoothing effects upon impact (T), which are the most relevant in size given the temporary nature of the stabilisers.[33] In terms of the modelling approach, we construct fiscal shocks on the basis of the semi-elasticities mentioned above and their disaggregation by components (those which have a direct impact on demand), which we then feed into the macroeconomic models to gauge the output effect.

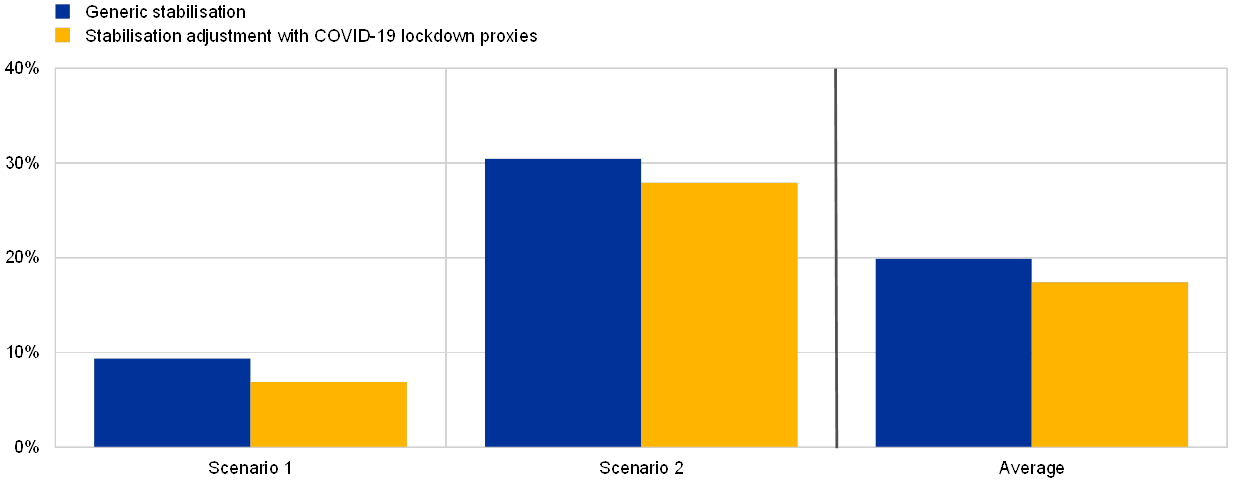

Following the model-based literature, we evaluate the degree of automatic stabilisation in relation to benchmark scenarios of “no automatic stabilisers”. The results for two scenarios, reflecting the two main aspects of automatic fiscal stabilisers in the literature as touched upon in Section 2, and their average (taken as the overall proxy for output stabilisation) are presented in Chart A.

- Scenario 1 reflects the countercyclical aspect of automatic fiscal stabilisers (changes of budget balance in levels), taking account of those budgetary components that are sensitive to the cycle, such as changes in taxes and unemployment benefits. In the construction of this scenario, we map the fiscal instruments into shocks on the labour income tax rate, the consumption tax rate and government transfer to households.[34]

- Scenario 2 reflects the government size/expenditure inertia aspect of automatic stabilisers (changes of budget balance in ratios to GDP). In the construction of this scenario, the shocks are implemented as changes to government consumption, investment and transfers (other than unemployment benefits) following their respective budgetary shares.

- The contribution of fiscal automatic stabilisers to output cushioning is calculated as the real GDP effect in these two scenarios relative to the standardised initial shock.[35]

Chart A

Output smoothing of euro area automatic stabilisers

Sources: ECB calculations.

Notes: The degree of output smoothing is calculated as the average percent deviation of the GDP level during the first year in a scenario with automatic stabilisers reaction relative to the percent deviation of the GDP level in a scenario without AS reaction (counterfactual). For Scenario 1 the counterfactual with no fiscal stabilisation is a scenario in which government revenue and expenditure are fixed (the countercyclical view of automatic stabilisers). In Scenario 2 the counterfactual is a scenario in which revenue and expenditure are kept constant in ratios to GDP (mostly the expenditure inertia). Price effects are not reflected in the construction of the standardised shocks under automatic stabilisers in any of the scenarios (standardised or with crisis adjustment). The results for Scenario 1 and Scenario 2 are the model averages of the output smoothing obtained from simulations using the BMEs and NMCM. In the scenarios with COVID-19 restriction proxies, simulations reflect increased savings ratios by reducing the model-implied propensities to consume. For the BMEs the simulations of the increased saving ratio do not take into account general equilibrium effects but only the direct effect of lower consumption on real GDP growth.

Turning to the COVID-19 crisis, given the extreme uncertainty associated with the shock and its macroeconomic (supply versus demand) and fiscal effects, we use illustrative adjustments to mimic the conditions of the crisis and gauge the potential impact in terms of the effectiveness of automatic stabilisers. To illustrate the impact of the unprecedented COVID-19 lockdown measures, we consider an increase in savings (both forced and precautionary), in line with estimations from the early stages of the crisis. We evaluate this alternative scenario by reducing the model-implied propensity to consume, in line with the savings-ratio increase. As a result, fiscal instruments supporting households’ disposable income have a lower effect on consumption profiles. In addition, we slightly adjust the counterfactual on the expenditure side, i.e. government investment, which is likely to be most affected by lockdown measures.[36] Altogether, this leads to a smaller implied automatic fiscal stabilisation contribution, as shown in Chart A. Averaging across the models and scenarios, the smoothing of automatic fiscal stabilisers declines from around 20% to 17% in year T. There is a larger relative effect for Scenario 1, where the effectiveness of automatic fiscal stabilisers drops by almost 25%, given that mostly transfers and taxes are considered, which are strongly affected by the increase in the saving ratio.[37]

These estimates are surrounded by high uncertainty. First, there is model-related uncertainty implying fiscal multiplier uncertainty. On the one hand, the literature points to evidence of larger fiscal multipliers during recessions, as well as in a low interest rate environment. On the other hand, particularly in high-debt countries, fiscal multipliers are found to be lower and the effectiveness of automatic stabilisers may be reduced through Ricardian effects and the anticipation of future consolidation needs. Second, there is uncertainty regarding the cyclical adjustment method, as described in Section 3. Third, and most importantly, the estimates of both the size and the effectiveness of automatic stabilisers during the COVID-19 crisis are particularly uncertain, given the unprecedented nature of the crisis in the euro area. Moreover, these model exercises rely on proxies for calibration and only partially reflect the possible channels through which the efficiency of fiscal stabilisation could be altered during the COVID-19 crisis (see Section 4).

5 Towards a second generation of automatic fiscal stabilisers

The COVID-19 crisis gives cause to review the role of fiscal policy in a severe economic downturn. On the one hand, monetary policy remains close to the effective lower bound, which would motivate a stronger role for fiscal policy.[38] On the other hand, traditional automatic fiscal stabilisers might be too small to counterbalance the sharp economic downturn and less effective than under normal circumstances. Also, automatic fiscal stabilisers are quite heterogeneous across euro area countries in terms of size and composition. At the same time, discretionary policy measures may react too slowly to sufficiently cushion a massive economic downturn, such as the one experienced as a result of the pandemic, and avoid hysteresis effects. These considerations have led to proposals to strengthen quasi-automatic fiscal instruments.[39]

So-called second generation automatic fiscal stabilisers could help deliver more timely, targeted and sizeable policy responses. In contrast to traditional automatic fiscal stabilisers, which are mostly a by-product of the structure and size-of-government revenues and expenditures, second generation automatic fiscal stabilisers – also referred to as “asymmetric” or “quasi-automatic” fiscal stabilisers – are fiscal tools specifically designed and implemented to provide macroeconomic stabilisation. Second-generation automatic stabilisers work as programmes that only turn active when the economy heads into deep recession and automatically revert to normal levels once specific indicators are back to pre-crisis levels. They are automatic in that their activation is rules-based rather than subject to a government decision. In contrast to traditional automatic stabilisers, they are asymmetric in that they are activated only in case of a severe downturn of the economy.[40]

Two types of asymmetric automatic fiscal stabilisers can be identified, depending on whether they work via public expenditure or via revenues. First, on the expenditure side, asymmetric automatic fiscal stabilisers can mainly help to stabilise household spending, e.g. through higher or longer individual unemployment benefit or social assistance payments once a certain pre-defined threshold is reached.[41] Short-time work schemes that activate in deep recessions are a notable example. Alternatively, asymmetric automatic fiscal stabilisers can work directly through higher government spending, e.g. on infrastructure investment projects.[42] Second, asymmetric stabilisers that work via the revenue side can influence the timing of household spending through intertemporal substitution effects. Typical examples are temporary tax deferrals or tax credits, such as a temporary decrease in the VAT rate to boost consumption in the short run.[43]

The design of quasi-automatic fiscal stabilisers influences their effectiveness. Crucial choices relate to the economic indicators and the threshold that triggers the activation of the programme, as well as the design of the spending programmes or temporary tax cuts. For asymmetric stabilisers via unemployment benefit payments, Blanchard and Summers suggest basing the trigger on the unemployment rate rather than on output movements, as the latter might also be driven by shocks related to potential output.[44]

If well designed, asymmetric automatic fiscal stabilisers could be a powerful instrument to effectively cushion a severe economic downturn. They are likely to be more effective than traditional stabilisers in that they are specifically designed to provide macroeconomic stabilisation in a downturn. While asymmetric automatic stabilisers usually do not respond to normal cyclical developments, they are of a much larger scale once they are activated. As such, they do not contribute to a further, permanent increase of the size of the government. Using a stylised counterfactual analysis, Blanchard and Summers show that asymmetric automatic stabilisers can be successful in limiting the impact of a recession, although the results are contingent on the role of discretionary measures and the length of the automatic stimulus period.[45] The IMF argues that countries with a relatively small tax and benefit system could benefit from the introduction of asymmetric automatic fiscal stabilisers.[46]

At the same time, asymmetric automatic fiscal stabilisers do not come without limitations. This is for at least three reasons: (i) they might lower incentives to take up necessary adjustments of the economy, in particular if a crisis results from the build-up of economic and financial imbalances, as was the case during the financial crisis; (ii) due to the asymmetry embedded in these instruments they do not automatically contribute to fiscal consolidation during good economic times, as countries have moved to a high debt trajectory during the downturn – to mitigate sustainability risks, it is important that countries build up fiscal buffer in good economic times; and (iii) as these instruments are meant to be sizeable, they might de facto not be available for countries with high debt levels, facing difficulties in accessing financial markets.

Until recently only a few examples of asymmetric automatic fiscal stabilisers existed in practice. In the United States, the length of unemployment benefit payments automatically increases as soon as the unemployment rate exceeds a certain threshold. Also social payments in kind, such as food stamps, automatically rise once a threshold is hit.

During the COVID-19 crisis, most euro area countries relied, to a large extent, on quasi-automatic discretionary fiscal instruments, which closely resemble asymmetric automatic stabilisers. In particular, short-time work schemes as well as temporary tax deferrals and tax credits have been widely used.[47] Short-time work schemes involve compensation payments, in the form of subsidies or grants to firms, that are contingent on firms not laying off workers who may otherwise have been made temporarily redundant due to the economic crisis. The aim is to limit households’ loss of income and firms’ wage costs. Short-time work schemes already existed in several countries, notably in Germany, France and Belgium, although legislation was required for their activation and for the instrument to be stepped up.[48] The scheme was newly introduced in several countries during the COVID-19 crisis. Tax deferrals and temporary VAT cuts have also been widely employed by most euro area countries.

6 Conclusions

In normal times automatic fiscal stabilisers play an important role for macroeconomic stabilisation in the euro area. According to ESCB estimates, automatic fiscal stabilisers are generally sizeable in the euro area, but vary significantly across Member States. They are particularly sizeable in some western European countries, which typically have in place more generous transfer schemes and a larger size of the government sector. In normal times they seem sufficient to cushion between 10% and 30% of an economic shock.

The effectiveness of automatic fiscal stabilisers in cushioning the economy is less apparent during the COVID-19 crisis, especially during the lockdown phase. Due to the massive economic downturn experienced by the euro area, and with monetary policy close to the effective lower bound, this gives cause to review the role of fiscal policy. So-called second generation automatic fiscal stabilisers could help deliver more timely, targeted and sizeable policy responses to preserve potential growth and avoid hysteresis effects. During the COVID-19 crisis, most euro area countries adopted measures aimed at protecting potential output by preserving those economic structures expected to remain viable after the crisis. More specifically, authorities in some countries provided short-time work schemes to keep employees in their jobs and offered liquidity support to firms to prevent them from going out of business.

Looking ahead, there are strong arguments for efficient second generation automatic fiscal stabilisers to play a more prominent role. The institutionalisation of asymmetric automatic fiscal stabilisers – such as a statutory short-time work schemes – could provide for more macroeconomic stability without overburdening the government sector. However, such instruments would need to be well designed to ensure that incentive structures are in place. Moreover, to mitigate sustainability risk, it is important that all euro area countries build up fiscal buffer in good times.

- See the box entitled “The COVID-19 crisis and its implications for fiscal policies”, Economic Bulletin, Issue 4, ECB, 2020.

- See Conclusions of the special meeting of the European Council, Brussels, 17-21 July 2020.

- This article also draws on the work of national central banks and the European Central Bank (ECB) in the Working Group on Public Finance, a sub-committee of the Monetary Policy Committee.

- These are often referred to the size of government or expenditure inertia in the literature.

- A poll tax is a tax levied as a fixed sum on a taxable individual, household or other entity.

- The degree of personal income tax progressivity is found to be negatively associated with output volatility in a sample of OECD countries. The effect is in addition to the stabilising role of a government’s size. See Rieth, M., Checherita-Westphal, C. and Attinasi, M., ”Personal income tax progressivity and output volatility: Evidence from OECD countries”, Canadian Journal of Economics/Revue canadienne d’économique, Vol. 49, No 3, Wiley, Hoboken, 2016, pp 968-996.

- Some authors argue that age and health-related social expenditure also react to the cycle in a stabilising manner. This is, for example, because the propensity of older employees to enrol in early retirement schemes increases in a cyclical downturn. See Darby, J. and Melitz J., “Social Spending and Automatic Stabilizers in the OECD”, Economic Policy, Vol. 23, No 56, Oxford University Press, 2008, pp 715-756.

- See, for example, Gali, J., “Government size and macroeconomic stability”, European Economic Review, Vol. 38, No 1, 1994, pp. 117-132, and Fatás, A. and Mihov, I.,“Government size and automatic stabilizers: international and intranational evidence”, Journal of International Economics, Vol. 55, No 1, Fontainebleau, 2001, pp 3-28.

- More precisely, the discretionary part of the change in the budget balance is captured by the cyclically adjusted (or structural) primary balance or fiscal stance, which consists of discretionary fiscal policy measures and a number of non-policy factors. The cyclical component of the budget balance captures those changes in the budget balance associated with the business cycle. Besides the discretionary and cyclical component of the budget balance, another component (in part exogenous to the budget) is the change in interest payments, which represents a financial flow between the government and other domestic or external sectors of the economy. See Van Riet, A. (ed.), “Euro area fiscal policies and the crisis”, Occasional Paper Series, No 109, ECB, Frankfurt am Main, April 2010.

- For the growth impact, several OECD studies, inter alia, point to evidence that too large governments – on either the tax side or the expenditure side – tend to reduce growth unless governments function in a highly effective way. See, for example, Johansson Å., “Public Finance, Economic Growth and Inequality: A Survey of the Evidence”, OECD Economics Department Working Papers, No. 1346, OECD Publishing, Paris, 2016. In addition to the growth impact, some studies provide evidence for nonlinear effects of government size on output volatility, i.e. the macroeconomic stabilisation effects of governments decline, or even vanish, when their size is very large. See, for instance, Crespo Cuaresma, J., Reitschuler, G. and Silgoner, M., “On the effectiveness and limits of fiscal stabilizers”, Applied Economics, Vol. 43, No. 9, 2009, pp 1079-1086.

- See also discussion in 't Veld J., Larch M. and Vandeweyer M., "Automatic Fiscal Stabilisers: What they are and what they do," European Economy - Economic Papers 2008 - 2015 452, European Commission, Brussels, 2012.

- See Mohl, P., Mourre, G. and Stovicek, K., “Automatic fiscal stabilisers in the EU: size and effectiveness”, European Economy Economic Briefs, Brief 045, European Commission, Brussels, May 2019.

- The automatic reaction of a budget balance can be estimated using two different approaches, namely, the aggregate approach or the disaggregate approach. The aggregate approach uses one synthetic measure of an economic cycle, i.e. the output gap, and applies it to all budget items. In the disaggregate approach cyclical patterns are identified separately for all budget balance components. The aggregate method is currently used by all major international institutions, including the ESCB, to estimate the cyclical component of a budget balance.

- Cyclical revenues increase in a boom and decrease in a recession, while the opposite relationship occurs for cyclical expenditure.

- Budget semi-elasticity measures the change of the budget balance, as a percentage of GDP, for a 1% change in the output gap.

- Bouabdallah, O., Morris, R. and Reiss, L. (eds.) (forthcoming). “Gauging the typical influence of the economic cycle on government finances: New (Eurosystem) methodology.” Working Paper Series, ECB, Frankfurt am Main.

- The macroeconomic base determines the amount of revenues collected and expenditures made by a government. For example, all goods and services that are subject to tax comprise a tax base. Due to the fact that exact bases are difficult to measure and forecast, proxy variables are used as macroeconomic bases, e.g. household consumption is a proxy base for VAT revenues.

- In general the size of automatic stabilisers is estimated as a semi-elasticity multiplied by an output gap. Hence, the size of automatic stabilisers is proportional to the size of an output gap. To improve comparability of results, it is assumed that an output gap equals 1% of potential GDP in all euro area countries.

- To simplify the analysis and ensure comparability of results we use the cumulative size of automatic stabilisers in this article.

- In the literature, the year-on-year change of the cyclical component is also used as a proxy for the size of automatic stabilisers. See for instance the overview and assessment of Stability and Convergence Programmes conducted by the European Commission.

- See for instance Grigori, F., Herman, A., Swiston, A. and Di Bella, G., “Output gap uncertainty and real-time monetary policy”, Russian Journal of Economics, Vol. 1, No. 4, Moscow, 2015.

- See Mourre, G., Poissonnier, A. and Lausegger, M., “The Semi-Elasticities Underlying the Cyclically-Adjusted Budget Balance: An Update & Further Analysis”, European Economy Discussion Papers, No 098, European Commission, Luxembourg, 2019. The euro area estimate is the weighted sum of the country estimates.

- See Price, R., Dang, T. and Guillemette, Y., “New Tax and Expenditure Elasticity Estimates for EU Budget Surveillance”, OECD Economics Department Working Papers, No 1174, OECD Publishing, Paris, 2014. The euro area aggregate is computed as weighted average and corrected for missing values for Cyprus, Lithuania and Malta.

- See Dolls, M., Fuest, C., Peichl, A. and Wittneben, C., “Fiscal Consolidation and Automatic Stabilization: New Results”, CESifo Working Papers, No 8021, CESifo, Munich, 2019.

- The US Congressional Budget Office estimates the automatic stabiliser in the US at, on average, 0.3% of potential GDP since 1970. See Russek, F. and Kowalewski, K., “How CBO Estimates Automatic Stabilizers”, Working Paper Series, No 7, Congressional Budget Office, Washington, DC, 2015. The studies by Dolls et al come to similar results for the income shock stabilisation in the United States. See Dolls, M, Fuest, C., Kock, J., Peichl, A., Wehrhöffer, N. and Wittneben, C., “Automatic stabilizers in the Eurozone: analysis of their effectiveness at the member states and euro area level and in international comparison”, ZEW Abschlussbericht zu Forschungsvorhaben fe 5/14, 2014; Dolls, M, Fuest, C., Kock, J. and Peichl, A., “Automatic stabilizers and economic crisis: US vs Europe”, Journal of Public Economics, 96, 2012. In contrast to most estimates for the US, the latest OECD estimate, (see Price at al. op. cit.), stands out as pointing to an upward revision of the estimate to 0.5% of GDP.

- See for Dolls et al op. cit.

- For a comparison of fiscal frameworks at sub-national level, see article “Fiscal rules in the euro area and lessons from other monetary unions”, Economic Bulletin, Issue 3, ECB, 2019.

- See Lee, V. and L. Sheiner, L., “What are automatic stabilisers?”, The Hutchins Center Explains Series, Brookings Institution, Washington DC, July 2019.

- See, for instance, Tödter, K-H and Scharnagl M., “How effective are automatic stabilisers? Theory and empirical results for Germany and other OECD countries”, Discussion Paper Series 1: Economic Studies, No 2004,21, Deutsche Bundesbank. The authors use the Deutsche Bundesbank’s BbkM model and find the smoothing power of a private consumption shock for Germany at maximum of 26%; of an investment shock at 15%; and of exports at 13%. In the same setting, using the QUEST model, they find a maximum smoothing power of 24%, 13%, and 14%, respectively.

- Regarding fiscal multipliers (directly relevant in the context of discretionary measures), most model-based estimates for a one-year temporary fiscal shock with no monetary policy accommodation hover around 1 for expenditure items such as government consumption and investment and are much lower, i.e. between 0.2 and 0.4 for general transfers and (direct and indirect) taxes.

- For the euro area, two analyses from 2002 and 2017 using the QUEST model, find estimates of output smoothing of 13% to 17% for the first benchmark and of 26% to 27% for the second, concluding that dampening of cyclical fluctuations through the inertia of discretionary spending largely exceeds the smoothing effect of tax revenue. See 't Veld J et al., op. cit. and European Commission, “Automatic stabilisers in the euro area: A model-based assessment”, European Economic Forecast Autumn 2017, pp. 65-68.

- See: Dieppe, A., Gonzalez Pandiella, A., Hall, S. and Willman, A., “Limited information minimal state variable learning in a medium-scale multi-country model”. Economic Modelling, Vol. 33, Issue C, Elsevier, Netherlands, 2013, pp. 808-825.

- On the revenue side, we also consider the lag effects from T+1 and T+2 in the simulation.

- Adjusting the semi-elasticities in Section 3 to measure elasticities of the revenue and expenditure levels rather than elasticities of the ratios to GDP gives an estimated budget balance deterioration in year T of 0.33 percentage points.

- This is broadly equivalent with another counterfactual scenario, in which we would determine the ex-ante fiscal shock needed to offset the budget balance impact of the automatic stabilisers, and then we would estimate the real GDP impact of such a shock. The relative difference between this impact and the initial shock would give the output smoothing of automatic stabilisers.

- See the June 2020 Eurosystem staff macroeconomic projections for the euro area and the euro area sectoral accounts for Q1 2020, which both point to increased households savings. The Q1 2020 sectoral accounts also point to a deceleration in government investment growth.

- It should be noted that a more persistent shock with larger consequences on potential output than currently assumed would reduce both the size and the effectiveness of automatic stabilisers.

- Fiscal multipliers are conventionally higher when monetary policy reaches the lower bound. See, for instance, Christiano, L., Eichenbaum, M. and Rebelo, S., “When is the Government Spending Multiplier Large?” Journal of Political Economy, Vol. 119, No 1, The University of Chicago Press, Chicago, February 2011, pp. 78-121, and Coenen, G. et al., “Effects of Fiscal Stimulus in Structural Models”, IMF Working Paper, Vol. 10, No 73, International Monetary Fund, Washington DC, March 2010.

- An evoking discussion of second generation stabilisers can be found in Eichenbaum, M., “Rethinking fiscal policy in an era of low interest rates”, mimeo, April 2019; Blanchard, O. and Summers, L., “Automatic stabilisers in a low-rate environment”, PIIE Policy Brief 20-2, Peterson Institute of International Economics, Washington, February 2020; Boushey, H., Nunn, R. and Shambaugh, J., “Recession Ready: Fiscal policies to stabilize the American economy, Brookings Report, Washington, 2019. The idea of asymmetric stabilisers is not completely new. See for instance Baunsgaard, T. and Symansky, S., “Automatic fiscal stabilisers”, IMF Staff Position Paper, 23, September 2009.

- Traditional automatic fiscal stabilisers reduce economic fluctuations in both directions, also mitigating risks for the economy to overheat.

- For example, it was proposed that lump sum payments to individuals should be triggered automatically when the three-month-moving average of the unemployment rate increase by at least 0.5 percentage points relative to its low in the previous 12 months. See Sahm, C., “Direct stimulus payments to individuals”, in Boushey, H. et al, op. cit.

- However, Auerbach (2009) raised doubts about the usefulness of “ready-to-go” infrastructure projects, which would only be realised once the economy is heading towards a recession. Holding back necessary public investment might be sub-optimal for the economy. See Auerbach, A., “Fiscal policy”, Conference paper, Peterson Institute of International Economics, October 2017.

- See Braunsgaard and Symansky op. cit.

- See Blanchard and Summers, op. cit.

- See Blanchard and Summers, op. cit.

- International Monetary Fund, “Fiscal Monitor”, April 2020.

- Estimates for the five largest euro area countries indicate that indeed a substantial share of employees is on short-time work or temporary lay-off, ranging from 45% of total employees in France to 21% in the Netherlands. See the boxes entitled “Short-time work schemes and their effects on wages and disposable income”, Economic Bulletin, Issue 4, ECB, Frankfurt am Main, 2020”, and “A preliminary assessment of the impact of the COVID-19 pandemic on the euro area labour market”, Economic Bulletin, Issue 5, ECB, 2020.

- The ESCB estimates for automatic stabilisers do not include the short-time work schemes, except in Germany.