PRESS RELEASE

13 January 2016 - Euro area quarterly balance of payments and international investment position (third quarter of 2015)

- The current account of the euro area showed a surplus of €307.2 billion (3.0% of euro area GDP) in the four quarters to the third quarter of 2015.

- At the end of the third quarter of 2015 the international investment position of the euro area recorded net liabilities of €0.9 trillion (approximately 8% of euro area GDP).

Current account

The current account of the euro area showed a surplus of €90.7 billion in the third quarter of 2015, compared with €76.9 billion in the same quarter of 2014 (see Table 1). The increase in the current account surplus was due to an increase in the surplus for goods (from €61.8 billion to €82.1 billion) and a decrease in the deficit for secondary income (from €24.8 billion to €23.4 billion) that were partly offset by a decrease in the surpluses for primary income (from €17.2 billion to €12.3 billion) and for services (from €22.7 billion to €19.7 billion). [1]

The decrease in the primary income surplus resulted primarily from a decrease in the surplus for direct investment income.

The decrease in the surplus for services resulted mainly from a deterioration in the balances for the “other business services” component (an increase in the deficit from €0.5 billion to €3.6 billion) and the “other” services component (an increase in the deficit from €3.8 billion to €7.9 billion). This was partly offset by an improvement in the balances for the telecommunication, computer and information services component (an increase in the surplus from €11.4 billion to €13.6 billion) and the travel component (an increase in the surplus from €9.3 billion to €11.1 billion).

In the four quarters to the third quarter of 2015 the current account of the euro area showed a surplus of €307.2 billion (3.0% of euro area GDP), compared with a surplus of €226.3 billion (2.2% of euro area GDP) a year earlier. The rise resulted from increases in the surpluses for goods (from €229.9 billion to €313.0 billion) and primary income (from €57.7 billion to €67.1 billion), and, to a lesser extent, from a decrease in the deficit for secondary income (from €137.1 billion to €134.5 billion). These developments were partly offset by a decrease in the surplus for services (from €75.8 billion to €61.6 billion).

International investment position

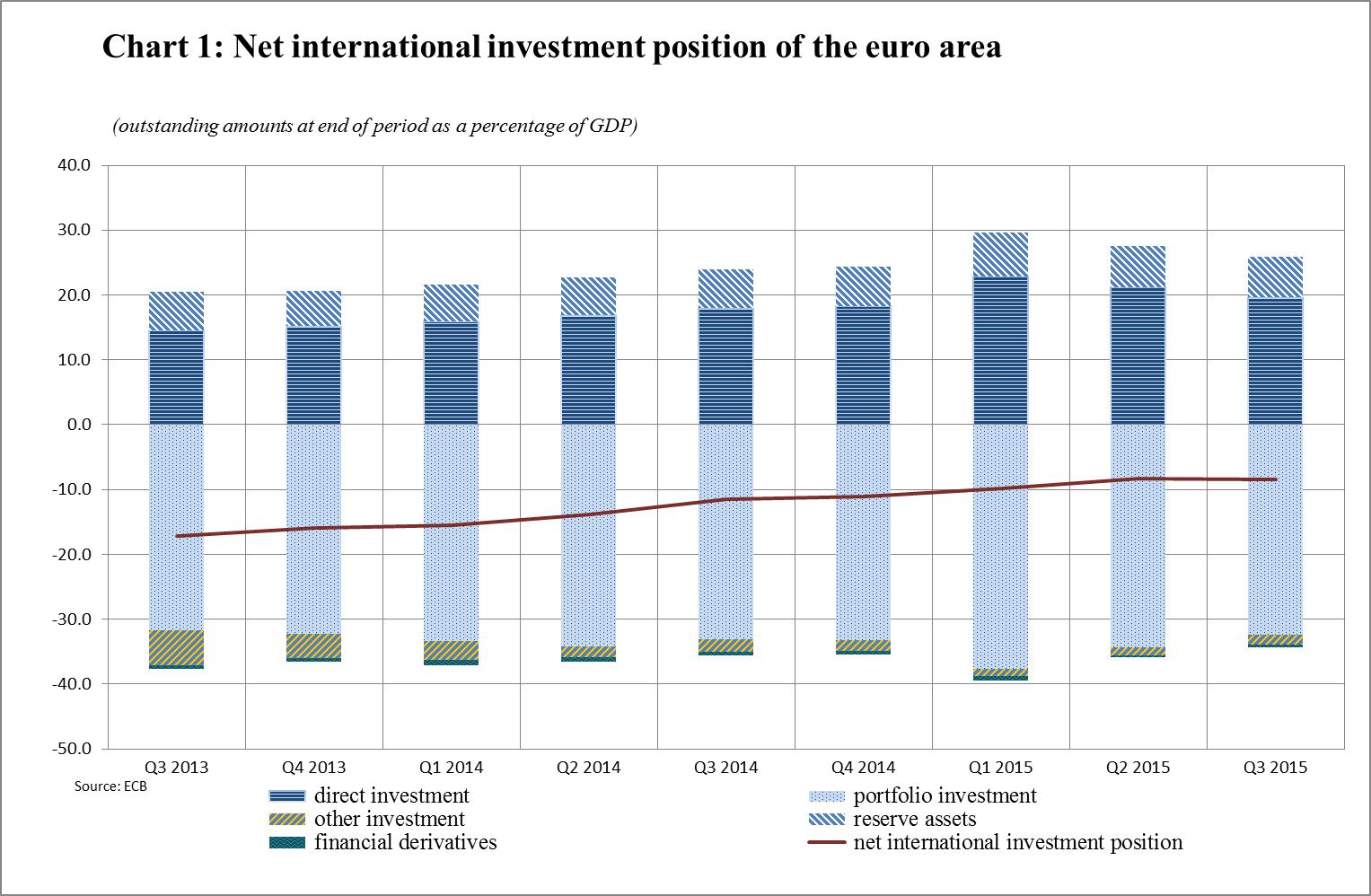

At the end of the third quarter of 2015 the international investment position of the euro area recorded net liabilities of €0.9 trillion vis-à-vis the rest of the world (approximately 8% of euro area GDP; see Chart 1). This represented an increase of €26 billion in net liabilities compared with the second quarter of 2015 (see Table 2).

This increase resulted mainly from lower net asset positions for direct investment (€2,024 billion, down from €2,168 billion) and reserve assets (€644 billion, down from €658 billion), and from higher net liability positions for other investment (€162 billion, up from €128 billion) and financial derivatives (€37 billion, up from €25 billion). These movements were only partly offset by a lower net liability position for portfolio investment (€3,344 billion, down from €3,522 billion).

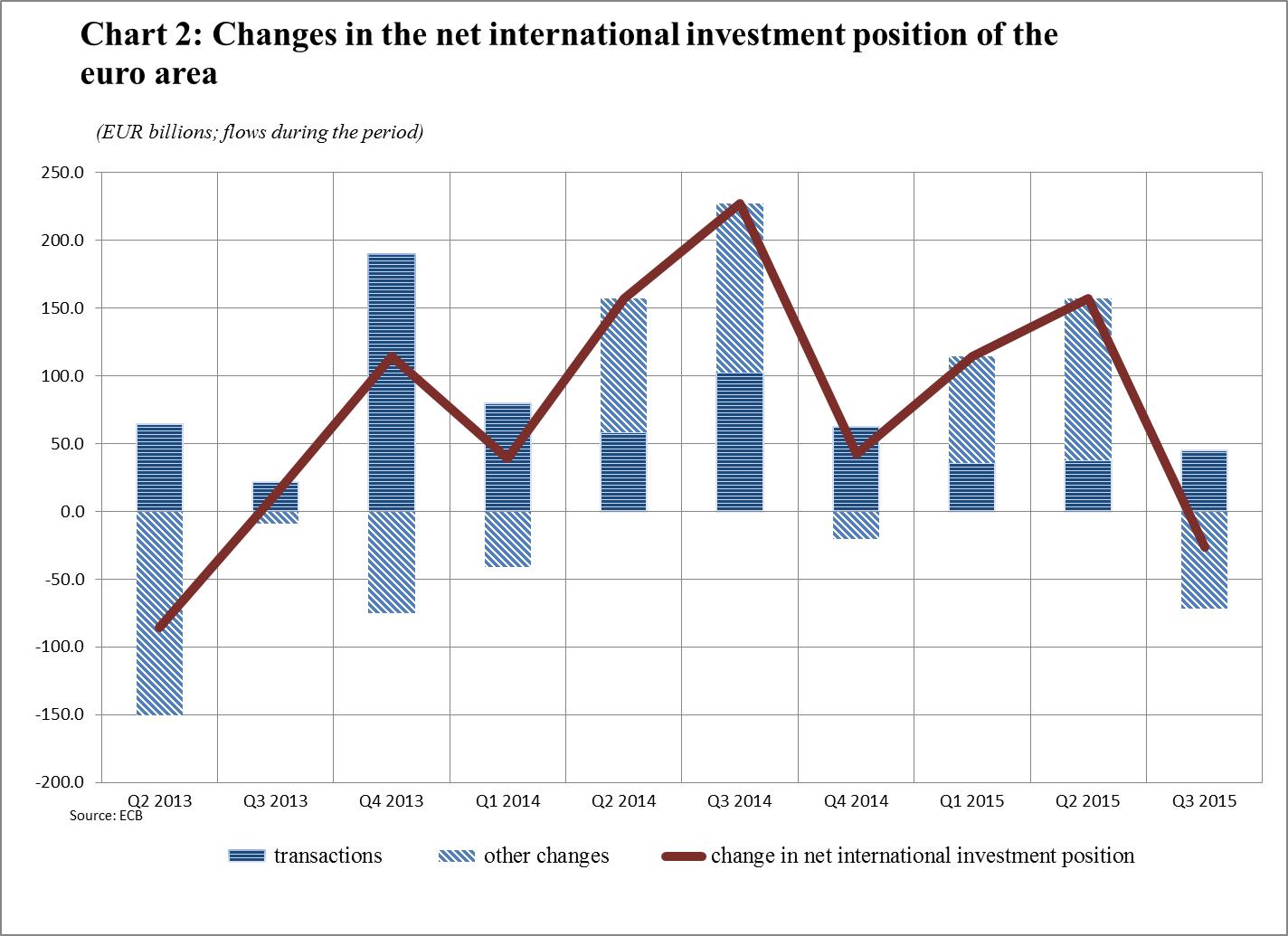

The change in the net international investment position of the euro area is broadly explained by large revaluations – changes in exchange rates and asset prices – and other volume changes (see Chart 2). The increases in direct investment assets and liabilities and portfolio investment liabilities were explained mainly by other changes and transactions, while other changes (mainly exchange rate effects) were mainly responsible for the developments in reserve assets. The increases in other investment assets and liabilities were mainly attributable to transactions (see Chart 2).

At the end of the third quarter of 2015 the gross external debt of the euro area amounted to €12.7 trillion (approximately 123% of euro area GDP), which represents an increase of €16 billion compared with the previous quarter. The net external debt also increased by approximately €31 billion at the end of the third quarter of 2015.

Data revisions

This press release incorporates revisions to the data for the reference periods from the first quarter of 2014 to the second quarter of 2015. These revisions reflect improvements in the national contributions to the euro area aggregates following the introduction of the new statistical standards and have not significantly altered the figures previously published.

Additional information

- Time series data: ECB’s Statistical Data Warehouse (SDW).

- Methodological information: ECB’s website.

- Next press releases:

- Monthly balance of payments: 19 January 2016 (reference data up to November 2015).

- Quarterly balance of payments and international investment position: 7 April 2016 (reference data up to the fourth quarter of 2015)

Annexes

- Table 1: Current account of the euro area

- Table 2: International investment position of the euro area

For media queries, please contact Rocío González, Tel.: +49 69 1344 6451.

Notes

[1] In broad terms, the new BPM6 concept of “primary income” corresponds to the old BPM5 concept of “income”, and the new concept of “secondary income” corresponds to the old concept of “current transfers”.

Europos Centrinis Bankas

Komunikacijos generalinis direktoratas

- Sonnemannstrasse 20

- 60314 Frankfurtas prie Maino, Vokietija

- +49 69 1344 7455

- media@ecb.europa.eu

Leidžiama perspausdinti, jei nurodomas šaltinis.

Kontaktai žiniasklaidai