- 20 APRIL 2023 · RESEARCH BULLETIN NO. 106

One product, two prices: the border effect in retail prices

This article examines price differences across a national border where most factors commonly used to explain international price differences are absent. While some products cost the same on both sides of the border between Austria and Germany, most prices differ significantly. We show that even retailers operating in both countries charge different prices for identical products on each side of the border.

Overview

The “law of one price” states that in a frictionless world the price of a product sold in two countries should be the same. A “frictionless world” is a hypothetical case – a stylised world where there are no administrative, cultural or technical trade restrictions, with free movement of goods and perfect competition, in which market participants can exploit any arbitrage opportunity. In reality, entirely frictionless cross-border markets are rare. Numerous studies have documented persistent deviations from the law of one price (e.g. Engel and Rogers, 1996; and Gorodnichenko and Tesar, 2009), even in neighbouring countries and after years of economic integration (e.g. Méjean and Schwellnus, 2009; Gopinath et al., 2011; and Reiff and Rumler, 2014). Many price differences can be explained by regulatory and technical trading obstacles (see, for example, Neiman, Rigobon and Cavallo, 2013, who discuss the role of a currency union for price convergence), but there is still no definite answer to whether and, if so, why purely administrative national borders without these obstacles can produce such deviations.

Isolating the effect of a solely administrative border is difficult, because typically many market characteristics change at a national border, even if the border is open. Examples of such characteristics include not only the language or currency used, but also different traditions and habits, and thus different consumer preferences. The border region between Austria and Germany provides an almost ideal setting for studying the effect of an administrative border: this region not only has strong economic and cultural ties, but it also constitutes an integrated retail market with several retail chains operating in both countries.

To rule out confounding factors as much as possible, we limit the sample region to a 60-kilometre band along both sides of the border. Within this region, classical trade barriers, exchange rates and distance should not affect the pricing decisions of retailers. Household expenditure is highly correlated across the border, indicating similar consumer preferences in both countries, which are therefore unlikely to be a source of price differentiation.

This article summarises the results of the empirical study by Messner, Rumler and Strasser (2023) on price and inflation differences at the Austrian-German border. Our sample builds on a detailed household panel survey for Austria and Germany from 2008 to 2018, provided by the Gesellschaft für Konsumforschung (GfK). It covers transaction-level prices of fast-moving consumer goods, which are primarily food and personal care items sold in supermarkets. The barcode information enables the comparison of products across 19 border regions in each country. Six of the eight retail groups in our study operate in both countries, facilitating cross-border price comparisons even within retail chains. Messner et al. (2023) describe our approach and data in more detail.

Price gaps at the border

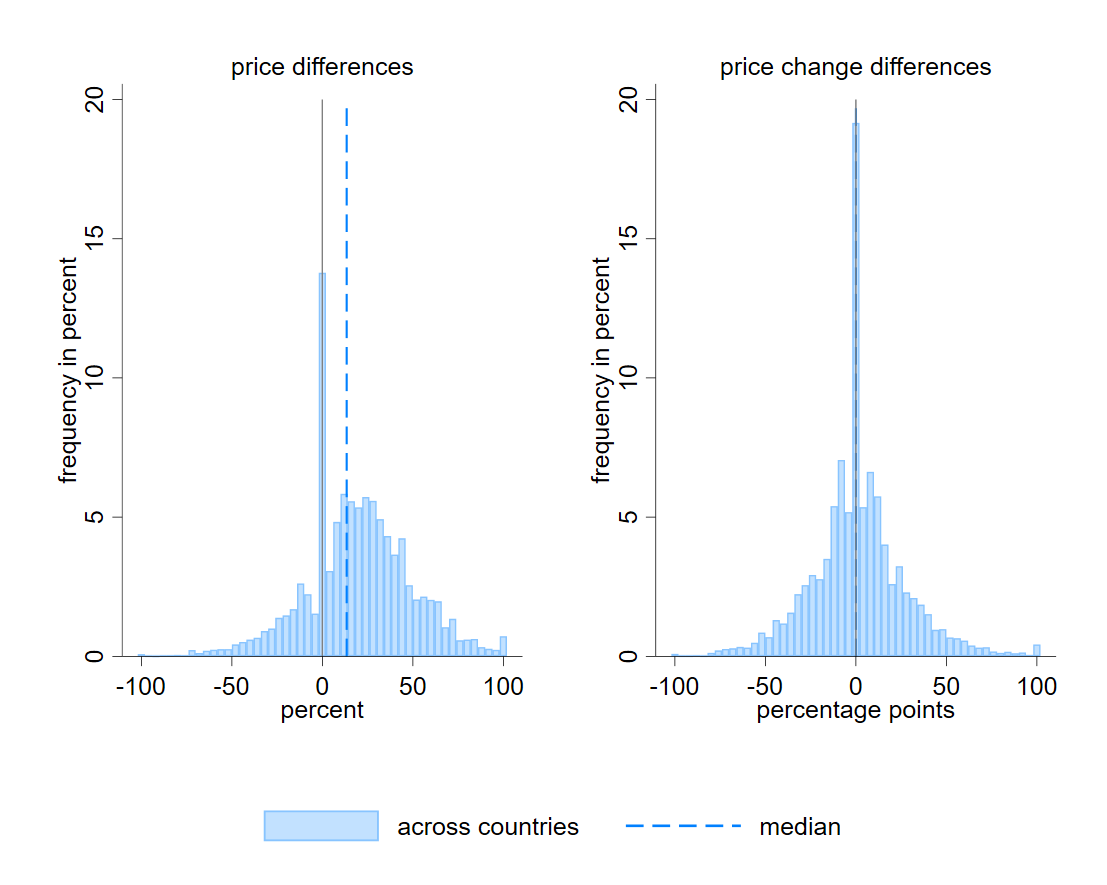

Comparing the prices of identical products sold on both sides of the border reveals sizeable price differences in either direction, which are significantly larger than those observed within each country. The left-hand panel of Chart 1 shows the average log price difference of a specific product sold by a specific retailer within a two-month period between any cross-country pair of regions.[2]

Chart 1

Price and price change differences

Notes: The histogram shows cross-border price differences (left-hand panel, Austrian prices minus German prices) and year-on-year price change differences (right-hand panel, Austrian price changes minus German price changes) in percentages. The bin width is four percentage points, except for the “zero” bin, which contains only zero values. The observational unit is product × region pair × retail chain × bi-monthly. The data cover 19 regions per country.

The pronounced mode at zero in the left-hand panel, which accounts for about 14% of all price comparisons, shows that a considerable share of products is priced the same. On average, however, prices are about 13% higher on the Austrian side of the border, as shown by the dotted line. Disregarding the mode at zero, cross-border price differences are centred around a 15-18% premium on the Austrian side – a clear “border effect”. This bimodality suggests the existence of a profit-maximising (non-zero) cross-border price differential.

The right-hand panel shows the analogous breakdown of year-on-year price changes at the product level. Contrary to differences in price levels, the distribution of differences in price changes is largely symmetric with a single mode and a median at zero. This indicates that price changes (and thus inflation rates) are on average comparable in the two countries despite sizeable variation – in either direction – at the product level.

These results indicate a clear violation of the law of one price. It holds only in a relative sense, i.e. for price changes. This could result from common inflation drivers in the two countries.

Cross-border price gaps within multinational retail chains

Price-setting is decided at the retailer level, and different retailers’ strategies might imply different pricing. International price differences could therefore arise from differences in the composition of the retail sector, if retailers differ in their overall price level (see, for example, Berardi and Sevestre, 2018). This would apply even in a sample of multinational retailers with centralised product procurement and uniform pricing, regardless of national borders.

Chart 2

Cross-border price gaps within retailers

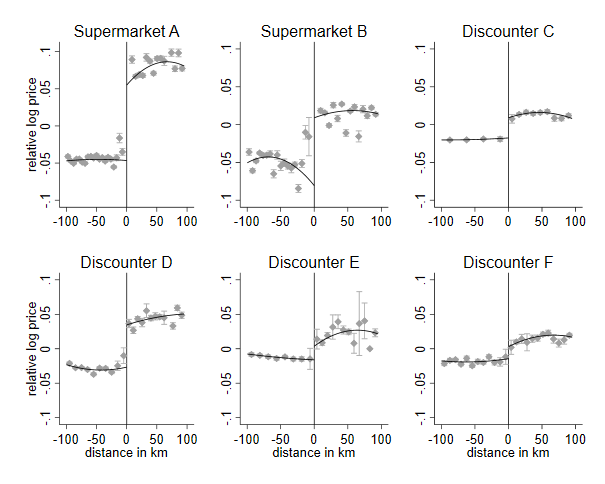

Notes: The diamonds show the average log price deviation from the mean for each distance bin. The solid line is an (unweighted) second-order polynomial fitted to these averages. The chart only includes barcodes of products sold in both countries. The horizonal axis measures the distance from the border in kilometres, with negative distances referring to Germany and positive ones to Austria. The number of bins is determined by the integrated mean squared error optimal evenly spaced method, separately for Austria and Germany.

For this reason, we study whether our results hold up even within retail chains operating on both sides of the border.[3] Chart 2 plots for each multinational retailer in our sample the average price differences as a function of the distance of the shopper’s residence from the border.[4] Within each country, the pricing seems largely uniform – it does not vary with the distance from the border. But while within-country distance does not seem to matter, the prices of each retailer display a pronounced jump at the border. In other words, retail chains operating in both countries set prices much more uniformly within each country than across the border. Retailers could apply price differentiation along any other line on the map, but they choose to follow the national border.[5]

Conclusions

Our work has three important implications. First, it shows that retailers practice cross-border price discrimination. This means that they maximise profits separately in each country, even within the European Union. This suggests that the cost of arbitrage remains sufficiently high – potentially owing to information cost, i.e. the efforts people must make to obtain information on prices – to discourage many consumers from exploiting these price differences.

Second, even within a fully integrated region a national border can affect prices. National borders can still matter even within the European Union because the evolution of logistics networks and marketing regions is rooted in history. Current distribution networks developed at a time when cross-border trade was more complicated than nowadays. The finding that price discrimination coincides geographically with the national border is thus likely a legacy of the economic borders of the past, and their effect is fading away only slowly.[6]

The third finding is that although the law of one price fails, it does hold true in a relative sense: inflation rates are comparable on both sides of the border. Common cost shocks move prices in both countries in the same direction, but product-specific pricing dominates the border effect. Therefore, the border effect by itself is unlikely to affect the transmission of monetary policy.

In conclusion, our study suggests that retailers have considerable market power vis-à-vis consumers, with the border effect pointing to retailers choosing to apply price differentiation – for historical reasons – based on existing distribution networks.

References

Berardi, N. and P. Sevestre (2018), “The price of the same product often varies across stores, but you can guess where to go shopping”, VoxEU Column, 13 March 2018.

Engel, C. and J. H. Rogers (1996), “How Wide Is the Border?”, American Economic Review, Vol. 86, No 5, pp. 1112–1125.

Gopinath, G., P.-O. Gourinchas, C.-T. Hsieh and N. Li (2011), “International Prices, Costs, and Markup Differences”, American Economic Review, Vol. 101, No 6, pp. 2450–2486.

Gorodnichenko, Y. and L. L. Tesar (2009), “Border Effect or Country Effect? Seattle May Not Be so Far from Vancouver After All”, American Economic Journal: Macroeconomics, Vol. 1, No 1, pp. 219–241.

Méjean, I. and C. Schwellnus (2009), “Price convergence in the European Union: Within firms or composition of firms?”, Journal of International Economics, Vol. 78, No 1, pp. 1–10.

Messner, T., F. Rumler and G. Strasser (2023), “Cross-country price and inflation dispersion: retail network or national border?” Working Paper Series, No 2776, European Central Bank.

Michaels, G. and F. Rauch (2018), “Resetting the urban network: 117-2012”, Economic Journal, Vol. 128, No 608, pp. 378–412.

Neiman, B., R. Rigobon and A. Cavallo (2013), “The euro and price convergence”, VoxEU Column, 29 November 2013.

Reiff, A. and F. Rumler (2014), “Within- and cross-country price dispersion in the euro area”, Working Paper Series, No 1742, European Central Bank.

Disclaimer: the article was written by Teresa Messner (Economist, Monetary Policy Section, Oesterreichische Nationalbank), Fabio Rumler (Senior Principal, Monetary Policy Section, Oesterreichische Nationalbank) and Georg Strasser (Team Lead Economist, Directorate General Research, Macroeconomics, European Central Bank). The authors gratefully acknowledge the comments from the members of the PRISMA team, and from Alexandra Buist, Gareth Budden, Michael Ehrmann, and Alexander Popov. The views expressed here are those of the authors and do not necessarily represent the views of the European Central Bank, the Oesterreichische Nationalbank, or the Eurosystem.

German prices are subtracted from Austrian prices.

Four of the eight retail groups in our sample are discounters, all of which are active in both countries. These discounters are traditionally characterised by lower prices and a smaller product assortment than regular supermarkets. In our sample, the product range purchased at discounters covers only one-third of the products purchased at regular supermarkets.

Our household panel survey reports the shopper’s residence, not the exact shopping location. We assume that the reported prices are from nearby stores, i.e., that people typically shop close to home.

Price changes, however, do not differ systematically across the border at the retailer level, which mirrors the overall cross-country result.

History has been shown to matter for the location of cities as well. Michaels and Rauch (2018), for example, document this for the network of cities in France. A city can continue to exist in a suboptimal location for hundreds of years, similar to the suboptimal logistics networks in our study.