How can euro area banks reach sustainable profitability in the future?

Published as part of the Financial Stability Review November 2018.

On aggregate, bank profitability in the euro area has improved in recent quarters along with the cyclical recovery. However, the level of earnings for many banks is still below that required by investors and bank profitability is still vulnerable to a possible turnaround in the business cycle. This special feature looks at possible avenues for banks to reach more sustainable levels of profitability in the future. It highlights the need to overcome structural challenges in the form of low cost-efficiency, limited revenue diversification and high stocks of legacy assets (in some jurisdictions).

1 Introduction

Weak bank profitability is one of the key challenges facing the euro area banking sector. Along with the cyclical recovery across the euro area, aggregate bank profitability has recovered from the troughs observed during and after the global financial crisis. This notwithstanding, the level of profitability is still low and the ECB has repeatedly flagged low bank profitability as one of the key systemic risks to euro area financial stability (see the Overview).[2]

The special feature takes a forward-looking perspective and examines possible scenarios and ways for banks to return to sustainable profitability in the future. It starts out by discussing the return required by bank investors and viable profitability targets over the medium term. It then reviews the main areas banks should focus on to improve profitability. This includes tackling structural challenges in the form of subdued revenue generation, low cost-efficiency, a lack of consolidation and high levels of non-performing loans (NPLs) in some jurisdictions. Furthermore, a stylised scenario analysis is employed to demonstrate the sensitivity of bank profitability to changing cyclical conditions and also considers the potential for bank management efforts to overcome the various structural challenges prevalent in the euro area banking sector.

2 Defining the “viable” level of bank profitability

The ECB has repeatedly highlighted that low bank profitability constitutes a key risk to euro area financial stability. Prolonged periods of very low bank profitability risk impeding credit intermediation in the economy, with potential adverse repercussions for growth and welfare. The question then arises which level of profitability is desirable from a financial stability perspective? In fact, excessively high bank profitability could also indicate risks to financial stability. As vividly experienced in the period leading up to the financial crisis, such a situation may be predicated on high risk-taking, which could sow the seeds for future banking crises.

Throughout this special feature, bank profitability is primarily assessed using the return on equity (ROE) metric. ROE is a useful gauge when discussing banks’ viable level of profitability. First, the indicator is widely used by practitioners as a standard measure of bank profitability. Second, analysts’ expectations about future ROE developments are widely available, facilitating a cross-check with market perceptions. Third, ROE developments are closely intertwined with the concept of cost of equity (COE), with the latter serving as an anchor for bank shareholders’ required returns. One notable caveat of ROE is that the metric is highly dependent on bank leverage and hence observed improvements might simply be due to increasing leverage.

A large share of euro area banks are not delivering the returns required by investors

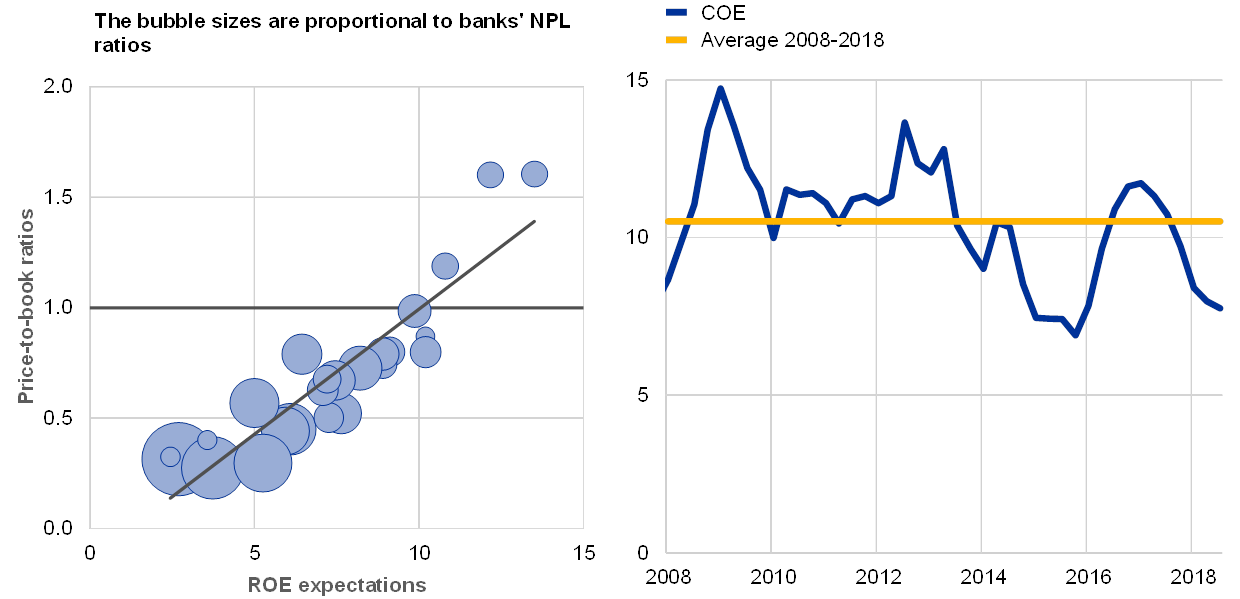

Price-to-book ratios, one-year-ahead ROE expectations and NPL ratios (left panel); euro area listed banks’ COE (right panel)

(left panel: ROE expectations (Sep. 2018), NPL ratios (Q2 2018), annual percentages and ratios; right panel: Q1 2008-Q3 2018, annual percentages)

Sources: Bloomberg, Thomson Reuters Datastream, ECB and ECB calculations.Note: In the right panel, the cost of equity is the expected return on the EURO STOXX Banks index estimated using the capital asset pricing model.

A broad range of indicators can be used to gauge the viable level of bank profitability. A number of survey and model-based indicators can be used to determine the level of profitability needed to generate sufficient levels of retained earnings (and hence capital), ensuring a sustained level of financial intermediation over the business cycle and at the same time delivering the returns required by shareholders.

Market valuations can be used to illustrate the low profitability problem for euro area banks. Chart A.1 (left panel) shows price-to-book (P/B) ratios – defined as the ratio of the market value of equity to its book value – for large listed euro area banks. As expected, banks’ P/B ratios are closely correlated with analysts’ profitability outlook for the banks. In addition, shares of banks with high legacy assets in the form of high NPL ratios tend to be trading at subdued valuations.[3] For many euro area banks, P/B ratios currently stand well below one. P/B ratios below one would indicate that those banks are not earning their corresponding cost of equity.[4] As a corollary, it can be inferred from Chart A.1 (left panel) that banks displaying P/B ratios above one are delivering ROE at or above 10% to satisfy investors. A model-based estimation of the cost of equity for large listed banks in the euro area has fluctuated around the 10% mark over the past decade (see Chart A.1, right panel).[5] A somewhat lower cost of equity has been recorded in recent years which would be in line with falling risk-free rates, which play an important role in the capital asset pricing model (CAPM).

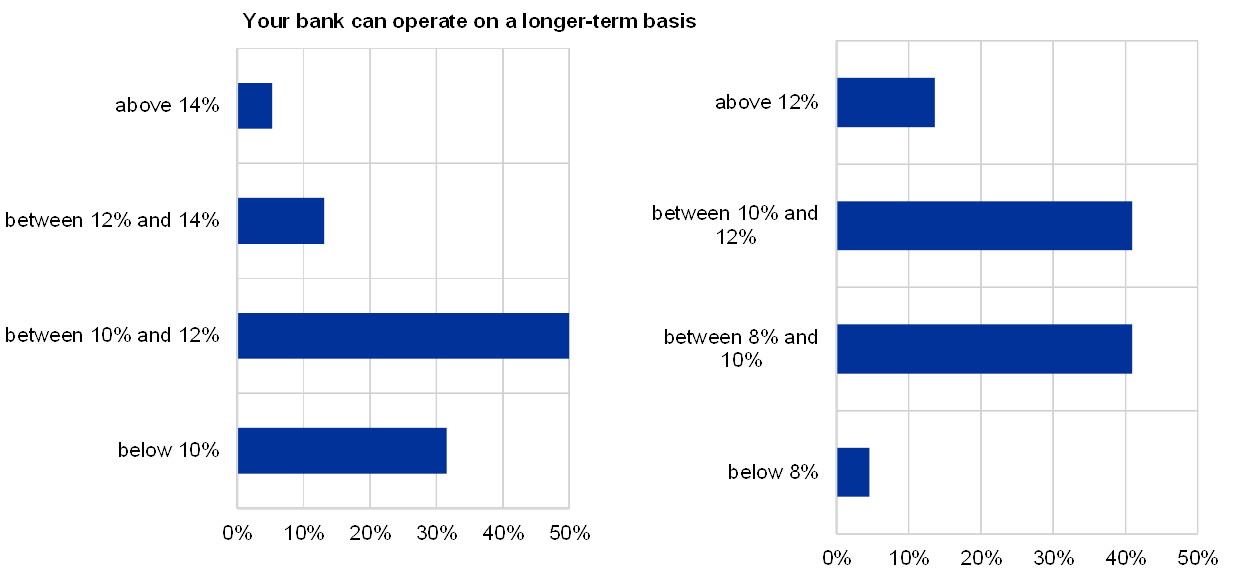

Survey-based evidence on banks’ future profitability targets

European banks’ long-term sustainable profitability targets (left panel) and ROE targets for large euro area banks (right panel)

(left panel: July 2018 EBA questionnaire; right panel: 2018-21 horizon)

Sources: EBA, individual bank disclosures and ECB calculations.Notes: In the left panel, the results are taken from the EBA’s Risk Assessment Questionnaire, which reports the responses from banks and market analysts. The right panel is based on 21 large euro area banks. The targets have been collected from banks’ business and strategic plans.

Survey-based evidence on banks’ medium and long-term targets confirms the need for banks to step up their efforts to reach sustainable profitability. The European Banking Authority (EBA) regularly publishes surveys gathering the responses of banks and market analysts regarding the level of ROE needed for European banks to operate on a longer-term basis.[6] These results point to required ROE levels at or above 10% (see Chart A.2, left panel). Corroborating these results, banks themselves have set ROE targets over the next three years at similar – albeit slightly lower – levels (see Chart A.2, right panel).

Realistic medium-term ROE targets should acknowledge the fact that banks are currently much safer than before the outbreak of the crisis a decade ago. A combination of efforts by banks to tackle structural challenges as well as higher loss-absorption capacity in the system and enhanced supervisory scrutiny should arguably have lowered the returns required by bank investors, compared with pre-crisis levels. Thus, the current gap between banks’ COE and ROE does not necessarily have to be closed exclusively by the ROE component; this may also come about via reduced required returns.

Combining estimates from these different approaches, a target range of 6-10% ROE for euro area banks is assumed and used as a benchmark against which to judge the ROE projections described below. Any assessment of sustainable levels of bank profitability is surrounded by high uncertainty and would differ across banks depending on their business models and the macro and regulatory environment they are operating in. The proposed range is indicative and there are banks for which this range may not be applicable. For instance, banks with low risk-taking and banks with non-private governance may be able to operate with slightly lower levels of profitability. By contrast, commercial banks operating with high leverage, combined with a high dependence on wholesale funding and complex asset structures, may have a higher cost of equity than the 6-10% ROE range.

3 Key focus areas for banks to reach viable profitability

Previous issues of the FSR have highlighted the need for euro area banks to overcome structural challenges. This includes stepping up efforts to reduce operating costs, achieving a higher degree of income diversification and, in some jurisdictions, reducing the still elevated stock of legacy assets. This section discusses measures that banks can adopt in these areas.

3.1 Cost-efficiency measures

Euro area banks’ cost-efficiency has deteriorated since 2010 and empirical evidence suggests that there is substantial scope for cost-efficiency improvements. Euro area banks’ aggregate cost-to-income ratio edged up from 62% in 2010 to 65% in 2017, primarily driven by an increase in staff costs. On aggregate, euro area banks’ staff costs remained high at 0.8% of total assets in 2017, compared with only 0.5% for Nordic banks, for example.[7] Furthermore, a recent empirical analysis to estimate euro area banks’ cost-efficiency shows that long-term structural factors play a significantly bigger role in bank efficiency than cyclical factors.[8]

Among the possible measures to improve (structural) efficiency, a further shift away from physical branch networks to digital banking may offer a permanent cost-saving opportunity for banks. The scope for potential cost savings via this channel may be particularly relevant in countries with dense branch networks. This notwithstanding, banks’ ability to cut costs by (further) branch network and staff rationalisation will depend on structural factors, such as labour laws (e.g. the strength of employment protection), population density, the overall degree of digitalisation in society at large, as well as market concentration (see Box A).

Box ADigitalisation and its impact on banks’ costs and profitability

This box examines the impact of digitalisation on banks’ costs and profitability, and thus on their structural resilience. Investment in digital technologies can improve cost-efficiency and enhance revenues through improved customer services. Indeed, it is widely considered as one success factor for banks domiciled in Nordic countries, for example. Conversely, a lower use of digital channels in banking services can imply a need for a dense branch network, which tends to be costly and labour-intensive. A slow adoption of digitalisation could thus lead to persistently lower profitability, which is the first line of defence against shocks.[9]

Technological innovation in financial services, heightened competition from non-banks (e.g. fintech companies) and changing customer expectations are challenging bank business models. In response, a number of banks are enhancing their digital offerings to customers and upgrading core banking systems to improve operational efficiency. Correspondingly, banks have increased their spending on information technology (IT) in recent years. According to estimates by Celent, a consultancy firm, global banks’ IT expenses amounted to USD 250 billion in 2017 (up from USD 180 billion in 2013) and are expected to rise at a 4.2% average annual growth rate in the period 2018-21, with new investment estimated to reach 40% of IT budgets by 2021.[10] At the same time, a shift in customer preferences towards digital banking options is transforming bank distribution models. According to a global survey by the Boston Consulting Group, the share of customers preferring digital-only and multi-channel banking reached a combined 86% in 2017, compared with 65% in 2015.[11]

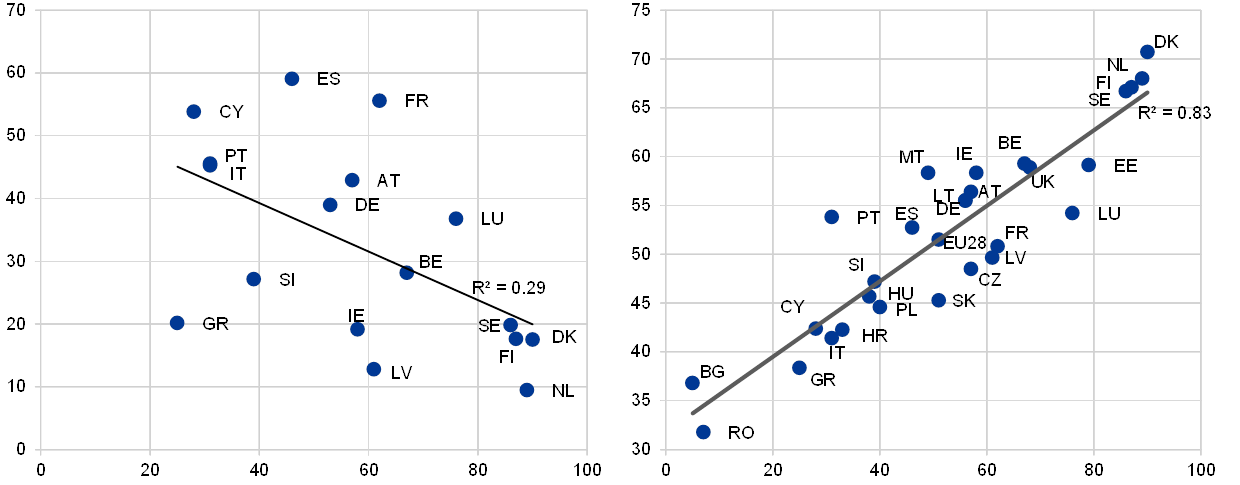

The speed of digital transformation and the substitution of branch networks by digital channels vary widely in Europe. Banks in the Nordic and Benelux countries have progressed the most in optimising branch networks, also facilitated by a higher adoption of internet and mobile banking by customers (see Chart A). The Nordic countries rank highly in terms of digital readiness and the usage of internet banking, a factor that has possibly helped to reap the cost advantages arising from introducing new banking technology.

Chart A

A leaner branch structure has in some countries been facilitated by internet banking, which in turn is strongly related to the general digitalisation of society

The share of population using internet banking vs. the number of branches per 100,000 inhabitants (left panel) and the Digital Economy and Society Index (right panel)

(2017; left panel: x-axis: percentage of individuals using the internet for banking; y-axis: number of bank branches per 100,000 inhabitants; right panel: x-axis: percentage of individuals using the internet for banking; y-axis: Digital Economy and Society Index)

Sources: ECB, Eurostat and European Commission.Notes: In the right panel, the Digital Economy and Society Index is calculated as the weighted average of five dimensions: connectivity, human capital, use of the internet, integration of digital technology and digital public services. Equal weighting is applied. The share of the population using internet banking is measured as a percentage of individuals aged 16 to 74.

While digitalisation may offer significant cost-saving opportunities for banks in the medium-to-long term, it may also entail material costs and, therefore, a closer look at the overall impact on bank profitability is warranted. On the one hand, branch rationalisation and process automation may bring significant cost benefits. In addition, digital leaders may also benefit from additional revenues via market share gains. On the other hand, the substitution of branches by digital distribution channels may entail significant one-off costs (e.g. severance payments) and running costs (e.g. cyber security spending). From a systemic point of view, recent empirical evidence suggests that a higher reliance on digitalised forms of providing financial services may also result in more contestable retail banking markets, as it becomes easier for bank customers to shop around and compare bank products and prices.[12] While this may have a positive impact on the sector’s overall efficiency and lead to enhanced product transparency for bank customers, it could also have a first-order negative effect on profitability via reduced margins.

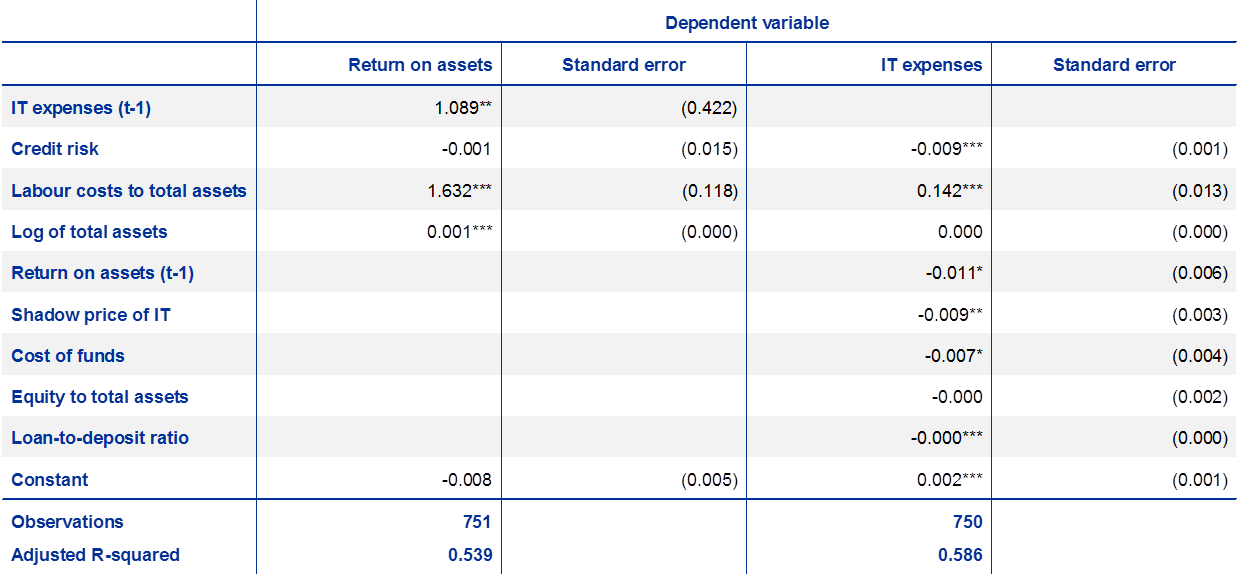

A bank-level analysis indicates that additional investment in IT could improve profitability, although potential benefits may vary widely across banks. Using the profit and loss statement item “IT expenses” as a first approximation of bank digitalisation efforts, a two-stage least squares panel econometric analysis with country fixed effects investigates, first, the impact of IT expenses on bank profitability and, second, the determinants of the decision to invest in IT (see Table A).[13] It turns out that higher IT expenses have a positive and significant impact on bank profitability. The small coefficient indicates that the magnitude of this impact is limited, which is logical given the small portion of overall production inputs represented by IT expenses. However, the results do not fully account for potential longer-term cost reductions through IT investments, for example via reduced utilisation of labour and physical capital, which can bring significant additional benefits.[14]

Table A

Additional investment in IT could improve bank profitability, but weak balance sheets could form barriers to it

Results of a two-stage least squares panel regression (second stage)

Sources: SNL Financial and ECB calculations.Notes: Standard errors in parentheses; * p < 0.05, ** p < 0.01, *** p < 0.001. Data refer to an unbalanced panel of 1,768 euro area banks for the period 2005-17; however, the effective sample is much smaller due to the fact that only a portion of banks report IT expenses. IT expenses are used as a proxy for bank digitalisation efforts. Capitalised software is treated as a sunk cost and therefore removed before performing the analysis. Credit risk is measured as the flow of provisions over total assets during the period. The shadow price of IT investment is calculated as the first derivative of IT investment in the translog cost function (see Huljak, I., Martin, R. and Moccero, D., “The cost efficiency and productivity growth of euro area banks”, ECB Working Paper, forthcoming). The cost of funds is calculated as the ratio of interest expenses to total liabilities. A two-stage least squares regression on pooled cross-section data is used. The endogeneity and the need to use instrumental variables are confirmed through the Wu-Hausman F-test (significant at 10% and 5% for the first and second equation respectively). The independent variables (IT expenses and return on assets) are instrumented with their own lagged variables. Country fixed effects are included to control for time-invariant heterogeneity at country level.

The analysis also shows that the strength of a bank’s balance sheet is an important determinant of IT investment decisions. The empirical results suggest that a higher credit risk, cost of funds and loan-to-deposit ratio decrease the amount of IT investment. Constraints resulting from restructuring or litigation costs, or from State-aid conditionality, may also have hampered investment in IT for some banks. At the same time, the negative and significant coefficient of the shadow price of IT investment indicates that a higher potential gain from IT in terms of enhanced efficiency is not inducing banks to invest. Besides the bank-specific factors in the regression, this could also be partially related to some exogenous enabling factors, such as a critical level of digital readiness in the economy, not being present.

Targeted policy action may support the transformation of IT investments into efficiency gains in regions where bank digitalisation remains less advanced. A successful transformation may in particular require the enhancement of the overall level of digitalisation in the economy. Moreover, distressed bank balance sheets may still hamper IT investment precisely where it could reap the most benefits in terms of efficiency improvements. Banks can thus get caught in a profitability trap, where balance sheet fragility creates a longer-term competitive disadvantage.

Consolidation via mergers and acquisitions (M&As) could be another way to enhance efficiency through cost-cutting synergies. Bank-level analysis of the drivers of M&As suggests that domestic acquisitions tend to focus on achieving cost synergies, possibly due to a greater scope for streamlining overlapping distribution networks, while cross-border M&A activity appears to be driven more by expansion opportunities.[15] Looking ahead, there is scope for domestic M&As that can deliver important cost savings through economies of scale (e.g. lower administrative expenses, branch rationalisation), in particular in less concentrated banking markets, as well as revenue synergies (e.g. lower funding costs of the merged unit). Furthermore, the current favourable macroeconomic environment, more regulatory certainty due to the finalisation of the Basel reforms, as well as improving bank fundamentals, should help M&A activity. However, making further progress towards the completion of the banking union and the capital markets union, as well as overcoming prevailing regulatory and supervisory obstacles (e.g. the harmonisation of insolvency laws and taxation regimes, the establishment of a European deposit insurance scheme, and the subsequent removal of national options and discretions), may be necessary to facilitate larger-scale M&As within the euro area banking sector.[16] Additionally, special attention should be paid to the emergence of potential risks associated with too-big-to-fail institutions that may result from the M&A process.

3.2 Revenue diversification measures

While banks’ ability to cut costs and improve operating efficiency will be crucial in restoring their profitability, many banks will also need to enhance their revenue-generating capacities. These efforts may require some adjustments to existing business models and management strategies. Notably, adjustments to banks’ revenue-generating strategies will likely occur in an environment of increasing competition from non-bank financial intermediaries (including fintech companies) and market-based finance, which entails both challenges and opportunities for the banking sector.

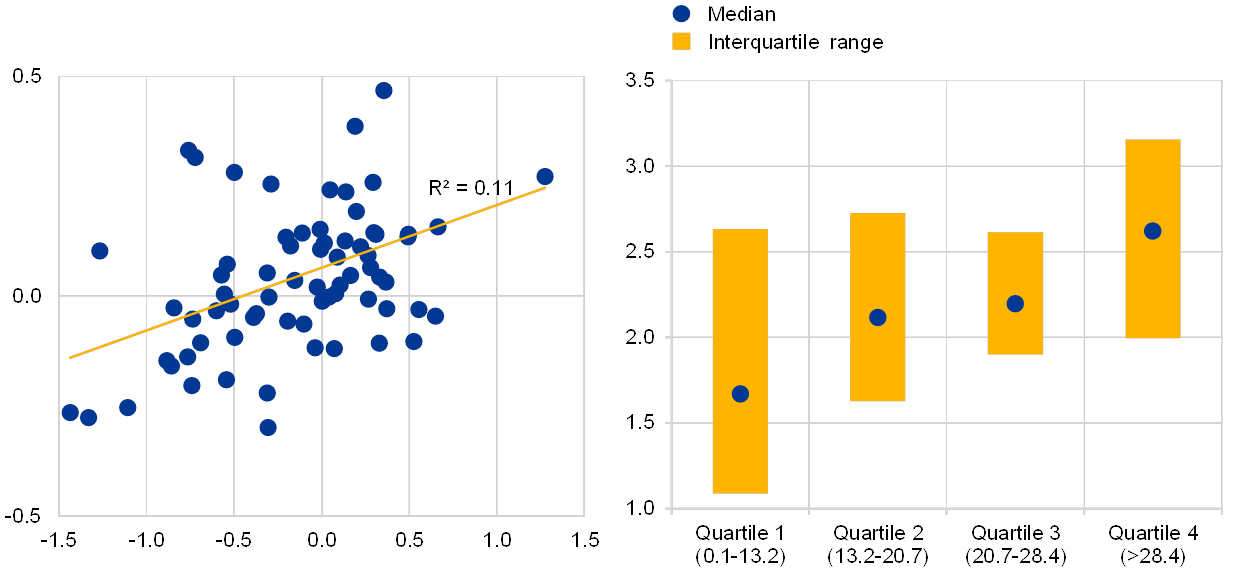

Weak positive relationship between net fee and commission income and net interest income suggests limited income source substitution, while banks with high shares of net fee and commission income have typically generated higher revenues in the past few years

Changes in NII and NFCI for euro area significant institutions between 2009 and 2017 (left panel) and operating income to total assets by fee income share quartile (right panel)

(left panel: x-axis: change in NII over total assets; y-axis: change in NFCI over total assets; percentage points; right panel: median and interquartile range of operating income to total assets by quartiles of NFCI/operating income (ranges in brackets); based on averages over the period 2014-17)

Sources: ECB, SNL and ECB calculations.

One important avenue for better income diversification, in particular for banks relying heavily on net interest income, could be to enhance fee and commission-based activities. Recent trends suggest that since the financial crisis there has been a gradual shift in euro area banks’ income structure towards non-interest income, including net fee and commission income (NFCI). NFCI is often generated from off-balance-sheet activities and, as a result, typically does not tie up significant amounts of capital and hence translates more directly into higher ROE (than, for instance, net interest income or NII). However, the extent to which banks can diversify into more fee and commission (F&C) income is likely to depend on their specific business model.[17] Some bank business models are more naturally geared towards fee-generating activities (such as custodian, asset management and investment banking activities). Further increasing their NFCI could even lower their level of income diversification. Other banks whose business models (e.g. specialised lenders and corporate/wholesale lenders) are predominantly relying on NII, however, could benefit from increasing the NFCI share in their total income.

Since the crisis a weakly positive relationship between fee and commission income and net interest income has been observed. The correlation between NII growth and F&C income growth over the period 2009-17 seems to be weakly positive for most euro area significant institutions, suggesting a limited degree of complementarity between these two income sources (see Chart A.3, left panel).[18] However, there is also a number of banks which have managed to compensate for weak NII dynamics by increasing their F&C income (the banks in the upper left part of the chart).[19]

In the past few years, banks with more diversified revenue streams seem to have coped better with profitability pressures in a low interest rate environment. In particular, banks with high shares of net fee and commission income have generally generated higher revenues in the period 2014-17, although the relationship between these two variables is heterogeneous (see Chart A.3, right panel).

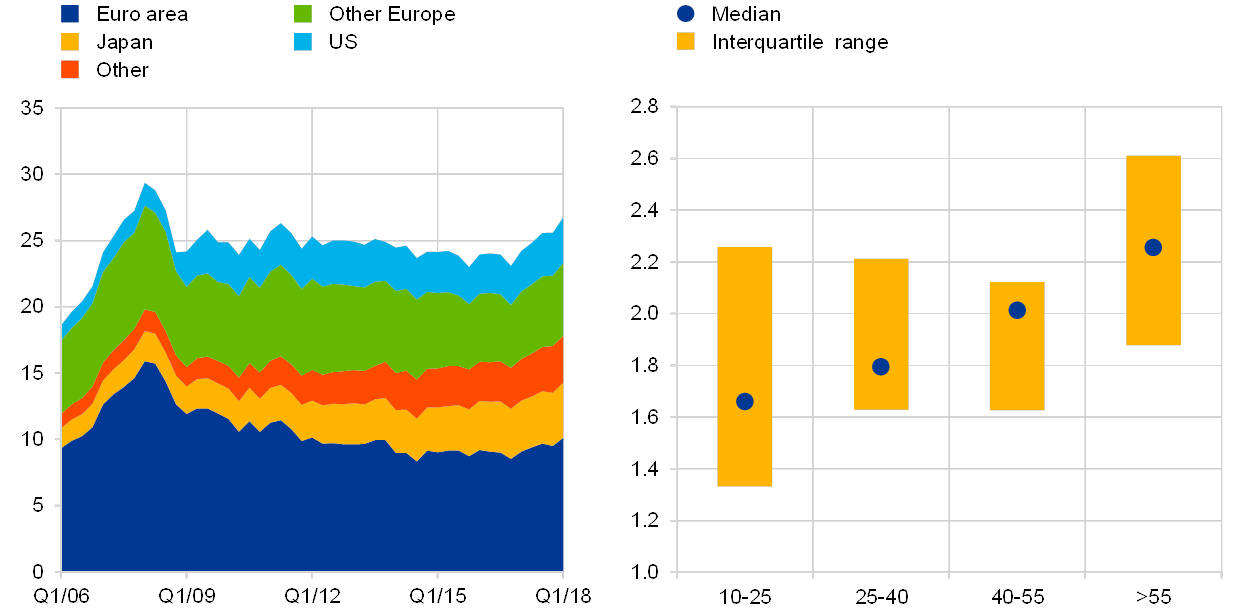

Euro area banks have significantly reduced their foreign claims since the financial crisis, while greater geographical diversification has tended to support banks’ revenue generation in the past few years

Banks’ foreign claims by region of reporting banks on an ultimate risk basis (left panel) and operating income to total assets by non-domestic revenue share (right panel)

(left panel: Q1 2006-Q1 2018, USD trillions; right panel: median and interquartile range of operating income to total assets by share of non-domestic revenue in operating income; based on averages over the period 2015-H1 2018, percentages)

Sources: BIS, ECB and ECB calculations.Note: Sample includes 39 significant institutions with a non-domestic revenue share of at least 10% (right panel).

Another avenue for banks to address revenue-side challenges could be to increase the geographical diversification of their activities following the crisis-related retreat from foreign markets.[20] As part of the broader deleveraging process after the financial crisis, since mid-2008 euro area banks have significantly reduced their foreign exposures (see Chart A.4, left panel). This was the result of increased pressure on banks to improve capital positions and to reduce their reliance on volatile wholesale funding sources (including short-term USD funding).[21] Furthermore, in some cases, restructuring and divesting risky foreign activities have been mandated by regulatory authorities as part of rescue packages, in particular for banks that received government support and had to follow EU State-aid rules. This retrenchment, in turn, allowed banking groups from other regions to expand their international operations, resulting in a significant loss of market shares for euro area banks.

In general, more geographically diversified banks have displayed stronger revenue performance in the past few years, despite some risks which may underlie the exposure to some geographical areas. Focusing on the group of banks which derive at least 10% of their revenues from foreign operations, institutions with the highest share tend to outperform others in terms of revenue generation, benefiting from higher margins and better growth opportunities in regions outside their home markets (see Chart A.4, right panel).

3.3 NPL resolution

Elevated loan impairment costs remain an important driver of low profitability in high-NPL countries.[22] Profitability is affected by the lower returns provided by the NPLs, given the weight of gross exposures in total assets. High NPLs also tie up capital, erode funding, as well as reducing operational capacity, thereby constraining banks’ ability to support the economic recovery. The NPL exposures therefore remain a risk to profitability, especially in cases where banks’ recovery efforts would be less successful than expected, or where the value of collateral (in particular property) unexpectedly declines.

Resolving the NPL problem requires concerted public and private sector action.[23] First of all, banks themselves need to build up internal workout capacity and expertise in handling non-performing exposures. In accordance with ECB Banking Supervision guidance, banks also need to reduce high stocks of NPLs via timely provisioning and write-off practices.[24] Various public sector initiatives, sometimes with private sector involvement, could also help overcome asymmetric information problems related to NPL valuations which make it costly to reduce the stock of NPLs. These include the setting-up of asset management companies, securitisation vehicles and transaction platforms, and the further development of secondary loan markets.[25] Finally, in some jurisdictions further efforts are warranted to reduce lengthy and inefficient debt enforcement and foreclosure procedures and remove tax disincentives to provisioning for, writing off or selling NPLs.

4 What can be learned from the best-performing banks?

Some banks in the euro area have delivered strong profitability despite the challenging macro environment. Notwithstanding the poor profitability performance of the euro area banking system as a whole, some individual banks have managed to deliver robust earnings in recent years. The drivers behind the better performance of these banks are assessed below in order to extract some useful lessons for the broader banking sector. Admittedly, some of the measures adopted by the best performers cannot be replicated by all banks. For instance, by definition, not all banks can simultaneously increase their market share. Nevertheless, a broad improvement in cost-efficiency and higher revenue diversification across the euro area banking system should enhance its competiveness vis-à-vis global peers also in aggregate terms.

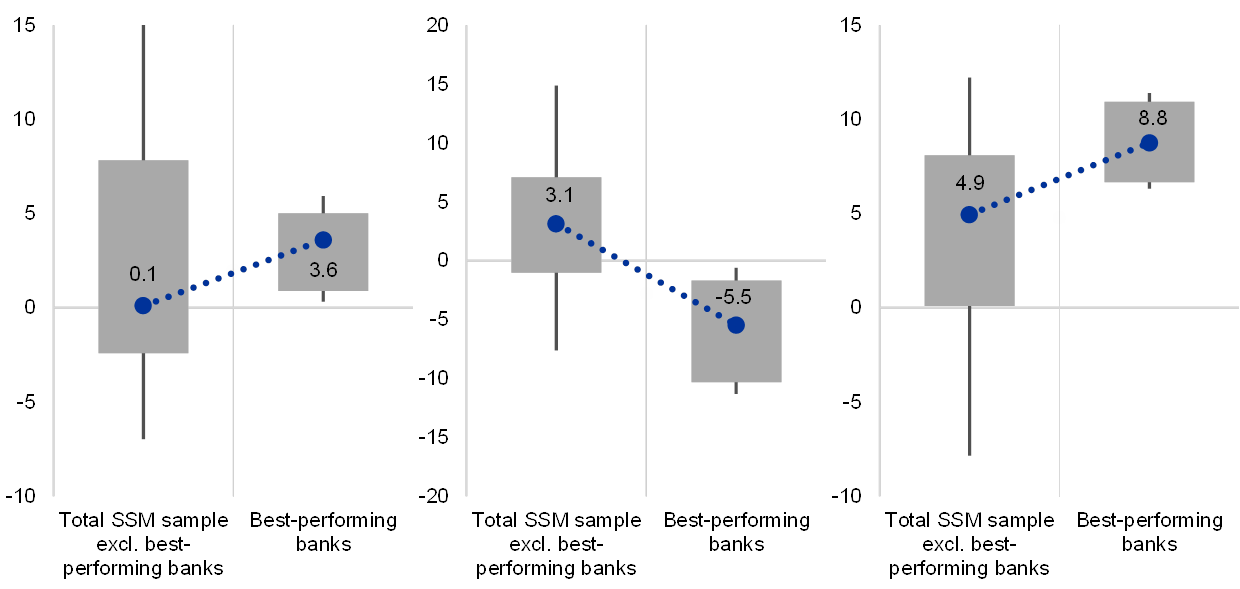

Significant progress in efficiency and profitability metrics for the best-performing banks

Changes in ROE between period 1 and 2 (left panel), changes in the cost-to-income ratio between period 1 and 2 (middle panel) and ROE in period 2 (right panel)

(percentages (left and right panels), percentage point change (middle panel); median, interquartile range and 10th-90th percentile)

Sources: SNL and ECB calculations.Notes: Total sample consists of 111 euro area significant institutions. 13 banks identified as best-performing. Period 1 covers 2009-13 and period 2 covers 2014-17.

The performance of the most successful banks highlights some salient features associated with sustained profitability improvements.[26] Using metrics of profitability and cost-efficiency, a few banks can be defined as “best-performing” institutions.[27] The best-performing banks were defined as those banks which between 2009-13 and 2014-17 managed to decrease their cost-to-income ratio and concomitantly increase their ROE, and had an absolute average ROE higher than 5% in the latter period.[28] It can be observed that the best performers managed to significantly reduce the cost-to-income ratio between the two periods (see Chart A.5, middle panel). These cost-efficiency improvements have been accompanied by a median ROE increase of 3.6 percentage points (see Chart A.5, left panel). The best-performing banks’ median ROE of 8.8% (2014-17) falls well within the target range of long-term sustainable profitability levels of 6-10% (see Chart A.5, right panel). By contrast, other institutions’ cost-efficiency deteriorated between the two periods, while ROE only marginally improved (resulting in a median ROE of 4.9% over the years 2014-17).[29]

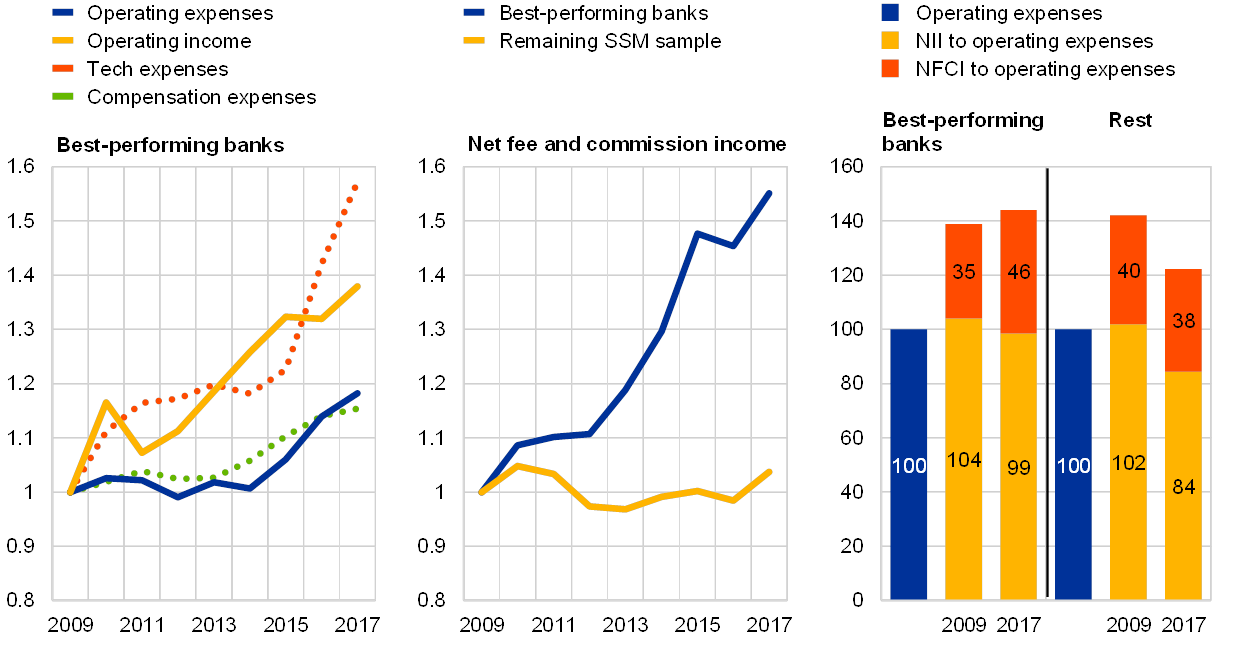

One underlying driver of the improved profitability of the best-performing banks is favourable developments in the cost-to-income ratio. Since the end of the financial crisis, these banks have managed to increase operating income by nearly 40%, while the growth rate of operating costs has been around 20 percentage points lower, indicating significant efficiency gains (see Chart A.6, left panel). For the rest of the sample, the cost-to-income developments have been less favourable, with overall rising operating costs coupled with flat or even reduced operating income.

Investment in technology and income diversification efforts helped to improve cost-efficiency for the best-performing banks

Changes in operating income and expenses for the best-performing banks (left panel), developments in NFCI (middle panel) and main income sources (right panel) for both samples

(average cumulative percentage change in operating income, operating, technology and compensation expenses, as well as NFCI indexed to 2009 values (left and middle panels); NII and NFCI to operating expenses in 2009 and 2017 (right panel))

Sources: SNL and ECB calculations.Note: In the right panel, aggregate NII and NFCI are indexed to the aggregate operating expenses of the respective sample.

The best-performing banks embarked on large-scale investments in information technology. The best-performing banks have increased IT expenses by nearly 60% since 2009 (see Chart A.6, left panel), which compares with an increase of around 10% for the rest of the sample. Looking ahead, in the latest risk assessment questionnaire of the EBA[30], the vast majority of the banks surveyed consider increases in automation and digitalisation to be one of the primary drivers of operating cost reductions. These observations indicate that most banks now recognise the need to boost technology spending in order to obtain efficiency gains in the future (see also Box A in this special feature).

There are signs that the best-performing banks have managed to reap benefits from revenue diversification. It is notable that the best performers’ NFCI increased by more than 50% between 2009 and 2017, whereas the remaining banks only managed to boost NFCI by less than 10% over the same period (see Chart A.6, middle panel). Furthermore, despite the low nominal growth and low interest rate environment, the best performers’ NII has remained broadly stable at levels similar to their operating costs (see Chart A.6, right panel). For the remaining banks, however, traditional interest-earning activities have not been sufficient to cover operating costs. This highlights the need for the euro area banking sector to broaden its income sources. Indeed, an increasing number of banks now acknowledge that there is a need for further income diversification.[31]

5 Outlook for euro area banks’ return on equity

A forward-looking analysis tries to gauge the impact on euro area bank profitability from (i) the ongoing cyclical recovery and (ii) discretionary bank management action. First, a baseline projection of euro area banks’ ROE is made employing the ECB top-down stress-testing framework using individual bank data reported in the context of the 2018 EBA EU-wide stress-test exercise.[32], [33], [34] Second, on top of the cyclical impact, a simple static analysis of discretionary bank management action is conducted to assess what it would take to bring the profitability of the majority of euro area banks back onto a more solid foundation.

A three-year baseline projection of significant euro area banks’ profitability is made using the ECB top-down stress-testing framework. While using data from the 2018 EBA EU-wide stress-test exercise, for the purpose of producing a central, unbiased projection conditional on a baseline scenario, a number of the methodological constraints embedded in the supervisory exercise were relaxed, such as the pass-through constraints affecting NII. Moreover, the assessment was conducted assuming a dynamic balance sheet, implying that banks’ balance sheets were allowed to evolve over the horizon in a manner consistent with the underlying macro-financial scenario assumptions.[35]

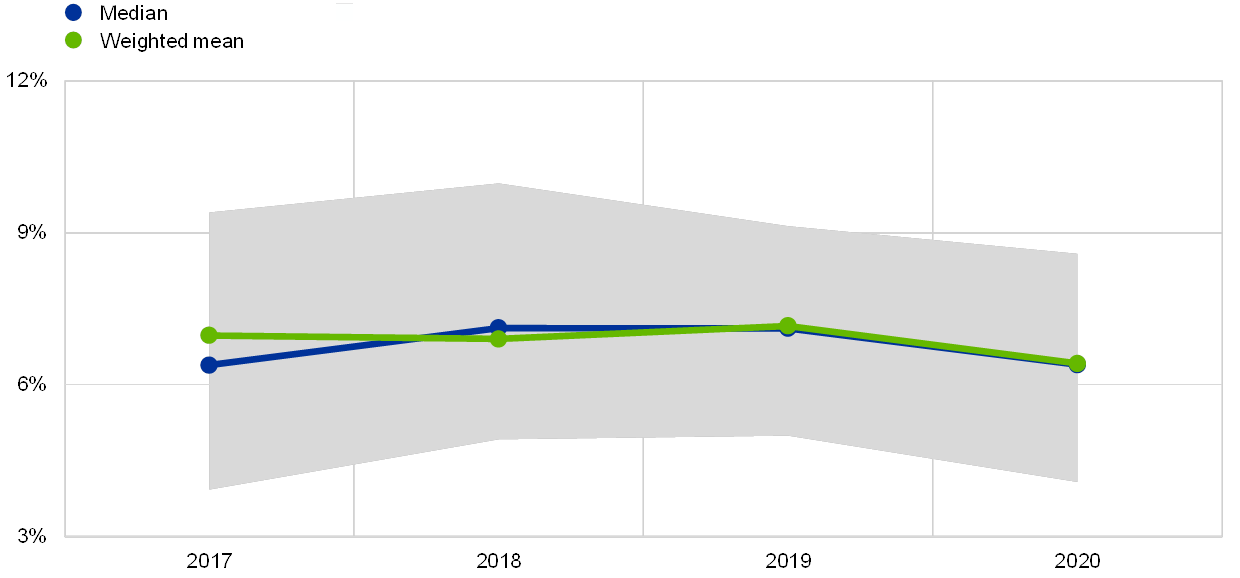

Under the baseline scenario of moderate economic growth, banks’ ROE is expected to slightly increase over the next three years. Chart A.7 shows a projected increase in the ROE (for the median bank) to around 7.1% in 2018 and 2019 from the 6.4% recorded in 2017. In 2020, bank profitability is expected to decline again. Large heterogeneity across banks is observed, as illustrated by the interquartile ranges. These profitability figures are somewhat lower than analysts’ expectations, which project a median ROE of around 8% by 2020.[36]

Baseline projections of euro area banks’ ROE using the ECB stress-testing framework

ROE projection for euro area significant institutions

(percentages, 2017 (actual), 2018-20 (projections), median and interquartile range)

Sources: ECB and ECB calculations.

The moderate increase in projected ROE can be explained by the subdued outlook for key profitability drivers. While the economic recovery in the euro area is expected to continue, the baseline outlook points to rather moderate improvements in key profitability drivers such as economic activity and interest rates. Thus, at the euro area level, GDP growth is projected to reach 2.3% in 2018 after which it would drop to 1.9% and 1.7% in 2019 and 2020, respectively. Similarly, property prices are projected to increase by 4% in 2018, with growth slowing somewhat in subsequent years. Importantly, while interest rates increase somewhat over the course of the scenario (with short-term money market rates and ten-year bond yields overall increasing by around 50 basis points from their respective 2017 levels), they overall remain subdued, thus continuing to exert downward pressure on banks’ net interest margins. The increase in short-term rates is relatively strong in the final year of the scenario which compresses interest margins as the rise in short-term rates typically passes through faster to bank funding costs than to interest-earning assets. This largely explains the slight drop in projected ROE figures for 2020.[37]

These findings indicate that the current moderately positive economic outlook will not be sufficient for many banks to return to more sustainable levels of profitability. Notably, for banks in the lowest profitability quartile, ROE is projected to be lower than 5% at the end of the scenario horizon (see Chart A.7).

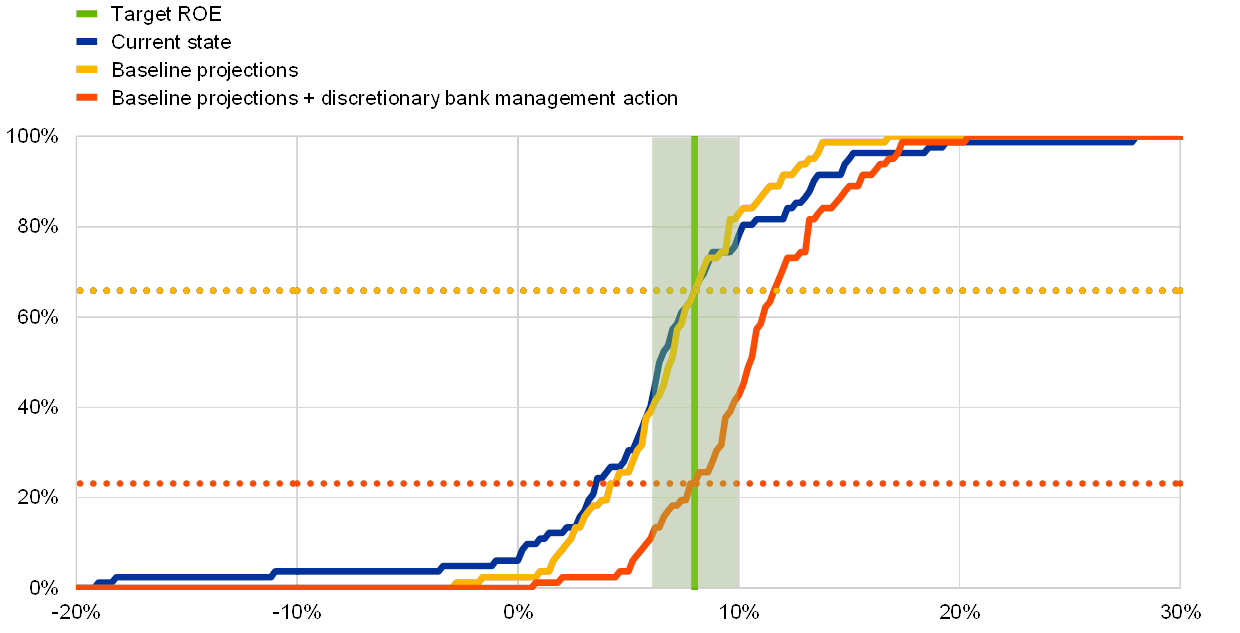

Around 25% of euro area significant institutions’ ROEs remain below the target (of 8%) even with optimistic profitability improvements

ROE of significant institutions with uniform profitability improvements

(Q4 2017; x-axis: ROE; y-axis: cumulative distribution of banks)

Sources: ECB supervisory data and ECB calculations.Notes: The sample is based on the 82 euro area significant institutions used in the baseline projections of the stress-testing framework discussed above. Discretionary bank management action refers to an extrapolation of past profitability improvements of the best-performing banks amounting to 3.6% to the entire sample of significant institutions.

Even assuming that discretionary bank management action would help improve the profitability of euro area banks, a significant proportion of banks is likely to remain below the 6-10% ROE threshold range. A static scenario analysis was conducted to examine potential gains assuming that all banks would benefit from a profitability improvement equal to the average increase in ROE of 3.6% over the last four years exhibited by the best-performing banks (on top of the average baseline ROE projections described above).[38] As argued above, potential drivers of such ROE improvements include cost-efficiency gains, income diversification and advancements in the area of technology and digitalisation. While under these scenarios the situation for many banks would improve (reflected in a rightward shift in the bank distribution curves depicted in Chart A.8), it is notable that even under the very favourable scenario where both adjustments are combined (i.e. discretionary bank management action on top of the baseline scenario), around 25% of the banks would still remain below the indicative ROE target of 8%.[39] The banks located in the lower ROE tail are predominantly mid-tier banks and banks with high stocks of NPLs. This highlights the importance of making further progress in resolving the NPL problems and of promoting further consolidation efforts in the euro area banking sector.

6 Conclusion

This special feature has highlighted the need to overcome structural challenges to euro area bank profitability, including low cost-efficiency, weak revenue generation and high stocks of NPLs. The analysis illustrates the potential impact on banks’ profitability of a variety of measures that banks could take to address prevailing structural impediments. Such measures could include cost reductions (e.g. lower staffing and streamlining of branch networks), enhanced digitalisation, revenue diversification and NPL resolution. The special feature also emphasises the scope for further banking sector consolidation, which could help improve the performance of mid-tier banks in particular, provided it does not create too-big-to-fail institutions.

While the needed adjustments to banks’ business models are first and foremost a responsibility of the banks’ own management, regulatory and policy initiatives could help to create an environment where such adjustments are facilitated. A number of regulatory and policy measures could help to improve the institutional setting in which the banking sector operates and facilitate banks’ efforts to adjust their business models. Such measures should encompass a completion of the banking union (in particular the establishment of a European deposit insurance scheme), the subsequent removal of remaining non-harmonised national options and discretions, the advancement of the capital markets union and continued public sector efforts complementing private sector action to resolve the NPL problem. Taken together, these measures would help to improve investor confidence in the euro area banking sector, remove obstacles to (cross-border) consolidation and generally strengthen the operating environment.

- [1]Also based on contributions from Martin Bijsterbosch, Andrea Deghi, Maciej Grodzicki, Lieven Hermans, Ivan Huljak, Nadya Jahn, Marco Lo Duca, Thomas Kostka, Katri Mikkonen, Diego Moccero, Philippe Molitor and Cristian Perales. Comments from Glenn Schepens are also acknowledged.

- [2]The low profitability issue and the need for euro area banks to adjust their business models have also been highlighted by the ECB and the IMF in recent publications; see e.g. “SSM thematic review on profitability and business models – Report on the outcome of the assessment”, ECB Banking Supervision, September 2018, and Euro Area Policies: Financial Sector Assessment Program – Technical Note – Systemic Risk Analysis, IMF, July 2018.

- [3]Using a panel regression framework, and based on a global sample, a recent BIS study also finds that profitability and asset quality measures significantly impact banks’ price-to-book ratios. See Bogdanova, B., Fender, I. and Takáts, E., “The ABCs of bank PBRs”, BIS Quarterly Review, March 2018.

- [4]This interpretation can be inferred from the dividend discount model. For a derivation, see Norman, D., “Returns on Equity, Cost of Equity and the Implications for Banks”, Reserve Bank of Australia Bulletin, March 2017.

- [5]The cost of equity is unobservable and any method to calculate it is prone to estimation and/or model uncertainty. For a further explanation of the model, see Box 5 in the May 2015 ECB Financial Stability Review.

- [6]See Risk Assessment Questionnaire – Summary of Results, EBA, July 2018.

- [7]Based on the average for Denmark, Finland and Sweden.

- [8]See Box 6 entitled “Cost efficiency of euro area banks” in the May 2018 ECB Financial Stability Review.

- [9]At the same time, digitalisation may increase vulnerabilities to systemic risks that arise from cyberspace and cause herd behaviour and procyclicality, inasmuch as it translates into reduced heterogeneity in strategies that are implemented through automated trading or credit granting. These dynamic impacts are, however, not within the scope of the present study, which concentrates on the direct impact of digitalisation on efficiency and profitability measures.

- [10]See Global Tech Spending Forecast: Banking Edition, 2018, Celent, March 2018.

- [11]See Global retail banking 2017: Accelerating bionic transformation, Boston Consulting Group, July 2017.

- [12]See Gropp, R. and Kok, C., “Competition and contestability in bank retail markets”, in Bikker, J. and Spierdijk, L. (eds.), Handbook of Competition in Banking and Finance, Edward Elgar Publishing, 2017.

- [13]It should be noted that the indicator has an approximate nature. The availability of data on IT expenses makes econometric analysis of the issue possible. At the same time, IT spending can also relate to other activities than investment in digitalisation, such as maintenance of potentially old and obsolete technical infrastructures, while it does not capture the cost of new IT investments which are capitalised and are not included in the profit and loss statement.

- [14]The positive and significant impact of labour costs to total assets on return on assets in the regression could be related to the need to hire more expensive labour, as IT investments are typically accompanied by a more specialised workforce. At the same time, higher labour costs can partially contain severance costs if higher IT investment coincides with the reduction of staff in branches.

- [15]See Box A entitled “Cross-border mergers and acquisitions in the EU banking sector: drivers and obstacles” in Special Feature C of the November 2017 ECB Financial Stability Review.

- [16]See also the special feature entitled “Cross-border bank consolidation in the euro area”, Financial integration in Europe, ECB, May 2017.

- [17]See Special Feature C entitled “Adapting bank business models: financial stability implications of greater reliance on fee and commission income” in the November 2016 ECB Financial Stability Review.

- [18]At the aggregate level, it could be expected that net interest income and net fee and commission income are driven by common factors such as economic growth, lending activity and conditions in financial markets.

- [19]Over the 2009-17 period only 45% of the euro area significant institutions were able to generate positive NII growth, while 56% of the institutions managed to generate positive NFCI growth.

- [20]A recent ECB review of euro area significant institutions’ business strategies finds that the international business will be a special focus for those banks that plan to grow their loan book; see SSM thematic review on profitability and business models – Report on the outcome of the assessment, ECB Banking Supervision, September 2018.

- [21]For a more detailed analysis of crisis-related deleveraging of euro area banks, see Special Feature A entitled “EU bank deleveraging – driving forces and strategies” in the June 2012 ECB Financial Stability Review.

- [22]More than three years after peaking, the aggregate NPL ratio of euro area banks stood at about 4.4% at end-June 2018. Other advanced economies – the US, the UK and Japan – have achieved a reduction in the NPL ratio to below 1.5%. Within the euro area, there is a large variation in NPL levels across countries, from less than 1% in Luxembourg to about 45% in Greece.

- [23]The topic of NPL resolution has been dealt with in several issues of the ECB Financial Stability Review. See, for example, the special feature entitled “Addressing market failures in the resolution of non-performing loans in the euro area” in the November 2016 issue and the special feature entitled “Resolving non-performing loans: a role for securitisation and other financial structures?” in the May 2017 issue. See also Fell, J., Grodzicki, M., Martin, R., Moldovan, C. and O’Brien, E., “Addressing the ‘Lemons’ Problem in the Market for Non-performing Loans”, Central Banking Journal, August 2017; Constâncio, V., “Resolving Europe’s NPL burden: challenges and benefits”, speech at the Bruegel event Tackling Europe’s non-performing loans crisis: restructuring debt, reviving growth, Brussels, 3 February 2017; Resolving non-performing loans in Europe, European Systemic Risk Board, July 2017; and Report of the FSC Subgroup on Non-performing loans, Council of the European Union, May 2017.

- [24]See “Guidance to banks on non-performing loans”, ECB Banking Supervision, March 2017, and “Addendum to the ECB Guidance to banks on non-performing loans: supervisory expectations for prudential provisioning of non-performing exposures”, ECB Banking Supervision, March 2018.

- [25]It should, however, be acknowledged that some of these solutions, notably the setting-up of asset management companies, are much more challenging to implement under the current EU regulatory framework.

- [26]The analysis made does not, however, control for other factors that may be influencing banks’ profitability. Conclusions should thus be drawn carefully.

- [27]The selection of best-performing banks is based on an ex ante definition using standard profitability/efficiency metrics.

- [28]This selection resulted in 13 best-performing banks out of a sample of 111 euro area significant institutions.

- [29]The results are similar to those presented in “SSM thematic review on profitability and business models – Report on the outcome of the assessment”, ECB Banking Supervision, September 2018. This report identified “best performers” as those with an average ROE above 6% over the last three years.

- [30]Risk Assessment Questionnaire – Summary of Results, EBA, July 2018, and Risk Assessment of the European Banking System, EBA, November 2017.

- [31]In a recent EBA study, 90% of banks stated that NFCI was their primary target for increasing profitability (up from 60% in 2014). Risk Assessment Questionnaire – Summary of Results, EBA, July 2018, and Risk Assessment of the European Banking System, EBA, June 2015.

- [32]The results reported in this section are based on 82 euro area significant institutions. The total assets of these institutions represent around 80% of the total assets of euro area banks.

- [33]See Henry, J. and Kok, C. (eds.), “A macro stress testing framework for assessing systemic risks in the euro area”, Occasional Paper Series, No 152, ECB, 2013; and Dees, S., Henry, J. and Martin, R. (eds.), “STAMP€: Stress test analytics for macroprudential purposes in the euro area”, ECB, 2017.

- [34]The December 2017 Eurosystem Broad Macroeconomic Projection Exercise (BMPE) has been used as the baseline scenario. For practical reasons, the December 2017 projections were used and not the more recent September 2018 MPE. However, the difference between the two projection exercises would not materially matter for the bank profitability projections.

- [35]This has been implemented by allowing bank balance sheets to grow in line with GDP growth over the course of the scenario which has an impact on the banks’ ability to generate profits.

- [36]It is worth noting that the analysts’ projections refer only to a sub-sample of the banks examined using the ECB stress-testing framework. The main drivers of the more optimistic analyst projections are higher net interest income and, to a lesser extent, higher fee income.

- [37]Focusing on the key macro factors driving bank profitability, the most recent (September 2018) MPE is slightly less optimistic, with somewhat more contained GDP growth projections, on aggregate, which would imply downward pressure on banks’ profitability. At the same time, the September MPE foresees a less marked increase in short-term interest rates, which would ease the pressure on banks’ net interest margins and thus counterbalance the effect from slower economic growth.

- [38]For simplicity, all banks in the sample are assumed to uniformly increase ROE by the same magnitude. In reality, banks with different business models and starting points may be more or less capable of improving their profitability along the lines sketched out in this illustrative exercise.

- [39]Similarly, a recent IMF study estimates that even under an optimistic scenario of increased GDP growth and reduced NPLs still around 50% of significant institutions would remain below the 8% ROE target. See Euro Area Policies: Financial Sector Assessment Program –Technical Note – Systemic Risk Analysis, IMF, July 2018.