Published as part of the ECB Economic Bulletin, Issue 1/2024.

This box provides estimates and projections of discretionary fiscal measures taken by euro area governments relating to the energy crisis, high inflation, and climate change, updated as part of the December 2023 Eurosystem staff macroeconomic projections.

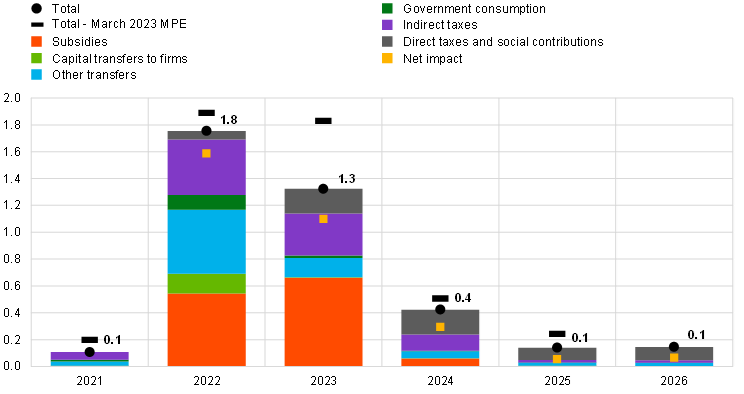

The discretionary fiscal measures to support households and companies in response to the energy price and high inflation shocks are projected to largely wind down in the coming years. They are estimated to amount to 1.3% of GDP in 2023, down from 1.8% in 2022, and to remain below 0.5% per annum over the 2024-26 projection horizon (Chart A). Specifically, about two-thirds of support measures in place in 2023 are expected to expire in 2024, and another 20% in 2025. The remaining measures are projected to stay in place in 2026. As regards the type of measures, in 2023 almost half were subsidies. Of these, more than half related to the energy price caps in Germany, France and the Netherlands. The share of subsidies in total energy and inflation support measures is expected to fall significantly in 2024 and to be negligible as of 2025.

Chart A

Euro area discretionary fiscal measures in response to high energy and inflation – by instrument

(percentage of euro area GDP)

Sources: ECB staff calculations based on the December 2023 Eurosystem staff macroeconomic projections and the fiscal questionnaires provided by the ESCB Working Group on Public Finance (WGPF).

The fiscal costs at euro area level of the energy and inflation support measures have been revised down in the December 2023 Eurosystem staff projections, as energy prices are lower than had been expected earlier in 2023.[1] Compared with the 2023 March ECB staff projections, these fiscal costs have been revised down in 2022 and especially in 2023. This partly reflects a stronger than anticipated fall in energy prices that has made these measures less expensive (Chart A).[2] For 2024 the fiscal impact is broadly in line with the March projections. Existing measures have been extended or new measures introduced in the 2024 budgets of many euro area countries. However, this effect is broadly offset by the German energy price cap expiring at the end of 2023, instead of in April 2024, due to the constitutional court ruling on the use of emergency credits.[3] Over the full projection horizon the fiscal costs of the compensation measures have been revised down by around 0.7 percentage points of GDP.

As the energy and high inflation support packages shrink over time, the share cross-financed through discretionary measures goes up. The discretionary financing measures predominantly consist of: (i) taxes on energy company windfall profits; and (ii) increases in energy taxes or cuts in subsidies.[4] The financing measures are projected to cover more than half of the remaining support measures in 2025 and 2026. Taking into account the limited overall size, this is a considerably higher proportion than in previous years.

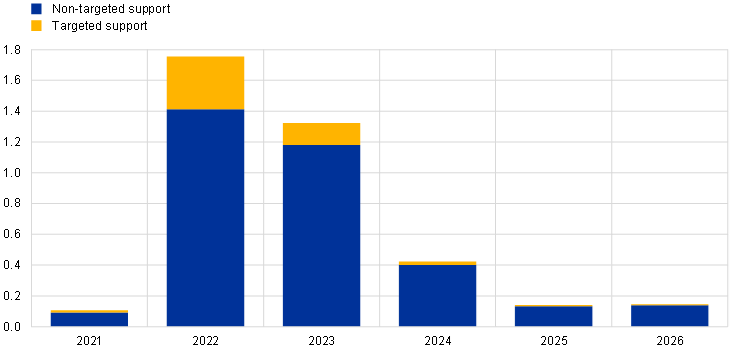

Chart B

Targeting of discretionary fiscal measures in response to high energy and inflation

(percentage of euro area GDP)

Sources: ECB staff calculations based on the December 2023 Eurosystem staff macroeconomic projections and the fiscal questionnaires provided by the ESCB Working Group on Public Finance (WGPF).

Note: Targeted measures denote measures intended to directly support households based on clear means-tested income criteria, see “Euro area fiscal policy response to the war in Ukraine and its macroeconomic impact”, Economic Bulletin, Issue 5, ECB, 2022.

For the euro area as a whole, the share of targeted measures has remained very low. Looking ahead, the measures are expected to be almost entirely untargeted as the energy crisis fades. The response to the energy price shock included compensation measures targeting retail prices, such as energy price caps, and other measures that broadly benefited all households or firms. While these measures ensured widespread compensation, they also came with a considerably higher fiscal cost than other more targeted measures, such as transfers to low-income households. The end of the price caps and the resulting reduction in the fiscal envelopes for energy and high inflation compensation is projected to coincide with a decrease in the share of targeted measures as a percentage of euro area GDP (Chart B). It should be noted that the aggregate number for the euro area conceals considerable heterogeneity across countries. In particular, a number of smaller countries relied more on targeted measures, but given their lack of weight this is not evident in the euro area aggregate. Still, even in an unweighted average of the country shares, targeted measures would only make up around one-fifth of the total in 2025 and 2026.

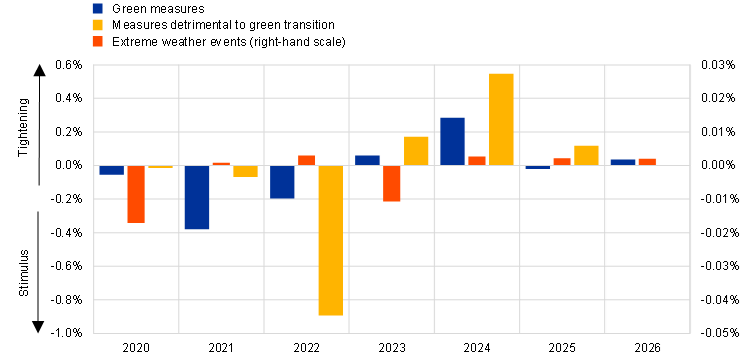

The winding down of the energy compensation measures shows up in the reduction in discretionary fiscal measures detrimental to the climate. The energy compensation measures that influence the price of energy or otherwise incentivise the use of fossil fuels, such as price caps or reductions in energy taxes, are assessed as being detrimental to the green transition. By contrast energy compensation measures not influencing the incentives to consume carbon-based fuels, such as social transfers, are not. Most of the climate-related measures (Chart C) are detrimental. While these measures have outweighed green measures in recent years, they have started to be phased out in 2023. This is expected to continue over the projection horizon.[5]

Chart C

Climate-related discretionary fiscal measures

(percentage of GDP)

Source: ESCB.

Note: The chart shows the budget balance impact of discretionary fiscal measures included in the December 2023 Eurosystem staff projections and related to climate change. A fiscal measure, whether on the revenue or the expenditure side, is classified as a climate change policy if it has a positive (green) or detrimental impact on climate change prevention and adaptation or compensates for the effects of extreme weather events. See also Box 5 “Climate-related policies in the Eurosystem/ECB staff macroeconomic projections for the euro area and the macroeconomic impact of green fiscal measures“ in Economic Bulletin, Issue 1, ECB, 2023 and Box 4 “Assessing the macroeconomic effects of climate change transition policies” of this issue of the Economic Bulletin.

See “Update on euro area fiscal policy responses to the energy crisis and high inflation”, Economic Bulletin, Issue 2, ECB, 2023.

See “Update on euro area fiscal policy responses to the energy crisis and high inflation”, Economic Bulletin, Issue 2, ECB, 2023. Earlier estimates of the fiscal compensation measures can be found in “Euro area fiscal policy response to the war in Ukraine and its macroeconomic impact”, Economic Bulletin, Issue 5, ECB, 2022 and “Fiscal policy and high inflation”, Economic Bulletin, Issue 2, ECB, 2023.

In some countries, measures were extended or newly introduced as part of the 2024 budget process after the cut-off date for the December 2023 Eurosystem staff macroeconomic projections.

In the December 2023 Eurosystem staff projections, euro area countries are expected to accrue total revenues over the projection horizon of around 0.1% of GDP, mostly in 2023.

See also Box 5 “Climate-related policies in the Eurosystem/ECB staff macroeconomic projections for the euro area and the macroeconomic impact of green fiscal measures”, Economic Bulletin, Issue 1, ECB, 2023, and Box 4 “Assessing the macroeconomic effects of climate change transition policies” of this issue of the Economic Bulletin.