Climate-related policies in the Eurosystem/ECB staff macroeconomic projections for the euro area and the macroeconomic impact of green fiscal measures

Published as part of the ECB Economic Bulletin, Issue 1/2023.

Following the conclusion of the ECB’s strategy review in 2021, the Governing Council adopted a comprehensive action plan to incorporate climate change considerations into its policy framework. Two of the action points presented in the accompanying detailed roadmap were: (i) introducing technical assumptions on carbon pricing; and (ii) regularly evaluating the impact of climate-related fiscal policies on the Eurosystem/ECB staff macroeconomic projections.[1] This box summarises the climate-related fiscal measures included in the December 2022 projections baseline. In order to evaluate the macroeconomic impact of climate-related transition policies, it assesses the impact of green fiscal measures on output and inflation in this baseline.[2] It then discusses the potential impact of the EU Emissions Trading System (ETS) and non-fiscal climate-related measures, as well as the risks they pose to the outlook for inflation and GDP growth.

A fiscal measure, whether on the revenue or the expenditure side, is classified as part of climate change policies in the Eurosystem/ECB staff macroeconomic projections if it has an impact on climate change mitigation or adaptation or compensates for the effects of extreme weather events. The discretionary fiscal measures included in the Eurosystem/ECB staff projections are classified based on their relation to climate change, with three (additive) categories for climate-related fiscal measures.

The first category is for measures that are labelled “green”, if these are expected to have a favourable impact on carbon emissions reduction, energy efficiency or carbon-free mobility, or if they finance adaptation to the consequences of climate change. Examples include increases in energy taxes and subsidies for electric cars or retrofitting buildings.

The second category is for measures that are labelled “detrimental to the green transition” because they have an adverse impact. Examples include compensation measures for high energy prices, such as subsidies for price caps or cuts in (energy) taxes, which decrease energy prices.

The third category is for measures related to extreme weather events that compensate for the effects of floods, forest fires, heatwaves and droughts. Examples include emergency aid, rebuilding destroyed infrastructure and compensation for uninsured private losses.

A fourth category consists of fiscal measures that do not fall under the three categories above and that are considered climate-neutral or indeterminate. This includes measures that do not specifically target the goals mentioned above (such as general changes in VAT or cash transfers to households) or that benefit specific sectors without clear climate-related goals (e.g. general subsidies for railway companies).

The objective of the strategy review roadmap is to evaluate the impact of climate-related fiscal policies on the Eurosystem/ECB staff macroeconomic projections, not to cover all climate policies in all euro area countries. Fiscal measures that have fallen within the scope of the Eurosystem/ECB staff projections relate to discretionary decisions of governments. As an example, this means that they include higher tax revenues due to tax rate changes but exclude higher tax revenues due to higher prices. Price developments of EU ETS auctions are also not included in this classification[3], and neither are non-fiscal climate measures (e.g. regulation).

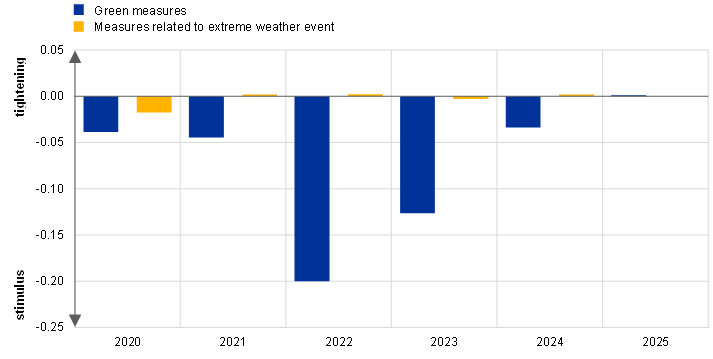

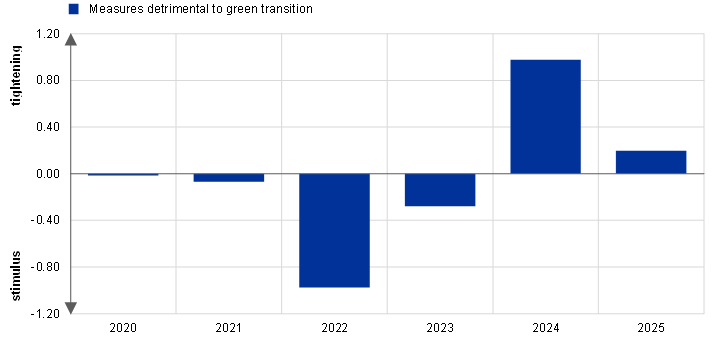

Green fiscal measures provide a modest fiscal stimulus. This can be seen in the December 2022 projections baseline, where the modest fiscal stimulus is strongest in 2022 (Chart A). Current fiscal measures related to extreme weather events are expected to have a marginal effect in the euro area as a whole over the projection horizon. However, their effect is larger in countries that have recently been hit by extreme weather events, such as the 2021 floods in Belgium, Germany, Luxembourg and the Netherlands.[4] The climate impact of green fiscal measures is not necessarily proportional to the macroeconomic impact, as some measures might mitigate climate change more effectively than others. In addition, some measures offset the macroeconomic impact of others, for example when an increase in carbon taxation is used to finance climate-related expenditures.

Currently, fiscal measures that are detrimental to the green transition significantly outweigh green measures. Large energy support measures that have a direct impact on incentives to use fossil fuels form the bulk of these detrimental measures, which include cuts in energy taxes and fiscal subsidies for energy price ceilings and have been adopted by all euro area governments in response to the energy crisis. However, they are expected to expire after 2023 in most countries.[5] Energy price compensation measures that do not directly affect incentives to use fossil fuels, for example transfers to households, are not classified as detrimental to the green transition.

Chart A

Fiscal measures related to climate change in Eurosystem/ECB staff macroeconomic projections for the euro area

a) Fiscal measures related to climate change mitigation and adaptation, and to extreme weather events

(percentages of GDP)

b) Fiscal measures detrimental to the green transition

(percentages of GDP)

Source: Eurosystem staff macroeconomic projections for the euro area, December 2022.

Notes: Measures are labelled “green” if they are expected to have a favourable impact on carbon emissions reduction, energy efficiency or carbon-free mobility, or if they finance adaptation to the consequences of climate change. Measures are labelled “detrimental to the green transition” if they have an adverse impact.

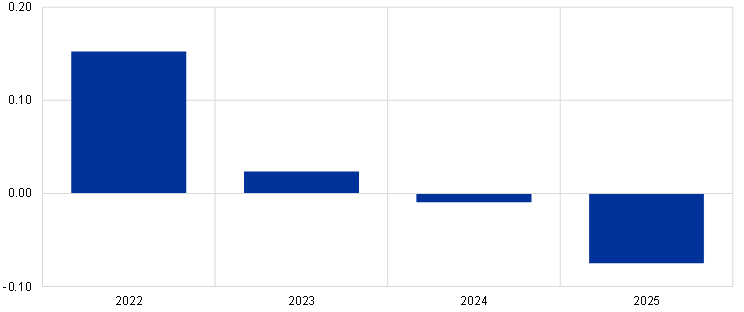

The overall impact of green measures on euro area real GDP growth is expected to be very small over the projection horizon (Chart B, panel a). While the aggregate stimulus is strongest in 2022, the impact reverses to become contractionary from 2024, albeit of negligible magnitude. Overall, the mix of green measures is expansionary throughout the projection horizon. Measures on the revenue side, whose impact tends to be more persistent, are contractionary in all years. Overall, the GDP effects included in the December 2022 projections suggest that the multiplier effect of green fiscal measures is far below one.

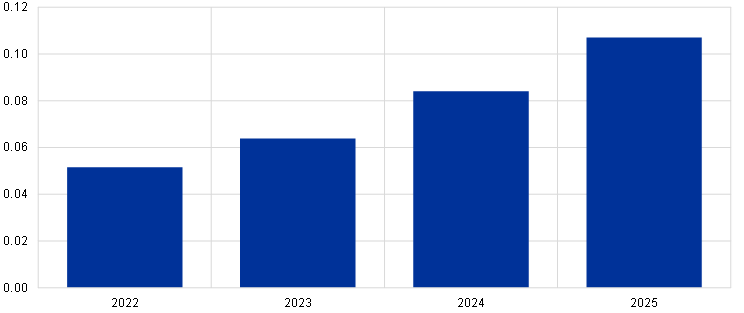

Green fiscal measures have a limited but slightly increasing upward impact on the baseline inflation outlook (Chart B, panel b). At euro area aggregate level, they are estimated to contribute 0.05 percentage points to HICP inflation in 2022, 0.06 percentage points in 2023, 0.08 percentage points in 2024 and 0.11 percentage points in 2025. This upward impact is strongly outweighed by the impact on inflation of many measures that are labelled “detrimental to the green transition”, such as price caps. Overall, fiscal measures to compensate for high energy prices and inflation are estimated to dampen headline HICP inflation by 1.1 percentage points in 2022 and 0.5 percentage points in 2023, and their withdrawal is expected to put upward pressure on inflation to the tune of 0.7 percentage points in 2024 and 0.4 percentage points in 2025.[6]

Chart B

Impact of green fiscal measures on GDP and inflation over the projection horizon

a) Real GDP growth

(percentage point deviation from baseline)

b) HICP

(percentage point deviation from baseline)

Sources: Eurosystem staff macroeconomic projections for the euro area, December 2022; Eurostat; and ECB calculations.

Beyond the impact of national green fiscal measures, increasing allowance prices under the EU ETS and policies planned under the “Fit for 55” package can pose both upward and downward risks to the inflation outlook. Increasing allowance prices under the EU ETS can increase wholesale electricity prices, putting upward pressure on retail electricity prices. However, based on EU ETS futures prices as underlying assumptions, the contribution of changes in EU ETS prices to changes in wholesale electricity prices over the projection horizon would be marginal, thereby limiting their impact on HICP electricity prices and, therefore, headline HICP. Beyond the baseline outlook, EU ETS price increases above those implied by futures curves and planned changes to the existing EU ETS (including the extension of emissions in scope) could imply increasing direct cost pressures for HICP energy, non-energy industrial goods and services inflation.[7] For example, the phasing-in of a separate EU ETS for building and transport emissions can have a direct upward impact on HICP energy and headline HICP. However, the emissions from building and transport emissions will only be phased in beyond the current projection horizon, i.e. after 2025.[8] By contrast, regulation targeting an increasing share of renewables could gradually put downward pressure on HICP energy. While there is substantial uncertainty around both how quickly renewables capacity will increase and the announced EU electricity market reform, when taken together these factors are likely to present a downside risk to energy prices towards the second half of the decade.

Climate change policies under the “Fit for 55” package would not only have substantial non-economic benefits, but should also help avoid economic losses from increasing physical risks in the longer term. The short-term effects on real activity from implementing transition policies are assessed to be negative but contained, while there are benefits of avoiding the negative macroeconomic effects from the climate incidents that these policies help mitigate. The long-term impact on aggregate real GDP could even be positive given the considerable green investment needs. And the impact on potential growth could also be positive, despite being surrounded by significant uncertainties and dependent on the policy strategy chosen. This is because the package reduces the economic damage of climate change and spurs faster structural transformation towards a greener European economy. At the same time, taking full advantage of the transformation requires complementary policy action to create incentives to spur green investment and innovation, as well as to support a swift reallocation of resources.

ECB, “Annex: Detailed roadmap of climate change-related actions”, 8 July 2021.

The impact of energy compensation measures, a large share of which are detrimental to the green transition, is evaluated in a separate article entitled “Fiscal policy and high inflation”, Economic Bulletin, Issue 2, ECB, 2023.

In government finance statistics, EU ETS revenues are part of energy taxes, which are included in the Eurosystem/ECB staff fiscal projections.

Extreme weather events are increasingly likely to have an impact on the growth and inflation outlook over the medium term. While these events are difficult to forecast and therefore tend to be included in the projections in a backward-looking manner, their fiscal impact can extend over several years because the recovery expenditures can last for more than one year and tend to be reversed within the projection horizon.

ECB, “December 2022 Eurosystem staff macroeconomic projections for the euro area”.

ibid.

In addition to these effects on the price level of individual components, the impact of these policies could also operate through other macroeconomic channels, which could affect the net impact on inflation.

Council of the European Union, “‘Fit for 55’: Council and Parliament reach provisional deal on EU emissions trading system and the Social Climate Fund”, press release, 18 December 2022.