- 27 MAY 2022 · RESEARCH BULLETIN NO. 95

Tax thy neighbour: local corporate taxes and consumer prices across German regions

To what extent are corporate taxes passed on to consumers? And more generally, how do wholesale producers affect retail prices? Using data from Germany, where individual municipalities set local corporate tax rates, we shed new light on these questions. To estimate the impact of changes in producers’ tax rates on consumer prices, we link 1,058 tax changes between 2013 and 2017 to changes in the retail prices of more than 125,000 food and personal care products sold across Germany. A one percentage point increase in the local corporate tax leads on average to a 0.4% increase in the retail price of goods “exported” by the taxed firms to stores in the rest of Germany. While neither the size of producers nor their market shares seem to affect the strength of this pass-through, the type of store selling the product does: supermarkets and hypermarkets account for most of the increase in prices. Our findings suggest the following policy-relevant implications: i) producers use their market power to shield profits from corporate taxes; ii) some retailers pass on a large share of wholesale price changes; iii) the low-inflation period from 2013 to 2017 did not impair the pass-through of shocks to consumer prices.

Who bears the burden of corporate taxes?

The amount of taxes that corporations actually pay has been a hot topic around the world in the last few years, with the G20 recently endorsing a global minimum corporate tax rate. Against the backdrop of increasing globalisation, there were fears of multinational enterprises shifting profits to countries with more favourable corporate tax rules and prompting an international “race to the bottom”. The G20 tax accord addresses the above concerns by implementing a 15% lower bound on corporate tax rates across OECD Member countries, which will lead to tax rises in some countries. The established academic literature has predominantly focused on whether the corporate tax burden falls on shareholders or workers, depending on the degree of capital mobility and trade integration. Shareholders are potentially affected because higher tax rates reduce after-tax returns to capital (Harberger, 1962). But when capital is highly mobile across regions, workers are more likely to bear the burden of corporate taxation because wages may fall in response to lower labour productivity if capital flows off.[2] However, besides affecting shareholders and workers, corporate taxes may have additional distributive implications by affecting consumer prices, a rarely analysed issue (Baker et al., 2020).

Firms may use their market power to shield their after-tax profit margins from increases in corporate taxes. This aspect is crucial for understanding the costs and benefits when setting corporate taxes. Some theoretical models feature product market power – a firm’s ability to set prices above marginal costs. These models predict that firms set prices such that they take into account corporate taxes; in particular, that firms raise prices in response to corporate tax hikes, including on products they export across regions. In turn, how much firms raise their prices may depend on their degree of market power, as captured, for example, by their size and market share. The ultimate effects on consumer prices crucially depend on how much of a given change in producer prices local retailers would pass on in each region.

Effects of corporate taxes on retail prices

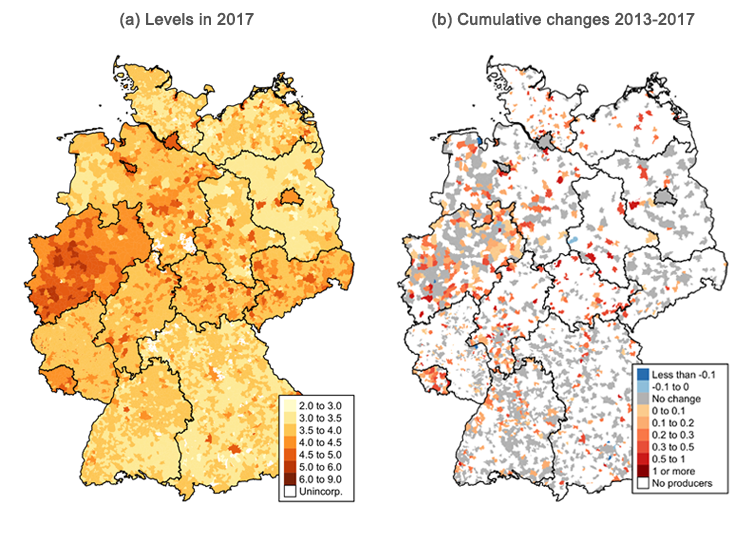

In Dedola et al. (2022), we provide empirical estimates of the pass-through of local corporate taxes to consumer prices across regions in Germany. The German institutional setting helps the empirical identification of the response of retail prices to changes in corporate taxes of producers. The estimation exploits 1,058 municipality-specific tax changes between 2013 and 2017.[3] Chart 1 illustrates the geographical heterogeneity in local business tax rates and their changes.

Chart 1

Geographical variation in local corporate tax rates

Notes: Both graphs show local tax scaling factors across municipalities. The effective corporate tax is computed as 3.5% times a scaling factor that can be changed by municipalities at the beginning of each year. White areas in panel (a) indicate unincorporated areas, which do not belong to any municipality. White areas in panel (b) indicate municipalities for which no producer location is observed in the sample.

To estimate the impact of corporate tax changes in a municipality on the retail prices across Germany of products manufactured there, the analysis uses scanner price data obtained by the ESCB’s PRISMA network.[4] Matching the price data with changes in the tax rates of specific firms results in a dataset covering the retail prices of 127,527 different food and personal care products produced by 4,684 firms located in 2,100 German municipalities.

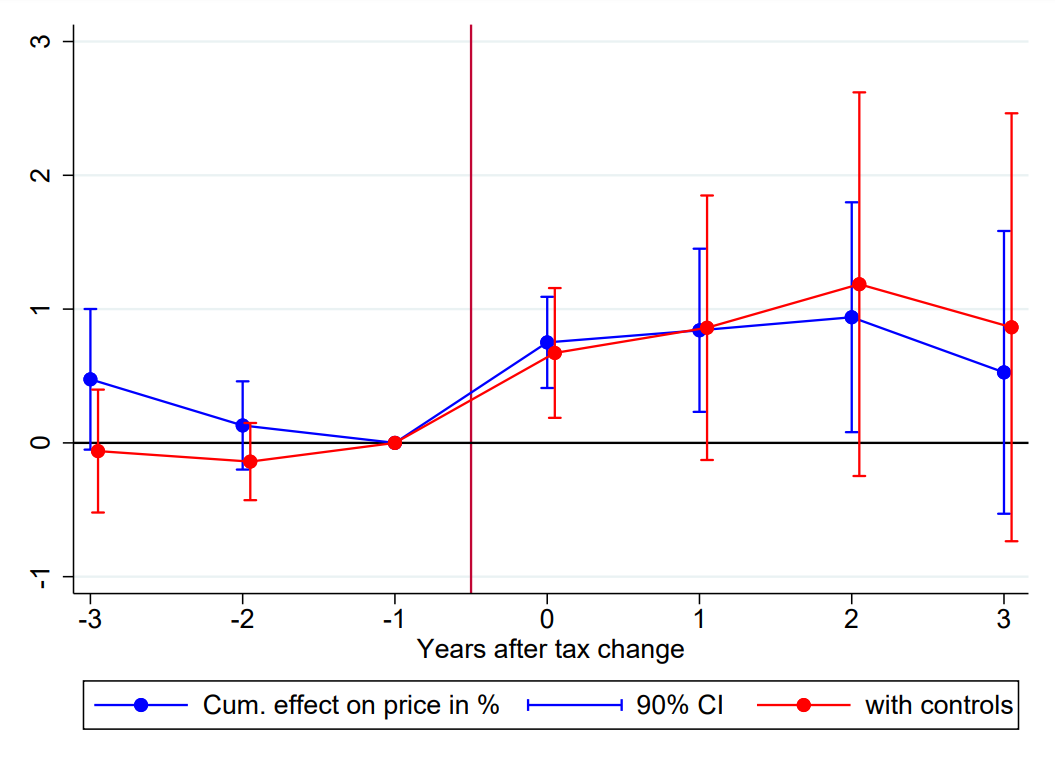

We estimate a significant pass-through of corporate taxes to consumer prices. Increasing the local corporate tax by one percentage point raises retail prices of locally produced products by 0.4% relative to those originating in other municipalities. Because we relate local tax changes to price changes outside the production municipality, the estimated effect is not contaminated by local shocks that may drive prices and tax rates.[5] Chart 2 shows the effects over time: consumer prices increase in the year of the tax hike and appear to stay persistently higher up to three years afterwards (though when also controlling for changes in local unemployment and public debt, estimates are less precise after impact).[6]

Chart 2

Dynamic effects of a one percentage point corporate tax change on prices (in %)

Note: This chart shows the average percentage increase in retail prices in response to a one percentage point increase in the corporate tax in the producers’ municipality. The specification with controls additionally includes changes in local unemployment rates and local debt levels. The whiskers describe 90% confidence intervals.

The result shows that firms use their product market power to shield their shareholders from hikes in corporate taxes. This is noteworthy given the evidence in Fuest et al. (2018) that wages fall after corporate tax increases, easing producers’ costs. The significant price effects documented here show that firms, by charging higher prices to consumers all over Germany, export the effects of local corporate taxes to other regions.

The strong effect of corporate taxes on retail prices also has other implications. Not only are producers able to adjust wholesale prices in response to shocks, but retailers also pass on the increase in wholesale prices to consumers to a large extent. This pass-through of wholesale prices to retail prices tells us something about the nature of vertical interactions between producers and retailers.

Comparing price responses across products, market shares, income in the sales region, and retail store type

The economic literature on market power and markup adjustment finds that the pass-through of corporate taxes to retail prices can be influenced by a host of factors. Pass-through may particularly depend on the price sensitivity of demand, which may vary across product categories or across household incomes. Pass-through can also vary with the degree of product market power of the manufacturer.

Our data do not in fact reveal any relevant variation in pass-through due to these factors. The pass-through estimates across categories of the Classification of Individual Consumption According to Purpose (COICOP) show some dispersion, but no significant differences arise. We look at product market shares and firm size as indicators of product market power, in line with economic theory. The data suggest that the pass-through doesn’t differ for products with a larger market share or produced by larger firms. Pass-through isn’t significantly different between sales regions with different household incomes levels either.

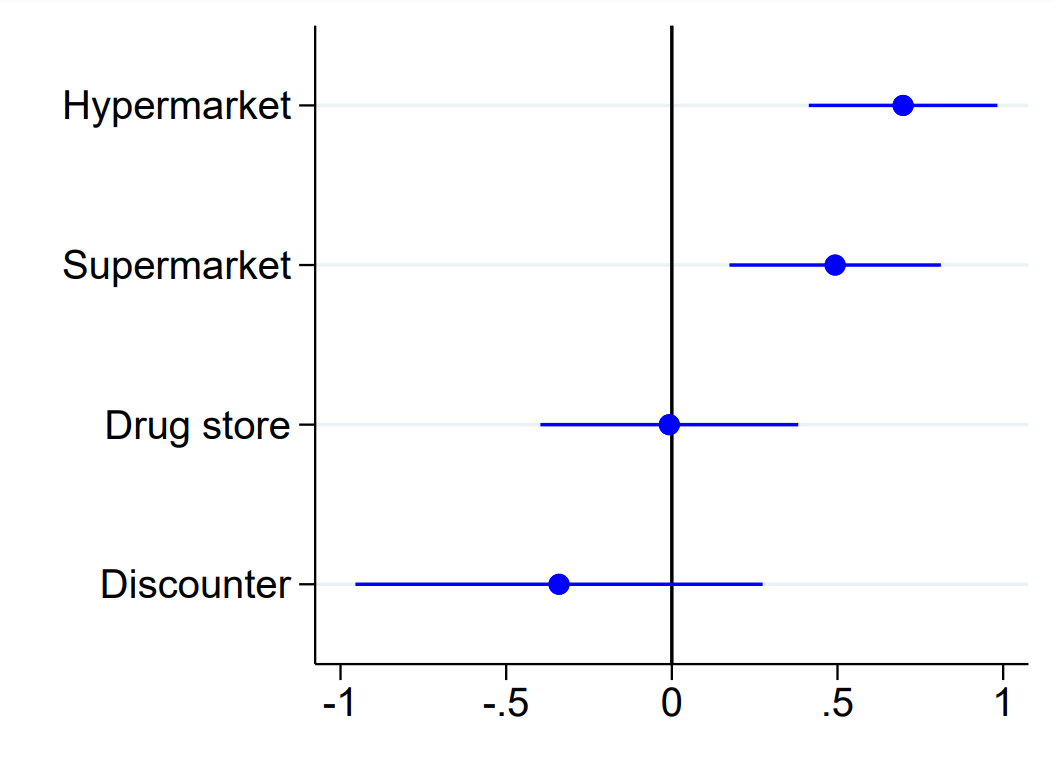

At the same time, there is evidence that pass-through varies greatly across different types of retail stores. Chart 3 shows the estimated effect of an increase in corporate tax rates on retail prices for four different types of retail store: drug stores, discounters, supermarkets and hypermarkets.[7] While the pass-through to prices of the same goods sold in drug stores and discounters is small and statistically insignificant, the pass-through in hypermarkets and supermarkets is sizable. These effects account for most of the overall rise in retail prices after tax hikes. Through the lens of theoretical models of interactions between producers and a retail sector, this suggests that different types of stores may play different roles in passing on wholesale price changes to consumers.[8]

Chart 3

Effects of corporate taxes on retail prices, for different retail store types

Notes: This chart shows the average percentage increase in retail prices in response to a one percentage point increase in the corporate tax in the producers’ municipality, for each of the different retail store types observed in the data. The lines represent 90% confidence intervals.

Conclusion

Corporate tax changes have significant effects on the retail prices of products of taxed firms. In highly integrated economies, it is no simple matter to determine the distributional implications, i.e. how the tax burden will ultimately be split between shareholders, workers and consumers. Our findings suggest that in Germany producers can shield their shareholders by passing on higher taxes to their customers. As a result, households that earn little from shares and/or shop in retailers that tend to pass on related price rises, such as supermarkets and hypermarkets, may bear a hefty share of the corporate tax burden. This makes it more complicated to analyse how tax reforms affect households with different levels of income and wealth.

Understanding how consumer prices respond to corporate tax changes may increase our general understanding of what determines product-level prices and inflation. Sometimes, inflation seems unresponsive to macroeconomic conditions, such as during the recent period of low inflation before the COVID-19 crisis. At other times, inflation seems very responsive to these conditions, as it has during the current steep rise in inflation. The way inflation responds depends partly on how willing firms are to adjust their prices in response to changes in costs and demand conditions. The significant tax pass-through we estimated suggests that producers were generally willing and able to adjust prices significantly in response to changes in their economic environment in the 2013-17 low inflation period, while different types of retailers could absorb or pass-through such price changes to different extents.

References

Baker, S., Sun, S. T. and Yannelis, C. (2020), “Corporate Taxes and Retail Prices,” NBER Working Papers, No 27058.

Dedola, L., Osbat, C. and Reinelt, T. (2022), “Tax thy neighbour: Corporate tax pass-through into downstream consumer prices in a monetary union,” forthcoming, ECB Working Paper Series.

Fuest, C., Peichl, A. and Siegloch, S. (2018), “Do Higher Corporate Taxes Reduce Wages? Micro Evidence from Germany”, American Economic Review, Vol. 108, No 2, pp. 393-418.

Harberger, A. C. (1962), “The Incidence of the Corporation Income Tax”, Journal of Political Economy, Vol. 70, No 3, pp. 215-240.

The article was written by Luca Dedola (Senior Adviser, Directorate General Research, European Central Bank), Chiara Osbat (Adviser, Directorate General Economics, European Central Bank) and Timo Reinelt (University of Mannheim). It is based on a paper entitled “Tax thy neighbour: Corporate tax pass-through into downstream consumer prices in a monetary union”, by the same authors, which is forthcoming in the ECB Working Paper series. The authors would like to thank Phillip Hartmannn. Alex Popov and Zoë Sprokel for their comments. The views expressed here are those of the authors and do not necessarily represent the views of the European Central Bank and the Eurosystem.

Our result compares to a 0.3% reduction in wages in response to a one percentage point corporate tax increase estimated by Fuest et al. (2018) in the same setting in Germany.

In addition to a federal corporate tax (“Körperschaftssteuer”), German firms pay a local business tax (“Gewerbesteuer”) set by the municipality once a year.

The Price-Setting Microdata Analysis (PRISMA) Network is a research network within the European System of Central Banks (ESCB). It collects and studies various kinds of microdata to study price-setting behaviour and inflation dynamics in the euro area. The data used in this study were provided by Information Resources, Inc. (IRi).

During the period covered by our sample, tax changes have been predominantly positive. Of the 1,058 observed tax changes, only 31 were tax cuts. Nevertheless, standard models would predict the effects to be symmetric across otherwise similar tax increases and decreases.

The estimated impact effects in the dynamic estimation, shown in Chart 2, are slightly higher than the 0.4% impact effect arising from the static estimation referred to above.

The types of store are defined as follows. 1) Traditional stores are outlets with a range of goods consisting mainly of groceries (excluding specialty stores) with a surface area from 200 to 799 square metres. This includes supermarkets, which have a surface area larger than 400 square metres, but in the text we use the term “supermarkets” for all traditional stores independent of size 2) Hypermarkets are self-service retail stores with large surface size (larger than 800 square metres) that are not discounters and offer groceries as well as consumer durables and consumer goods mostly for short to medium-term use. 3) Discounters are self-service stores carrying mainly groceries in a limited range with emphasis on low prices. 4) Drugstores are self-service retail outlets carrying medicines and cosmetics as their core product range.

There could be various reasons for this result. On the one hand, producers may be following different pricing strategies for discounters versus other stores, e.g. they may perceive little market power for sales by the former, or they may be less able to apply price increases to them. On the other hand, if producers don’t discriminate across store types and raise prices across the board, retailers may transmit the shocks differently to their customers depending on their own market power, with discounters absorbing price increases into their profit margins, unlike supermarkets and hypermarkets.