- SPEECH

The pandemic emergency: the three challenges for the ECB

Speech by Philip R. Lane, Member of the Executive Board of the ECB, at the Jackson Hole Economic Policy Symposium, Federal Reserve Bank of Kansas City “Navigating the Decade Ahead: Implications for Monetary Policy”

27 August 2020

Today, I will discuss the monetary policy measures taken by the ECB in response to the pandemic shock, take stock of the progress to date and outline the main challenges that lie ahead.[1]

The pandemic: the three challenges for the ECB

The nature of the pandemic shock called for an extraordinary policy response. From the outset, there were three challenges for the ECB: (i) to stabilise markets; (ii) to protect credit supply; and (iii) to neutralise the pandemic-related downside risks to the inflation path. Tackling the first pair of challenges is needed in order to achieve the inflation aim, since it is problematic to run an effective monetary policy under conditions of market instability or a credit crunch.

As is shown in Chart 1, the ECB adopted a comprehensive package of crisis measures over a number of months in order to address these three challenges.[2]

Chart 1

Overview of the ECB policy measures taken since the outbreak of the COVID- 19 crisis

Source: ECB.

Notes: *The interest rates on the lending programmes are linked to the key ECB interest rates. The lending performance for the temporary rate reduction of TLTROs is targeted towards the pandemic period.

The ECB reconfirmed its forward guidance on the path of policy interest rates and the asset purchase programme (APP) throughout this period. The Governing Council expects the key ECB rates to remain at current or lower levels until the Governing Council has seen the inflation outlook robustly converge to a level that is below, but close to, 2 percent, and such convergence has been consistently reflected in underlying inflation dynamics. The Governing Council also expects net purchases under the APP to continue at a monthly pace of €20 billion for as long as necessary to reinforce the accommodative impact of its policy rates, and to end shortly before the Governing Council starts raising the key ECB interest rates. In addition, the Governing Council intends to continue reinvesting, in full, the principal payments from maturing securities purchased under the APP for an extended period of time past the date when the Governing Council starts raising the key ECB interest rates, and in any case for as long as necessary to maintain favourable liquidity conditions and an ample degree of monetary accommodation.

Our flagship policy initiative has been the pandemic emergency purchase programme (PEPP) that was announced on 18 March. The PEPP was designed to play a dual role, both contributing to market stabilisation and enabling a substantial easing in the monetary policy stance.[3]

The market stabilisation role of the PEPP was facilitated by its design, which allowed flexibility in the composition of purchases over time, across asset classes and among jurisdictions.[4] The significant drop in yields upon the announcement of the PEPP vividly illustrated the importance of central banks in underpinning market stability in the event of a large adverse shock.

The additional asset purchases under the PEPP also serve to ease the monetary policy stance. In response to the substantial pandemic-related downward revision to inflation outlook in the June staff projection round, we expanded the size of the PEPP envelope by €600 billion to a total of €1,350 billion and extended the minimum expected horizon for net purchases by half a year, to at least the end of June 2021.[5]

In addition to stabilising markets and ensuring a sufficiently-accommodative monetary policy stance, it has also been imperative to limit the risk of a credit crunch. The maintenance of credit supply could not be taken for granted, since the pandemic was likely to both reduce the credit quality of potential borrowers and increase the funding costs facing banks in the absence of central bank intervention. To counter this threat, we substantially eased the conditions under which banks can obtain liquidity under our targeted long-term refinancing operations (TLTROs), which strengthened the incentives for banks to continue lending to the real economy.[6] We also eased collateral requirements to make sure that banks could make full use of these operations.

The set of measures was designed to work as a package, in order to ensure that all three challenges posed by the pandemic shock were tackled simultaneously.[7] Chart 2 shows that the measures have resulted in a sizeable expansion of the ECB’s balance sheet, illustrating the value of central banks being ready to commit their balance sheets to fight risks to their policy aims, especially in the event of a major shock to the real economy and the financial system.[8]

Chart 2

Eurosystem balance sheet in 2020

(percentages of euro area GDP in Q4 2019, cumulative changes relative to January 2020)

Source: ECB.

Notes: “MROs” stands for “main refinancing operations”, “LTROs” for “longer-term refinancing operations”, “APP” for “asset purchase programme”, “TLTROs” for “targeted longer-term refinancing operations” and “PEPP” for “pandemic emergency purchase programme”. Monthly data. The latest observations are for July 2020.

Taking stock

Almost six months after the introduction of our measures, the evidence suggests that the policy package has stabilised markets, protected credit provision and supported the recovery.[9] Of course, across all dimensions, fiscal policies have also played a vital role and there have been powerful complementarities between monetary and fiscal policies during this period. I will return to the fiscal policy contribution later on.

Since its announcement in March, the PEPP has acted as a powerful market-stabilising force. In the euro area, sovereign yields play a pivotal role in the transmission of monetary policy, since these affect the funding costs of corporates, households and banks (as well as governments, of course). Chart 3 shows that the decline in the GDP-weighted average sovereign yield has been substantial. The reduced dispersion in sovereign bond yields is also due to the profound change in the European fiscal landscape, as reflected in the far-reaching agreement at the July European Council meeting.

Chart 3

Euro area sovereign yields

(cumulated changes since 1 February 2020, percentage points)

Sources: Bloomberg and ECB calculations.

Note: The latest observations are for 21 August 2020.

The stabilisation of markets is also visible in the balance of payments data as shown in Chart 4. In relation to foreign assets, the initial retrenchment has been reversed, with increasing net purchases of foreign assets by domestic investors in both less vulnerable and more vulnerable countries. In relation to foreign liabilities, the scale of net selling by foreign investors of the debt securities issued by more vulnerable countries has steadily declined, with a return to net inflows in the June data.[10]

Chart 4

Cross-border portfolio investment flows

(monthly flows as a percentage of each group’s aggregate GDP)

Sources: ECB and Eurostat.

Notes: Data recorded on the basis of the Sixth Edition of the IMF Balance of Payments and International Investment Position Manual (BPM6). Averages calculated from January 2008 to June 2020. “Less vulnerable” countries are Austria, Belgium, Finland, France, Germany and the Netherlands; “more vulnerable” countries are Greece, Italy, Portugal and Spain.

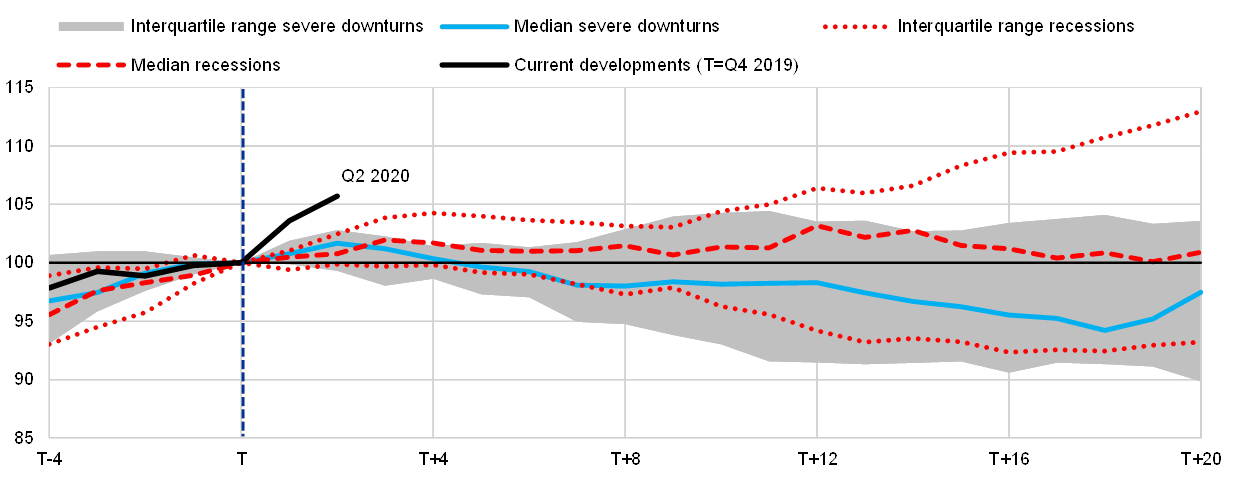

Chart 5 shows that loans to firms have held up well so far and have even been increasing in the past months. Credit supply has been supported by our refinancing operations, especially through the €1.3 trillion take-up under the June round of the TLTRO-III programme. The continued flow of credit to the real economy has been facilitated by forceful fiscal action, which has included measures to limit the pandemic-related losses suffered by many firms and the introduction of sizeable government guarantees programmes.[11]

Chart 5

Euro area loans to firms

(indices, with T=100 for period of peak in economic activity)

Sources: ECB and ECB calculations.

Notes: Non-financial corporation (NFC) loan data deflated by the HICP. Derivation of interquartile range and median for recessions and severe downturns based on quarterly data from Q1 1980 to Q2 2020 for France, Germany, Italy and Spain. Recessions defined by business cycle chronologies. Severe downturns defined as periods of one or more quarters of real GDP declining by 1 percent or more quarter-on-quarter (whether part of a recession or not). The latest observations are for Q2 2020.

By successfully countering a tightening in financing conditions and by protecting credit supply, the measures taken in response to the pandemic have provided critical support to the outlook for the economy and inflation and have helped to limit tail risks around the baseline scenario. According to internal estimates, the package of measures is projected to increase output by around 1.3 percentage points and inflation by around 0.8 percentage points cumulatively between 2020 and 2022. These estimates are conservative, since these do not fully capture the benefits gained by avoiding the adverse feedback loops between the real economy and financial markets that would have emerged in the absence of a prompt and comprehensive policy response.

Reaching our inflation aim: a two-stage approach

The pandemic crisis represents a significant negative shock to the inflation outlook, since the disinflationary pressures arising from greater economic slack are likely to outweigh any inflationary forces stemming from negative sectoral supply shocks.[12]

Chart 6

The future inflation path

Source: ECB.

Notes: “AD” (the blue line) represents the expected inflation path before the pandemic shock. The initial negative impact of the pandemic shock – in the absence of additional monetary policy accommodation – is captured by the downward shift in the expected path from “A” to “B”. The “BE” path (the yellow line) illustrates a transition path of inflation that is even lower than originally envisaged. By providing additional monetary policy accommodation, the central bank can aim towards the upper region of the “BCDE” zone, so that the adjustment is closer to the “BCD” path.

Chart 6 shows a stylised sketch of the choice facing the ECB in terms of the monetary stance. Before the onset of the pandemic, inflation was expected to rise gradually towards the inflation aim, represented by the “AD” path (the blue line). The initial negative impact of the pandemic shock – in the absence of additional monetary policy accommodation – is captured by the downward shift in the expected path (the drop from “A” to “B”).

One option would be to simply accept that convergence to the inflation aim will take more time and that inflation will be even lower than originally envisaged during the transition path, as illustrated by the “BE” path (the yellow line).[13] However, this option is costly in terms of the implied higher path for real interest rates and the slower economic recovery that results. It is also risky, since a longer phase of even lower inflation might become entrenched and contribute to a downward drift in inflation expectations, which would make it even more difficult to deliver the inflation aim over the medium term. A substantial weight should be attached to these risks in the context of the euro area, in view of the already-low pre-pandemic inflation rate and the long interval of below-target inflation.

It follows that, for the ECB to deliver on its mandate, the more effective and safer option is to aim towards the upper region of the “BCDE” zone by providing additional monetary stimulus, so that the adjustment is closer to the “BCD” path. This is the line of reasoning behind the design of the PEPP, with a temporary phase of additional asset purchases intended to restore momentum to inflation dynamics.

Accordingly, the monetary policy challenge consists of two stages. The first stage is to counteract the negative shock to the expected inflation path caused by the pandemic: through an intense temporary phase of additional monetary accommodation, the PEPP (in combination with the other monetary policy instruments) is designed to accomplish this first-stage task. Once the negative shock has been sufficiently offset, the second stage is to ensure that the post-pandemic monetary policy stance is appropriately calibrated in order to ensure timely convergence to our medium-term inflation aim. To these ends, the ECB Governing Council stands ready to adjust all of its instruments, as appropriate.

Especially in an environment of low inflation and low interest rates, monetary and fiscal policies have the potential to reinforce each other. In particular, in relation to the price stability mandate, the scale of the monetary policy adjustment required to neutralise the negative pandemic shock to inflation dynamics and sustain the subsequent convergence to the inflation aim depends on the extent of the fiscal support for the economic recovery.

All euro area countries have taken significant fiscal measures in response to the pandemic crisis. Over the near-term and medium-term, national governments will need to continue supporting their economies to recover from the severe pandemic shock. The recently-agreed €750 billion EU recovery fund – the Next Generation EU initiative – puts in place a shared budgetary instrument that both complements and supports national fiscal actions. An ambitious, high-quality and coordinated fiscal stance is central to securing a strong recovery across the euro area and constitutes a vital complement to the support provided by monetary policy.

Finally, the emerging lessons from the policy response to the pandemic shock will also feed into our monetary policy strategy review. The strategy review will be an important focus for our work over the next year.

- I am grateful to Ine Van Robays and Leopold von Thadden for their contributions to this speech.

- I discussed the ECB’s response to the pandemic crisis in more detail in a recent speech. See Lane, P.R. (2020), “The ECB’s monetary policy response to the pandemic: liquidity, stabilisation and supporting the recovery”, 24 June.

- Since the ECB was already an active purchaser of both sovereign and private-sector securities, the PEPP could be rolled out quite quickly. On 12 March, the ECB had already expanded the size of its long-established asset purchase programme (APP) with an additional EUR 120 billion allocated for the rest of 2020. The 18 March launch of the PEPP was in recognition that a temporary and flexible programme was better suited to respond to the exceptional nature of the pandemic shock, rather than just relying on a mechanical expansion of the APP.

- See also Lane, P.R. (2020), “The market stabilisation role of the pandemic emergency purchase programme”, The ECB Blog, 22 June.

- See also Lane, P.R. (2020), “Expanding the pandemic emergency purchase programme”, The ECB Blog, 5 June.

- Unconditional liquidity operations were also offered, in order to ensure a well-priced liquidity backstop for the banking system. This includes the pandemic emergency longer-term refinancing operations (PELTRO) programme that serves to support liquidity conditions in all segments of the euro area financial system and preserve the smooth functioning of money markets. Furthermore, at the international level, we provided euro liquidity facilities through a variety of agreements with central banks outside the euro area, while the existing network of swap lines with the other major central banks was also reactivated, which enabled euro area banks to obtain foreign-currency liquidity if needed.

- In addition, a number of supervisory measures offered temporary capital, liquidity and operational relief to banks, to ensure that banks could continue to fulfil their role in funding the real economy.

- Before the pandemic shock, sizeable policy accommodation was already in place with short-term yields at record low levels, forward guidance indicating that rates would be kept low or lower, net asset purchases under the APP restarting in autumn 2019, our continued reinvestment policy, and the third series of the TLTROs (TLTRO-III).

- See also footnotes 2 and 4.

- See also Lane, P.R. (2020), “The macroeconomic impact of the pandemic and the policy response”, The ECB Blog, 4 August.

- See also Haroutunian, S., Hauptmeier, S. and Leiner-Killinger, N. (2020), “The COVID-19 crisis and its implications for fiscal policies”, Economic Bulletin, Issue 4, ECB.

- See also footnote 6.

- For simplicity, this post-pandemic inflation path is represented here as a parallel shift, but it might well be that inflation would recover more slowly in the post-pandemic economy in the absence of additional monetary accommodation.

Ευρωπαϊκή Κεντρική Τράπεζα

Γενική Διεύθυνση Επικοινωνίας

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

Η αναπαραγωγή επιτρέπεται εφόσον γίνεται αναφορά στην πηγή.

Εκπρόσωποι Τύπου