Published as part of the ECB Economic Bulletin, Issue 7/2023.

This box summarises the findings of recent contacts between ECB staff and representatives of 56 leading non-financial companies operating in the euro area. The exchanges took place between 25 September and 5 October 2023.[1]

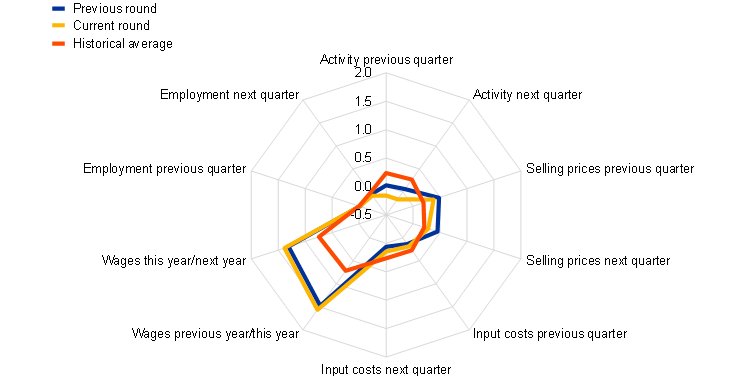

On average, contacts described a worsening of activity, consistent with a mild contraction in output for the third and fourth quarters of 2023, as well as moderating price growth (Chart A). As in recent quarters, there was still a lot of variation in terms of the reported levels and growth of activity. Poorly performing sectors remained weak for longer than expected, while some of the drivers of growth in better performing sectors started to wane. Employment was stable, but the outlook was worsening slightly. Meanwhile price growth continued to moderate against a backdrop of stable input costs, and wage pressures were expected to remain strong despite a slight moderation in wage growth being anticipated for 2024.

Chart A

Summary of views on activity, employment, prices and costs

(averages of ECB staff scores)

Source: ECB.

Notes: The scores reflect the average of scores given by ECB staff in their assessment of contacts’ statements about quarter-on-quarter developments in activity (sales, production, orders), input costs (material, energy, transport, etc.) and selling prices, and about year-on-year wage developments. Scores range from -2 (significant decrease) to +2 (significant increase). A score of 0 would mean no change. For the current round, previous quarter and next quarter refer to the third and the fourth quarter of 2023 respectively, while for the previous round these refer to the second and third quarter of 2023. Discussions with contacts in January and in March/April regarding wage developments normally focus on the outlook for the current year compared with the previous year, while discussions in June/July and September/October focus on the outlook for the next year compared with the current year. The historical average reflects an average of scores compiled using summaries of past contacts extending back to 2008.

In the industrial sector, activity was still weak or contracting for intermediate goods, durable consumer goods and construction. Contacts said that sales of consumer electronics and durable household goods were still low or falling, as demand was reduced by the squeeze on household incomes and the fact that purchases of these items had been brought forward during the COVID-19 pandemic. Together with low and contracting activity in the construction sector and ongoing inventory adjustment in parts of the supply chain, this translated into continually weak demand for many intermediate goods. Producers and distributors of steel, chemicals and building materials in particular described business contracting strongly. Activity was more resilient elsewhere in the manufacturing sector. Demand for most non-durable consumer goods was fairly stable and even had pockets of growth. Moreover, production in the automotive and capital goods sectors was still high or growing as order backlogs resulting from past supply disruption were worked through. However, order books were shrinking in some sectors, particularly the automotive sector, raising the prospect of production cuts later in the year or in early 2024 if demand did not increase.

Ongoing weakness in the demand for goods was reflected in subdued transport and retail activity, whereas tourism and digital services continued to grow strongly. Shipping, haulage and warehousing activity declined further in the third quarter as many firms continued to try to reduce working capital. The normal seasonal pick-up in global shipping activity from August to September due to the transportation of goods ahead of Christmas was observed to have been much weaker than usual. Food retailers continued to observe “downtrading”, with consumers favouring discount stores and cheaper products. Some retailers were, nonetheless, more optimistic about a recovery in spending in the latter months of the year, as households are expected to increasingly feel the benefit of rising wages. Contacts in the tourism and passenger air travel industries reported a very positive summer season, with tourism activity having equalled or even exceeded its pre‑pandemic levels and supply constraints having eased. In this context, the higher cost of long-distance travel benefited intra-European tourism. Planning for 2024 assumed continued, albeit moderating, growth. Activity in digital services continued to grow strongly, which was partly supported by firms’ increasing desire to implement artificial intelligence solutions to contain rising labour costs, including for skilled office functions. However, even in this rapidly growing sector, there were reports of lengthy sales negotiations and reduced demand from new and smaller firms. Demand for more traditional consultancy services reportedly also fell as customers put projects on hold.

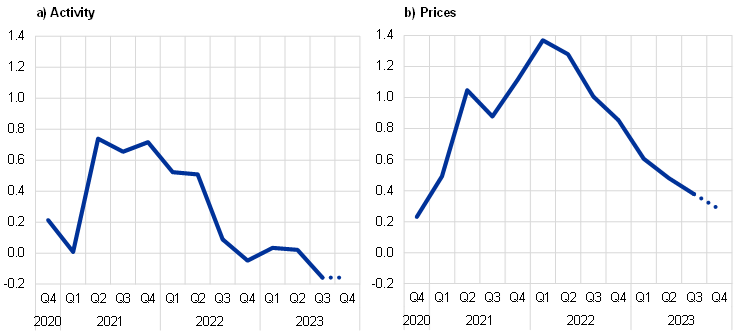

Overall, contacts were quite pessimistic about the outlook for the remainder of 2023 and, in some cases, for 2024 (Chart B, panel a). While tailwinds from the easing of supply constraints moderated, there were continued headwinds from the squeeze on real incomes caused by inflation and rising interest rates. Some contacts therefore pushed their expectations for any significant pick-up in overall activity back to the second half of 2024. Despite many contacts looking out for them, signs of an aggregate recovery in consumer spending had not yet materialised.

Chart B

Evolution of views on developments in and the outlook for activity and prices

(averages of ECB staff scores)

Source: ECB.

Notes: The scores reflect the average of scores given by ECB staff in their assessment of what contacts said about quarter-on-quarter developments in activity (sales, production and orders) and prices. Scores range from -2 (significant decrease) to +2 (significant increase). A score of 0 would mean no change. The dotted line refers to expectations for the next quarter.

Contacts described a fairly stable employment environment that also showed signs of weakening in the future. Many contacts reported that firms were cautious about reducing headcount even in sectors where activity was faltering, as it did not make sense to lose skilled staff when the labour market in many countries remained tight. In many cases the adjustment of labour input – where necessary – was instead achieved by resorting less to agency staff, reducing working hours or making use of government-funded short-time work schemes. Employment agencies reported a softening in demand for placements in the manufacturing and logistics sectors especially. Many firms reduced, or planned to reduce, headcount by only replacing a number of staff who retired or left the company. This was especially true for blue-collar and administrative roles.

Growth in selling prices continued to moderate on average in the third quarter, with a further moderation also anticipated for the fourth quarter (Chart B, panel b). The aggregate picture still masked a lot of heterogeneity reflecting different demand and supply conditions and cost pressures across sectors. Prices in sectors where supply had been catching up with demand, including the capital goods, automotive and tourism and travel sectors, continued rising in recent months. However, most contacts in these sectors now saw price growth moderating or prices stabilising as demand and supply came back into balance. By contrast, most contacts in the non-durable consumer goods sectors and in most business and consumer services anticipated further price growth, as increases in input costs, particularly from wages, were passed through to prices to sustain margins. The outlook for agri-food prices was mixed, depending on the extent to which past cost pressures had already been accommodated. However, retail food prices were expected to decline slightly in the coming months. Contacts in many parts of the construction, intermediate goods and durable consumer goods sectors, as well as those involved in the transport of goods, mostly described low and/or falling prices. This was related to low levels of demand as well as declining or stabilising material costs that reflected the prices for many commodities having fallen since last year. The latter eased the immediate cost pressures faced by input-intensive industries.

Wage growth was still strong but was expected to moderate slightly next year. Taking a simple average of the mid-points of the quantitative indications provided, contacts expected wage growth to decrease from around 5.6% in 2023 to 4.9% in 2024. This was very similar to the average expectations recorded three months earlier. While the delayed effect of past (multiannual) negotiations still put significant upward pressure on wages for next year, the easing of inflation and a subdued demand outlook were anticipated by some to potentially moderate wage requests or to increase the ability of firms to resist them.

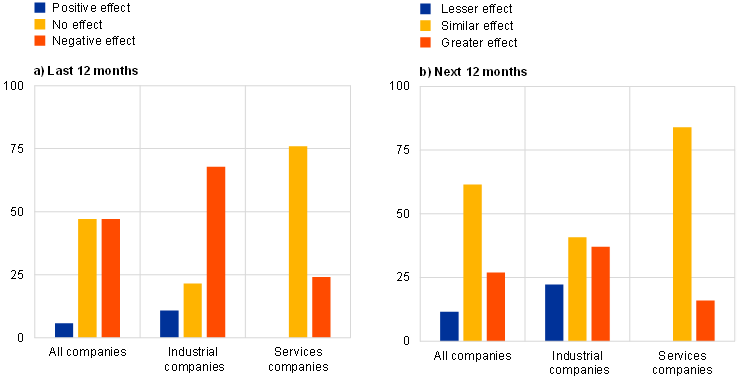

The tightening of financing conditions since last summer has had a much larger effect on the industrial sector than on services (Chart C, panel a). This round, contacts were asked (i) how changes in the cost and availability of funding since mid-2022 had affected their business activity over the past 12 months, (ii) whether they expected these changes to have a greater or lesser effect on activity in the next 12 months and (iii) what the main factors underlying this assessment were. There was an almost even split between contacts who said that financing conditions had not affected the activity of their company and those who said that there had been a negative effect. The former were primarily located in the services sector and the latter in the industrial sector. Those who said that tighter financing conditions had no effect on their activity cited their strong cash positions, limited external financing needs, a slow pass-through of market interest rates to the average cost of debt and a continued willingness of banks to lend at reasonable rates. Two-thirds of contacts in the industrial sector said that tighter financing conditions were having a negative effect on their operations, either directly through their financing or indirectly as a result of reduced demand. Several contacts reported that banks and institutional investors were paying greater attention to credit risk, or that the higher cost of capital raised the required rate of return on investment. Many saw tighter financing conditions as dampening customer demand for their products, especially those in, or those supplying, the construction and capital goods sectors.

On balance, the effect of the tightening of financing conditions on activity was expected to intensify over next 12 months (Chart C, panel b). Most contacts believed that there would be no significant change in how the tightening of financing conditions would affect their firm’s activity in the next 12 months compared to the previous 12 months. This included a majority of contacts in the services sector, who expected tightening financing conditions to have no effect at all. Of the contacts who did signal a change, 27% expected tightening financing conditions to have a greater effect on activity, while only 12% expected it to have a lesser effect. Some contacts cited a greater need to access external financing as existing debt matured or large investments projects were carried out. Others stressed how expected future demand acts as the main driver of investment and that downgrades of forecasts due to the present weakness in activity meant it was likely they would reduce their future capital spending (e.g. by spreading the execution of planned investments over time). The decisions of individual firms depended on where they were in the investment cycle. In this context, the disruption caused by the COVID-19 pandemic and the requirements of the transition to net zero resulted in significant heterogeneity. A broad range of factors also influenced investment decisions, with input costs, subsidies and regulatory uncertainty currently playing a more important role than financing conditions for many firms.

Chart C

Summary of views on the effect of the change in the cost and availability of funding on the activity of firms

(percentage of responses)

Source: ECB.

Notes: Based on conversations with 52 contacts, comprising 27 contacts from firms in the industrial sector and 25 contacts from firms in the services sector.

For further information on the nature and purpose of these contacts, see the article entitled “The ECB’s dialogue with non-financial companies”, Economic Bulletin, Issue 1, ECB, 2021.