- THE ECB BLOG

Why we need models to make projections

5 July 2023

Central banks need to look ahead to make good decisions. Since we lack a crystal ball, economic models are the best tool available. They provide a test environment to craft and think through different scenarios. This ECB Blog post provides an overview of why, and how, we do this.

Asking any economist to explain economic behaviours or make predictions without a model is like asking a meteorologist to predict the weather by glancing at the sky. Although economic models are a simplified and subjective approximation of reality, they allow us to learn from the past to predict the future. In more technical terms, they are quantitative frameworks simulating our economies. They allow us to test our assumptions using economic data. This is crucial for credible macroeconomic forecasting, developing economic narratives and calibrating policy decisions.

Of course, reality does not always unfold as models predict, and can invalidate some of the theories or mechanisms underlying the models’ equations. Models can fail to predict events such as the 2008 financial crisis or the more recent inflation dynamics. Still, deviations from model predictions help economists uncover gaps in analysis and improve their economic assessments. That’s why almost every central bank and economic institution uses models for its forecasts and constantly revises and updates them to learn from forecasting errors.[1] This post provides an overview of the economic models the ECB uses for the economic projections, which serves as an important input into the monetary policy decisions of the ECB’s Governing Council.

ECB and national central bank (NCB) staff work together to produce projections in preparation for monetary policy decisions. They use models to forecast how various economic and financial developments will affect future growth and inflation. This analysis is based on past regularities. For example, a typical projection model can evaluate how the recent increases in energy costs would affect households’ and firms’ expenditures down the road, and how wages and prices might evolve. Models also can be used to estimate the degree of uncertainty surrounding projections and to produce alternative scenarios. Models are in this respect virtual laboratories for economic experiments.

Unfortunately, as crucial as they are to our work, models have limitations. They can never quite match the complexity of reality and will always remain based on assumptions, which of course can be wrong. The past patterns on which they are based may also not remain true in future. This is why our projections are a combination of model-based computation and expert “judgement”.

But what is “judgement”? Judgement is any adjustment that is made to the projections of the main macroeconomic models to take into account additional information that is available to the forecasters. This can be based either on expert knowledge and experience or on so-called “satellite models”. Judgement aims to address shortcomings that are inevitable in the main macroeconomic models, such as the fact that they cannot reflect unprecedented events (e.g. the COVID-19 pandemic, financial market volatility or the Russian invasion of Ukraine) or may not fully capture preannounced changes in fiscal or structural policies (e.g. effect of price caps on energy prices).

As both models and judgement are prone to some degree of uncertainty, projections are subject to a thorough peer review. This is done by various groups which report to the Eurosystem’s Monetary Policy Committee.[2] Following a bottom-up approach, individual country projections are prepared first and then aggregated into euro area figures.[3] ECB and NCB staff discuss the figures for individual countries. They use the euro area perspective as a benchmark, and agree on adjustments to the country figures to arrive at the final projections. This ensures that country assessments and expertise (combining models and judgement) are integrated into an overall euro area framework.

The Eurosystem uses a suite of models for projections to provide a good balance between model diversity and specialisation, in line with international best practice.[4] The models can be divided into three groups.

- The main projections models – These are built around a small theoretical core that specifies long-run relationships among the key macroeconomic variables. As projection exercises are bottom-up, ECB staff use the ECB-Multi-Country (MC) model to produce country projections.[5] The ECB-BASE model is the main ECB model for euro area aggregate data. It plays an important role in cross-checking the bottom-up aggregation of country projections, in scenario analyses and in monetary policy preparation.

- Dynamic stochastic general equilibrium (DSGE) models – These are general equilibrium models based on microeconomic behaviours. The macroeconomic outcomes are the aggregate consequences of the simulated decisions of the various economic agents. These models are not straightforward to use for forecasting purposes. Therefore, they generally complement the main projection models with counterfactual scenario analyses as well as monetary policy evaluations.[6] The New Area-Wide Model II (NAWM) is the main euro-area structural model for forecasting and monetary policy analysis at the ECB. Beside specific NCB models, a multi-country version of the NAWM is the Euro Area and Global Economy model (EAGLE), which jointly models the euro area and the world economy. EAGLE has been designed for conducting quantitative policy analysis of macroeconomic interdependence within the euro area and between euro area regions and the world economy.

- Satellite models – These refer to a wide range of econometric and statistical frameworks used for short-term forecasting, cross-checking projections, or modelling sectoral or financial factors not fully captured by the main models. Satellite models include, for instance, time series models such as vector autoregressive, factor and machine learning models. Recent examples include new econometric methods developed to produce short-term forecasts with higher frequency information during the pandemic or cope with exceptionally high energy price volatility during the current inflation surge.

The main uses of models are (i) building projections, (ii) assessing uncertainty and risks around the central tendency, and (iii) quantifying alternative scenarios. The main and satellite models are designed to produce projections for the euro area and its largest countries. These central tendencies are conditional on assumptions about the international environment, commodity prices, financial conditions, trend supply-side features and fiscal policy.

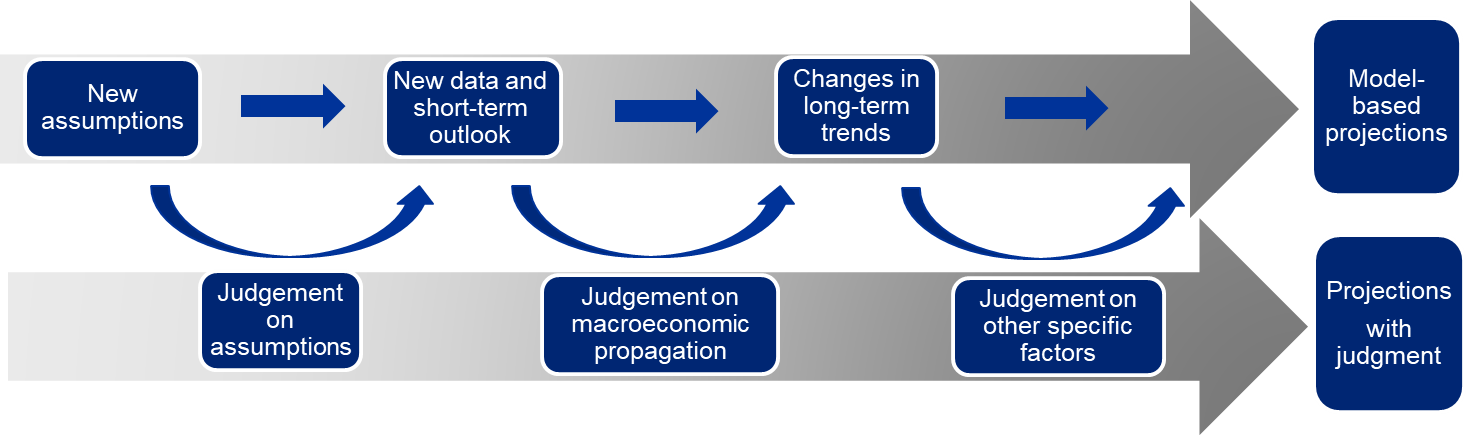

When building projections, models are used to start the process by first mechanically updating the previous baseline projection (including previous judgement). They then help to project the variables conditional on the full set of assumptions, incoming data, short-term forecasts, and other relevant factors including changes in long-term trends (see Chart 1). Models provide a projection narrative based on a structural interpretation of cyclical developments, i.e. the “story” behind the forecast. This includes, for example, the relative role of demand and supply factors or the identification of impairments in the monetary policy transmission mechanism. They also ensure discipline and continuity with previous exercises.

Judgement may be added at various stages of the process, be it on the assumptions (e.g. add-ons on lending rates to capture tighter financing conditions), on the macroeconomic propagation (e.g. nonlinearities in the inflation process), or on other specific factors (e.g. supply constraints due to supply bottlenecks). Judgement typically improves forecasting accuracy over a short-term horizon by incorporating preannounced policy measures or accounting for unprecedented events for which models are not available.

Chart 1

Model-based forecast with judgement: analytical roadmap

Source: ECB.

A key role of models is to produce risk indicators around the projection baseline, i.e. to give a sense how likely the projected outcome is, and quantify the uncertainty around the baseline. This can be done in various ways.

- Sensitivity analysis: this is typically a simple exercise to assess the consequences for inflation or GDP of different paths assumed for selected technical assumptions. Chart 2a illustrates the sensitivity of the inflation outlook to oil and gas price developments which is usually presented in the projections articles.

- Fan-chart type of approaches: These aim at generating probabilistic distributions around the projection baseline. They use main or satellite models, with or without judgement. Chart 2b displays the NAWM risk distribution around the March 23 ECB staff projections for HICP inflation.

- Scenario analyses: These are particularly useful in the presence of large shocks or very uncertain socioeconomic or geopolitical developments. The pandemic scenarios introduced in the staff projections from March 2020 until December 2021 are good examples of such a strategy when the use of statistical risk metrics is technically challenged by unprecedented shocks. Chart 2c illustrates the type of pandemic scenarios which were conducted over the COVID-19 period and the corresponding quantification of uncertainty surrounding GDP outlook.[7]

In conclusion, models are an essential tool for producing the baseline projections and the risk assessments around them, as well as for providing continuity and discipline in the various projection exercises. They will never be perfect, but complementing them with judgement ensures that they better capture the dynamically evolving economic reality.

Chart 2

Illustrative model use cases in the Eurosystem projection process

Source: ECB staff calculations, ECB staff macroeconomic projections for the euro area, March 2021 and March 2023.

Notes:

Panel a: This sensitivity analysis uses a synthetic energy price index that combines oil and gas futures prices. The 25th and 75th percentiles refer to the option-implied neutral densities for the oil and gas prices as at 15 February 2023. The constant oil and gas prices take the respective value as at the same date. The macroeconomic impacts are reported as averages of a number of ECB and Eurosystem staff macroeconomic models.

Panel b: The blue areas show the 16%, 25%, 75% and 84% quantiles of NAWM II risk distribution constructed around the March 2023 ECB staff projections HICP baseline. The density is derived by randomly drawing structural shocks using their estimated distribution and adding them to the baseline

Panel c: Mild and severe alternative pandemic scenarios are described in March 2021 ECB staff projections. The grey areas represent the 90% and 68% confidence intervals from the ECB-BASIR forecast. They are centred around March 2021 ECB staff projections. In the ECB-BASIR model, the density forecast is computed using a bootstrap method that re-samples the in-sample residuals of the model and also considers the uncertainty related to pandemic developments, like the efficiency of vaccination campaign and underlying virus fundamentals. The ECB BASIR forecast density remains conditional the baseline assumptions.

The views expressed in each blog entry are those of the author(s) and do not necessarily represent the views of the European Central Bank and the Eurosystem.

Subscribe to the ECB blogSee, for example, Chahad et al (2023), “An updated assessment of short-term inflation projections by Eurosystem and ECB staff”, Box 6, Economic Bulletin Issue 1/2023, ECB.

Models are constantly updated in interaction with academia and university consultants and regularly assessed in the Working Group on Econometric Modelling. The projections are thoroughly reviewed in the Working Group on Forecasting, including with the support of the Working Group on Public Finance, which provides the projections for fiscal variables. The quarterly staff projections are produced by Eurosystem and ECB staff working together in close cooperation. In March and September, the projections are primarily produced by ECB staff, but these projections benefit also from the input and expertise of NCB experts, especially as regards the short-term inflation outlook. In June and December, the projections are produced by NCB staff in collaboration with ECB staff.

See ECB (2016), “A guide to the Eurosystem/ECB staff macroeconomic projection exercises”.

For a detailed overview of types of models and their uses in the Eurosystem, see the ECB Occasional Paper no. 267, 2021. Notice that in terms of geographical scope, Eurosystem models encompass either specific jurisdictions of the monetary union or the euro area as-a-whole. Beyond the euro area specification, the main projection models generally feature a small open economy setting.

A working paper describing the ECB-MC model is forthcoming. The ECB-BASE is also a blueprint for each country block.

Some NCBs (notably Finland, Latvia, and Czech Republic) also use DSGEs as the main projection models.

These simulations were produced with the BASIR model, an enhanced version of the ECB-BASE model that captures the macroeconomic effects of pandemic developments and associated mitigation policies. For a detailed description of the BASIR model, see Angelini et al (2023), "Modelling pandemic risks for policy analysis and forecasting," Economic Modelling, Vol. 120(C). Regarding the BASIR uncertainty bands, also see Angelini et al (2021), "Model-based risk analysis during the pandemic: introducing ECB-BASIR", Box 4, Economic Bulletin Issue 1/2021, ECB.