Decomposing market-based measures of inflation compensation into inflation expectations and risk premia

Published as part of the ECB Economic Bulletin, Issue 8/2021.

This box presents a model-based approach for distinguishing between two unobserved components embedded in market-based measures of inflation compensation, namely inflation expectations and inflation risk premia. The approach relies on econometric models used to analyse the term structure of inflation-linked swap (ILS) rates. Estimates indicate that the rise in forward ILS rates observed since mid-2020 is attributable more to inflation risk premia than to inflation expectations. This suggests that the rise is mainly related to a shift in the inflation risks priced in, from lower than expected to higher than expected.

ILS rates are often used as a benchmark for market-based measures of inflation compensation in the euro area. ILS contracts exchange at maturity the fixed swap rate agreed in advance against the average inflation rate realised over the life of the swap, with both rates applied to a notional amount. Unlike break-even inflation rates derived from inflation-linked and nominal sovereign bonds issued by specific euro area member states, ILS rates are less affected by market liquidity issues.[1]

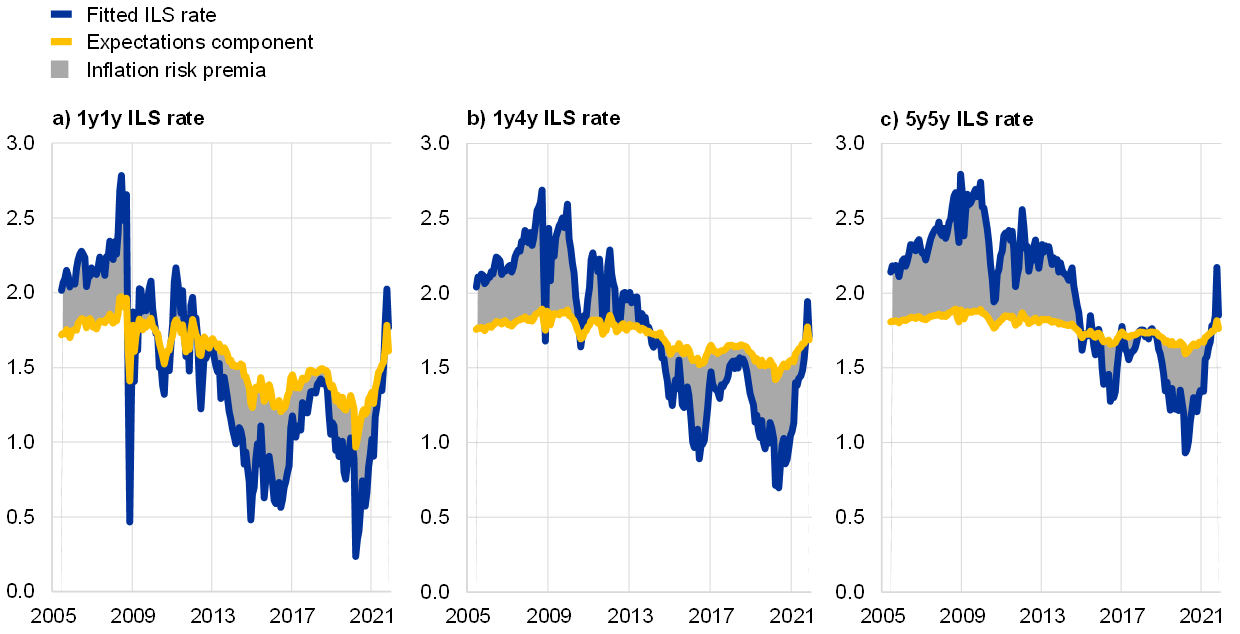

Because ILS rates reflect financial market participants’ views about future inflation, they are closely monitored by central banks (Chart A). ILS rates were relatively stable at slightly above 2% over the period 2005-07 but plummeted in the second half of 2008 as the global financial crisis unfolded. While they had returned to close to 2% by the end of 2010, they gradually declined again to levels incompatible with the ECB’s inflation target at the time of “below, but close to” 2%. For example, the one-year forward ILS rate four years ahead stood slightly below 1% in mid-2016. Although ILS rates recovered somewhat by mid-2018, they subsequently slid again to low levels until the coronavirus (COVID-19) crisis induced another dramatic decline, with a trough reached at the end of March 2020. They then increased significantly over the next year and a half. Most recently, the one-year ILS rate has reached as high as 3%, but the one-year forward rate one year ahead has remained below 2%. This suggests that the financial markets are pricing the recent rise in inflation as transitory. Importantly for the medium-term objective of price stability, the five-year forward rate in five years ahead has returned to levels close to 2%.

Chart A

Euro area inflation-linked swap rates

(percentages per annum)

Sources: Refinitiv and ECB calculations.

Notes: The “1y4y ILS rate” is the one-year forward ILS rate in four years’ ahead, and similarly for the “1y1y ILS rate” and “5y5y ILS rate”. The latest observation is for 26 November 2021.

ILS rates and other market-based measures of inflation compensation reflect not only financial market participants’ actual inflation expectations, but also inflation risk premia. The presence of inflation risk premia is due to financial market participants being risk-averse and having to deal with uncertainty. In general, theory suggests that inflation risk premia tend to be positive in times dominated by supply shocks and negative in times dominated by demand shocks.[2] Adverse supply shocks, for instance, support positive inflation risk premia, as they imply that inflation tends to increase when financial asset payoffs (in real terms) are highly valued, i.e. when real activity declines and the marginal utility of consumption rises.

Econometric models of the term structure of ILS rates can be used to decompose ILS rates into inflation expectations and inflation risk premia. Estimated models typically incorporate the key economic drivers of the short-term inflation rate (“pricing factors”) and a mechanism for the dynamics of these pricing factors (the “law of motion”). These constituents allow forecasts of the short-term inflation rate and averages of these forecasts to be generated for any maturity. Inflation expectations can then be estimated as the average short-term inflation rate over a given horizon, and inflation risk premia can be proxied as the difference between ILS rates and these inflation expectations.[3]

Two variants of an econometric term structure model are used in this box to decompose ILS rates into inflation expectations and inflation risk premia. The models incorporate three pricing factors that explain the bulk of the variation in end-of-month ILS rates of different maturities over time.[4] Both models imply that the short-term ILS rate converges on a fixed number over the long run, as will any stationary term structure model. As this endpoint is hard to pin down empirically,[5] it is calibrated to a level of 1.9%. This is in line with the all-time average of long-term inflation forecasts from the Survey of Professional Forecasters and Consensus Economics, and compatible with numerical implementations of the ECB’s objective for most of the period analysed.[6] The two variants differ in the way they estimate the law of motion for the pricing factors. Specifically, the method used to estimate one of the variants accounts for a well-known bias afflicting estimates of persistent processes; the other method does not take this bias into account.[7]

Decomposition results are represented as averages of the two model outcomes. Inflation expectations based on the first approach have the advantage of being relatively close to the level of survey forecasts, which is a meaningful cross-check since survey data are not taken into consideration at the estimation stage. However, inflation expectations for longer horizons based on the first approach tend to be fairly rigid and possibly underestimate the true and unobserved time variation. The second approach, which corrects for the estimation bias, renders long-term expectations more variable, but occasionally seems to establish too tight a connection between short-term ILS rates and long-horizon expectations. Model averaging strikes a balance between the two approaches.[8] At the same time, it should be noted that model-based inflation expectations (and, conversely, premia) extracted from ILS rates are subject to estimation uncertainty and their levels cannot be validated directly by an observed counterpart.[9]

Chart B

Model-based decomposition of euro area inflation-linked swap rates

(percentages per annum)

Sources: Refinitiv and ECB calculations.

Notes: Average estimates based on two affine term structure models following Joslin, Singleton and Zhu (2011) applied to ILS rates adjusted for the indexation lag, as in Camba-Mendez and Werner (2017). The latest observation is for November 2021 (monthly models).

Estimated decompositions suggest that inflation expectations are in general more stable than ILS rates, and that inflation risk premia across tenors have changed sign in the past, including recently (Chart B). Decompositions indicate that inflation expectations can vary significantly through time, although they are in general smoother than ILS rates. This holds especially true for more distant forward rates, which is in line with the intuition that inflation expectations are, in principle, better anchored in the long run. Inflation risk premia are estimated to have gone from positive to negative around 2013-14, suggesting that markets increasingly accounted for the risk of inflation outcomes falling below their expectations. More recently, as the effects of the coronavirus (COVID-19) pandemic have started to dissipate, inflation risk premia estimates have increased significantly, and even changed sign to possibly become slightly positive again. This change in sign might be related to the pricing in of a greater likelihood, or at least risk, of the economy being dominated by supply shocks in the foreseeable future in the context of ongoing supply bottlenecks.[10]

- For an overview of the ILS market, see “Derivatives transactions data and their use in central bank analysis”, Economic Bulletin, Issue 6, ECB, 2019; “Interpreting recent developments in market-based indicators of longer-term inflation expectations”, Economic Bulletin, Issue 6, ECB, 2018; Work stream on inflation expectations, “Inflation expectations and their role in Eurosystem forecasting”, Occasional Paper Series, No 264, ECB, 2021. By market convention, the reference price index for euro area ILS rates is the HICP excluding tobacco (HICPxT). ILS rates refer to the HICPxT with a three-month indexation lag.

- See, for instance, Rostagno, M., Altavilla, C., Carboni, G., Lemke, W., Motto, R., Saint Guilhem, A. and Yiangou, J., “Monetary Policy in Times of Crisis: A Tale of Two Decades of the European Central Bank”, Oxford University Press, 2021.

- Inflation risk premia are usually estimated as the difference between “fitted” ILS rates (i.e. implied by the estimated model) and estimated expectation components.

- The reference model follows the methodology of the seminal paper by Joslin, S., Singleton, K.J. and Zhu, H., “A new perspective on Gaussian dynamic term structure models”, The Review of Financial Studies, Vol. 24, Issue 3, 2011, pp. 926-970, and is applied to end-of-month ILS rates adjusted for the three-month indexation lag, as in Camba-Mendez, G. and Werner, T., ”The inflation risk premium in the post-Lehman period”, Working Paper Series, No 2033, ECB, 2017.

- See, for instance, Villani, M., “Steady-state priors for vector autoregressions”, Journal of Applied Econometrics, Vol. 24, Issue 4, 2009, pp. 630-650.

- Calibrating the long-run inflation mean at 1.9% is in line with the New Area-Wide Model in which, prior to the adoption of the ECB’s new inflation target of 2%, the central bank’s long-run inflation objective was set to 1.9% per annum (see Christoffel, K., Coenen, G. and Warne, A., “The New Area-Wide Model of the euro area: a micro-founded open-economy model for forecasting and policy analysis”, Working Paper Series, No 944, ECB, 2008; and Coenen, G., Karadi, P., Schmidt, S. and Warne, A., “The New Area-Wide Model II: an extended version of the ECB’s micro-founded model for forecasting and policy analysis with a financial sector”, Working Paper Series, No 2200, ECB, 2019). See also Mazelis, F., Motto, R., and Ristiniemi, A., “Monetary policy strategies in a low interest rate environment for the euro area”, forthcoming, who also use 1.9%. The ECB’s 2020-21 strategy review adjustment to aim for 2% inflation over the medium term means the long-run mean of inflation expectations may need to be updated at some point, which would result in slightly lower inflation risk premia estimates overall.

- Augmented Dickey-Fuller tests and Philips and Perron tests fail to reject the null hypothesis of a unit root in ILS rates. The correction of the estimation bias (toward a lack of persistence) in the second model follows the methodology of Kilian, L., “Finite sample properties of percentile and percentile-t bootstrap confidence intervals for impulse responses”, Review of Economics and Statistics, Vol. 81, No 4, 1999, pp. 652-660.

- As a broad check for “reasonableness”, the standard deviation of the expectation components obtained from the average of the two model estimates is relatively close to that of inflation forecasts derived from the Survey of Professional Forecasters and Consensus Economics (e.g. around 10 basis points at the four to five-year horizon).

- Specifically, survey estimates can differ from true (unobserved) expectations embedded in ILS rates by the simple fact that different market players are expressing their views.

- See for instance Box 4, “The impact of supply bottlenecks on trade”, Economic Bulletin, Issue 6, ECB, 2021.